A Quick Take On Oddity Tech Ltd.

Oddity Tech Ltd. (ODD) has filed to raise $100 million in an IPO of its Class A ordinary shares, according to an F-1 registration statement.

The firm sells beauty and wellness products direct to consumers and through third-party online platforms.

ODD has produced impressive revenue growth, profits and free cash flow.

I’ll provide a final opinion when we learn more information about the IPO from management.

ODDITY Overview

Tel Aviv, Israel-based Oddity Tech Ltd. was founded to develop a platform for a portfolio of beauty and wellness product brands using advanced data mining techniques in its DTC (Direct To Consumer) marketing efforts.

Management is headed by co-founder and CEO Mr. Oran Holtzman, who has been with the firm since its inception and previously earned a B.A. in Accounting and Business Management.

-

The company’s primary offerings include the following:

-

IL MAKIAGE

-

SpoiledChild.

As of March 31, 2023, ODDITY has booked fair market value investment of $68.1 million from investors, including private equity firm L Catterton.

ODDITY – Customer Acquisition

The firm seeks customers for its products via direct marketing to its website and through major online platforms such as Amazon.

As of March 31, 2023, the firm had over 4 million active customers that had made a purchase within the previous 12 months.

The company is also integrating AI technologies to help it develop new beauty product chemicals.

Selling, G&A expenses as a percentage of total revenue have trended lower as revenues have increased, as the figures below indicate:

|

Selling, G&A |

Expenses vs. Revenue |

|

Period |

Percentage |

|

Three Mos. Ended March 31, 2023 |

56.0% |

|

2022 |

58.7% |

|

2021 |

60.1% |

(Source – SEC.)

The Selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling, G&A expense, rose to 0.8x in the most recent reporting period, as shown in the table below:

|

Selling, G&A |

Efficiency Rate |

|

Period |

Multiple |

|

Three Mos. Ended March 31, 2023 |

0.8 |

|

2022 |

0.5 |

(Source – SEC.)

Oddity’s Market & Competition

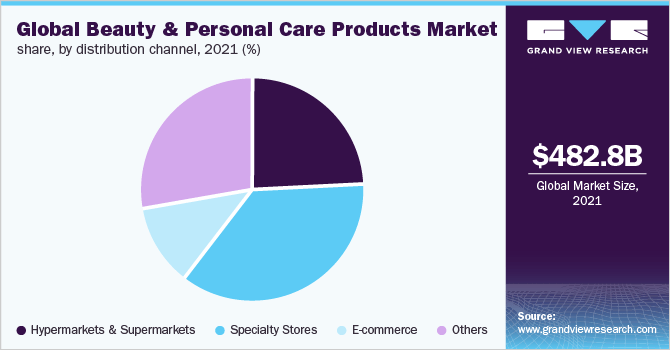

According to a 2022 market research report by Grand View Research, the global market for beauty and personal care products was estimated at $483 billion in 2021 and is forecast to reach $942 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 7.7% from 2022 to 2030.

The main drivers for this expected growth are the growing demand from consumers for products that improve their appearance and are natural and non-toxic.

Also, below is a pie chart showing the global beauty and personal care products market share by distribution channel in 2021:

Global Beauty And Personal Care Products Market (Grand View Research)

Major competitive or other industry participants include the following:

-

Unilever

-

The Estée Lauder Companies Inc.

-

Shiseido Co., Ltd.

-

Revlon

-

Procter & Gamble

-

L’Oréal S.A.

-

Coty Inc.

-

Kao Corporation

-

Avon Products, Inc.

-

Oriflame Cosmetics S.A.

ODDITY Tech Ltd. Financial Performance

The company’s recent financial results can be summarized as follows:

-

Sharply growing topline revenue

-

Increasing gross profit

-

Variable gross margin

-

Growing operating profit

-

Substantially higher cash flow from operations.

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2023 |

$ 165,654,000 |

83.2% |

|

2022 |

$ 324,520,000 |

45.8% |

|

2021 |

$ 222,555,000 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2023 |

$ 117,485,000 |

94.6% |

|

2022 |

$ 218,050,000 |

42.3% |

|

2021 |

$ 153,181,000 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

% Variance vs. Prior |

|

Three Mos. Ended March 31, 2023 |

70.92% |

4.2% |

|

2022 |

67.19% |

-2.4% |

|

2021 |

68.83% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

Three Mos. Ended March 31, 2023 |

$ 24,721,000 |

14.9% |

|

2022 |

$ 27,665,000 |

8.5% |

|

2021 |

$ 19,512,000 |

8.8% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

Three Mos. Ended March 31, 2023 |

$ 19,590,000 |

11.8% |

|

2022 |

$ 21,728,000 |

13.1% |

|

2021 |

$ 13,920,000 |

8.4% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

Three Mos. Ended March 31, 2023 |

$ 53,199,000 |

|

|

2022 |

$ 39,032,000 |

|

|

2021 |

$ 10,224,000 |

|

|

(Glossary Of Terms.) |

(Source – SEC.)

As of March 31, 2023, Oddity had $99.9 million in cash and $139.9 million in total liabilities.

Free cash flow during the twelve months ending March 31, 2023, was $69.8 million.

Oddity Tech Ltd. IPO Details

Oddity intends to raise $100 million in gross proceeds from an IPO of its Class A ordinary shares, although the final figure may differ.

Class A ordinary shareholders will be entitled to one vote per share, and Class B shareholders will have ten votes per share.

The S&P 500 Index (SP500) no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

As a foreign private issuer, the company can choose to take advantage of reduced, delayed or exempted financial and senior officer disclosure requirements versus those that domestic U.S. firms are required to follow.

The firm is also an “emerging growth company” as defined by the 2012 JOBS Act and may elect to take advantage of reduced public company reporting requirements; prospective shareholders would receive less information for the IPO and in the future as a publicly-held company within the requirements of the Act.

Management says it will use the net proceeds from the IPO as follows:

We intend to use the net proceeds from this offering for developing and launching new brands, working capital, and other general corporate purposes. We may also use a portion of the proceeds to acquire or invest in businesses, brands, products, services, or technologies; however, we do not have agreements or commitments for any material acquisitions or investments at this time.

(Source – SEC.)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management believes that any legal claims it is a party to would not have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are Goldman Sachs, Morgan Stanley, Allen & Company, BofA Securities, Barclays, Truist Securities, JMP Securities and KeyBanc Capital Markets.

Commentary About ODDITY’s IPO

Oddity is seeking U.S. public capital market funding for its general corporate growth and working capital requirements.

The firm’s financials have produced strong growth in topline revenue, higher gross profit and fluctuating gross margin, increasing operating profit and much higher cash flow from operations.

Free cash flow for the twelve months ending March 31, 2023, was $69.8 million.

Selling, G&A expenses as a percentage of total revenue have trended lower as revenues have increased; its Selling, G&A efficiency multiple rose to 0.8x in the most recent reporting period.

The firm currently plans to pay no dividends and retain any future profits for reinvestment back into the firm’s growth and working capital requirements.

Also, payment of dividends, if any, may be subject to Israeli withholding taxes.

ODD’s recent capital spending history indicates it has spent moderately on capital expenditures as a percentage of its operating cash flow.

The market opportunity for beauty and personal care products is large and expected to grow at a moderately robust rate of growth in the coming years.

Goldman Sachs is the lead underwriter, and the five IPOs led by the firm over the last 12-month period have generated an average return of 22.4% since their IPO. This is a top-tier performance for all major underwriters during the period.

Business risks to the company’s outlook as a public company include its ability to create additional popular branded products and its ability to expand its distribution at a profitable rate.

When we learn more about the Oddity Tech Ltd. IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Read the full article here