It has been a while since we last covered Ford Motor Company (NYSE:F) stock. Therefore, we decided to provide our readers with an update on our latest findings of the asset’s prospects.

Many of our existing readers will know by now that we have a very active stance on the stock, frequently adjusting our ratings between buy, hold, and sell. This is due to our belief that this is not a long-term buy-and-hold security; instead, we think the stock’s cyclical nature means that it is best utilized within an actively managed portfolio.

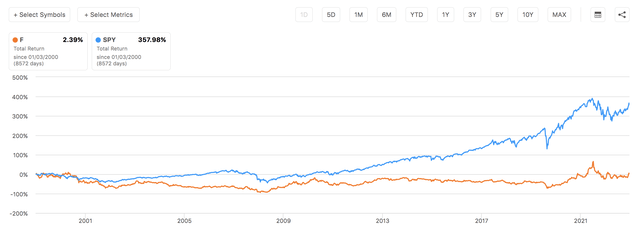

To illustrate the claims I made above, I charted Ford’s historical total return since the turn of the millennium and compared it to the SPDR® S&P 500 ETF Trust’s (NYSEARCA:SPY) return. As the chart shows, Ford’s total returns have been poor in the long run due to its cyclicality; nevertheless, short-term opportunities exist, as illustrated by the stock’s most recent 20% month-over-month surge.

F Stock’s Total Return Since 2000 (Author on Seeking Alpha)

Despite our belief that Ford does not possess solid long-term prospects as a stock and despite the fact that the asset is trading above its 50-, 100-, and 200-day moving averages, we think it has further room for interim growth; here’s why.

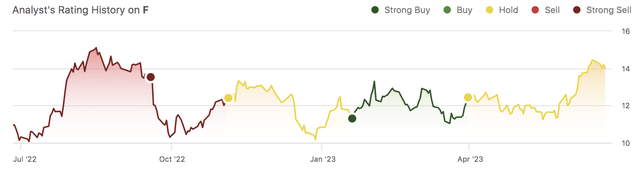

Pearl Gray’s Historical F Ratings (Seeking Alpha)

Supporting Factors For Ford Stock

As this article covers Ford’s stock and not the company in isolation, it is critical to consider the risk premiums involved in today’s stock market to determine whether cyclical stocks such as Ford are primed for gains.

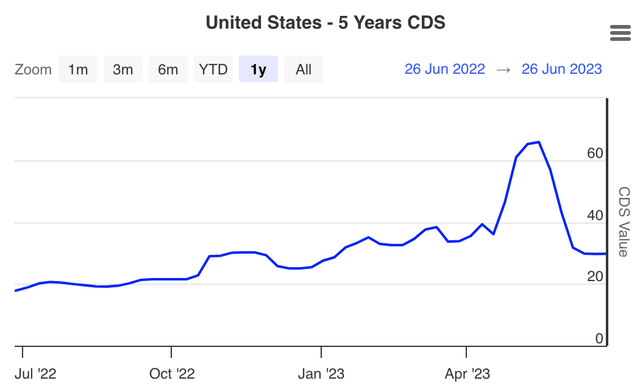

The primary metrics we have kept an eye on in recent months are the U.S. CDS values, which convey the level of credit risk observed in the financial markets (the corporate bond market, in particular). A quarter-to-date decrease in CDS values indicates that investors have become more risk-seeking, raising the allure of corporate bonds and cyclical stocks.

In our view, these CDS values are set to deplete even further, which might provide significant support to Ford’s stock.

U.S. CDS Values (worldgovernmentbonds.com)

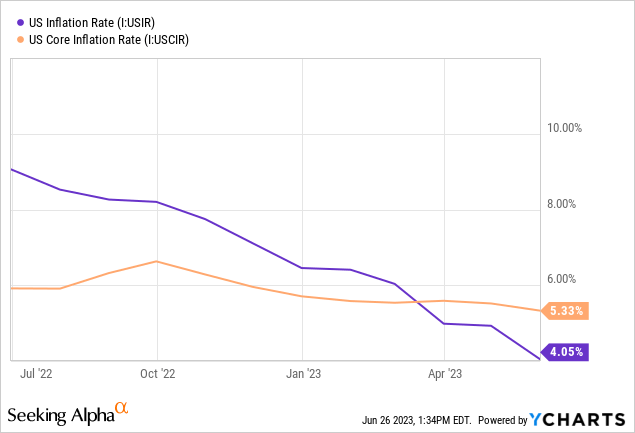

Furthermore, we have a positive outlook on the inflationary environment within the United States. Our basis here is that inflation is less volatile than earlier this year, enabling policymakers to establish a clear trajectory. In addition, core inflation remains robust while non-core costs (food and energy) are tapering, indicating that consumer strength remains resilient. Yet, input costs are diminishing (especially if the broad-based drawdown in commodity prices is intertwined).

Operational Update

Ford Layoffs – Don’t Worry It’s Just A Restructuring Process

Without outlining any names, certain media outlets have sent investors into a tizzy after it was announced that additional layoffs are due to occur at Ford.

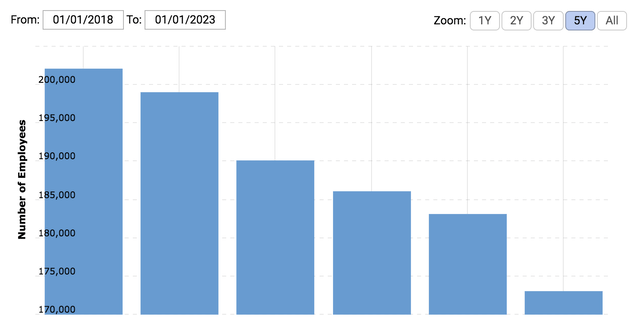

We urge investors to consider that the layoffs/planned layoffs are due to the company’s restructuring process, which includes streamlining its supply chains. Therefore, in isolation, this event is likely not a bearish signal for Ford’s financial prospects. In fact, Ford has been streamlining its labor force for quite some time now as it plans to run a more cost-friendly business model.

Ford Number of Employees (Macro Trends)

Efficiency Assessed

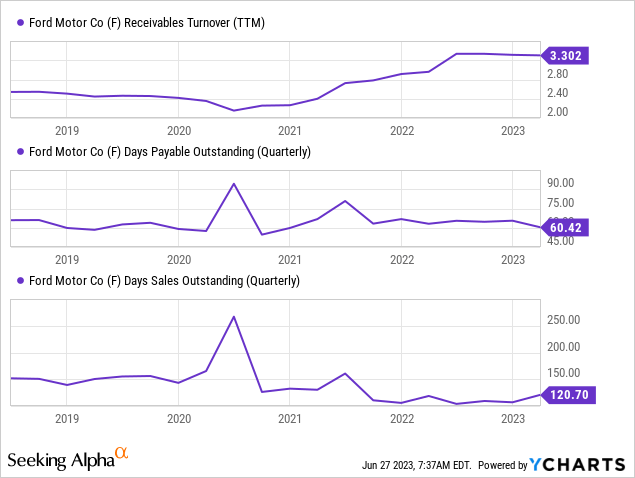

A look at Ford’s efficiency ratios implies that the firm is relatively resilient to challenges embedded within today’s economy. One would usually see a significant uptick in receivables turnover and days sales outstanding during trying economic periods while companies also try to extend their payables. However, Ford has yet to experience any significant changes in its operating cycle that we are concerned about.

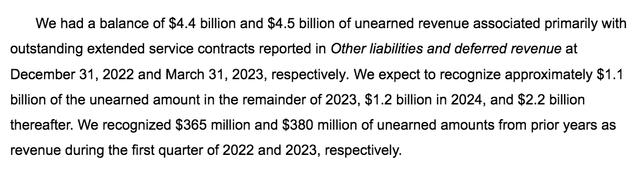

Furthermore, as illustrated in its latest 10-Q, Ford has a lot of unearned revenue that could settle in succeeding quarters. The firm’s recognition practices differ by business line; however, in general, it is based on customer contract acceptance.

If Ford’s previously estimated unearned revenue realizes, we think investors can anticipate a significant uptick in the firm’s year-over-year revenue growth within the company’s next earnings report. Moreover, we believe Ford’s efficiency ratios will improve accordingly and that its gross profit margins might recede amid a pullback in material costs.

10-Q Footnote (Ford)

Electronic Vehicles – From A Hidden Asset To A Material Catalyst

Ford’s electric vehicle, or EV, sales are growing at scale, stretching by an additional 41% year-over-year in its previous quarter to reach approximately 2.38% of its quarterly sales mix.

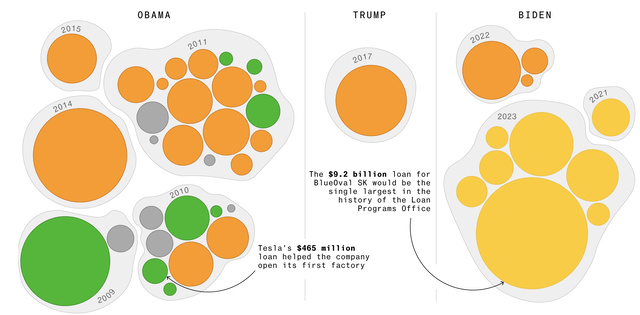

Apart from growing consumer appetite, we think the primary tailwind behind Ford’s EV segment is government support. The U.S. Government recently decided to back Ford with a $9.2 billion loan to help the company complete three EV battery factories.

Loans or government subsidies are completely normal in macroeconomic management as governments usually appropriate them to industries that they believe can either stem social benefits or create external financial gains. In our view, the U.S. government has recognized that it needs to challenge China in the EV space to sustain the stronghold its local markets possess in the ICE vehicle space. As such, market-leading companies such as Ford and Tesla (NASDAQ:TSLA) will likely benefit in the foreseeing years.

Government EV Loans Map (Bloomberg)

Valuation and Dividends Assessed

Ford is a worthwhile consideration if you are looking to allocate capital toward the auto industry, as its relative valuation metrics are undervalued relative to the broader industry.

In our view, the firm’s price-to-book ratio might worsen slightly at year-end as industry-wide asset impairments are likely given the high-interest rate environment coupled with lower industry-wide corporate earnings. Nevertheless, the stock generally seems undervalued.

| Metric | Value | Vs. Peers |

| Forward Price-to-Cash Flow | 4.09 | -51.17% |

| Forward Price-to-Earnings | 8.93 | -47.46% |

| Forward Price-to-Book | 1.24 | -49.35% |

Source: Seeking Alpha.

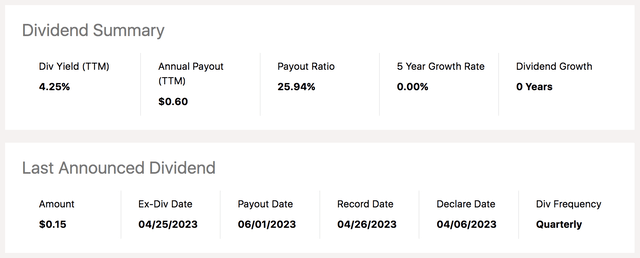

Furthermore, Ford’s stock has appealed to a broader investor base since introducing its dividend payout in late 2021, adding allure to its stock for income-seeking investors. Considering the stock’s dividend yield and dividend coverage ratio of 3.2, we think it is safe to say that its stock might benefit from the “bird in hand” theory for the foreseeable future.

Dividend Scorecard (Seeking Alpha)

Why We Might Be Wrong

Although most indicators point toward an upside for Ford’s stock, a few risks remain.

Let us run through a few risks that we identified.

An Alternative Valuation Method

Despite key metrics implying that Ford is fundamentally undervalued, a seminal absolute valuation metric suggests otherwise. According to the P/E expansion formula, Ford’s fair value is around x per share, leaving it in overvalued territory.

- Formula = Normalized P/E x EPS Estimate for Dec. 2023 = 7.46 × 1.82 = $13.57.

Considering this finding, we believe Ford possesses more valuation risk than most investors believe.

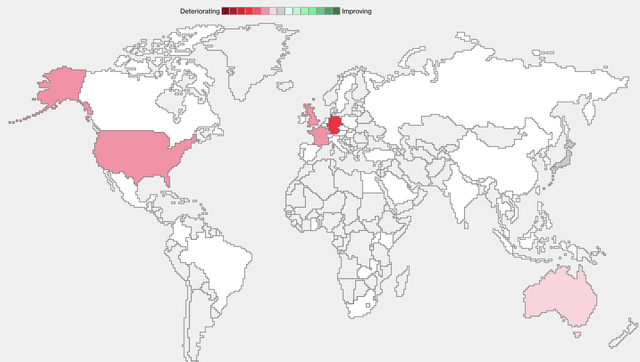

Purchasing Managers’ Index Woes

A final risk that we identified relating to Ford is the global softening in PMIs, which, if continued, might stun durable goods companies and their stocks. Although we believe industrial production will recover sharply in the coming quarters, PMI remains a risk as the current numbers are abysmal.

Global PMI Tracker (Bloomberg)

Final Word

Although history suggests that Ford’s stock trades within a range, we believe the asset’s recent surge can be sustained given its suitability to the current financial market environment. Moreover, critical aspects like government support for Ford’s EV endeavors and scope for enhanced operating efficiency provide much to cheer about.

In essence, our analysis conveys that Ford’s positives by far outweigh the negatives. As such, we deem its stock undervalued.

Read the full article here