In a report published in March, I discussed the roadblock that the merger between Spirit Airlines (NYSE:SAVE) and JetBlue (JBLU) hit. At the time, I pointed at Spirit Airlines as the better investment in case of a standalone scenario for both airlines. The reality, however, is that Spirit Airlines lost 7.5% while JetBlue lost less than 2%. Both airlines have been underperforming the broader market. I will discuss the most recent earnings, some operational challenges and developments regarding the combination with JetBlue.

Spirit Airlines: Not An Extraordinary Quarter

Spirit Airlines

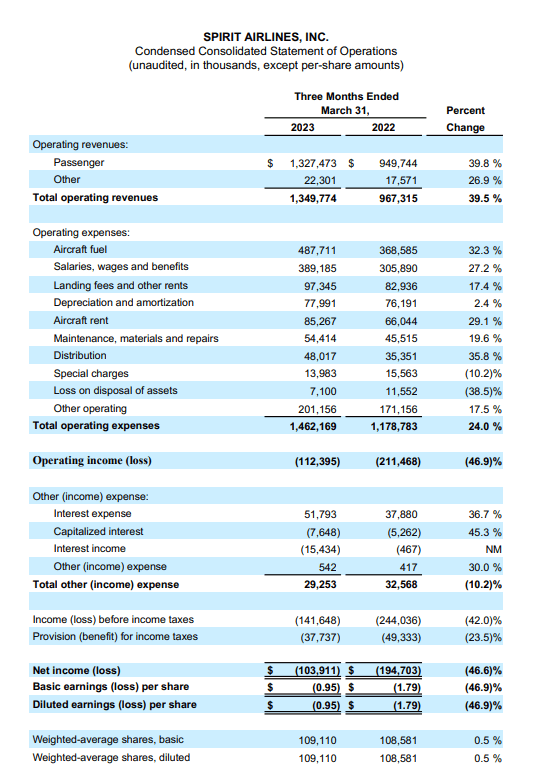

First quarter revenues increased nearly 40% driven by a 3.6 pts increase in load factor, 12.7% increase in capacity and a 24% increase in unit revenues. The year-over-year TRASM came in at the upper half of the 23% to 24.5% guided range while the capacity expansion fell 0.5 pts short of the initial guidance and 0.1 pts short of the updated guidance from March. Operating expenses excluding special items were slightly lower than expected driven by lower fuel costs per gallon. Year-over-year, inflationary pressures and high fuel prices led to a 24% increase in costs.

The first quarter tends to be the slowest quarter for many airlines, so I wouldn’t want to attach too much value to the business not being profitable, but there’s a lot of work to be done to get to >10% operating margins for the business. Obvious positives are further capacity expansions, better aircraft utilization and lower fuel prices.

Fleet Plan And Capacity: Supply Chain Impacts

Airbus

With the Pratt & Whitney challenges regarding turnaround times in the MRO facilities for the PW1000G geared turbofan, it’s interesting to see whether there’s any impact for Spirit Airlines. The latest data shows that there are five GTF powered aircraft parked, and Spirit Airlines shared that its 0.5 pts cut in capacity guidance was in fact related to the issues with the Pratt & Whitney engines where engines come off with wing prematurely and turnaround times leave to be desired.

Spirit Airlines

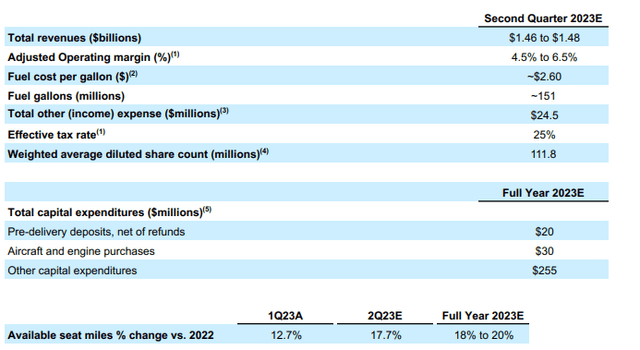

For the second quarter, Spirit Airlines expects an operating profit as fuel prices drop, capacity is expanded by almost 18% and demand for air travel remains robust. For the full year, the capacity expansion guidance is maintained at 18 to 20 percent in-line with its March guidance, but it’s down 100 basis points at the low-end and 200 basis points at the high end. So, there’s some impact on the capacity expansion due to these engine issues and furthermore, delivery delays at Airbus (OTCPK:EADSF) also pushed two deliveries out of the 2023 timeframe. What we’re seeing overall with jet makers is an inability to meet demand for airplanes, and while inconvenient for airlines, we also do see this as an element supporting continued strength in unit revenues.

It also seems that airlines are recognizing this. While the A321neo deliveries are delayed for Spirit Airlines this year, the company sticks to its plan to retire the A319ceo fleet. I wouldn’t say there’s an artificial limiting from airline side to keep the unit revenues high, but airlines are certainly keeping in mind what a supply chain constrained space means for ticket prices. Furthermore, continuing the phase out of less efficient airplanes now is favorable from a financial perspective since finding buyers for these jets should happen at beneficial terms. So, it makes a lot of sense to continuing selling those aircraft now as the airlines can basically sell at more attractive terms, receive discounts from OEMs for delayed deliveries and support existing unit revenues. In some way you could view this as an acquiring the long-life assets such as the A321neo that should bring significant reduction in unit costs at a more attractive price.

The Merger Between Spirit Airlines and JetBlue

The combination of Spirit Airlines and JetBlue is one that’s challenged by the Department of Justice and Department of Transportation arguing that JetBlue as evident from the alliance with American Airlines (AAL) leans more toward the Big Four and the department fears that a combination eliminates the pricing pressure and dupes cost-conscious travelers deeming the Spirit effect on offering competitive pricing is bigger than the JetBlue effect.

Recently, the court ruled that the North East Alliance between JetBlue and American Airlines is illegal and should be dissolved. The argument that the alliance is pro-competitive carried no significance due to a reduction in some NEA markets following the operations of the alliance and the elimination of competition between American and JetBlue was weighed heavier than the combined ability to compete with Delta Air Lines (DAL) in the markets. What this means for the path toward an eventual combination of JetBlue and Spirit Airlines is unknown, but if the removal of competition between two parties that combine operations weighs heavier than an ability to compete with a third party, then things do not bode well for the targeted combination between the two.

Conclusion: Spirit Airlines Stock Remains A Buy

While the doubts about a combination with JetBlue might hold the stock down, I do believe that the stock remains a buy. There are two reasons for that. Approval of the combination provides significant upside, around 76%, for Spirit Airline’s stock while its upgauging strategy and addition of fuel efficient jets should provide a strong growth path ahead in case the combination with JetBlue is eventually blocked.

The risk obviously is that the current strong demand environment for air travel might not and likely will not last and the Pratt & Whitney engine issues are putting a damper on growth. Though the supply-demand imbalance for new airplanes could provide support to pricing strength and Pratt & Whitney is working on insertion of the D block standard for the GTF with continued developments of D1 and D2 packages along with expansion of MRO capacity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here