Investment thesis

Since last year there is a lot of turbulence in the market when it comes to financial stocks. This is mainly because of the turmoil caused by several American and European banks. In my opinion this situation has created some great investment opportunities in the financial space, because I think there was some overreaction, especially in the insurance sector. NN Group N.V. (OTCPK:NNGPF) is one of the companies that took a hit in share price and the stock is down heavily on an annual basis and trades around €33.32 euro. From a dividend investment point of view things are getting really interesting with a current dividend yield above 8%. But is it really an attractive investment or is it more like a dividend yield trap?

NN group stock price (Seeking Alpha)

In this article I am going to explain why NN is an attractive “BUY” based on dividend- and valuation metrics.

Company overview

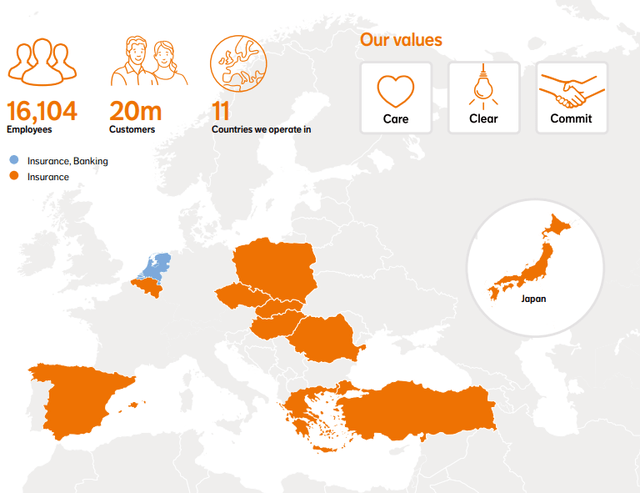

NN Group is an international financial services company with its roots in the Netherlands. The company is the market leader in the Dutch life- and pension markets, with about 40% market share in the pension market. At first, NN Group was a part of ING Groep N.V. (ING), but on 2 July 2014 it became a standalone listed company. The company has a market cap of €10.04 billion and shares are listed on Euronext Amsterdam (NN.AS) and their ADRs trade on the OTC markets (NNGPF). I would encourage you to buy the shares from Euronext Amsterdam for liquidity reasons. NN Group has approximately 20 million customers in 11 different countries and has a strong presence in Europe and Japan.

NN Group international presence (NN Group investor relations)

The company offers several services such as: retirement services, pensions, life and non-life insurance and banking.

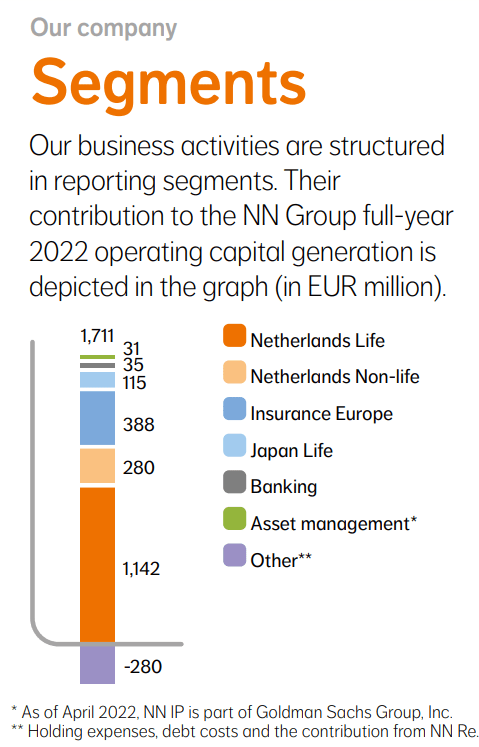

Operating capital generation per segment. (NN Group 2022 annual report)

NN Group uses operating capital generation as their main financial metric in their reports. The picture gives an overview of the different business segments and their contribution to the operating capital generation. The majority of the operating capital generation profits comes from insurance activities in the Netherlands. Banking accounts for only a small percentage of the total operating capital generation.

Financial strength

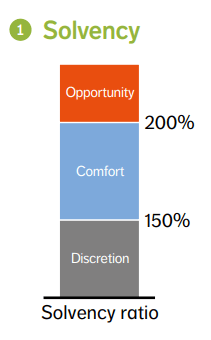

The financial strength of NN Group can be called solid. At the end of fiscal year 2022 NN Group had a solvency II ratio of 197%, which was lower than the 213% of fiscal year 2021. The reason for that was the high amount of cash returning to shareholders and the negative impact of the market. However, their current solvency is still good if we look at the bar chart below.

Three-pillar capital framework (NN Group 2022 annual report)

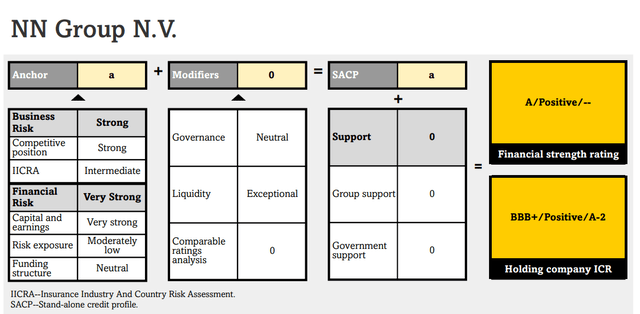

NN Group states in its 2022 annual report that if they can manage to keep their solvency ratio above the 200% threshold, they are planning to return more cash to shareholders in the form of additional share buybacks. At 24 March 2023, the company also received a “A” credit rating from S&P global, which means that NN Group should have a strong capacity to meet its financial commitments.

NN Group credit rating (S&P global)

Strategy & capital allocation

The main goal of NN Group is to create long-term value for all stakeholders. They believe that they can keep growing their business at a mid-single digit rate based on operating capital generation. On the short term NN Group has a clear vision about the current economic environment. The fact that interest rates are way higher than previous years can be a good thing for NN Group, because it allows them to reinvest at higher yields.

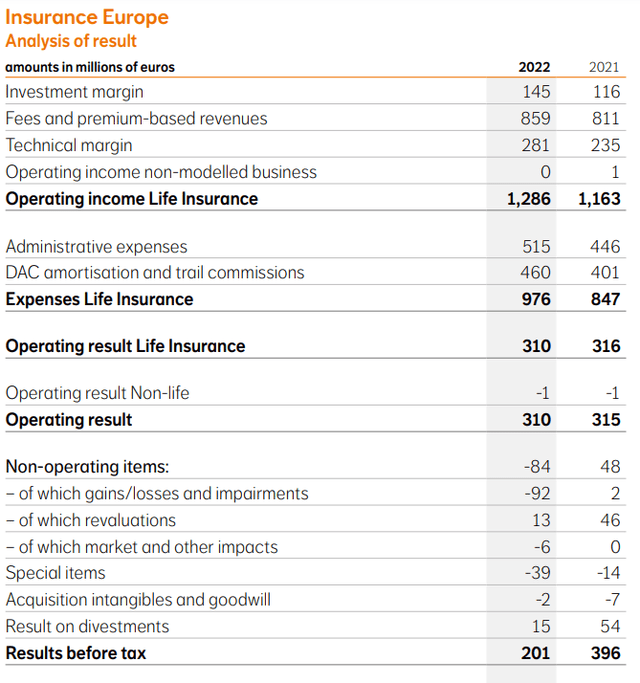

There are some long-term trends that can trigger growth in the future. One of these trends is the increased risk awareness among consumers in international markets. Mainly in markets where insurance penetration rates are still relatively low. In my opinion the growth really has to come from other countries in Europe, because in the Netherlands the market is already highly penetrated. In 2022 NN Group has completed the acquisition MetLife’s activities in Greece and Poland. They launched a variety of new products in Spain, while also growing their customer base though digitalisation in Romania. This has led to an improved operating income in their life insurance segment. However, it hasn’t translated into a better operating result yet due to higher expenses.

Insurance Europe segment (NN Group 2022 annual report)

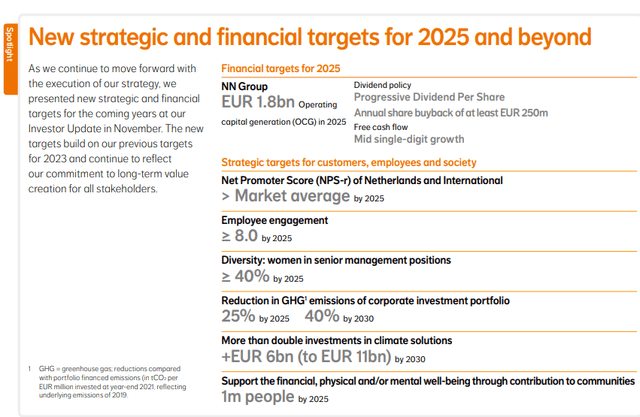

NN Group has set up a clear capital allocation framework. Their goal is to generate €1.8 billion in operating capital in 2025 and aiming for free cash flow growth at a mid-single digit rate in the long term. The growth of the company should be coming from their international activities, while generating strong cash flows from their activities in the Netherlands.

NN Group financial targets (NN Group 2022 annual report)

Dividends

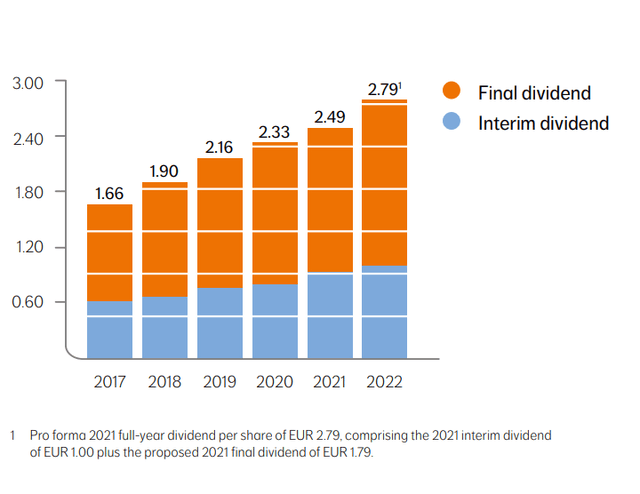

Analyzing the dividend, there are a lot of positives to mention. Firstly, there is an option to choose if you want to get the dividend paid in cash (after deduction of the dividend withholding tax of 15%) or in stock. In fiscal year 2022 NN Group paid a dividend of €2.79 per share annually At the current share price the dividend yield is around 8.37%, which is really high.

Dividend distribution NN Group (NN Group 2022 annual report.)

NN Group is also planning to steadily grow its dividend. The 5-year dividend growth rate (2018-2022) is 7.98%, which is in line with the sector average of 7.49%. However, the dividend yield is way higher than the industries average, which makes NN Group very attractive. Combine the dividend yield with the dividend growth and the company has the potential to be a dividend powerhouse. The future dividend increases will depend on the market conditions at that moment in time. NN Group expects that the dividend increases will be in line with the growth of its operating capital generation, which shall be in the mid- single digit range. One of the most important metrics is the safety of the dividend, because as a dividend growth investor I want a dividend that is growing in a durable way. If we take the annual dividend of fiscal year 2022 of €2.79 per share and divide it by the earnings per share of €5.09 it comes down to a payout ratio of 54.8%. This payout ratio is in my opinion safe and there should be enough room to further grow the dividend in the future.

Share Buybacks

NN Group did a share buyback program of €1 billion in 2022. They are also planning to do more share repurchasing for at least €250 million annually until 2025. This is about 2.5% of its own market cap. So we’re looking at a total shareholder yield of around 11%. If there will be excess capital it could be even more than the minimum of €250 million. At the moment I think it is a good thing that they do buybacks, because I think the valuation of NN Group is attractively enough to do so. This statement shall be explained in the next section of the article.

Valuation

NN Group has a price-to-book ratio of 0.52, which means the company trades for less compared to the value of its total assets. The price-to-book value is also far below its sector median of 1.02. This could be a signal that NN Group is undervalued.

To calculate my own fair value of NN Group I used the dividend discount model (Gordon’s Growth Model). This model fits NN Group very well, because it’s a stable company with constant “predictable” dividend growth. The growth model requires the following numbers:

- The value of the next years dividend.

- The rate of return.

- The expected dividend growth rate.

As described earlier, the annual dividend of NN Group is €2.79. I used a rate of return of 12.5%, because I want a return of investment of around 12.5% per year. I took a relatively conservative dividend growth rate of 5%, just to be on the safe side. If we do the math this comes to a fair value of €37.2 euro per share. Compared to the current share price NN Group is 11.7% undervalued.

For comparison, analysts are giving NN Group an average target price of €48 per share.

Another valuation method that is often used for dividend stocks is the Chowder rule. Combining the current dividend yield of 8.37% and the 5 year CAGR of 7.89% leads to a total of 16.26%, which is way better than the threshold of 12%. This is also an indication that the stock is attractively valued at current levels. A disadvantage of using the Chowder rule is that the dividend growth rate is a reflection of the past, and in my opinion it is questionable if the future 5 year growth rate will be as high as 7.89%. There is some margin of safety here, because if the 5 year growth rate will be 4-5% the Chowder score is still higher than 12%.

Investment risks

As an investor is it always important to look at the potential investment risks. One of the most important risk factors is enduring inflation or even stagflation. Periods of higher inflation can have a negative impact on the solvability of NN Group. Inflation can also have a negative impact on their claims or labour costs, which can lead to a decrease of profitability. It can also have a secondary effect on interest rates, equities, real estate and their sales. Geopolitical friction, such as an escalation in the war between Russia and Ukraine can also be a risk factor. NN Group doesn’t have business activities with those two countries, but it can be a potential trigger for higher inflation. NN Group has exposure to inflation-linked liabilities via the Netherlands life insurance segment (< € 5 billion), but the liabilities are fully hedged on an economic bases. In my opinion it is really hard to guess how the inflation will develop on the short term. Only if it stays at higher levels for too long, it can hit the bottom line of NN Group.

It looks like that the inflation numbers in Europe will remain above the target of the European Central Bank. Based on the outlook of the European Central Bank itself, inflation should decline from an average of 5.4% this year to 3.0% in 2024 and 2.2% in 2025. However, it would not be the first time that the European Central Bank would make a wrong estimate about the inflation outlook.

Macroeconomic projections (Website European Central Bank)

Another risk that is worth taking into account is the possible competition/disruption of non-traditional insurance companies, for example Big-tech or smaller “Insurtech” companies. Digitalisation is rapidly taking place, so it is really import that old school insurance companies like NN Group can adapt quick enough. However, it is good to see that NN Group is looking to accelerating their digital transition by partnering with start-ups and Insurtech companies.

Conclusion

NN Group is a stable Dutch insurance company and is a market leader in Dutch life- and pension markets. The company’s solvency ratio and balance sheet are good enough to stay financially flexible. With a current dividend yield of 8.37%, an expected mid-single digit dividend growth rate and a healthy pay out, there is enough to get excited about as a dividend growth investor. Combine this with a share buyback program of at least 250 million and you get a total shareholder yield of 11%. Based on the Chowder score and the outcome of the Gordon’s Growth Model it looks like NN Group is undervalued right now. Don’t expect a lot of growth from NN Group the coming years, but at current valuations and the high shareholder yield this isn’t even necessary to be a rewarding investment. With this in mind I give NN Group a “BUY” rating. I also initiated a position in my own dividend stock portfolio on the 16th of June at a price of €32.78 euro per share.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here