Investment Rundown

With momentum to start 2023, Digi International (NASDAQ:DGII) has impressed as revenues grew and margins expanded. Operating in the information technology sector, the company is experiencing strong demand as the industry wants faster software and applications. DGII offers businesses the opportunity to enable faster and more efficient machine communications, which has helped maintain a strong history of profitability for the company.

Looking ahead, DGII sees the market opportunity to be around $64 billion. This presents an intriguing opportunity for DGII to both invest heavily to gain market share and build solid revenue streams. The share price cratered down to under $30 per share recently but has since recovered very well and I view the share price under $40 to still offer a good entry point for the long-term.

Company Overview

Digi International is a provider of IoT products, services, and solutions across the globe. The company operates through two segments: IoT Products & Services and IoT Solutions. Their offerings assist customers in developing and implementing secure IoT connectivity solutions.

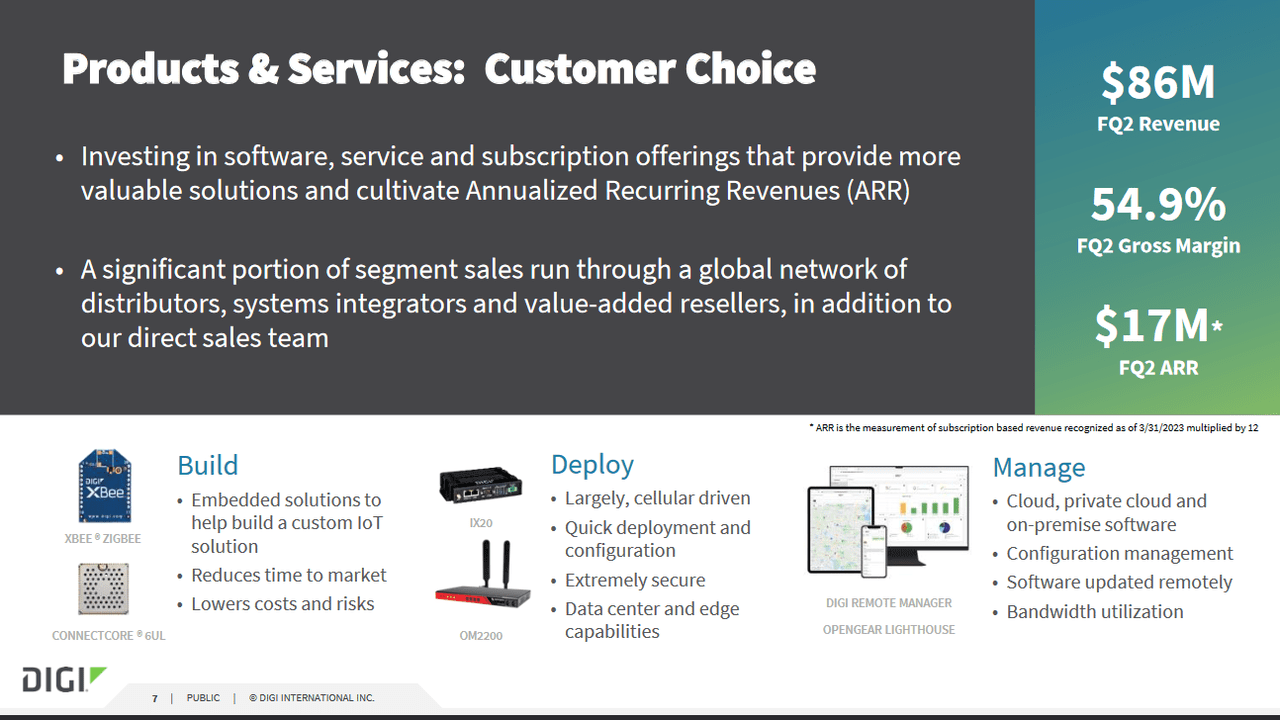

Company Offerings (Investor Presentation)

Digi International provides a range of products, including wireless modules, routers, and device management platforms, to enable seamless IoT connectivity. Additionally, they offer Managed Network-as-a-Service (MNaaS) and SmartSense by Digi services. These services cater to various industries and provide cellular and fixed-line WAN solutions, as well as wireless temperature and other monitoring services tailored to specific markets like food service, healthcare, and supply chain.

To gain a competitive edge, Digi International competes on multiple fronts. They emphasize product features, service and software application capabilities, brand recognition, technical support, quality and reliability, product development, pricing, and availability. By delivering high-quality products, responsive customer service, and competitive prices, the company strives to surpass its competitors in the market.

Earnings Highlights

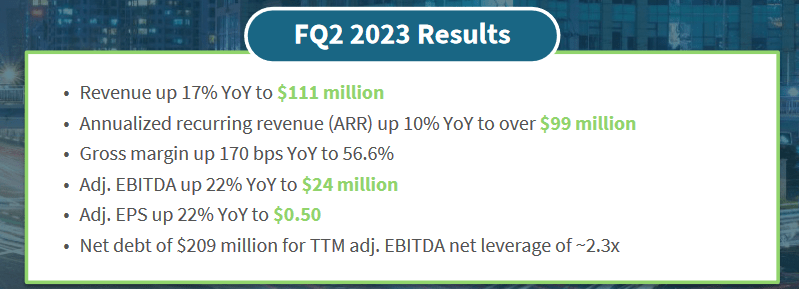

Looking at the most recent report from DGII they had yet another strong quarter in 2023, as revenues grew 17% YoY. This market is the ninth consecutive record-breaking quarter for the company, highlighting the strong momentum they have maintained so far.

Much momentum was seen in the Product & Services segment as each of their product lines experienced growth, resulting in a 20% YoY growth. But the momentum was also continuing in the second segment of the company, the Solutions segment. Here the increased offerings of SmartSense and Ventus helped grow revenues and the segment boasts the largest gross margins yet at 62.4%.

Q1 Results (Q1 Earnings Presentation)

Where I think a lot of the attention for investors will be is the recurring revenues the company can achieve. Right now they have grown it to $99 million, which is an increase of 10% YoY.

Looking at the full year of 2023, DGII has noted the easing of supply chain issues and the continued strong demand is a tailwind that will carry them to grow annual revenues of at least 12%. But where I am most impressed is that ARR and Adjusted EBITDA is expected to grow faster than 12% YoY, indicating DGII expected further improvements in margins.

The one worry now with the guidance for Q3 of 2023 is that DGII sees the shares increasing a fair bit to 37.3 million outstanding. This would result in a sequential dilution of 1.6%, which I am not a fan of. I would rather see the positive cash flows used for further investments into new product lines.

Risks

Digi faces foreign currency translation risk as it consolidates the financial position and operating results of its foreign subsidiaries, which are translated into U.S. Dollars. A 10% fluctuation in the average exchange rate between the Euro, British Pound, Australian Dollar, and Canadian Dollar to the U.S. Dollar could lead to a 1.0% upward or downward impact on shareholders’ stake in the business. As an international company, this is simply something you have to accept and hopefully, DGII can achieve efficiently around it.

These fluctuations do play out over the long term and in most cases these are small headwinds. Looking at the bigger picture, often small fluctuations like this help present another buying opportunity for investors. Where I am also seeing some risks presented is the debts climbing very fast. Back in 2021, DGII had a negative net debt which put them in a very strong position financially. But from the negative $85 million they had in net debt, it has climbed to $216 million now. A result of having both less cash and a need to raise capital to fund acquisitions.

Industry Comparison

Taking a look at a company operating in the same sector we have Infinera Corporation (INFN), a company offering optical transports networking equipment, but still benefiting from similar market demand as DGII. Looking at the valuations of the two companies I think that DGII is looking a little less richly valued. A FWD p/e of 19 makes sense given the growth they project to have. Where INFN pulls ahead is that they have significant margin expansions expected in the coming years, but they lack significant cash flows to support some of the growth I think, and that will result in a continued dilution of shares for shareholders. DGII at least has positive cash flows, which I view as a major benefit compared to INFN.

Looking at the TTM profit margins of the two, DGII wins out here too, with gross margins reaching 57%, far above INFN and 36%. The high expectations for INFN to grow its margins put some risk on the investor’s part as a failure would likely lead to a lower multiple and a share price decrease. The TTM net margins for INFN are a negative 2.62%, and the projected EPS for 2023 would mean they can grow the margin to a positive 2.8%. A big jump which I don’t find very likely and a safer and more reliable investment seems to be in DGII.

Final Words

Right now DGII offers investors the possibility to gain good exposure to the growing demand for improved machine communications. DGII has built out its product line very efficiently over the last few years which has helped them grow revenues consistently and expand margins. That trend does seem to be slowing down and DGII is now focusing on securing strong annual recurring revenues, which will be a strong support for the company and aid in fueling growth. I am rating DGII a buy here and think that anything under $40 per share seems to offer a good starting position.

Read the full article here