Introduction

Shares of SpartanNash Company (NASDAQ:SPTN) have fallen 29% YTD. Despite the fact that the current valuation, according to multiples, looks attractive, I believe that it is still not the best time to go long.

Investment thesis

In my personal opinion, this is still not the best time to go long. First, based on macro data and management comments, we may see a slowdown in inflation in the second half of 2023, which could have a negative impact on business growth. Second, declining economies of scale and recent wage increases could put pressure on operating margins, especially in the retail segment. In addition, I like the company’s initiatives to improve gross profit; however, I estimate the effect of new initiatives at the level of 0.5%-0.6%, which, in my opinion, is not enough figure to serve as a catalyst for growth in shares.

Company overview

The company distributes food and household products in the US market. The company operates in all 50 states. The main business segments are wholesale and retail segments. In the retail segment, the company operates 144 supermarkets, as well as its own network of large distribution facilities.

1Q 2023 Earnings Review

According to the results of the 1st quarter of 2023, the company’s revenue increased by 5.2% YoY due to the same growth rate in both the wholesale and retail segments. The main driver of revenue is inflation, which the company passes on to the end consumer, while sales volumes were under pressure in line with management comments.

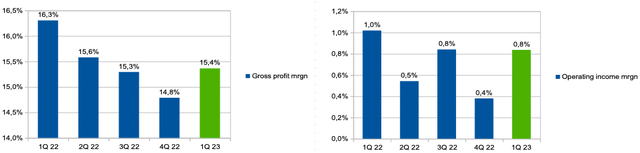

Gross profit margin decreased from 16.3% in Q1 2022 to 15.4% in Q1 2023 due to lower benefits in the wholesale segment and lower profitability in retail pharmacies. Spending on SGA (% of revenue) decreased from 15.3% in Q1 2022 to 14.4% in Q1 2023. Thus, operating margin decreased from 1.0% in 1Q 2022 to 0.8% in 1Q 2023. You can see the details in the chart below.

Margin trends (Company’s information)

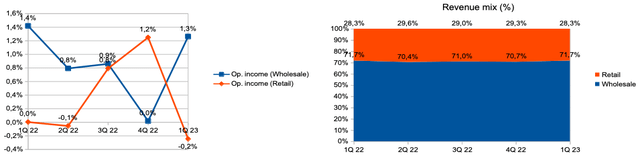

I would like to draw attention to the operating margin in each of the segments. The operating margin in the Wholesale segment remained almost the same, but decreased slightly from 1.4% in 1Q 2022 to 1.3% in 1Q 2023. In the retail segment, we see a stronger decline from 0% in Q1 2022 to -0.2% in Q1 2023. In line with management’s comments, the negative operating margin in the retail segment is attributable to additional restructuring and provisioning costs of $4.1 million that arose due to the closure of two stores. However, if we calculate the operating margin in the retail segment without additional restructuring costs, then the operating margin in the segment will be about 0.25%, which is better than in 1Q 2022, but still looks weak, in my personal opinion, relative to previous quarters. You can see the details in the chart below.

Op. margin by segment & revenue mix (Company’s information)

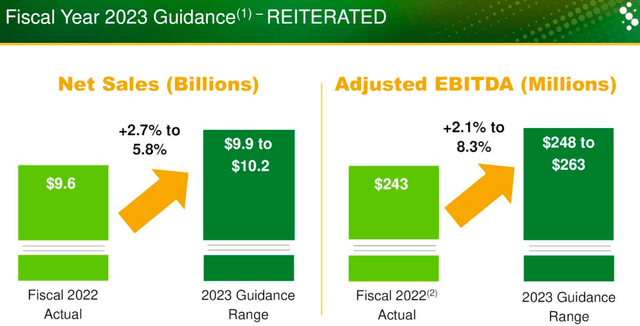

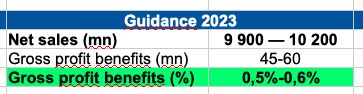

In addition, the company confirmed guidance for 2023, which it provided to investors earlier.

Guidance 2023 (Company’s information)

My expectations

Based on the company’s guidance, market data and my own forecasts, I think we will see a modest pace of revenue growth in the coming quarters. According to the company’s guidance, the revenue growth rate will be 2.7-5.8%, which, in my personal opinion, is not a high growth rate, as evidenced by the quotes reaction at the time of the guidance publication.

In addition, I see additional risks in the form of a slowdown in inflation in the second half of 2023. So, in accordance with the comments of management, the biggest contribution to comparable sales is made not by traffic, but by inflation, which can lead to additional pressure on business growth rates.

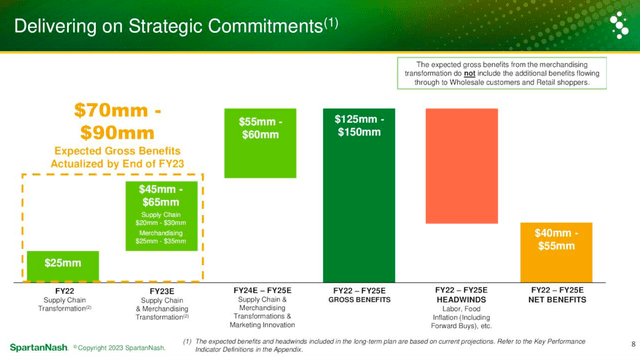

In addition, a decrease in the scale of business in the retail segment may lead to a decrease in economies of scale, which is negative for the level of operating profitability. The company has announced a number of initiatives, such as supply chain optimization and merchandising, that could help generate benefits at the gross margin level. You can see the details in the chart below.

Initiatives (Company’s information)

However, if we analyze the potential contribution from new initiatives to future gross margin levels, we can see that the potential effect will be about 0.5% -0.6% in 2023. In my personal opinion, these initiatives are strategically correct, but this effect in 2023, in my opinion, will not be enough to provide significant support to profitability in the face of declining inflation.

Effect of initiatives (Personal calculations)

Risks

Macro (general risk): lower inflation in the second half of 2023 may have a negative impact on revenue dynamics, because the company focuses on core demand, where the business has the ability to pass on the increased level of incoming costs to the end consumer without a significant decrease in demand. Margin: Slower revenue growth could put pressure on operating margins, especially if sales growth lags behind operating expenses.

Drivers

Macro (general risk): a relatively high level of inflation can support the dynamics of business revenue, because the company has the ability to pass on the increased level of inflation to the end consumer, as it focuses on basic demand. In addition, outstripping new store openings could also support the company’s top line growth.

Margin: management initiatives to optimize the supply chain and improve the efficiency of merchandising can help increase profitability in terms of reducing operating costs and increasing sales per 1 square meter in the retail segment.

Valuation

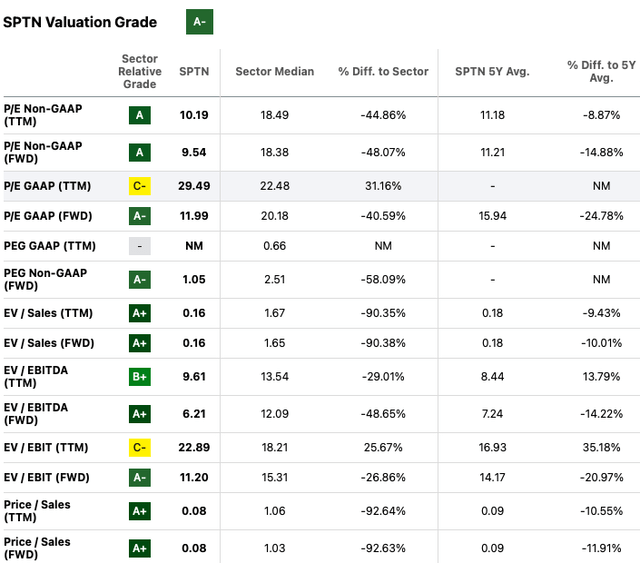

At the moment, in my personal opinion, the company’s shares are not expensive relative to historical values and relative to industry averages. To value companies in the retail sector, I prefer to use P/E and EV/EBITDA multiples. Thus, the P/E (fwd) multiple is 9.5x, which is 48% less than the sector median and 15% less than the 5-year average. The EV/EBITDA (fwd) multiple is 6.2x, which is 49% less than the sector median and 14% less than the 5-year average. I believe that the current discount is due to the fact that the market is taking into account downside risks due to slower growth and lower margins, as well as taking into account the discount for the size of the company.

Valuation (SA)

Conclusion

In my personal opinion, now is not the best time to go long in a company’s stock. At the moment, I see more potential risks to revenue growth and margins than potential catalysts for share price growth in the coming quarters. On the other hand, the stock is not expensively priced in line with the sector averages and in line with the 5 year average multiples, which in my opinion limits the downside, which is why I recommend HOLD rather than SELL on the company’s shares.

Read the full article here