Investment thesis

Fastly (NYSE:FSLY) has been one of the hottest stocks this year since the share price almost doubled since January. My valuation analysis suggests there is still room for stock price appreciation, but the level of uncertainty is very high. The company’s revenue growth has been impressive over the past six years, but profitability metrics deteriorated which looks like a red flag for me. Moreover, the level of debt is substantial and I consider it is very risky because the company is far from breaking even from the operating cash flows perspective. After considering all pros and cons together I assigned FSLY a “Hold” rating.

Company information

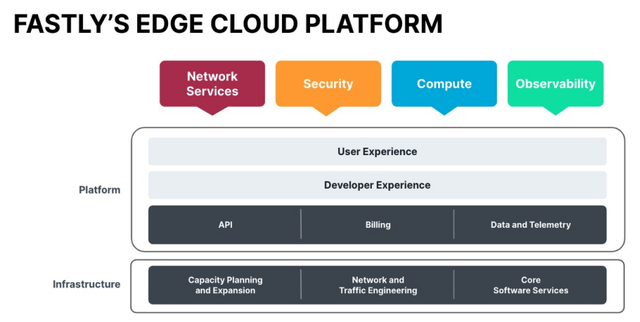

Fastly is a technology company specializing in content delivery and edge cloud computing services. Fastly’s service offerings are diversified, including content delivery, video and streaming acceleration, image optimization, load balancing, real-time logging and analytics, and security capabilities.

Fastly’s latest 10-K report

The company’s fiscal year ends on December 31. About 90% of total sales were generated from enterprise customers. According to the latest 10-K report, about 75% of sales were generated in the U.S.

Financials

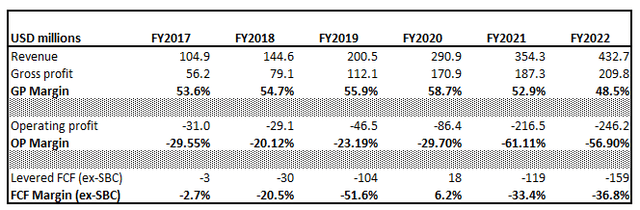

Fastly went public in 2019, so I have a relatively short horizon for long-term analysis. We have financials available for the last six years when the company demonstrated an impressive 33% revenue CAGR. Still, a big red flag for me is that profitability metrics softened as the business grew. It should be vice versa. Otherwise, there is no point in delivering revenue growth. The company did not achieve a sustainable positive free cash flow [FCF] margin.

Author’s calculations

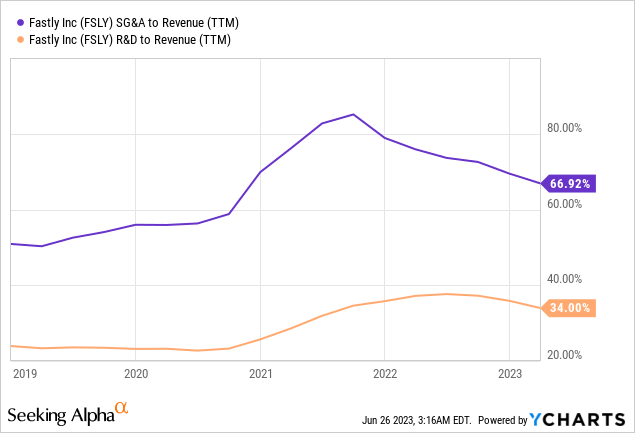

The company invests a substantial portion of sales into R&D, which is good. But, the portion of sales spent on SG&A is twice more extensive than the R&D. When I see such a proportion, the first thing that pops into mind is that the company will not sustain an impressive growth rate if it cuts spending on SG&A. A 67% SG&A to revenue ratio means the company is far from creating a solid brand with the help of word-of-mouth.

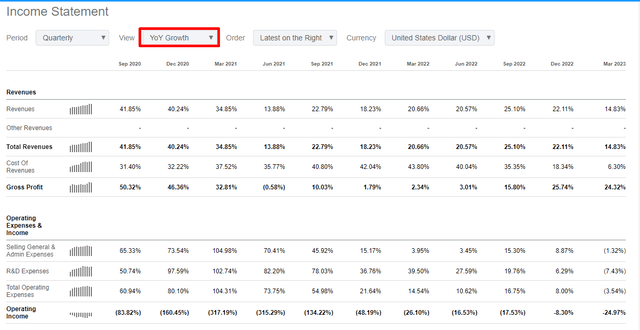

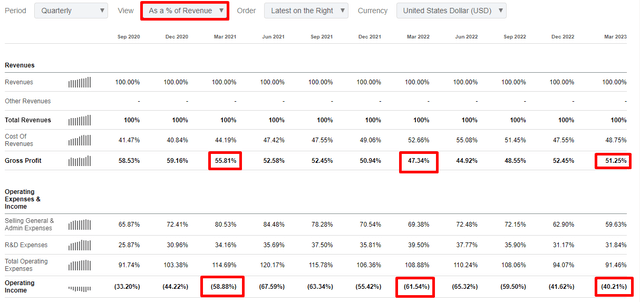

Now let me narrow it down to quarterly performance. The company reported its latest quarter on May 3, delivering above-the-consensus earnings. Revenue grew about 15% YoY which is impressive. On the other hand, in the below table, we can see that the revenue growth decelerated compared to previous quarters.

Seeking Alpha

Profitability metrics improved substantially on a YoY basis. The gross margin was lower sequentially and substantially lower than all-time highs. During the last quarter, the company demonstrated a solid commitment to innovation with an above 30% R&D to revenue ratio. Operating profit improved significantly YoY but is still far from breaking even with minus 40%.

Seeking Alpha

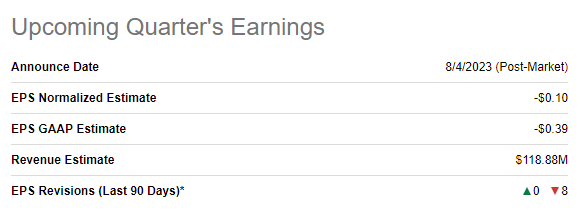

The upcoming quarter’s earnings are expected to be released on August 4. Revenue is expected at about $119 million, indicating about 16% YoY growth, indicating that revenue growth momentum is still solid. Adjusted EPS is expected to improve but is still projected to be negative.

Seeking Alpha

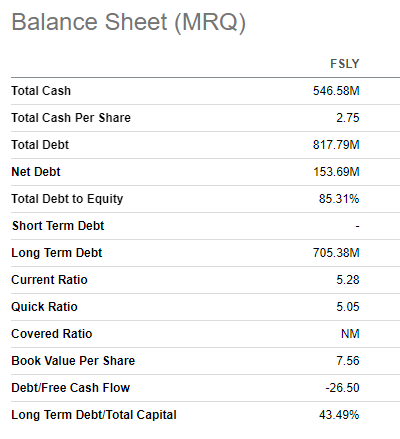

The company has generated negative levered FCF for three quarters in a row. Cash from operations is negative, and the company heavily sells marketable securities to finance its operations. That said, the company’s balance sheet is not a fortress. This is because of a high level of leverage, which is a risk for the company since cash flows are negative. Solid liquidity ratios do not persuade me that the balance sheet is strong.

Seeking Alpha

Valuation

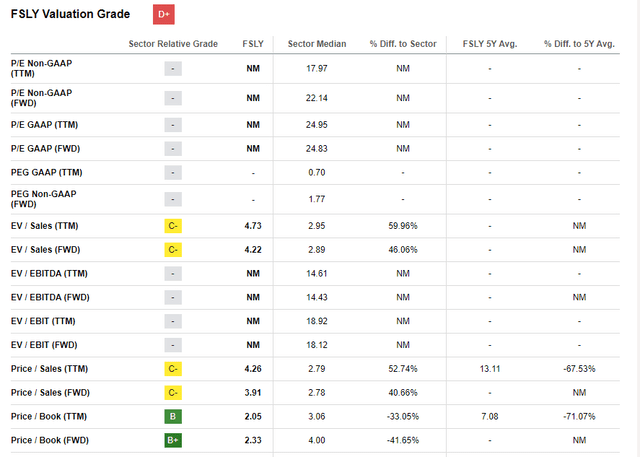

FSLY stock outperformed the broader market this year with a 92% year-to-date rally. Seeking Alpha Quant assigned the stock a “D+” valuation grade, indicating that multiples are high. Indeed, price-to-sales and EV-to-sales ratios are substantially higher than the sector median. On the other hand, other multiples look attractive.

Seeking Alpha

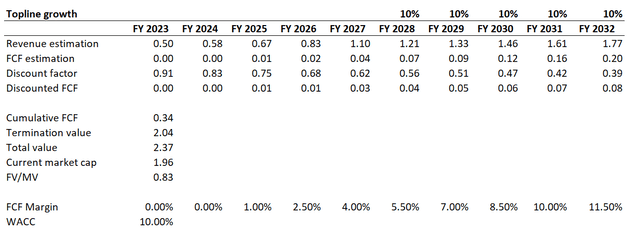

Fastly is a growth company. Therefore, I use discounted cash flow [DCF] valuation approach. I use a 10% discount rate close to the WACC projected by valueinvesting.io. For future revenue, I have consensus estimates up to FY 2027. For the years beyond, I implement a 10% revenue CAGR. FCF margin is tricky to project because the company is still losing cash. I think that implementing a 1% FCF margin in FY 2025 and further yearly 150 basis points expansion is fair.

Author’s calculations

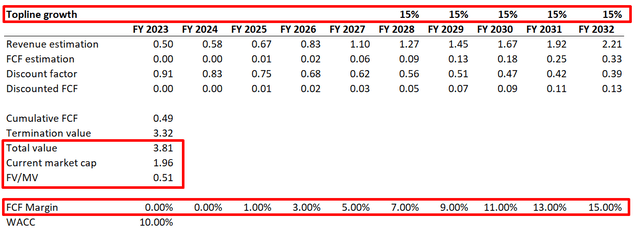

Under these assumptions, the stock looks about 17% undervalued, but the level of uncertainty is very high. Now let me simulate a 15% revenue CAGR for the years beyond and 200 basis points FCF margin expansion from FY 2026.

Author’s calculations

Under the optimistic scenario, we can see that the stock is substantially undervalued. The business’s fair value under optimistic simulation is nearly $4 billion, while the current market cap is about $2 billion. If we talk purely from the figure’s perspective, the stock is attractively valued. But, the level of uncertainty regarding future growth and FCF margin improvement is substantial.

Risks to consider

Investing in FSLY is very risky due to several reasons. First, there is minimal certainty about when the company will start generating positive FCF. As we saw in the “Financials” section, the business does not demonstrate a clear path of margin improvement as the company scales up. Moreover, profitability metrics even softened over the long term. The company’s EPS is stagnating, and a substantial SG&A to-revenue ratio close to 70% seems ineffective in fueling sustainable growth.

The second significant risk is the substantial leverage ratio, especially given the company’s “cash burn” mode. The longer FSLY will be unprofitable in terms of the FCF, the higher the credit risk for the company will be.

The third major risk is competition and shallow barriers to entry. The business model is not capital-intensive and does not involve very sophisticated algorithms that cannot be replicated. That said, new competitors for FSLY might appear rapidly and the company’s market share will be at risk.

Bottom line

FSLY’s valuation looks very attractive, but I am not investing due to the very high level of uncertainty regarding the underlying assumptions. I also don’t like the fact that profitability metrics do not improve while the business scales up at a rather rapid pace. A high leverage ratio is also a substantial risk, especially given the negative FCF. Therefore, I assign FSLY stock a “Hold” rating.

Read the full article here