A lot has happened since my last article covering the Polygon (MATIC-USD) network in late March. It’s been an interesting year for the Polygon network and for the MATIC token. Roughly three months after launching a zkEVM chain that lives separately from Polygon’s original Proof of Stake chain, Polygon Labs recently announced plans for “Polygon 2.0.”

The Elephant in the Room

I don’t want to go too much further in this article without first acknowledging Polygon’s recent designation as an unregistered security by the United States Securities and Exchange Commission. In the agency’s lawsuit against Binance (BNB-USD) in early June, the SEC accused the exchange of selling unregistered securities to customers.

As part of that accusation, the agency designated Cardano (ADA-USD), Solana (SOL-USD), and Polygon (MATIC-USD) to be unregistered securities, among more than a half dozen other coins as well. Since that designation, MATIC has declined more than 25% had has dramatically lagged other coins in the crypto market. This is what I wrote last year regarding the regulatory risks of buying MATIC:

Polygon carries significant regulatory risk in the United States. The market still requires clarity on if MATIC would be considered a synthetic commodity, currency, or a security. I will not attempt to handicap how the federal government views MATIC but in my opinion it would probably negatively impact the price of the coin to a larger degree if the SEC gets regulatory oversight of Polygon.

The SEC has now claimed jurisdiction. Whether that planted flag bears any fruit for the SEC or not is anyone’s guess but judging from the 25% MATIC price decline since the designation, I’d say we’re much closer to pricing in that risk than we were in December. MATIC has characteristics of a commodity or currency since it’s used as payment in network transactions. However, there was an IEO through Binance in 2019. The latter of which adds credence to the notion that MATIC could be considered a security.

In my personal opinion, we’re still very much in need of clarity regarding whether MATIC truly is a security or not. But it’s also important to remember that distributed ledger blockchain networks are global. In the event the SEC is ultimately granted regulatory oversight of MATIC, non-compliance with SEC regulations could theoretically result in US consumers being geo-blocked from dApps that utilize the Polygon network.

Polygon 2.0

On June 12th, Polygon Labs announced “Polygon 2.0.” This new iteration of Polygon has been dubbed “The Value Layer of the Internet” by its proponents. Where the internet has allowed for improvements to information access and speed at the user level, one area where the internet is still held back by analog systems is in value transfer and ownership authentication. According to Polygon Labs:

The Internet democratized access to information; the Value Layer democratizes access to the global economy. It enables decentralized finance, digital ownership, new mechanisms for coordination and much more. It is the missing piece of an Internet that serves users, not gatekeepers, rent-seekers or middle-men.

Essentially, Polygon wants to be the property ownership layer of the internet. In building this, Polygon has proposed updates to the main PoS chain as well as how the network will be governed in the future.

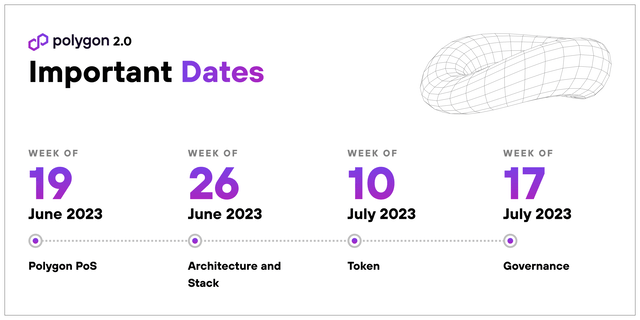

2.0 Announcement Calendar (Polygon Labs)

We don’t yet have details on all of these proposed changes, but we do know Polygon Labs wants a “purple merge” from PoS to zkEVM Validium for the main chain. Due to the fact that Polygon just launched a separate zkEVM earlier this year, for the remainder of this article we’ll refer to the post-transition PoS network as the “zkValidium” chain to avoid confusion:

If accepted by the community, this upgrade will mark an incredible technical achievement-the first time that an existing chain (especially of this size and importance) adds ZK proofs to become an L2.

Validium is a bit different from roll-ups because the transaction data is not all stored on the Ethereum (ETH-USD) blockchain. In practice, this would allow for network activity that is faster and more cost-efficient. However, it would come with some tradeoffs. For instance, off-chain data requires greater trust in the operator. If something catastrophic were to happen to Polygon’s zkValidium network, it could make it more difficult to prove prior ownership state because some of the data pre-catastrophe wouldn’t be publicly recorded on-chain.

From a user standpoint, the transition from PoS to zkValidium should be seamless for the overwhelming majority of current developers. According to Polygon Labs, validators will have to upgrade to the new software, but for users and developers the transition from PoS to zkValidium shouldn’t have any friction whatsoever. Of course, this is if the broader community wants to go through with the plan. So far, this discussion is all pre-proposal as there hasn’t been any official PIP yet. We’re told those things could come later this year with plans for a Q1-2024 finished product.

Impact on MATIC?

The proposed change from of the PoS network does come with some questions that don’t yet have answers. One of the major changes when Polygon launched its zkEVM chain earlier this year was the token utility for the MATIC coin. Polygon’s PoS chain utilizes MATIC as the gas payment coin for transactions. Polygon’s zkEVM chain uses ETH for gas fees and instead utilizes MATIC for staking only. All we know so far regarding the PoS/zkValidium proposal is that MATIC would still be used for staking. We don’t know what would be used for gas post-transition though Polygon Advisor Pete Kim speculated that it would still be MATIC:

AFAIK Polygon PoS will continue to use $MATIC for gas post zk-validium transition, unlike Polygon zkEVM. It won’t be backward compatible otherwise.

Polygon Labs’ Product VP David Silverman added some important context and suggested that the Polygon community would ultimately determine how MATIC is used:

the polygon community will decide together as we collectively discuss the best way to transition PoS to a zkValidium. speaking as myself, MATIC as native token would be the most backward compatible

From where I sit, maintaining utility as a gas payment token is one of the core reasons MATIC remains a top 5 holding in my cryptocurrency portfolio. I suspect the broader Polygon community would feel similarly as I do that forfeiting that utility would be detrimental to MATIC’s bull thesis. Thus, I view it as a low probability outcome if the community is truly able to determine how the token is used. But I will freely admit that it’s a possibility that MATIC becomes a pure-play staking token in Polygon 2.0.

zkEVM Growth

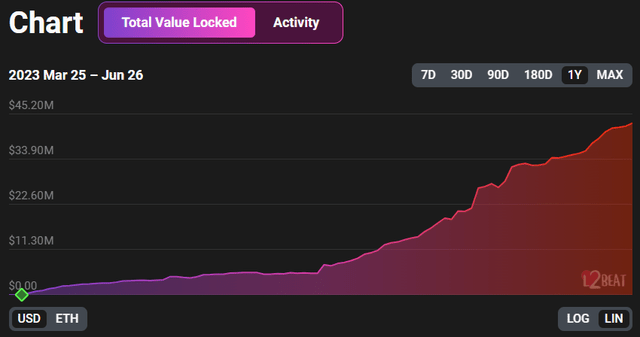

Following the launch of the zkEVM in late March, TVL growth on Polygon’s roll-up chain was slow up until mid-May. Since then, the trend has been far more impressive after having gone from $5.4 million on May 10th to roughly $43 million about six weeks later:

Polygon zkEVM (L2 Beat)

A major catalyst in this TVL spike on the zkEVM chain appears to be in response to a May 10th tweet from Polygon Labs Founder Sandeep Nailwal that hinted at a MATIC airdrop at some point in the future:

Also good things take time. Remember Arbitrum One took 1 year+ to fully blossom. Polygon zkEVM ecosystem is getting ready for a big boost with critical infra deployments like safe, oracles like Chainlink coming in, UX improvements per early devs feedback, cost optimisations using data compression and so much more. Plus there is no rule that an existing token can’t do a massive airdrop. If there is one thing you can’t doubt Polygon on, it would be adoption.

Bold my emphasis. This seems to corroborate a theory that I’ve had for some time that a lot of the L2 activity we’ve seen in other ETH scaling chains like Arbitrum (ARB-USD), Optimism (OP-USD), StarkNet and zkSync Era can be explained by airdrop hunting. In late March I said the following:

But even the small prospect of an airdrop could conceivably juice activity from speculators. That element is missing from Polygon’s zkEVM because Polygon already has a native token on its PoS chain.

Turns out, Polygon evidently can dangle an airdrop. Whether or not MATIC is airdropped to Polygon’s zkEVM depositors remains to be seen. I don’t know that the airdrop model has proven to be all that successful at this point in time, but it is something that development teams are still apparently considering.

Summary

Polygon is clearly going through a transformational moment in the chain’s history. From a usage standpoint, Polygon is still one of the most widely used networks in the crypto market and continues dominance in daily active users of Ethereum scaling chains:

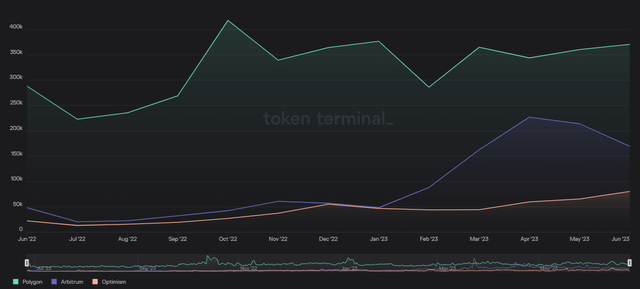

Monthly DAU Trend (Token Terminal)

At 370k average DAUs, June is shaping up to be the 8th month out of the last 9 with at least 300k average daily active users. Polygon has consistently averaged more DAUs than Arbitrum and Optimism combined according to Token Terminal.

There is an obvious regulatory concern for the network, but I do wonder if an antagonistic SEC hasn’t been priced in already at least to some degree. Furthermore, BlackRock’s (BLK) spot Bitcoin (BTC-USD) ETF proposal could be an indication that the SEC’s actions regarding crypto are losing favor with power financial institutions. Of course, that’s pure speculation on my part and spot bitcoin ETF applications certainly aren’t indicative of broader crypto acceptance in TradFi.

What we do know is Polygon Labs has lofty goals for the network and as currently constructed the success of the network should benefit the price of MATIC. In a diversified crypto portfolio with a longer term outlook than just a few months, I still think MATIC deserves a spot.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here