Investment Thesis

Bumble Inc. (NASDAQ:BMBL) has seen its share price collapse since its IPO. Presently, looking out to 2024, I believe that the stock is priced at 17x forward free cash flows.

Bumble is not the cheapest stock going. But if Bumble could reignite investor confidence that it could grow its top line by 20% CAGR in 2024, then, in that case, I believe the stock is attractively priced.

Why Bumble? Why Now?

Bumble seeks to distinguish itself from other online dating platforms by empowering and putting women in the proverbial decision-making driving seat.

Since Bumble’s IPO, it sometimes feels that not a month goes by where its stock does not continue its incessant travel south.

And while I absolutely do not buy the argument (nor should you), that ”just” because a stock is down, means that the stock is undervalued, I nevertheless do believe that Bumble stock is undervalued.

As a point of reference, Q1 2023 saw paying users increase by 15% y/y. This is clear evidence that paying users find enough value to stick with the dating site.

After all, there are very limited barriers to entry. All it takes for users to drop Bumble and seek out a competing online dating platform is a few taps on the phone.

Furthermore, if its users truly become disgruntled with Bumble or conversely find a relationship and move on, the number of users paying for Bumble would not continue trickling higher. And that’s what’s happening here, Bumble’s paying users moving higher with time.

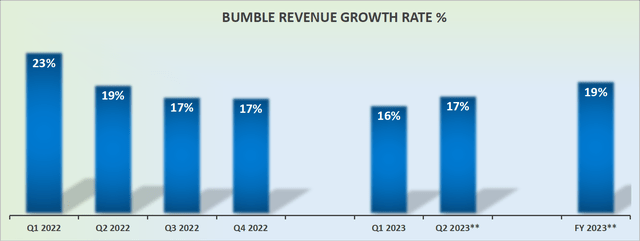

And by extension, we see that Bumble’s revenue growth rates are stabilizing.

Revenue Growth Rates Are Stabilizing

BUMBL revenue growth rates

The aforementioned graph makes it abundantly evident that Bumble is no longer a rapidly growing company. But does this truly matter? Recall, at this stage, the share price is down more than 75% since its IPO.

Yes, it turns out, in hindsight, that Bumble was too expensive for what it was.

But with a market cap valuation of $2 billion, investors are clearly no longer paying for a story stock here.

Let’s invert this proposition. At the most superficial level, is Match Group, Inc. (MTCH) truly worth 5x more than Bumble? I’m not entirely convinced that is a fair appraisal by the market.

Particularly when we consider that Bumble is still delivering mid-teens growth and is pointing to exit 2023 with revenue growth rates within a few basis points of 20% CAGR.

This is my point. Fundamentally, Bumble may be more compelling than its share price would lead one to believe on the surface.

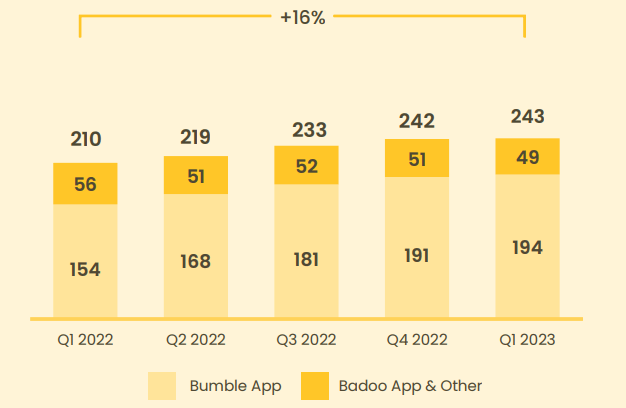

The main bearish aspect facing the stock is that aside from its flagship product, the Bumble App, its Badoo App appears to be delivering declining revenue growth rates, see below.

BMBL Q1 2023

And for investors, that clearly poses some uncertainty. Namely, investors want to know how long until Badoo stabilizes? For their part, this is what management stated on their earnings call:

Badoo continues to be one of the top rated scale dating apps on the App Store and on the Google Play Store.

While we still have work to do to further stabilize Badoo and return it to growth, we are encouraged to see registration and reengaged users growing in several key markets.

Essentially, the point that I’m making here is that Bumble’s value proposition is not particularly rosy, but that investors are more gloomy than it’s warranted.

Highly EBITDA Profitable, With a But

Bumble guides for approximately 26% EBITDA margin for 2023 as a whole. This is a slight increase compared with 2022, but still falling short of the slightly higher than 27% EBITDA margin that Bumble reported in 2021.

The problem here is that only around 50%, in the best-case scenario, of Bumble’s EBITDA converts into free cash flows.

Bumble’s ever-recurring litigation costs and high-interest expenses are notable drags on Bumble’s EBITDA to FCF conversion, which leads to a wide gap between Bumble’s EBITDA and its actual free cash flows.

Accordingly, this implies that if were to assume that Bumble’s free cash flows were to improve in 2024 by approximately 10% relative to 2023, this could see its free cash flow reach around $135 million.

This puts the stock priced at about 17x forward free cash flow. Not the cheapest multiple to free cash flow by any stretch. But a compelling risk-reward, if we can presume the business in 2023 could grow at close to 20% CAGR.

The Bottom Line

Bumble’s stock price has plummeted since its IPO, but I believe it is attractively priced at 17x forward free cash flows, particularly if it can regain investor confidence that it could reach 20% CAGR in 2024.

Despite slower revenue growth, Bumble’s valuation seems undervalued both relative to itself and compared to Match.

While its Badoo App poses some uncertainty, management is taking steps to stabilize it. Bumble’s high EBITDA profitability is hindered by litigation costs and interest expenses, impacting its free cash flow conversion. However, assuming a 10% improvement in its free cash flow in 2024, Bumble Inc. stock presents a compelling risk-reward opportunity.

Read the full article here