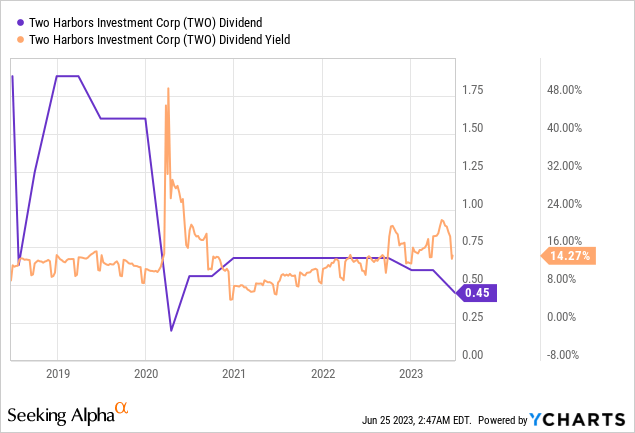

There were signs that a dividend cut for Two Harbors (NYSE:TWO) was lingering, with the prior $0.60 quarterly cash dividend set against earnings available for distribution of $0.09 per share. This came with a 25% dividend cut to $0.45 per share for a 13.7% forward annualized dividend. Two Harbors has had somewhat of a turbulent history with three recorded reverse stock splits since 2013, highly volatile dividend payouts, and a tangible book value under sustained decline. The mREIT’s stock price is down 33% over the last year to reflect not just the broader disruption from the Fed hiking ten consecutive times to its highest level since 2008 at 5% to 5.25%, but a business whose operating footing has slipped with two dividend cuts over the last 12 months.

The income is the prize with mREITs, and it’s hard to recommend the common shares against such a disrupted near-term dividend history. The preferred shares continue to offer the better value here, with a double-digit yield that has gotten fatter on the back of preferred shares that are down by 7% over the last year. Critically, this battle between the commons and preferreds has been settled by the latest cut and earnings available for distribution for its first quarter that formed an unsustainable payout ratio against the current lowered dividend. Bulls would be right to flag that earnings available for distribution included market-driven changes that fail to reflect the earnings potential of the mREIT’s portfolio.

The Preferreds And Commons Diverge

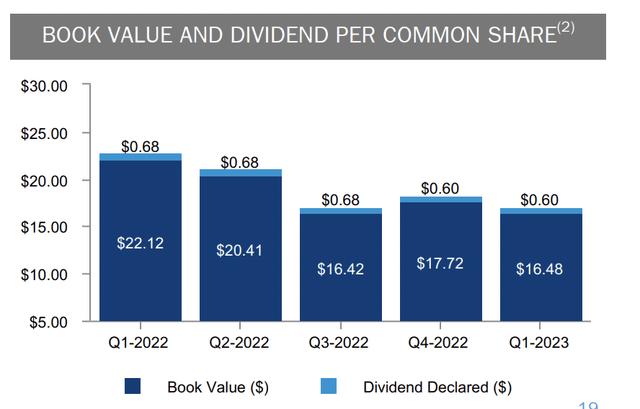

Two Harbors 8.125% Series A Fixed-to-Floating Rate Cumulative Preferred Stock (NYSE:TWO.PA) pays out a $2.03 coupon for a 10% yield on cost as it’s currently swapping hands for $20.36 per share. These are down roughly 8.16% since my last article on the ticker. Critically, whilst you give up around 370 basis points on the yield versus the commons, you’re getting a security that’s trading for 81 cents on the dollar and whose coupon has a near-zero risk of being suspended. Bulls would of course highlight that the mREIT’s common shares are currently swapping hands for $13.17 per share against a last reported book value per share of $16.48 for its fiscal 2023 first quarter.

Hence, you can buy the commons at a 20% discount to book, around 80 cents on the dollar. TWO’s book value per share in its year-ago quarter was $5.53 pre-split, which after adjusting for the 1 for 4 reverse stock split in November last year would mean a book value of $22.12. The year-over-year $5.64 decline in book value per share followed what was a 7% sequential decline from $17.72 realized in the fourth quarter. Critically, this trend of a book value under sustained decline renders the start of a position in the commons as highly risky. Hence, while you’re able to buy TWO at what’s now a 20% discount to book value, this is under pressure and could be entirely removed through 2023 if current turbulent macroeconomic conditions fail to normalize.

Two Harbors Fiscal 2023 First Quarter Presentation

The mREIT reported earnings available for distribution of $0.09 per share, a sequential decline of $0.17 from the fourth quarter. If you stripped out market-driven changes, then this would have come in at $0.59 per share, also down sequentially from $0.73 per share in the prior quarter. This came as the mREIT’s portfolio, worth $15.74 billion as of the end of March, sported a yield of 5.09% versus an average cost of financing at 4.57%. The net spread at 0.52% declined by 45 basis points sequentially.

A Possible Normalization Of A Turbulent Macroeconomic Backdrop

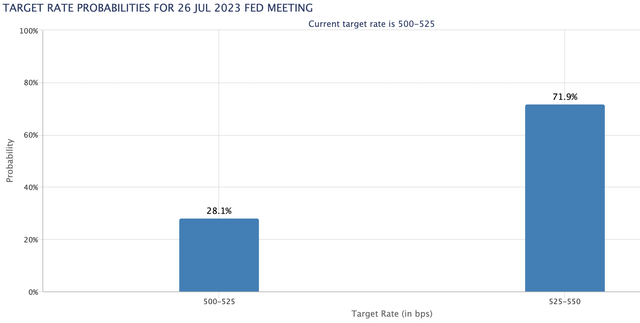

The continued drop in inflation continues to support bullish forecasts that the Fed will keep interest rates paused through 2023 to possibly follow up with a cut sometime in the first half of next year. However, Fed policymakers did state that they could restart hikes as soon as July after their pause in June with the market currently pricing in a 71.9% probability of interest rates being hiked at least 25 basis points to 5.25% – 5.5% at the upcoming July 26th FOMC meeting.

CME FedWatch Tool

My forecast is for inflation to fall back to the Fed’s 2% target at the back end of the year or early 2024 as lower natural gas prices, the August resumption of student loan repayments, and crude oil price weakness, act as catalysts for the release of broader inflationary pressure on the US economy. Hence, the common shares might be able to stage a recovery if the broader market becomes less turbulent. The preferreds are the play here from a safety perspective even as the mREIT’s lowered dividend is covered by earnings available for distribution excluding market movements.

Read the full article here