Investment Thesis

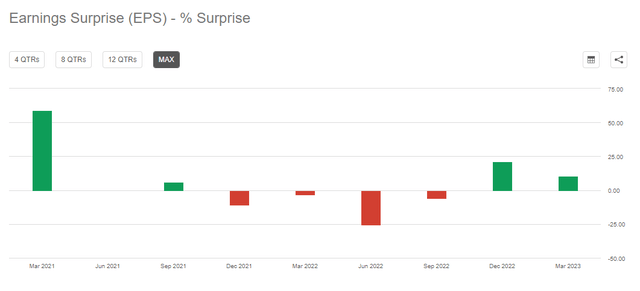

ThredUp (NASDAQ:TDUP) is the largest fashion resale e-commerce platform allowing users to buy and sell second-hand clothes within a $17 bn market size. Its platform boasts a stellar 55k brands across 100 different categories through a network of sellers serving its 1.7 mn quarterly active buyers with 1.5 mn quarterly orders. It reported strong earnings in Q1 guiding Q2 better than consensus as well as raising the guidance for the year. After several misses during the last year, a positive earnings report along with continued momentum for the year demonstrates that the Resale as a Service (RaaS) model is back on track in our view.

Seeking Alpha

Strong Earnings and Continued Momentum

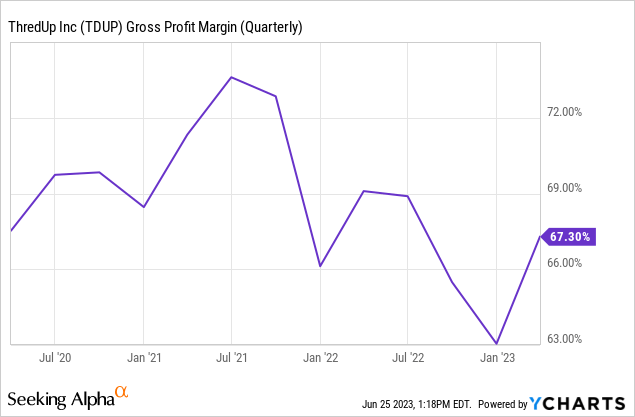

TDUP reported a strong Q1 earnings with beats both on the top line and bottom line as internal initiatives that started in late 2022 including: driving higher quality supply, charging sellers for clean-out bags and per bag processing fees, and partnerships with several brands including H&M and others started showing visible signs of performance resonating with the company’s objectives. It reported a sales growth of 4% YoY driven by higher average order value (AOV) partially offset by lower orders (declined 8% YoY). It showed sequential improvement in buyer base as the budget buyer continues to push the discretionary purchases amidst the current macroeconomic uncertainty. However, its increasing exposure to upscaled shoppers (penetration improved 700 bps for Q1) as demonstrated by higher AOV has helped them to wade through the current volatile environment. Gross margin declines are fading, down 180 bps YoY due to tough backdrop for Remix while US gross margins reaching a record high of 74.5%. This led to relatively lesser operating loss with FCF burn almost halving to ~$10 mn for the quarter, and we see continued improvement as the capex spends are curtailed.

It guided Q2 revenues to be in the same range as Q1 which was a surprise to what the street was anticipating, and a clear visibility entering into the $80 – $85 mn revenue range. Management had earlier guided EBITDA breakeven in the same revenue range, however, it still targets breakeven in Q4 as proactive CAC and ongoing investments in operations would keep the losses at a slightly elevated level despite the revenue run rate. Revenue guide was upped for the year by $10 mn with a steeper rise for 2H23 (expect 20% revenue growth vs 5% in 1H23). The balance sheet remains strong as it ended up with $94 mn in cash with $38 mn in revolver that the company is yet to draw. It indicated that cash position will not fall below $50 mn before reaching FCF plus position which we believe is achievable as a result of lower capex, which we also believe would be able to support its revenue run rate from its Dallas facility with sufficient capacity to drive growth.

Valuation

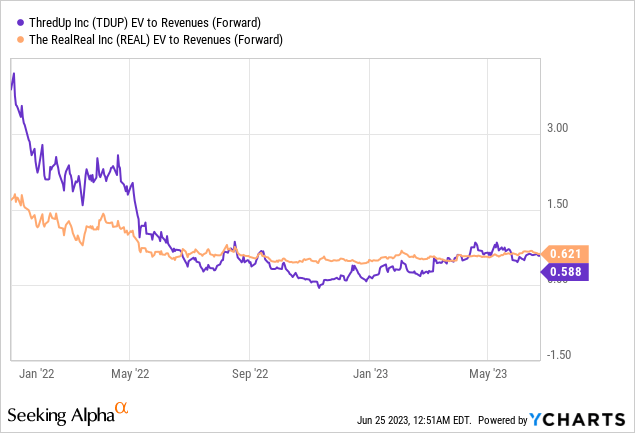

TDUP trades cheaply at 0.6x EV/ Revenue. As for any growth-led digital-focused third-party e-commerce player who is not yet profitable, we believe EV/ Revenue is an appropriate valuation metric to value the company. We believe given the stronger operating performance than TheRealReal (REAL), it should trade at a premium to its peer. We assign a Buy rating given near-term EBITDA inflection, strong revenue run rate and valuation.

Risks to Rating

Risks to Rating include 1) TDUP struggles to scale rapidly as order growth continues to be in negative territory (as demonstrated in Q1) which would put significant pressure on its 2H23-reliant sales guide 2) it might need to continue to spend more on customer acquisition and marketing to ramp up which would push its path to profitability a few more quarters away 3) its ongoing automation at distribution centers would not be able to drive significant efficiency and impact per order profitability, and 4) Remix struggles which would mean a significant impact to its European expansion plans.

Conclusion

TDUP is a disruptor in the resale category and has created a moat in the lower-priced fashion and accessories segment, which is a difficult space to operate for competitors to make the economics work (ASP of under $20). Its acquisition of Remix has led them to expand in Europe and address an ever-increasing TAM providing significant upside potential. It has invested heavily in distribution centers and has moved away from manual distribution centers to now fully automated ones, which has significantly improved efficiency and per order profitability. We believe the increasing revenue run rate along with improvement in per order profitability due to automation and gross margin improvements should enable them to achieve breakeven by the end of the year and achieve EBITDA profitability by next year. We believe the company is at an inflection point and initiate at Buy.

Read the full article here