Investment Thesis

MasterBrand (NYSE:MBC) has a mixed revenue and margin outlook. Its sales are expected to face near-term challenges due to softening housing market and normalized backlog levels. However, the company has a long-term opportunity to gain market share and is likely to resume growth in FY24 once the housing market bottoms. On the margin side, sales deleveraging and a mix shift towards lower-priced cabinets are expected to affect margins negatively in the coming quarters. Nevertheless, cost reduction and productivity initiatives should help margins in the long run. The stock is not pricey, trading at a P/E of 7.69x, but I would prefer to be on the sidelines and wait for the near-term challenges to abate. Hence, I have a neutral rating on the stock.

Revenue Analysis And Outlook

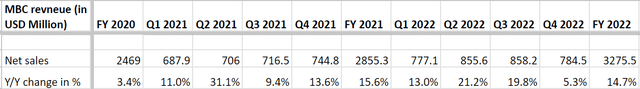

MBC, which was previously part of Fortune Brands Home & Security, reported its first-ever quarterly report as a standalone company in Q4 2022. The company achieved 5.3% Y/Y revenue growth in the quarter, bringing in $784.5 million. This growth was primarily driven by previously implemented pricing strategies and strong performance from selected brands like Mantra, an affordably priced full plywood construction product that grew double digits Y/Y in the fourth quarter, outpacing other parts of the business.

MasterBrand Sales (Company data, GS Analytics Research)

Looking ahead, I believe that revenue growth for MBC may be impacted by volume declines due to softening demand in the housing market, as the order rate slowed on the builder channel. Additionally, the company’s backlog has normalized, and management anticipates a $200 million Y/Y (or mid to high single digits percentage Y/Y) headwind due to the normalized backlog level. The mix shift of consumers towards lower-priced products from higher-priced ones is another headwind and should result in a reduction of Average Selling Price (ASP), adversely affecting revenues in the coming quarters. While the carryover impact of pricing increases implemented by management last year, especially in the back half, should help year-over-year, a significant decline in volumes and mix-shift towards lower priced products should more than offset it and result in a meaningful decline in sales in the current year.

The longer-term outlook is slightly better, and the company has the potential to gain market share. MBC is the largest residential cabinet manufacturer in the U.S. with a 24% market share and has significantly expanded its near-shore manufacturing and sourcing capabilities over the last couple of years to increase advantages over Asian imports. Furthermore, with 45% of the market remaining highly fragmented, MBC presents a compelling opportunity to grow and gain market share in this $17 billion and growing industry. Also, interest rates are likely to peak around the middle of this year, and analysts are expecting a rate cut around the end of this year and the next year. So, the housing industry might also bottom out in 2023, and we can see some recovery in FY24 and beyond.

Overall, the company’s revenue outlook is negative in the near term, but the company can see some recovery in the medium to long term.

Margin Analysis And Outlook

The company reported a ~150 bps Y/Y improvement in its adjusted EBITDA margin last year, which increased to 12.6%. For Q4 2022, the adjusted EBITDA margin was up 350 bps Y/Y to 12.5%. This growth was primarily driven by price increases and continuous operational improvement benefits, which more than offset supply chain constraints, and material, logistics, and wage inflation.

Looking ahead, while supply chain constraints and inflationary headwinds are easing, the company’s margin is expected to face pressure due to volume deleverage, softening demand in the housing market, and decreasing ASP due to a mix shift to lower-priced products. The company typically sees 20% to 25% decremental margins, and given my expectation of a significant revenue decline this year, margins should also decrease.

From the medium to long-term perspective, the company is taking several initiatives to drive cost savings and improve profitability. The “Lead through Lean” initiative has helped the company identify $80 million in addressable waste, and management is working on reducing these costs. The company is also focused on simplifying and modernizing its technology foundation through the “Tech-Enable” initiative, which is expected to improve inventory accuracy and provide better visibility into material movement, resulting in cost savings in the longer term. There are short-term costs related to the investments in these initiatives, and management expects an additional $5-$10 million of corporate expenses in FY23 from them. However, they should benefit the company’s margin in the longer term.

Valuation And Conclusion

MBC stock is currently trading at a forward P/E ratio of 7.69x based on the FY23 consensus EPS estimate of $1.05, while its EV/EBITDA (FWD) is 6.33x. While the stock is inexpensive, the company is expected to face near-term headwinds due to the softening housing market and normalizing backlog levels. This should lead to a meaningful decline in revenue as well as margins this year. While the company has the potential to perform well in the long run, I would prefer for near-term headwinds to abate before becoming more positive on the stock. For now, I have a neutral rating on MasterBrand.

Read the full article here