Investment Rundown

Earlier in the year, MKS Instruments (NASDAQ:MKSI) was hit with a ransomware attack enabled by hackers who deployed malware in the systems and momentarily disrupted the entire business of MKSI. This impacted the revenue for the quarter but MKSI remains optimistic about resuming its momentum and recovering revenues substantially. The incident resulted in a class-action litigation that we will see develop further it seems.

For a diversified portfolio having exposure to the semiconductor space is important. It’s not a new industry, but it is seemingly always reimagining and reigniting itself with new innovation which results in companies posting impressive results in terms of both sales and earnings. But with the current p/e being 30 on a forward basis for MKSI, I can’t say it screams a buy. The company expects to recover revenues, but I think there might be better buying opportunities ahead, at least from a risk/reward perspective. Right now MKSI is a hold until we see a full recovery to where they were before.

Company Segments

Within MKSI they have a few different end markets they focus on. The primary one is the semiconductors market, where also most of the revenues are generated.

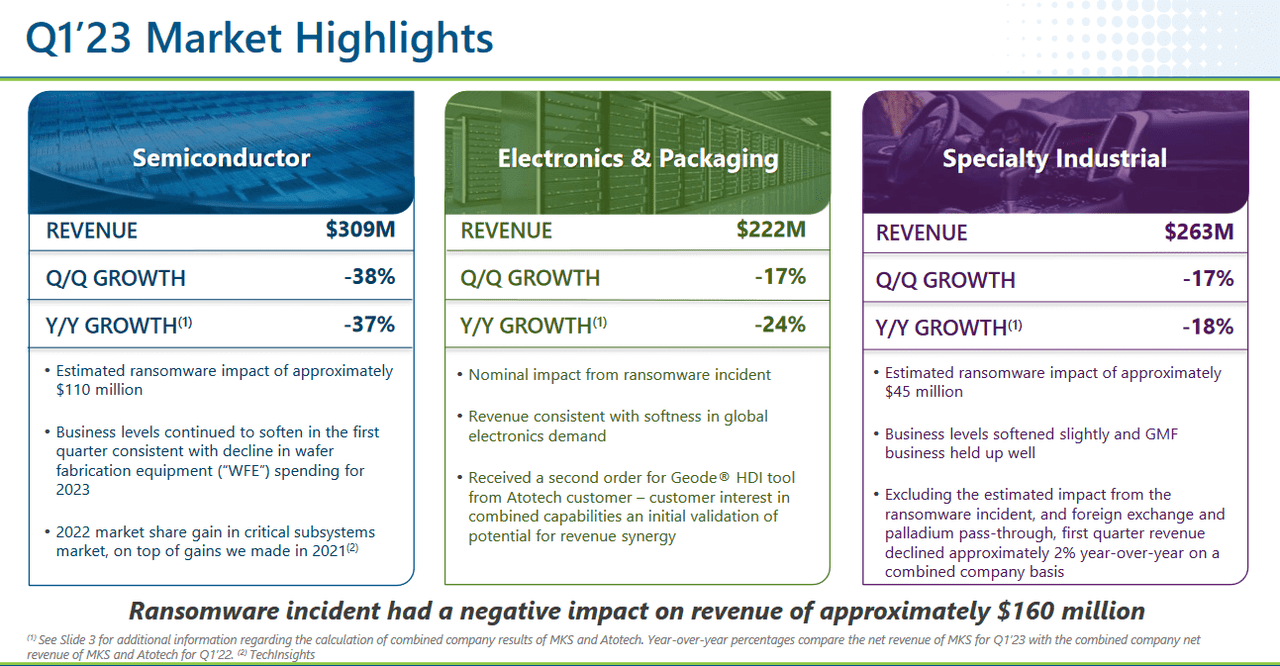

Segments Q1 (Q1 Report)

With the ransomware incident, it impacted revenues by $160 million according to the company. The worrying part of the different end markets is that they are all experiencing a slowdown in growth, and actually declining instead. The semiconductor segment is being hit the hardest as a result of softer business levels.

Within MKSI there are three different divisions right now, Vacuum Solutions (VSD), Photonics Solutions (PSD), and Materials Solutions (MSD). The last one is the newest and is not responsible for any revenues generated until Q3 of 2022. But it has grown immensely in that time, growing from $177 million in revenues back then to $304 million in the last quarter. This addition helped ensure that MKSI had a positive YoY growth overall.

Where ransomware brings further risk into the equation is the fact it impacted the company so much that the operating margins were barely positive. From an investor’s point of view, I think they should be worried. If MKSI is susceptible to these attacks then incontinent quarterly reports will definitely continue to happen and then a lower premium should be applied to the company.

With MKSI not being able to utilize their factories as a result of the ransomware, the next couple of quarters will need to showcase strength in the company if they want to gain back the confidence of investors.

Markets They Are In

As MKSI provides technology solutions they are exposed to a vast variety of different end markets, with the largest one being the semiconductor industry. Which in and of itself encompasses many different smaller markets.

Market Opportunity (Investor Presentation)

The solutions that MKSI offers help companies enhance their business practices and bring down costs and in turn increase margins. This appealing offer has helped MKSI them grow into many other markets. Back in 2015, they generated 75% of their revenues from the semiconductor industry, but it now just accounts for a little over 50% of the revenues. This diversification has helped MKSI maintain its net margins even through ups and downs in the overall market.

Risks

I think the main risk associated with MKSI right now is the rich valuation they have. Paying 30x forward earnings is a bit much, even for a semiconductor-related company. There is a lot of hype around the business and I think the best time to buy would be when the sentiment is bad, which right now seems to be the complete opposite.

Besides that, the incident that happened back in February exposed some of the fragile parts of MKSI I think and I would be worried about further attacks which could hurt quarterly results. The ransomware brought down the operating margins significantly, almost turning negative and that should make MKSI be valued at a lower multiple, to reflect the risk associated.

Financials

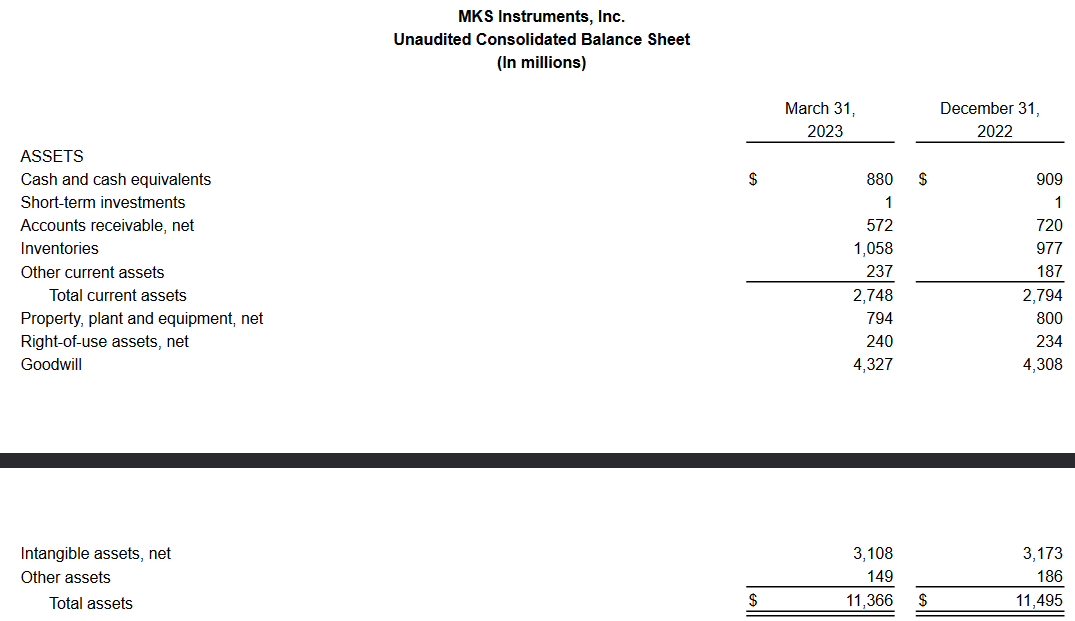

Looking at the financials that MKSI has built up over time they remain quite decent. The total assets experienced a QoQ decrease primarily driven by the cash position lowering and the accounts receivables decreasing, most likely a result of the ransomware incident.

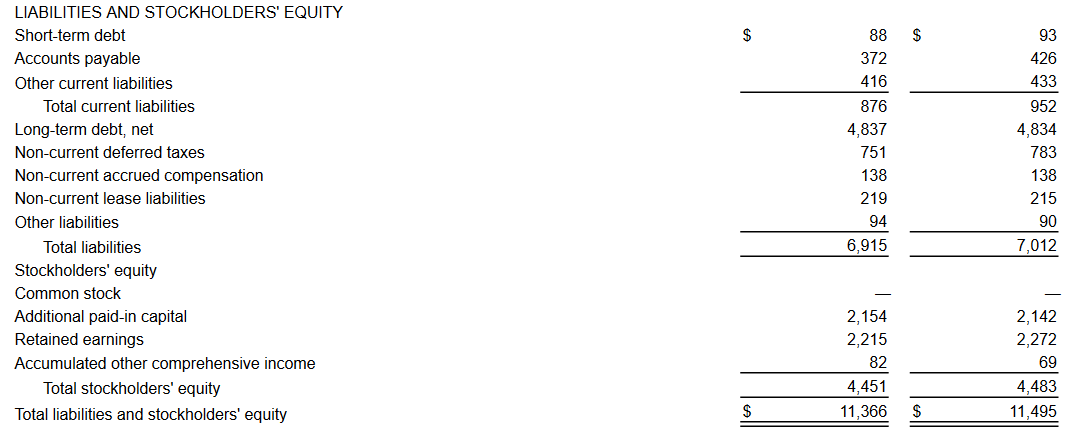

Moving over to liabilities for MKSI I think they have a quite high long-term debt position right now. Sitting at $4.8 billion it has grown substantially over the same period the company transitioned into other markets. Back in 2016 the company had $600 million in debts and a debt/EBITDA ratio of about 2.2. That ratio has since increased a lot and is now at 6. For me that is too high to constitute a buy case at these levels, and I think the risk is too severe that MKSI might have issues paying back debt.

Assets (Balance Sheet) Liabilities (Balance Sheet)

The company has been very consistent regarding maintaining positive levered FCF during the last several years. This has aided them in establishing a dividend. Although not that high, just 0.84%. I think there is an argument to be made that perhaps they should abolish the dividend in favor of diverting that capital to paying down debts instead. I would feel more confident in the long term if MKSI would be able to stop diluting shareholders in order to pay down debts. The company’s shares outstanding grew by nearly 12% in the last 2 years. That really doesn’t support a buy thesis around the company in my opinion. Instead, it should warrant caution instead.

Final Words

There is no lack of companies that are gaining exposure to the semiconductor industry. MKSI had previously a much larger portion of their revenues coming from this segment, but in recent years they have diverted into other markets too. This hasn’t necessarily constituted a strong margin expansion, but they have been able to preserve them nonetheless.

I think that for investors believing that the ransomware incident back in February was simply a one-time hurdle for MKSI, then buying now or at a lower price won’t matter much in 10 years’ time. But, the incident had a noticeable impact on the performance and makes me worried about it happening again. This risk factor should constitute a lower multiple as a result, and 30x forward earnings is not that. I find a buy case more suitable and intriguing around the 15-18x p/e range instead. Given the strong outlook and decent history of the company, they will still be a hold rating for me though. A big pullback could translate to a great buying opportunity, but right now I find the stock too pricey.

Read the full article here