Article Thesis

Microsoft Corporation (NASDAQ:MSFT) is a company of exceptional quality. It also has a leadership position in the Artificial Intelligence space, thanks to its stake in ChatGPT owner OpenAI, while being active in the AI space via in-house developments as well. Enthusiasm for Artificial Intelligence investments has made Microsoft’s shares explode upward over the last couple of months, and those that bought into MSFT at the right time have reaped massive gains.

AI As The New Megatrend

Artificial Intelligence, or AI, has been in everyone’s mouth and on everyone’s mind for the last couple of months. While the technology is not very big for now, it is pretty clear that AI will have a huge impact on how we live our lives, how we work, and so on, in the future. AI can be used to make employees more productive, e.g., to speed up repetitive tasks, but it can also be used to replace employees. AI can likely be used to make vehicles self-driving (or, at some point, self-flying), AI can be used to create new forms of art, and so on.

It is not possible to know how fast this change will happen, where the impact will manifest first, and where it will take more time. But it seems pretty likely that the impact of AI will, ultimately, be vast. Not all companies will benefit equally from this trend, of course. Those that win in the AI race could see their business expand massively, while others could get left behind. In the AI hardware space, NVIDIA (NVDA) seems to be very well-positioned, as demand for its AI chips is exploding, which has made the company guide for massive revenue growth during the current quarter.

Microsoft As A Prime AI Player

In the software AI space, other companies will be the winners. Microsoft is among the best-positioned companies in the artificial intelligence space. This is due to its stake in ChatGPT owner OpenAI, which gives Microsoft the ability to integrate ChatGPT into its existing products.

But ChatGPT – although the best-known AI tech so far – is not the only way for Microsoft to benefit from artificial intelligence. The company is investing in other AI areas on top of its investment in OpenAI, and thanks to its massive scale and vast resources, Microsoft is among the best-positioned companies to invest heavily in this high-growth industry. Smaller competitors likely won’t have the financial resources to invest heavily in data center capacity, engineers, and so on, and will thus likely have a hard time keeping up with Microsoft and the other deep-pocketed software giants, such as Alphabet (GOOG) (GOOGL). Since the AI space requires substantial upfront investments, and since AI products are oftentimes not profitable yet, size, scale, and financial resources are an important competitive advantage. I would thus not be surprised to see the biggest software players, including Microsoft, dominate this future industry as well. Even when smaller players are coming up with new technologies or innovations, the giants such as Microsoft can just acquire them or buy a stake in them – similar to what MSFT has done with OpenAI.

Microsoft Executes Very Well

At least for now, Microsoft’s revenues, profits, and cash flows mostly rest on other businesses, however. The company’s legacy businesses – operating systems and business productivity software – continue to throw off huge sums of cash, and they even generate some growth, although the market is not expanding rapidly. The subscription model allows MSFT to monetize users across the entire lifecycle, however, which means that Microsoft is highly profitable even during times when consumers and businesses spend less on new PCs, for example – which is the case right now, as many had upgraded their hardware during the pandemic, resulting in weaker demand for PCs and similar products today.

Cloud computing is a faster-growing market for Microsoft, relative to its legacy businesses, but unlike the AI space, it is already a large contributor to Microsoft’s top line. Microsoft’s cloud ventures are also pretty profitable. Overall, Microsoft is thus well-exposed to different industries that are at different points in the cycle: The legacy businesses are not growing quickly, but Microsoft absolutely dominates these areas and generates high profits and cash flows. The cloud computing market is growing faster and is profitable already, and the AI space is in an early stage and not profitable yet, but promises hefty growth potential over the coming years and decades.

Of course, Microsoft also owns some additional businesses on top of that, such as its gaming business (with a pending acquisition of Activision Blizzard (ATVI), and its Surface hardware business. But in the long run, those will, I believe, contribute only incrementally to MSFT’s growth, whereas cloud computing and AI will be the major long-term growth drivers. Still, from a diversification perspective, one can argue that these additional business units make Microsoft even more resilient.

During the most recent quarter, Microsoft generated revenue growth of 7%. This is less than what investors got used to over the last couple of years, but considering the tough macro environment with major economic uncertainties and a potential recession on the horizon, a high-single-digit revenue growth rate is still attractive. Many businesses are lowering their tech spending in order to prepare for a potential recession, and the strong US Dollar has been a headwind in the recent past as well – in that environment, Microsoft’s performance was appealing.

Valuation And Returns

We last covered Microsoft on October 15. Back then, Microsoft’s share price was temporarily depressed due to a Hedgeye report that suggested MSFT as a new short idea. Hedgeye’s reasoning, back then, was centered on an expected growth slowdown. But Microsoft continues to grow at an attractive pace, and its AI leadership position results in a compelling future growth outlook, I believe. Since MSFT’s share price was rather depressed last fall, we recommended Microsoft as a buy, noting the undemanding valuation and the fact that Microsoft is a high-quality company that has proven to be innovative and resilient versus external shocks, such as recessions or the COVID pandemic.

Since then, Microsoft’s share price performance was very appealing. Shares are up 45% since our buy recommendation, easily beating the performance of the S&P 500 index over the same time. Buying high-quality companies when they are temporarily out of favor due to overblown worries can work out very well. Not surprisingly, we are very happy with our long position in Microsoft, and I believe that other Microsoft shareholders will agree.

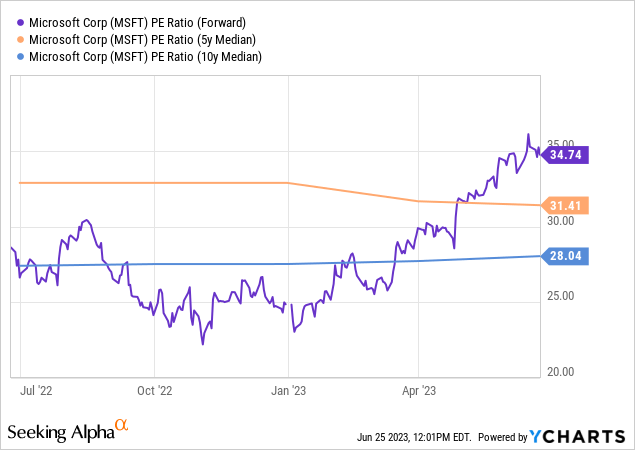

However, Microsoft being a great investment last fall does not automatically mean that Microsoft will be a great investment at current prices, too. Valuation has to be considered, after all – last fall, the valuation was depressed, whereas today, it isn’t, as we can see in the following chart:

The current earnings multiple for this year, based on forecasted consensus earnings per share, stands at 35 today. The 5-year and 10-year median earnings multiples are considerably lower. Depending on whether one wants to focus on the shorter-running or the longer-running average, Microsoft currently trades at a 10% to 25% premium versus the historic norm. That’s not surprising, as the current AI hype has led to massive buying, but investors should nevertheless not neglect what it means to buy a stock at a historically high valuation.

When MSFT traded below the historically normal valuation range last fall, future expected total returns were highly attractive, due to a combination of expected business growth and multiple expansion tailwinds working in investors’ favor. When one buys today, however, Microsoft’s business growth will work in favor of investors, whereas multiple normalization will likely be a headwind going forward, as mean reversion suggests that MSFT will not trade at 35x net profits forever.

Microsoft thus was a significantly better buy last fall, whereas it is less appealing today. That doesn’t mean that returns for someone buying here will be bad – they could be attractive still. But they won’t be as attractive as the returns that were available for those that bought MSFT last fall when it was out of favor and cheap.

While MSFT has a compelling growth outlook and is a high-quality company, the above-average valuation makes me believe that waiting for a better buying opportunity could pay off for those that want to enter or expand a position in this AI leader. I won’t add at current prices but am happy holding onto MSFT, which has already delivered very strong returns in recent months. When another buying opportunity arises, I will likely add to my existing position.

Read the full article here