“Air, I should explain, becomes wind when it is agitated.” – Lucretius

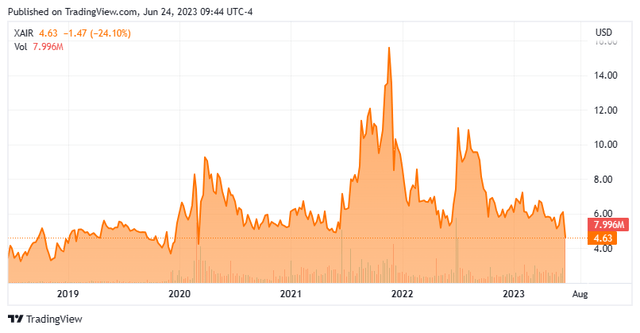

Today, we shine the spotlight on Beyond Air, Inc. (NASDAQ:XAIR). The company is ramping up the rollout of its first approved product and has other assets in development. The stock is well-liked by analyst firms, but the company recently had to raise additional capital that came with some onerous terms. Can Beyond Air gain enough sales traction to avoid additional dilution? An analysis follows below.

Seeking Alpha

Company Overview:

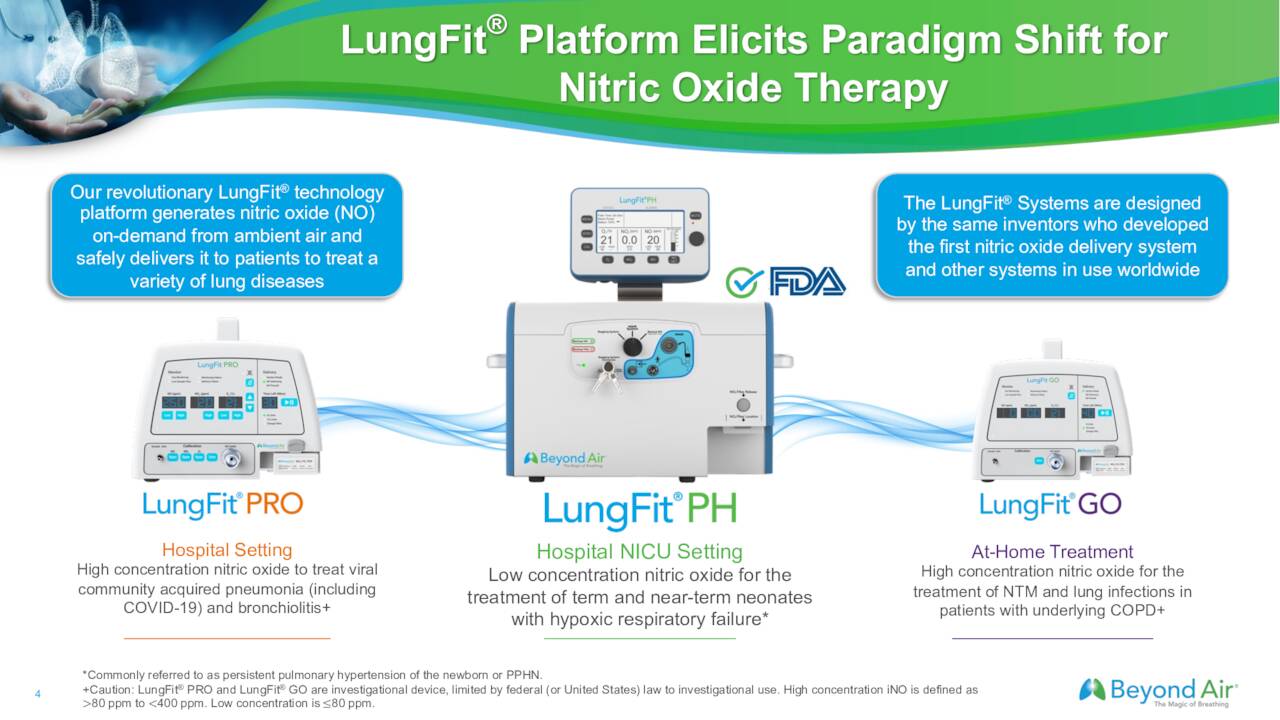

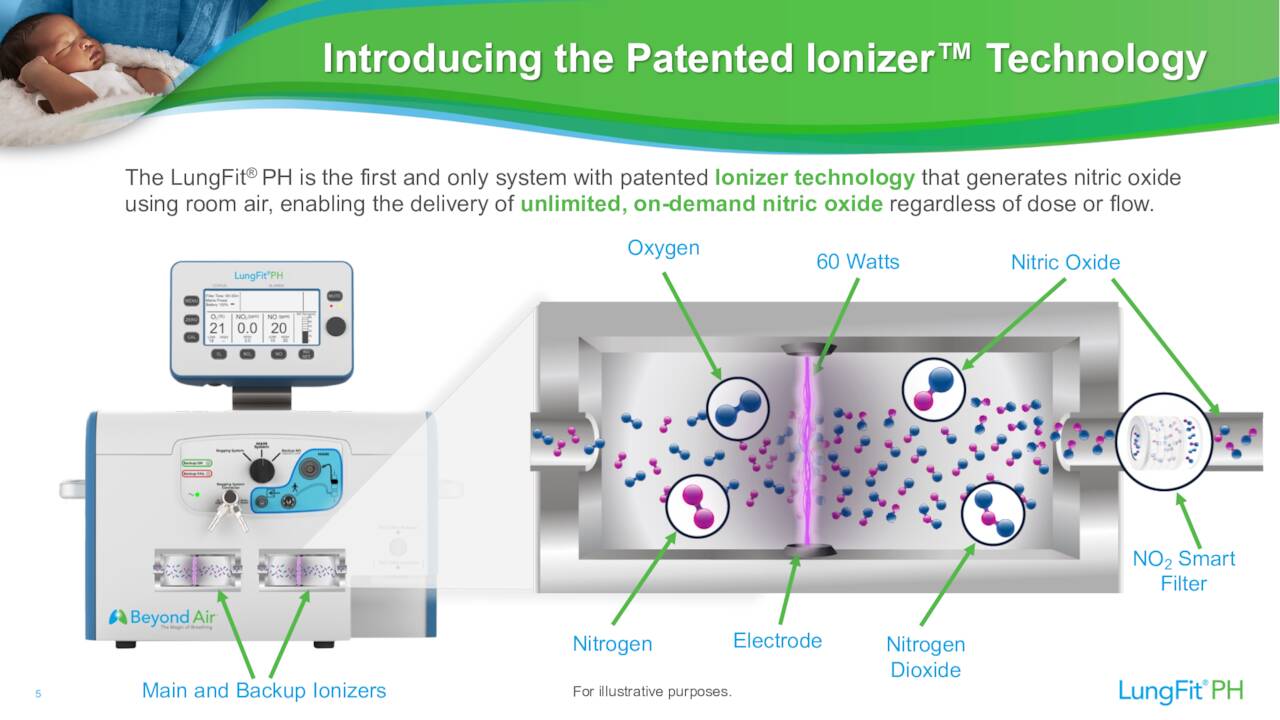

This small medical device and biopharmaceutical company is based just outside of New York City. The company has one product on the market and is developing others based on its of LungFit platform, which is a nitric oxide generator and delivery system.

September 2022 Company Presentation

The company’s product portfolio/pipeline include:

September 2022 Company Presentation

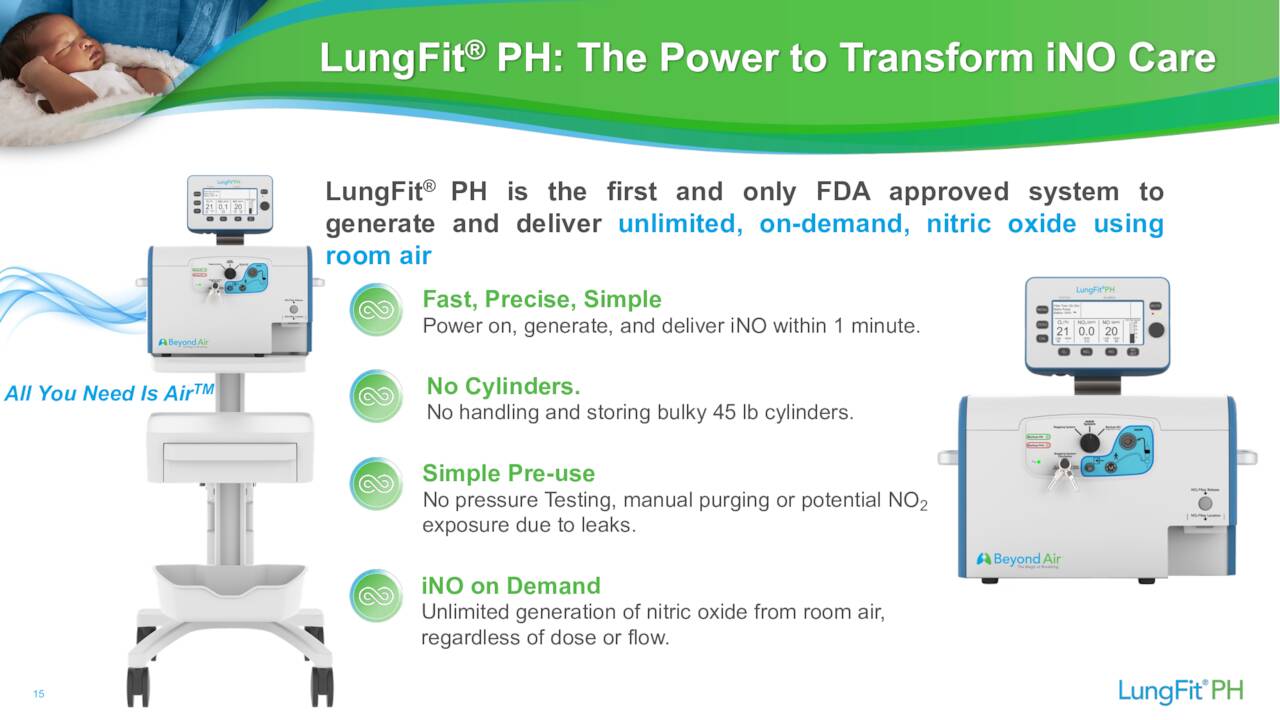

LungFit PH

Approved for the treatment of persistent pulmonary hypertension of the newborn. The company recently completed the first phase of a limited commercial launch of LungFit PH, signing several hospitals to contracts. Beyond Air is now moving to a wider-scale launch of this product.

September Company Presentation

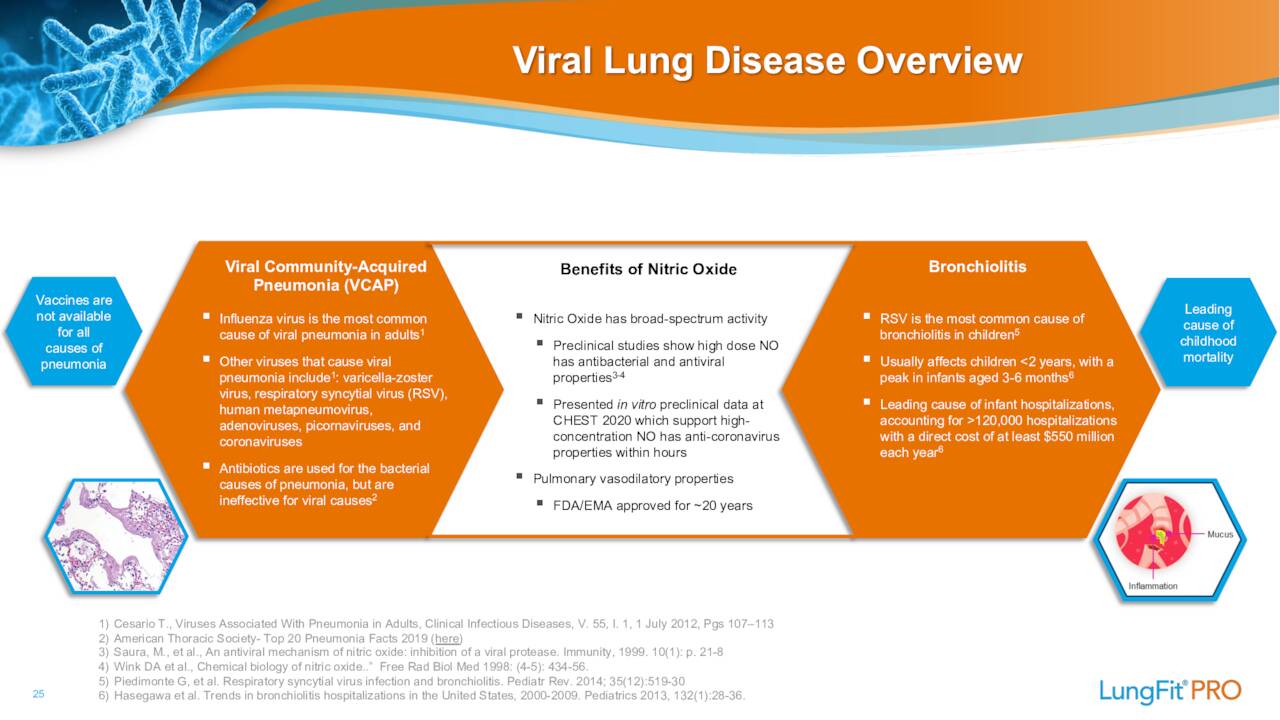

LungFit PRO

In development for the treatment of viral lung infections, such as community-acquired viral pneumonia and bronchiolitis in hospitalized patients. The company is scheduled to initiate a trial to evaluate this device to treat viral community-acquired pneumonia (VCAP) in the fourth quarter.

September 2022 Company Presentation

LungFit GO

In development for the treatment of nontuberculous mycobacteria. A pilot program studying this device to treat a subset of COPD patients recently discharged from hospitals is calendared for late 2024. A trial evaluating LungFit Go to treat patients with nontuberculous mycobacteria is scheduled for the first half of 2025.

September 2022 Company Presentation

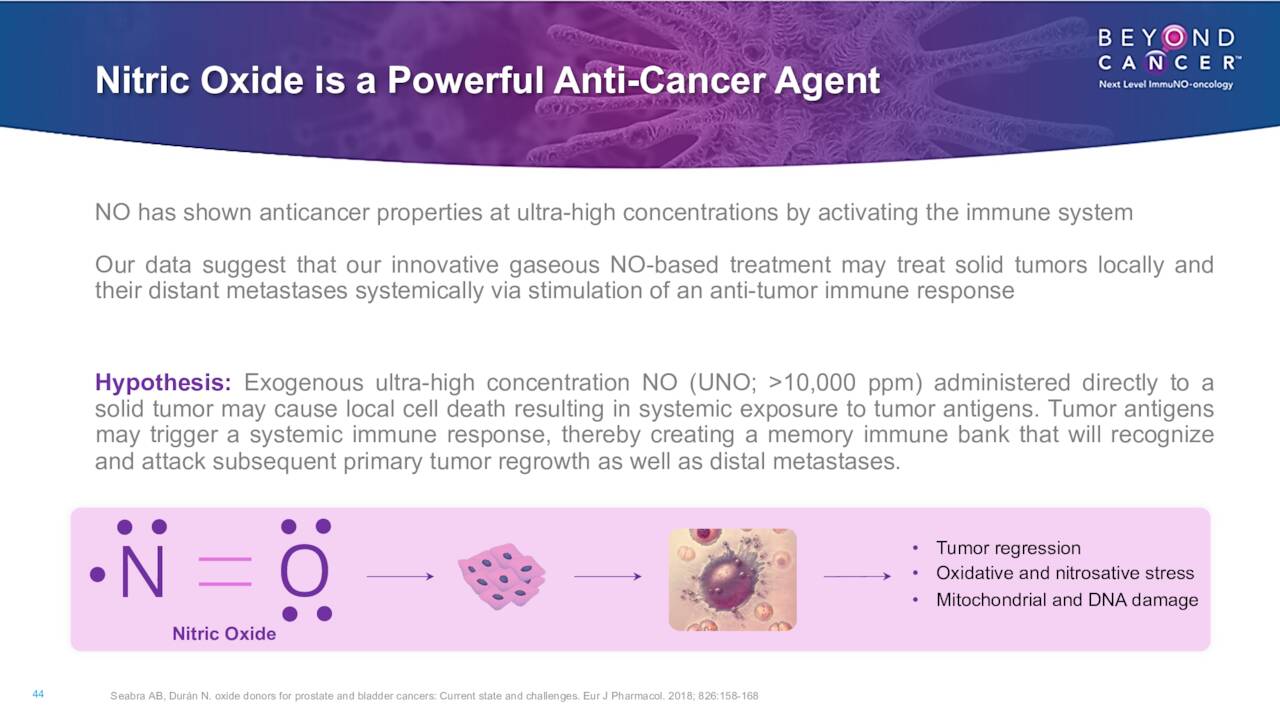

The company also is focusing its novel nitrous oxide therapy to treat various types of solid tumors as a single agent and in combination with checkpoint inhibitors (anti-PD1 and anti-CTLA4). Those efforts are too early staged development to be germane to this analysis.

September Company Presentation

The stock currently trades for just over $4.50 a share and sports an approximate market capitalization of $140 million. The company’s fiscal year starts on April 1st.

Analyst Commentary & Balance Sheet:

This past week, both Oppenheimer ($10 price target) and BTIG ($15 price target) reissued Buy ratings on XAIR. In February, Truist Financial did the same but lowered their price target to $18 a share from $20 previously. That is the only analyst firm activity I can find on the stock so far in 2023.

Several insiders, including the company’s CEO and CFO, bought just over $900,000 worth of stock in the first quarter collectively when the shares traded north of eight bucks a share. That has been the only insider activity in the stock so far in 2023. Approximately nine percent of the outstanding float is currently held short.

The company ended the fourth quarter with just over $45 million of cash and marketable securities on its balance sheet after posting a GAAP net loss of $59.4 million. Beyond Air still also owes $8 million due to a settlement with Circassia, which will pay in two installments in FY2024 and FY2025. The company burned through $37.9 million worth of cash in FY2023 and anticipates a cash burn rate of approximately $10 million a quarter in FY2024.

Beyond Air then got $17.5 million from a new four-year $40 million credit facility that had some quite onerous terms. The first three years can be interest-only repayments, but with a 12% interest rate. The company also had to grant the lender just over 233,000 warrants at a conversion price of $5.88 per share.

Verdict:

The current analyst firm consensus has the company losing $1.77 a share in FY2024 as sales grow from zero in FY2023 to just under $20 million this fiscal year. They see collectively losses falling to $1.40 a share in FY2025 as revenues approach $50 million. It is important to note there is a wide range of sales estimates among analysts both for FY2024 and FY2025.

At its projected cash burn rate, the company has funding in place for six quarters. The challenge is projecting whether revenues can rise enough to circumvent additional dilutive financing. Unfortunately, Beyond Air is too early in its marketing rollout phase to get a reliable projection on how the sales ramp will play out. One reason analyst firm projections are all over the place right now. Given that uncertainty as well as my cautious stance on the overall market right now, I am passing on any investment recommendation on Beyond Air.

September 2022 Company Presentation

By the end of this year, the company should have attained the CE Mark in the EU for LungFit PH and garnered a cardiac label expansion application for this product here in the States as well. Therefore, this is a story we will circle back on once the company posts a couple quarters of sale results and its growth trajectory is easier to peg.

“Disappointments are to the soul what a thunderstorm is to the air.” – Friedrich Schiller

Read the full article here