Back in March, I put a “Sell” rating on Beyond Meat (NASDAQ:BYND), noting that the company had made a number of missteps over the past year but that weak demand for its product was its biggest issue. The stock is down over -18% since my original article. Let’s catch-up on the name.

Company Profile

As a reminder, BYND is a manufacturing and distributor of plant-based food that is designed to have the texture and taste of meat, including beef, poultry, and pork items. Its leading product is the Beyond Burger, which is purported to taste, look, and cook like a beef hamburger. It also offers other items such as Beyond Chicken Tenders, Beyond Chicken Nuggets, Beyond Sausage, Beyond Meatballs, Beyond Breakfast Sausage Patties, and other items. The main protein source for these products comes from yellow peas.

Its products are sold through both the grocery retail channel as well as through the foodservice channel, such as quick service restaurants. Its items are sold in over 80 countries.

A Return to Gross Profits

The last time I looked at BYND, the company had reported negative gross profits the past three quarters. That’s a dubious distinction of a business that has a lot of major issues.

One of the big issues for this was that it decided to launch a Beyond Meat Jerky product without regard to being able to do it in an efficient manner, having to process the product across a variety of facilities just to produce one batch.

In addition, the company has had to deal to with low utilization at plants, inventory reserves, lower revenue per pound, the termination of co-manufacturing agreements, and higher transport costs.

For Q1, the company was able to produce a gross profit of $6.2 million. That was good for a measly 6.7% gross margin, but that’s a lot better than negative and is certainly moving in the right direction. However, $5.1 million of the gross margin was due to increasing the useful life of some of its manufacturing equipment, so much of the gain was an accounting function. Excluding the accounting change, gross margins would have been only 1.2%.

BYND Gross Margins (FinBox)

Discussing margins on its Q1 earnings call, CEO Ethan Brown said:

“The company is focused on the deployment of lean management structure and process to drive cost out of our operations. We continue to rationalize our production network, collapsing processes and eliminating steps that generate unnecessary cost while consolidating and optimizing our co-packing resources. Though we have much heavy lifting left to do, we are seeing tangible progress. For example, even as inflation continues to plague supply chains more generally, we reduced COGS per pound by approximately 15% on a year-over-year basis, primarily on the back of solid improvement in manufacturing and logistics costs, excluding any impact from depreciation. The swift production allowed us to cross over into positive gross margin in Q1 of 2023 from a trough of negative 18% margin as recently as Q3 2022. We will continue to imply intense focus on margin restoration and cost reduction versus raising prices as we pursue our long-standing price parity target with animal protein. At this point, we are achieving these margin gains even as our average price per pound is down 6% on a sequential basis and 9% on a year-over-year basis, reflecting both changes in mix as well as deliberate pricing programs consistent with our path to price parity.”

The one thing I’d note that the above comments show is that the company has no pricing power at the moment. When gross margins are as poor as they are and the company is reducing prices, that’s an issue.

Product volumes clearly show an issue as well. U.S. retail is the biggest issue, with Q1 volumes plunging -33.2% to 8.315 million pounds. U.S. Foodservice also saw volumes decline -7.3% to 2.551 million pounds, while international retail volumes dipped -5.5% to 3.337 million pounds. One bright spot was international foodservices, where volumes soared 115% to 5.549 million pounds.

Distribution is also a problem and appears to have maxed out in the U.S. Excluding Beyond Meat Jerky, U.S. retail distribution points were actually down 2,000 outlets year over year to 33,000. Meanwhile, U.S. foodservice outlets dipped 1,000 channels sequentially.

Speaking of distribution, the company said it would take over the distribution of Beyond Meat Jerky from PepsiCo (PEP) to help with margins starting in Q4. Given PEP’s relationship in the convenience store space and BYND’s lack on them in this channel, this doesn’t seem like the best of moves in my view.

BYND is also dealing with inventories that are too high, which also leads to the question of spoilage, since we are dealing with a food product. The company is trying to monetize excess ingredients and have tight controls on aging inventory, but this could become another potential issue.

On the positive front, the company does seem to be making good inroads in the international foodservice business, including at McDonald’s (MCD) and Yum (YUM). It is also looking to introduce a new burger platform this summer to try to regain some lost ground.

Balance Sheet and Valuation

BYND has $1.1 billion in debt on its balance sheet, consisting of a 0% convertible note not due until 2027. Meanwhile, it has $258.6 million in cash, down from $310 million at year-end 2022.

BYND will look to be free cash flow positive in the 2nd half of 2023. However, that will be from an inventory drawdown, not a sudden strong turnaround. As such, continued free cash flow momentum in 2024 will likely be difficult.

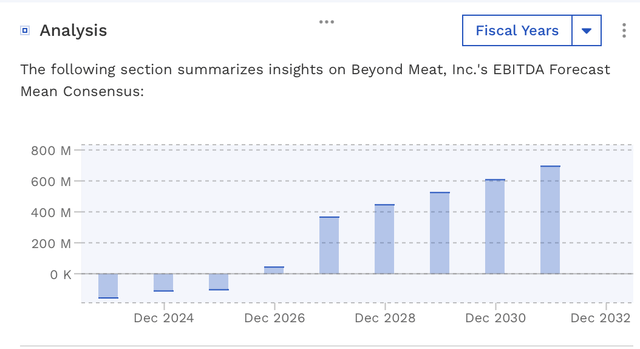

Analysts don’t expect the company to turn EBITDA positive until 2026 and then they expect EBITDA to take off and be $366 million in 2027. Given its maxed-out distribution in the U.S., lack of pricing power, and declining consumer interest, I don’t see outer-year estimates as being achievable.

BYND Adjusted EBITDA Estimates (FinBox)

Conclusion

BYND remains a mess in my view. Management greatly misread demand for its products, and clearly consumer tastes for its offerings are waning. Volumes are down tremendously in its main U.S. market, and the company has started to lose distribution The reckless roll out of its Beyond Jerky Product was a mistake, and taking over its distribution from PEP isn’t a good idea in my view.

While BYND should be able to improve its terrible gross margins, I don’t see BYND being a thriving company any time soon. As such, I’m going to keep my “Sell” rating for now.

Read the full article here