Author’s note: This article was released to CEF/ETF Income Laboratory members on June 4th.

A reader asked for my thoughts on the iShares Core Moderate Allocation ETF (NYSEARCA:AOM), a diversified, multi-asset class, fund of funds, index ETF. Although there is nothing inherently wrong with AOM, it offers investors few significant benefits, and compares unfavorably to some of its peers, including Vanguard’s suite of retirement mutual funds. As such, I will not be investing in the fund.

AOM – Quick Overview

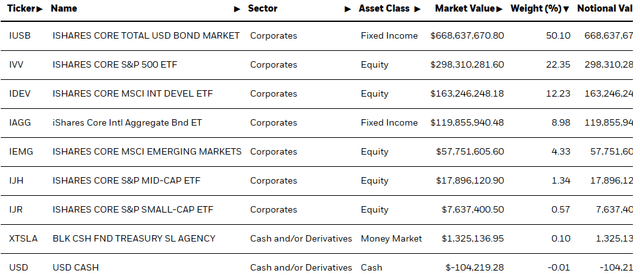

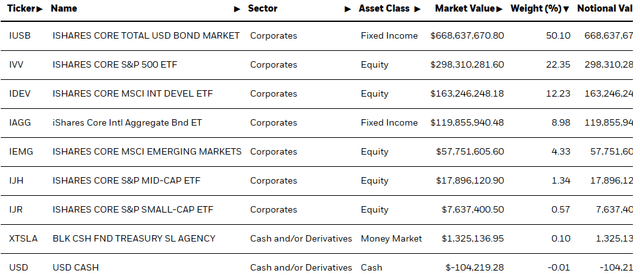

AOM is a diversified, multi-asset class, fund of funds, index ETF. It is managed by BlackRock, and invests in a diversified suite of BlackRock bond and equity index ETFs. AOM’s portfolio is as follows.

AOM

As can be seen above, AOM is roughly 60% bonds, 40% equities, very slightly overweight U.S. equities, with a very small (indirect) allocation to high-yield corporate bonds. The fund’s asset mix is reasonable enough, with a slight tilt towards lower-risk, lower-return assets, generally appropriate for more conservative investors and retirees.

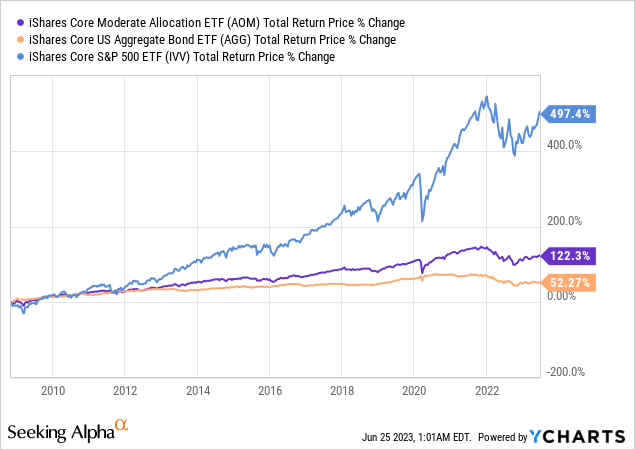

AOM’s performance is somewhere between that of bonds and U.S. equities, tilted towards bonds, as one would expect. Long-term performance is significantly tilted towards bonds, due to the effect of (lack of) compounding.

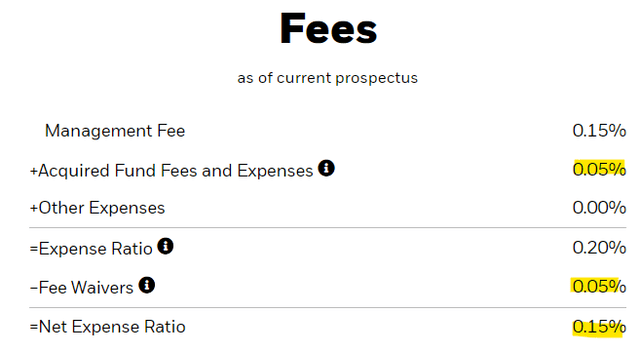

AOM has a 0.15% expense ratio, and underlying fund fees are waived by BlackRock. So, investors pay AOM’s 0.15% in expenses and nothing else.

AOM

The fund currently yields 2.3%, quite low on an absolute basis, but broadly reflective of current equity and bond yields.

In general terms, AOM’s strategy, holdings, expenses, and performance are all reasonable enough. Some investors desire a simple, all-in-one fund for their retirement or investment portfolio, and AOM delivers on that adequately, without any significant issues. It does, however, compare unfavorably to certain Vanguard funds. Let’s have a look at these.

AOM – Vanguard Target Retirement Fund Comparison

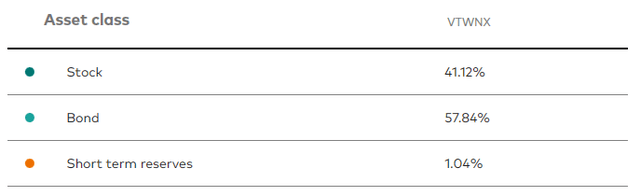

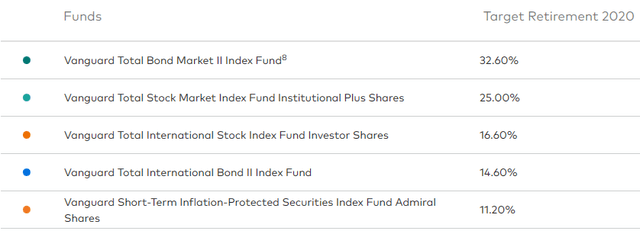

Vanguard has a suite of target retirement funds, for prospective retirees of most ages. AOM seems closest to the Vanguard Target Retirement 2020 Fund (VTWNX), with similar asset allocations. Compare VTWNX:

VTWNX VTWNX

To AOM:

AOM

As can be seen above, both funds invest in a diversified set of bond and equity index ETFs. Both also focus on bonds, with these accounting for around 60% of their respective portfolios. AOM invests in more funds, but VTWNX’s funds are a bit broader, resulting in roughly equal levels of portfolio diversification. VTWNX does have a large allocation to short-term inflation-protected securities, unlike AOM.

VTWNX and AOM are broadly similar funds, but VTWNX seems like an overall stronger choice, for several reasons.

VTWNX is a target retirement fund, which adjusts its underlying asset mix over time. At first, when investors are (presumably) far from retirement, the fund is overweight equities, to maximize returns. As the target retirement date nears, the fund shifts towards bonds, to decrease risk and boost yields as investors are (presumably) nearing retirement. The end result is much more attuned to the realities and needs of many investors, especially prospective retirees. I, for example, might invest in the Vanguard Target Retirement 2050 Fund (VFIFX) get equity-like returns for a decade or two, and then get bond-like returns in the 2040s, as I near retirement.

Notwithstanding the above, some investors might prefer AOM’s more stable asset mix, especially those who are already retired.

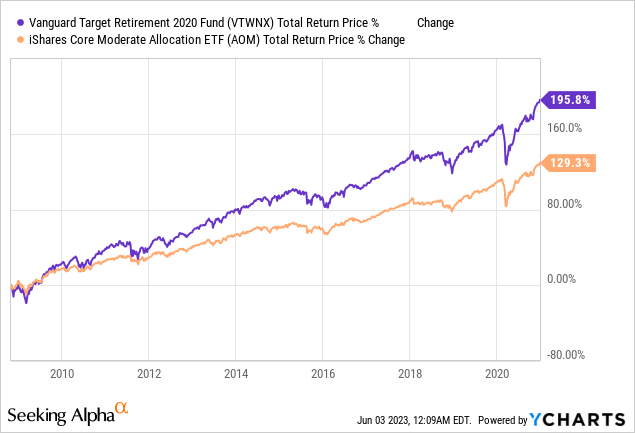

VTWNX’s performance track-record is significantly stronger than that of AOM, for two reasons. First, due to VTWNX’s greater equity allocation plus equity outperformance in prior years.

Data by YCharts

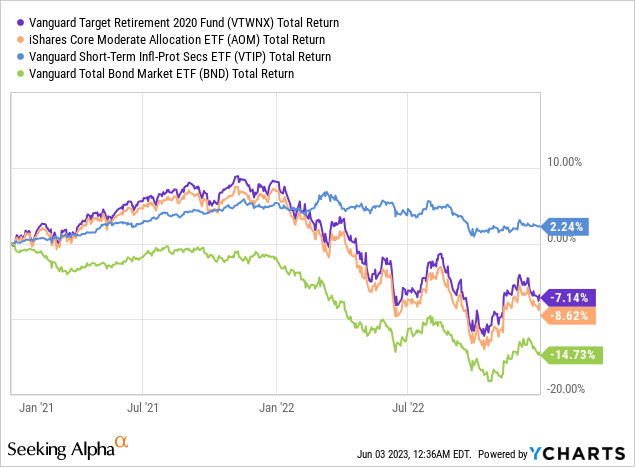

Second, VTWNX’s inflation-protected securities outperformed broader bond indexes in 2021 and 2022.

Data by YCharts

VTWNX’s stronger performance track-record is, I think, a very clear indication of the superiority of its investment strategy. Although AOM might not necessarily underperform moving forward, especially considering that equity weights are equal between these two funds right now, the fund’s past results are not encouraging. All else equal, I prefer funds which outperformed in the past, and that means VTWNX, and Vanguard’s other target retirement funds.

Finally, VTWNX is a bit cheaper than AOM as well, with a 0.08% expense ratio, versus 0.15% for AOM.

AOM does have one key advantage relative to VTWNX, it is an ETF, and ETFs are generally more tax-efficient. This is due to complicated structural and operational reasons, but, simplifying things a bit, we can say that ETFs are generally structured so as to avoid taxable events / the realization of capital gains. In most cases, ETF investors only pay capital gains taxes when they sell their shares, while the same is not always true of mutual fund investors.

The importance of these tax efficiencies are dependent on many factors, including where these funds are bought / placed, and an investor’s tax burden. I imagine these funds are generally bought in tax-advantaged retirement accounts or portfolio, where AOM’s tax efficiencies are less relevant. This is, off course, not certain, and ultimately dependent on each individual investor.

Conclusion

AOM is a diversified, multi-asset class index ETF. Although there is nothing inherently wrong with AOM, it offers investors few significant benefits, and compares unfavorably to some of its peers. As such, I would not be investing in the fund.

Read the full article here