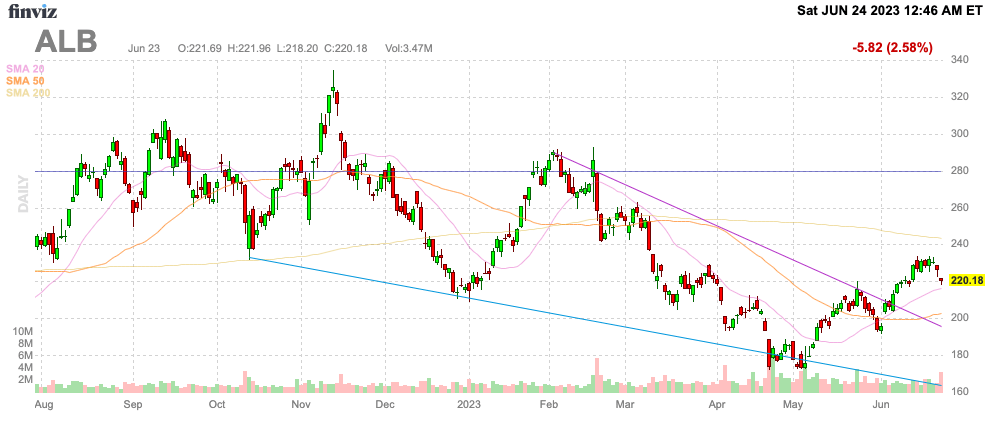

A lot of EV news this year has pushed down lithium miner stocks, but investors shouldn’t doubt the long-term demand despite the risks. Albemarle (NYSE:ALB) traded down nearly 50% at the lows as Chinese EV demand hadn’t met expectations this year, but analysts are now sounding the alarm again about looming lithium shortage. My investment thesis remains ultra Bullish on the stock due to the long-term demand trends and the struggles with bringing on new supply.

Source: Finviz

Lithium Shortages

Albemarle has long promoted the concept of lithium shortages in the years ahead despite a lot of new mines coming online. The biggest risk to the concept of lithium meeting the soaring demand for EV batteries is that new mines face serious delays in product starts. A prime example being the Kachi lithium project in Argentina from Lake Resources (OTCQB:LLKKF) recently delayed for years due to issues with power supply and logistics and cost double the original capex estimate.

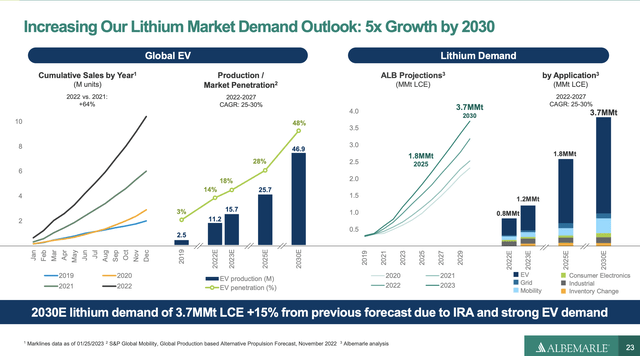

Albemarle projects lithium demand continues to surge despite the ongoing supply constraints. The lithium miner now forecasts 2030 demand will reach 3.7 MMt, up 15% from the prior forecast.

Source: Albemarle June ’23 presentation

This demand number is crucial considering supply is only projected at 2.9 MMt in 2030 leaving a massive 20% gap with demand at 800 kt. Fastmarkets has 45 current lithium mines operating with up to 18 new mines forecast to reach production in the next 2 years, yet this amount isn’t enough to meet demand and the risk is that projects are pushed out, not pulled forward.

The other part of the story is that Albemarle has existing supply with low costs. The company estimates that lithium mining costs are going to soar to $20/kg in order for the industry to bring on new projects online by 2030. Without lithium prices maintaining at higher levels, new supply won’t come online towards the end of the decade. Albemarle will maintain strong profits and cash flows from the higher prices required to bring needed supply online and due to the expected supply shortages even with the higher cost supplies.

Strong Financials Ahead

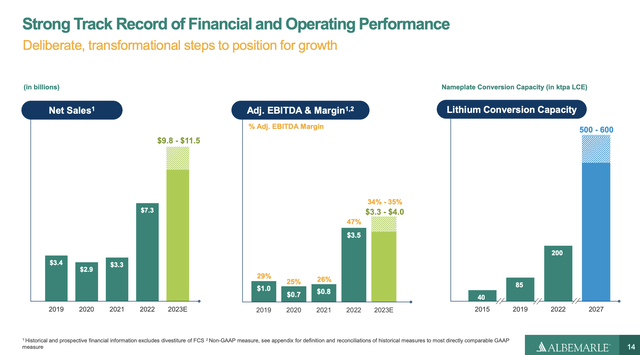

Recent lithium price reductions required Albemarle to lower forecasts for the year. The company is now guiding to a 2023 adjusted EBITDA of $3.3 to $4.0 billion, down sharply from the guidance at the start of the year of $4.2 to $5.1 billion.

Source: Albemarle June ’23 presentation

The pricing scenario might hamper short-term financials, but the company should still be on the path to hit 2027 financial targets provided earlier this year.

- Sales – $17.6 – $19.3 billion

- Ad. EBITDA – $7.2 – $8.4 billion

- FCF – $2.6 – $2.7 billion

Albemarle actually missed Q1 revenue targets when reporting back in early May and cut full year estimates. The company still reported a strong EPS of $10.32, which should provide some perspective for the stock trading at only $220.

The market cap falling back below $30 billion provides a very attractive entry point here. Of course, anyone snapping up Albemarle 10% lower really made a great investment when the stock dipped below $200 back in April.

Lithium has too much demand in the future considering EV market penetration is only in the 15% range on a global basis and far lower in the US. Annual EV production is forecast to rise from 11 million units in 2022 to nearly 50 million in 2030 to reach 50% market penetration at the time.

The stock only trades at ~3.5x the 2027 adjusted EBITDA targets and 5.0x EPS targets. Albemarle will be a massive operating cash flow machine by 2027 with the lithium miner still spending aggressively on capex in order to only produce $2.6+ billion in free cash flows.

Takeaway

The key investor takeaway is that investors should use any weakness to load up on strong lithium miners like Albemarle. The sector faces massive supply shortages due to surging lithium demand while the miners struggle getting new mines ramped up to production on time.

Albemarle stock has now traded flat for a couple of years while EV demand is only growing. A lithium miner stock trading at only 7x adjusted EBITDA targets for 2023 is just too cheap.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

Read the full article here