ASML Holding N.V. (NASDAQ:ASML) delivered strong Q1 2023 results, beating analyst consensus estimates with regards to both topline and earnings. Although the strong January quarter is appreciated, investors are likely looking beyond the short-/mid term financial results, and try to price how the world’s leading manufacturer of photolithography equipment will likely be influenced by the AI tailwind – with the stock up by ~20% since Nvidia (NVDA) delivered its bumper guidance beat.

Overall, I like ASML as a leading player in the semi-industry and a likely key beneficiary of the AI tailwind, which, according to my estimates, may support a ~11-12% topline CAGR through 2030, likely resulting in a 6.25% annual earnings yield based on a 38-40% EBIT margin (see analysis in section “A Note On EPS and Valuation”).

For reference, ASML stock has strongly outperformed the broad market since early 2023 – ASML stock is up about 27% YTD, versus a gain of close to 14% for the S&P 500 (SP500).

Seeking Alpha

ASML beats Q1: Topline & Earnings

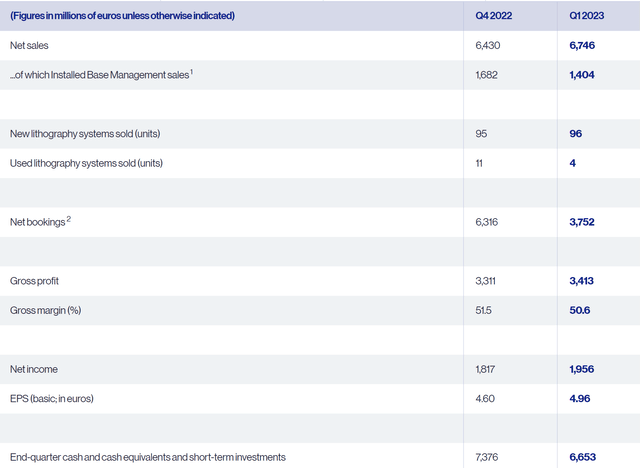

ASML reported strong Q1 2023 results, beating analyst consensus estimates with regard to both revenue and earnings. During the period from January to end of March, the world’s leading equipment maker for key semiconductor technology generated total revenues of €6.75 billion, up about 5.5% QoQ on a FX adjusted basis, and beating analyst consensus at midpoint by almost ∼€500 million. During the period, ASML sold 96 new lithographic systems (units), one more than in Q4 2022.

With regard to profitability, ASML’s gross profitability expanded ~3% QoQ, to €3.4 billion (50.5% gross margin), and net income grew ~9% QoQ, to €1.96 billion (€4.96/share), beating consensus estimates by 81 cents ( ~20% upside surprise vs. €4.2/ share expected at midpoint)

ASML closed Q1 with less than €6.7 billion of cash, as compared to a TTM operating cash flow of about €9.7 billion.

ASML Q1 2023 results

Strong Guidance Supports Bull Thesis

Together with a strong start in the new year, ASML also provided supportive guidance for Q2 and beyond.

For Q2 2023, ASML has provided the following financial projections:

- Net sales are anticipated to fall within the range of €6.5 billion and €7.0 billion, including an estimated €1.3 billion in sales from Installed Base Management.

- The gross margin is expected to be between 50% and 51%, in line with Q1 results.

- Operating expenses, summarizing R&D and SG&A, are projected to be within to the range €1,250 – €1,300 million.

Furthermore, for 2023, ASML foresees a net sales growth of more than 25% compared to 2022 and a ‘slight’ improvement expected in the gross margin.

Guidance Upside in Q2 Likely – Following AI Demand Tailwind

Although ASML delivered already a strong Q2/ FY 2023 guidance, I argue that the likelihood for a guidance upside revision in Q2 is likely, as management will likely anchor on more visibility around the demand tailwind coming from AI-related (new) business. In that context, investors should consider that Nvidia’s enormous guidance beat (~20-30% depending on analyst) was delivered approximately one month after ASML provided Q1 insights. And as leading chipmakers structure their capacity for higher chip volume, ASML will likely see a jump in its order books during Q2 – Q4 2023. Moreover, I argue that as long as AI continues to be predominantly utilized in data centers and cloud-based environments, the technology boom will serve as a structural demand driver and a positive business catalyst for the semiconductor capital equipment industry.

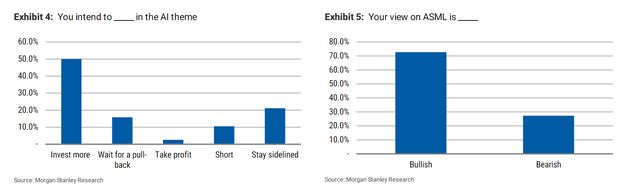

Arguing about the positive impact of AI on the semiconductor capital equipment industry, I would like to highlight Morgan Stanley’s latest “AI Polling Results”, dated June 12th. Equity strategist Edward Stanley and his team gathered insights and perspectives of 40 Chief Information Officers and Project Managers on AI, and found that about 50% of the respondents believe that AI will fundamentally change the business/ technology landscape, while approximately 30% acknowledged the expectation of a “wholesale change”. Only a small percentage, around 2%, considered AI to be “almost all hype.”

Moreover, referencing investment opportunities related to AI, the Chips/Semis industry was considered a key opportunity area, with close to 50% of respondents expressing intention to invest more in the AI theme. Specifically, with regards to ASML, 73% of the respondents were bullish, while only 27% were bearish.

Morgan Stanley Equity Research

A Note On EPS and Valuation

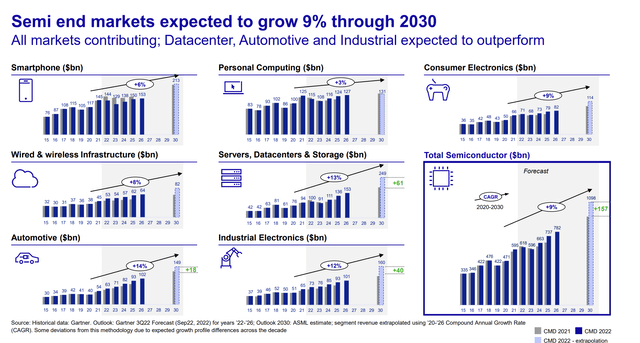

ASML has previously estimated that the demand for semiconductors will likely grow at a 9% CAGAR through 2023. Reflecting on various press releases by OpenAI, Microsoft, Google, Meta, etc., I believe that the AI tailwind will likely be ~2-3% CAGR accreditive to the 9% base as estimated by ASML.

ASML Capital Markets Day 2022

If investors assume that the industry expansion translates about 1:1 in topline expansion for ASML, then the company’s 2030 revenue may ~€58-62 billion. Extrapolating a 38-40% cyclically adjusted EBIT margin to 2030, I calculate ASML’s FWD 2030 EBIT at about ~€22.5-24 billion.

Now, if we discount the estimated FWD 2030 EBIT at 6%, then we can calculate ASML’s implied FWD EV/EBIT (FY30) at about x16, which I argue is quite a reasonable valuation for a quality company such as ASML – but not necessarily cheap. (Remember, the inverse of the EV/EBIT multiple is approximately the estimated earnings yield: 6.25%)

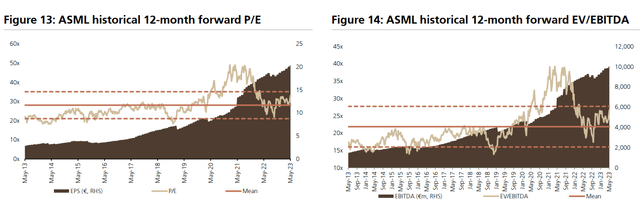

Expanding on valuation, I would like to point out research by UBS equity team, which mapped ASML’s 10 year historic P/E and EV/EBIT against its current valuation — highlighting that ASML is currently trading above the company’s historic mean, and slowly approaching a 1 std. dev. implied premium.

UBS equity research

Conclusion

ASML delivered strong Q1 2023 results, beating analyst consensus estimates with regards to both topline and earnings; however, investors likely are focused more on the company’s potential benefits coming from the AI boom. All else equal, I estimate that the AI tailwind will likely contribute to 20-25% cumulative revenue uplift vs. TTM Q1 2023 expectations for FY 2023.

Investing in ASML based on the company’s current enterprise value, investors will likely enjoy an earnings yield on their investment of ~6.25%. While I believe ASML’s implied yield is ‘fair’, I don’t see it as a ‘bargain’, and return-seeking investors will likely find more rewarding opportunities elsewhere. I assign a ‘Hold’ recommendation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here