In this article I will outline why I think, Stanley Black & Decker Inc. (NYSE:SWK), a dividend aristocrat with 54 years of consecutive dividend increases, is at an inflection point. Technical analysis indicates that now is a great time to initiate a position in SWK to lock in a 3.64% yield. I will analyze price action, volume, momentum, and relative strength to outline my thesis.

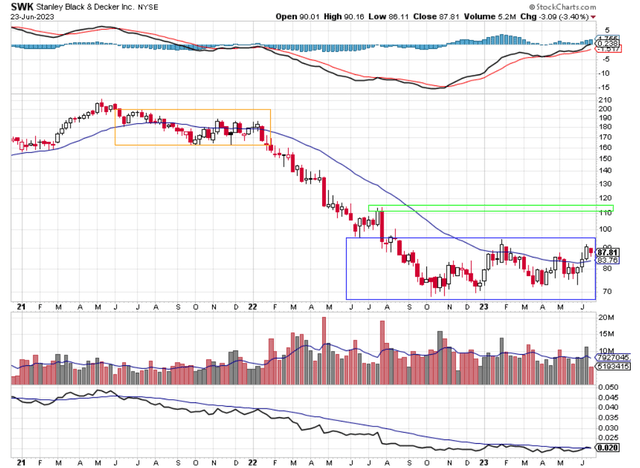

Chart 1 – SWK Weekly Chart with 30-week EMA, PPO, Volume, and Relative Strength

www.stockcharts.com

When I analyze a stock, I like to start with looking at price action. My favorite timeframe is the weekly chart and I like to use a 30-week exponential moving average (EMA) which represents the medium to long term time frame in my opinion. Chart 1 shows the last 2.5 years of price action. You can see that SWK made a high in May 2021 at $211.38. From there SWK declined slightly and then went into a multi-month consolidation or distribution period which lasted until late January 2022. During this period there was no defined trend to SWK. SWK oscillated above and below the 30-week EMA. This period is very frustrating for trend following traders because there is no defined trend to follow. In January 2022, SWK dropped below its 30-week EMA and stayed below that EMA for over a year. A person who shorted SWK after price closed outside of the orange box in January 2022 would have realized a 56% gain on their position when SWK hit its low in October 2022. This was a strong bearish trend and could have been captured by using the 30-week EMA as a trend following tool. For most of 2022, SWK made a series of lower lows and lower highs. This is the textbook definition of a downtrend. This downtrend began to change after October 2022. Once the low was reached in October, SWK rallied a bit to the lower 80s in November 2022. Then SWK declined to a low in December 2022. A person who studies price action would have noticed that SWK failed to go lower than the low set in October 2022. This represents a higher low. That is different than anything that happened previously in 2022. A potentially bullish sign. Then SWK rallied until late January 2023. During this rally two significant things happened from a price action standpoint. First price rallied above the high it set in November 2022 representing a higher high. Something that was done at all in 2022. Second, SWK closed above it 30-week EMA. Something not done since early January 2022. SWK couldn’t hold its 30-week EMA and then declined to the low 70s in March. This was also a higher high from the previous low in mid-December 2022. Now there is a series of higher lows and higher highs. That’s bullish. SWK continued to show its trend is trying to change from bearish to bullish. SWK rallied back to close above its 30-week EMA and managed to stay above its 30-week EMA for two consecutive weeks before dipping below that EMA. Now SWK has closed above its 30-week EMA for the last three weeks. This hasn’t occurred since early January 2022. SWK may hold its 30-week EMA for an extended period of time or it may drop back below this EMA. From a price action standpoint, once SWK closes above the blue box and the 30-week EMA shows to be trending higher than the bull trend is in full force. I would add to my position under those circumstances as I prefer to own stocks that are above their 30-week EMAs and that have their 30-week EMAs rising. That combination is very bullish. If SWK does break out higher I see the $110 area as the first level of resistance. This level is shown with the green box and was a level that preceded the last downward move that started in late July 2022. There may be some trapped buyers at that level that may want to exit their positions if SWK rallies back to the $110 level. Now, SWK is at a price level that shows me it’s okay to start buying shares if you want lock in a decent yield (3.64%) ahead of an expected price advance.

Price now is inside a period of consolidation outlined by the blue box. This period is like the period of consolidation discussed earlier outlined in orange. The difference for me is that this period is not a period of distribution, but a period of accumulation. Periods of accumulation happen because institutions are acquiring shares of stock over time in anticipation of a new bull trend. I think this because of what I see when looking at the volume which is shown in the third pane of Chart 1. Since October 2022, which was when SWK reached its low, the highest volume bars have coincided with bullish moves in price for that week. That tells me institutions have been acquiring SWK during those weeks. Before last week, SWK had a nice bullish move with high volume. Another healthy volume sign is that while SWK declined this past week, volume for the week was the least it’s been since November 2022 which coincided with Thanksgiving. You must be cautious here though. Price is under consolidation or accumulation and could visit the lower part of the blue box which is a 22% drop from current levels. I would not feel comfortable holding SWK through a 22% drop. That’s too much of a drawdown for me.

Momentum is the next part of my analysis. The Price Percentage Oscillator (PPO) is shown in the top pane of Chart 1. This oscillator measures momentum in the stock by using multiple moving averages and computations. The math underlying the oscillator is not important. The PPO is easy to understand. When the black line is above the red line that is an indication of bullish momentum in the stock. Another indicator of bullish momentum in the stock is when the black line is above the centerline or zero level on the chart. As of the close on 23 June, both bullish momentum signs have been met. Bearish momentum is the opposite of bullish momentum meaning that black is below red and the black line is below the centerline or zero level on the chart. You can see that during the long decline which showed a loss of 56%, PPO was in bearish momentum as the black line was below the red line and the black line stayed below the centerline or zero level on the chart. All things considered; I want to own stocks when PPO shows both signs of bullish momentum like it does now. It is important to understand that PPO doesn’t predict price action. It is a lagging indicator that can help confirm price action.

The last part of my analysis is relative strength. I prefer to own stock in companies that are outperforming the S&P 500 index. A relative strength ratio can show if the stock is doing so. The bottom pane of Chart 1 shows the relative strength ratio of SWK to the S&P 500 index in black and the 30-week EMA of that ratio in blue. When the black line is declining that shows that SWK is underperforming the S&P 500 index. When the black line is rising that means SWK is outperforming the S&P 500 index. You can see that during the 56% percent decline in 2022, the black line was falling and it stayed below a declining 30-week EMA. That’s because during that time SWK lost 56% of its value while the S&P 500 declined around 25% of its value. SWK underperformed the S&P 500 index. Now when I read the chart, I believe that SWK is on par with the S&P 500 index. It is neither outperforming nor underperforming the major index. If the black line starts to rise and the 30-week EMA starts to trend higher, that is a good time to add to your SWK position.

In summary, I think that now is a good time to initiate a position in SWK if you are inclined to own Dividend Aristocrats. Price is showing bullish price action signs, is under accumulation by institutions, and has bullish price momentum. SWK is still inside an accumulation zone and may stay there for some time. That is why I say start a position. That doesn’t mean go all in on SWK. Once SWK closes outside of the blue box and the 30-week EMA shows to be trending higher, then you can add to your existing position.

Read the full article here