How hard is it to moderate my market pronouncements to have a bit of healthy ambiguity?

I dislike ambiguity, nearly everyone who comments on the market is so wishy-washy. Though, I admit that I could easily say “I expect a turn in about 2 weeks.” In my case, it nearly always is about 2 to 3 weeks out from my first observation, that a turn happens. Did I know that Powell would threaten 2 more rate hikes beforehand, after all that’s what caused the selling?

TradingView

TradingView

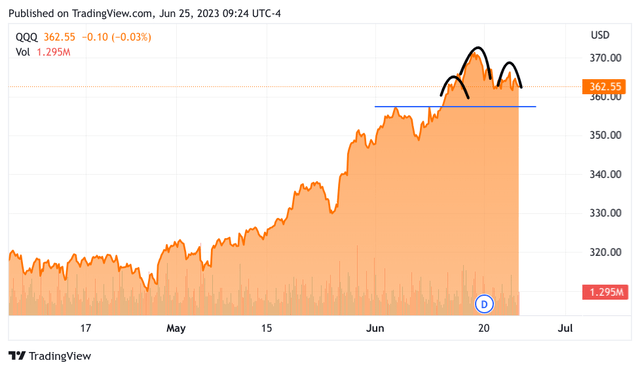

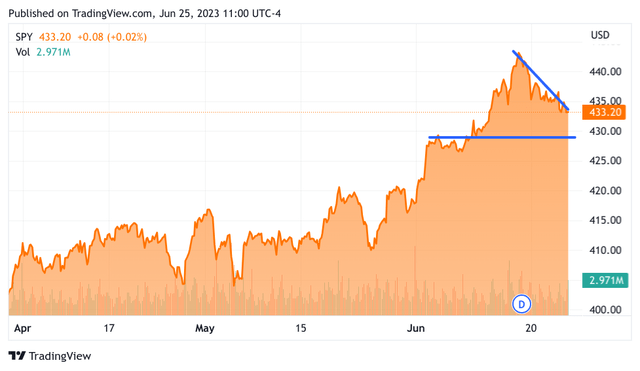

No, It really could have been anything or nearly anything. If the market wasn’t as overbought it could have easily moved right past the Powell commentary. What do I mean by overbought, there is an actual measurement for being “overbought”, usually people mention the RSI – the Relative Strength Index. It’s a great indicator and for everyone who wants to understand the market or individual stock “mood,” RSI is a good place to start. I am a seat-of-the-pants guy, This means I watch the charts and read or watch all the relevant media I can. So when the bulls start to be dominant and the chart starts to like a geyser or rocket ship going straight up, that is when I start letting people know that the market is about to turn (with a 2-week head-start). Okay now that we are selling off, how far can we go? I said it was possible to lose 8% to 9%, and that would hurt, even if you were hedged. I don’t like to hedge over the weekend, though Monday morning it might become necessary. Especially since we do have a “Known, Unknown” coming up. More on that later. So let’s take a look at the S&P 500 ETF (SPY), and the Nasdaq-100 ETF (QQQ). I am starting with the QQQs for a change below is a 3-Month chart

TradingView

We see a head and shoulders top and then some support at 357, the thin blue line. The QQQ ended at 362ish. So that is 5 QQQ points. I will also share what that means in the actual Nasdaq 100 ended Friday at 14,891 points and support comes at 14,546. So that is another 350ish Nasdaq points. This doesn’t mean that Monday opens with the Nasdaq down by 350 points. Monday might just start down but be up decently by mid-afternoon. If we do get that respite you might want to trim positions to have cash ready for a possible (being wishy-washy) sell-off Thursday, especially into the close. The “Known Unknown” happens on Friday. We could be corrected enough that even if the Core PCE is flat or even a tick higher the selling might be perfunctory. I believe that the Core PCE will show downward progress. If we haven’t corrected enough then we had better made noticeable progress or Friday might just sell harder than I would like. Let’s look at the SPY now…

TradingView

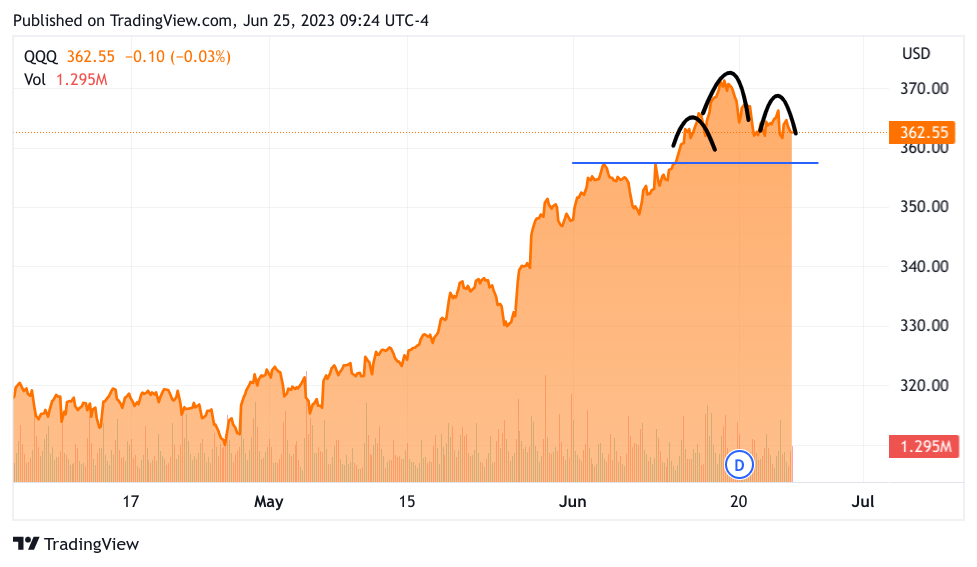

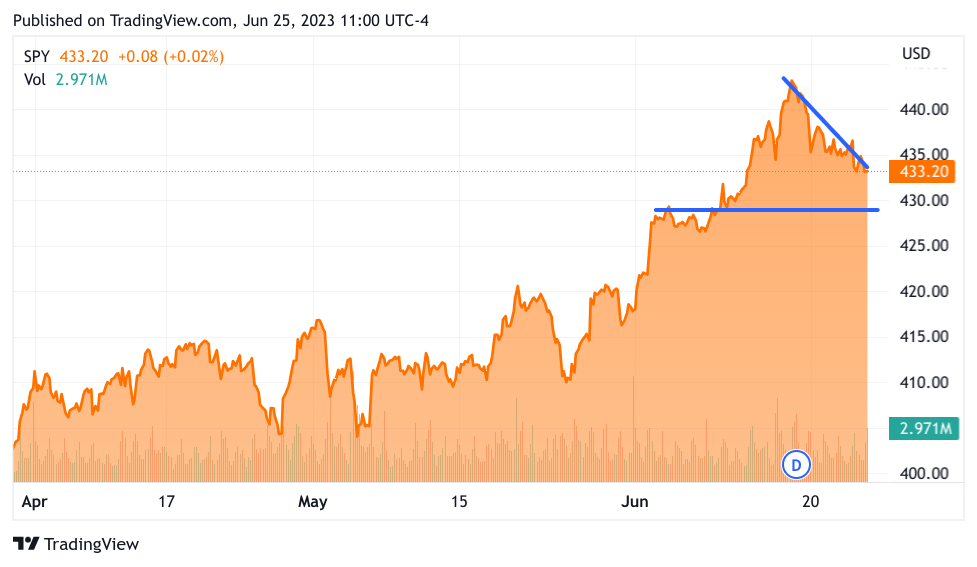

This is again the 3-month chart. I am not going to draw the “head-and-shoulders” though it’s very apparent. Just look at that downward-sloping line and the clear support level shown by the horizontal line. SPY is a little easier to associate with the actual S&P 500 just move the decimal point. Though there is still a bit of a discrepancy the spy closed at 433.20 and this (horizontal) support line is at 429.02 of course the support line will not be that exact but for the spy, this comes to 4.18, or if you move the decimal point 42 S&P 500 points. That could be covered without too much pain in a week. I guess that means the S&P 500 has more downside resistance. This makes total sense since tech is more vulnerable to higher rates (a fundamentalist might say). I would give more weight to the “technical” explanation that the techs enjoyed most of the over-exuberance, or being overbought. How to take advantage of this insight? Well perhaps spread out your trading to growth stocks that aren’t tech-forward. Also, if timed correctly buying select tech names that have been unduly punished could generate some nice alpha. I would focus on tech that is already profitable, and not just from the “Magnificent 7”. Now how does this translate to the actual S&P 500? This is very interesting, the S&P 500 closed at 4,348, the 52-week high is 4.448! One hundred S&P 500 points almost to the penny. Not that that means anything to a chartist, still it’s notable. The support line is at about 4,293 so like 50ish points, given that the selling will be over several days it too can be reached without causing panic. Probably the bulk of the losses will be Wednesday at the close through Thursday. The reveal is at 8:30 am, there is in my mind a very decent chance that we actually rally Friday morning. For one thing, we will largely have discounted the negativity with 150 S&P 500 points washed away. Also, fingers crossed, but the PCE might just be kind to us this time.

I am still bullish, though it is never wonderful to see the market head lower quickly

Why do I think the Core PCE – Personal Consumption Expenditure will bear good news? It is true that Core PCE is what Jay Powell prefers to follow as an inflation indicator. However, Fed President Powell drills down into services expenditures which are all about experiences. Also, housing equivalent rent is another area he is very concerned with. The good news is that the rate of climb for rents is falling hard according to several articles in the Wall Street Journal earlier this month “Apartment rent growth is declining fast, shifting the rental market to the tenant’s favor for the first time in years. The average of six national rental-price measures from rental-listing and property data companies shows new-lease asking rents rose just under 2% over the 12 months ending in May.” Will all this show up in the PCE? Government numbers are notoriously backward looking so it might not capture all this friendly news but April no doubt had cooling rents as well. So I give the odds to less fearsome economic data. If that is so, we should bounce up rather nicely and perhaps get to 4500+ in July even with the .25% raise. I have another reason for optimism…

Does anyone stop to think about what “long and variable lags” mean when it comes to raising rates?

It means “we have no idea when the higher rates will hit the economy”. So whenever a Fed President speaks and wants to throw a wet blanket on market enthusiasm, they start talking bringing up “long and variable lags.” Could it be that the rising market is replying “Hogwash” to this admonition? Just like they have been calling for a recession that has never come, the long and variable lags that were supposed to sicken our economy with higher rates will never come as well. I know this will excite the wags will chime in with “This time it’s different” as sardonically as possible. Let’s take a moment to consider, in the olden days of the last great recession you got your loans from your banks, and that was it. Even if you were willing to take a usurious rate up to one’s keister (whatever that is, probably near the lumbago). Those banks were not issuing any credit, and there was no credit to be had. Now everyone and their brother wants to lend small businesses money. Block (SQ) made a huge deal that they were extending credit, BILL Holdings (BILL) offered me credit, and there are a ton of fintech names looking to lend. Even hedge funds are in the biz. So yeah it is different this time, maybe the few bank failures that we had, and maybe a few small ones are up ahead, and that is the extent of the interest rate unintended consequences. In fact, I believe I’ve said this before, I think the rate raises actually made the economy stronger by giving credit a real value. That means that credit went to viable businesses that showed cash flow and not malinvestment like Virgin Orbit ,in my opinion, for example. So now Chairman Powell wants to raise another measly ¼ point? I don’t think it will do anything, to someone with a hammer everything is a nail. Raising rates slowly now will remove its shock value and might be justified by the resurgent economy by lowering the rate of inflation going forward.

So what about my trades?

I started a new Call with Boeing (BA), and I am willing to add to it if it falls below 200 again. The stock reacted to the news that Spirit AeroSystems (SPR) machinists went on strike. Below 205 is my first buy point for BA and I believe I will be rewarded. Firstly, BA has a lot of fuselages in inventory, this was due to BA accepting and paying for them during the pandemic to keep the lights on at SPR. Secondly, the union has them over a barrel, and as long as they don’t get greedy, SPR and BA will likely sweeten the deal. They need to raise salaries to entice workers to this career, this is just like the Railroad Strike. They will take yes for an answer, though I suspect that if they don’t announce something this weekend BA will fall to like 197ish and I will gladly add more calls. This time I will ride some of them to 220, and not be so timorous.

My next trade is getting back into Oracle (ORCL) having made out so well the last time. ORCL is now a brand well associated with AI, and its cloud business is growing like Kudzu in Georgia. Albeit their cloud business is rather small they are taking share from someone, likely International Business Machines (IBM). They are profitable and getting re-rated with a higher P/E. So I already have several calls at the 120 strike and looking to add more once ORCL breaks under 117 to 115.

I also when long another old-timer and that is Cisco (CSCO), they just released a networking chip geared toward network communication in an IA-centric cloud. This will compete with Marvell (MRVL) and Broadcom (AVGO). I like this feistiness; networking could be a key area in innovation for AI.

I also started Call Options in Green Brick (GRBK) I think they are on the move. I have it as a long-term investment, and I am seeing fly. It finally occurred to me, why not participate on the trading side, so I have a bunch at the 60 strike.

That oughtta hold you. Do I think these names can fall further this week? The answer is yes, I am counting on it. I want to buy more going into Friday. I might also put on some hedges which I will discuss with the Group Mind Members tomorrow morning. Perhaps just organize a community trade at 8 am to buy the sell-off at its deepest right before the reveal.

Have a great everyone, let’s not get too anxious. In the end, it will all be fine.

Read the full article here