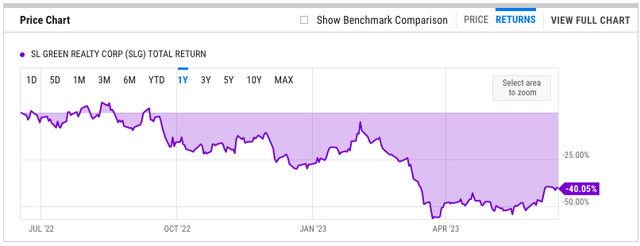

SL Green (NYSE:SLG) has seen its share price fall like a rock over the past 5 years. The stock was trading around $100 per share pre-Covid, but never managed to reach those highs once the pandemic started. Currently, the shares trade at just $26 on two distinct fears:

- High interest rates – increasing cost of capital and lowering valuations

- Work from home – threatening occupancy and the very existence of offices

In this article, I want to address both of these fears and conclude whether they are justified or overblown.

Industry Landscape

Unless you’ve been living under the rock, you’ve probably noticed an uptick in bearish headlines regarding commercial real estate and office in particular. The sentiment is now as bearish as ever, with many people arguing that offices are doomed. The bearish thesis is mostly predicated on the fact that work from home will continue to be a significant threat to occupancy and that given the tight credit market, office REITs will struggle to refinance their debt maturities as they come due.

YCharts

SL Green Overview

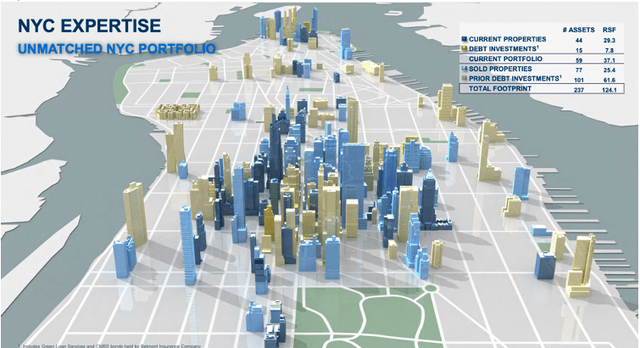

SLG is an established New York City office landlord with a long history who owns some of the most recognized and well-known skyscrapers in Manhattan, including the likes of One Vanderbilt. In total, the REIT owns 44 properties and has debt investments in 15 properties. As already mentioned, the portfolio is predominantly office with a small, insignificant exposure to residential. The company also has a very strong management team, which has managed to get through the 2008/2009 financial crisis.

SLG

Recent price action has certainly been scary, but recent operational performance hasn’t been that bad as occupancy remains over 90% and the REIT has been able to refinance some of its near-term debt maturities. It’s really the long-term viability of offices that has scared investors away, so let’s start with that.

By now, everyone is familiar with the work-from-home trend, and there are two camps of investors. The first one argues that work from home is here to stay and offices are doomed. This indeed is what the status quo seems like. The second camp thinks that work from home is a short-term phenomenon and that companies will eventually require people to return to the office, especially if the economic situation worsens and companies have more bargaining power. My opinion is that offices will continue to exist in some form as people will continue to have in-person in meetings in big cities, but it will likely be the highest quality ones that survive. The ones that are in the best locations and provide the highest standard. That’s why my office REITs are Boston Properties (BXP) and Kilroy Realty Corporation (KRC), both of which have some of the youngest portfolios of all REITs.

This is unfortunately where SLG and frankly the vast majority of office space in Manhattan falls short. Sure, their newest buildings such as One Vanderbilt are likely to perform very well, but the bulk of their portfolio consists of much older buildings, similar to the Empire State Building, for example. That’s B-quality at best by today’s standards, and the thing is that conversions (whether to A-class office or residential) are incredibly expensive and difficult as those buildings are very constructed with completely different layouts.

As a result, it’s very likely that a large portion of SLG’s buildings will struggle to renew leases as they expire and as a result, financing institutions will be very hesitant to refinance any debt ties to those buildings. Recently, SLG has managed to sign a significant number of leases, but it should be noted that those were for space in some of its best buildings. It’s really the not so good buildings that will, in my opinion, struggle. This is where the second fear comes from. High interest rates and a tight credit market, combined with very negative sentiment towards commercial real estate at the moment, have created a situation in which any near-term debt maturity is potentially risky.

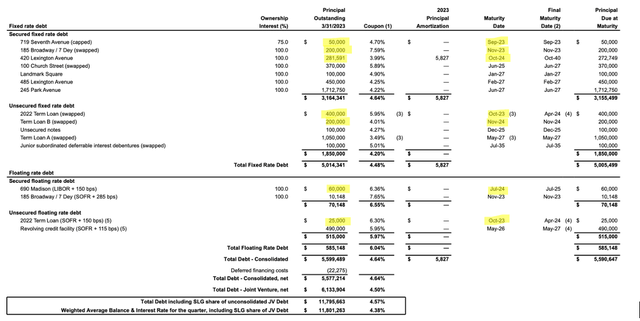

SLG

Once again, near-term debt maturities is where SLG falls short of its peers. I went through all of their debt and highlighted all facilities that mature this year ($685 Million) and next year ($540 Million). With $150 Million in cash and quarterly NOI of just over $100 Million, the company will not generate enough cash flow to repay these maturities as they come due. This means that they will either have to sell some properties, which will be incredibly difficult, or refinance these loans. On disposals, it’s worth noting that they have been trying to sell some of their non-core assets, but only managed to sell a small stake in 121 Greene Street for $14 Million in Q1. On refinancing, it will be very difficult to find a lender willing to refinance loans backed by office space in Manhattan, and it will be very costly.

There’s a real risk that SLG will not be able to refinance, in which case it would have to declare bankruptcy. I don’t think it’s likely, but the risk is there. Moreover, from a long-term perspective, I’m not confident that their portfolio of old office space will be good enough to maintain high occupancy.

In terms of valuation, SLG seems cheap. Trading at just 3.6x last 12-months FFO and a forward FFO of 4.31x. This is significantly below the industry average, as well as SLG’s historical average, but as I’ve already suggested, the stock is cheap for a reason.

SA

I see market fears as largely justified and am therefore not willing to invest, regardless of a seemingly large discount to NAV and a 13% dividend, which has been confirmed recently. I worry that the NAV will be permanently impaired as occupancy gradually decreases. Because of this, I will not touch SLG here and rate as a HOLD. You might ask, why not a sell? The reason is that SLG has the highest short interest of any office REIT, which makes it quite susceptible to a short squeeze. Moreover, shorting from such depressed levels is rarely a good idea. The time to short was a year ago, now it’s best to watch from the sidelines.

Read the full article here