Investment Thesis

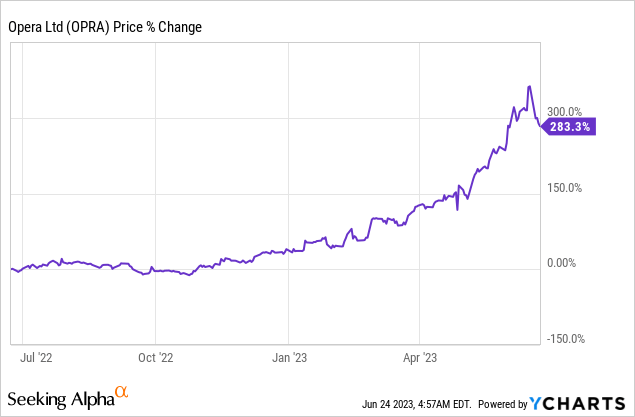

Opera (NASDAQ:OPRA) has been one of the best-performing companies in the past year, with shares up over 280%. Despite the massive rally, I believe there is still ample room to run. The browser company has massive opportunities in its gaming segment, which continues to see upbeat momentum. It should also benefit from the development of AI, which helps drive engagement and usage. The latest earnings were extremely strong, especially the bottom, which should continue to support the share price moving forward.

Opera’s Background

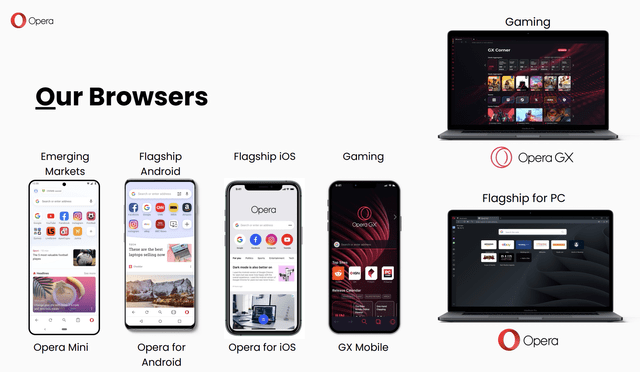

Opera is a Norway-based technology company that specializes in developing browsers. It offers multiple browsers for gaming, crypto, iOS, Android, and more. The company differentiates itself from other browsers (eg. Chrome, Firefox, and Safari) through unique features such as ad-blocker, free VPN, integrated messenger, crypto-wallet, etc. Its niche-specific browsers also provide users with a much more personalized experience.

These advantages helped Opera quietly accumulate over 319 million MAU (monthly active users), with 76.2% coming from mobile browsers and 23.8% from PC browsers. Other than browsers, the company also operates Opera News, a leading personalized news aggregator. It is one of the world’s largest news platforms with over 350 million users and has a specifically strong presence among African and European countries.

Opera

Massive Opportunity In Gaming

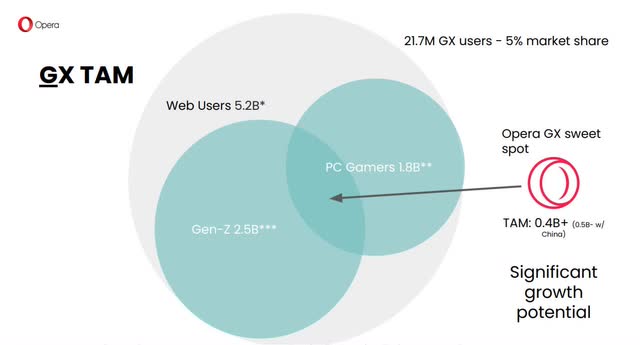

Gaming presents a massive opportunity for Opera. In 2019, the company launched Opera GX, a gaming-focused browser with dedicated features such as performance control, Twitch & Discord integration, gaming feed, and extensive customization options. It quickly gained strong momentum and already has over 21.6 million MAU. In 2021, the company acquired the 2D gaming engine GameMaker and subsequently launched GX Games, its own gaming platform that allows users to create, publish, and play games. GX Games currently has over 2 million user accounts and 4,000 games.

Opera GX, GX Games, and GameMaker together create a highly synergistic gaming ecosystem that is well-positioned to benefit from the rapid expansion of the gaming industry. According to Fortune Business Insight, the global market size of gaming is forecasted to grow from $229.2 billion in 2021 to $546 billion in 2028, representing a strong CAGR (compounded annual growth rate) of 13.2%. The company estimates its total addressable users to be around 400 million, as shown in the chart below. Considering its MAU of 21.7 million, this gives them a market share of only 5.5%, which present massive room for further expansion.

Opera

AI Initiatives

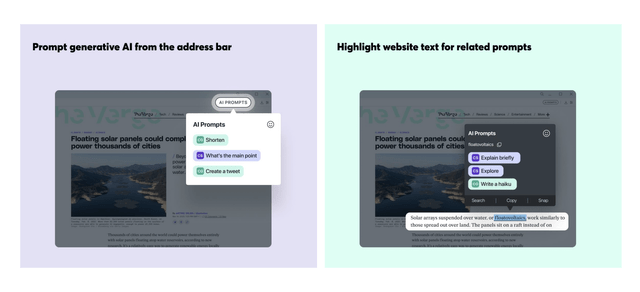

Opera should also be a major beneficiary of AI (artificial intelligence). Thanks to the rapid development of AI, the company has recently launched Aria, its own browser AI made in collaboration with OpenAI. Aria is natively built into the company’s browser and provides free generative AI services with access to real-time information from the web. Unlike Bing or Chrome, Opera’s browser also allows users to connect Aria to multiple AI models for better flexibility.

Besides Aria, the company is also incorporating AI technology into Opera News. AI should help improve the platform’s algorithm and machine learning capability to deliver more personalized news. The company is also using AI to generate summaries of top stories across different segments, such as sports and energy. These AI initiatives should help increase user engagement rate, which subsequently drives search and advertising revenue.

Song Lin, CEO, on the opportunity of AI

I am thrilled with the early integration of generative AI services into the Opera browsers including an AI assistant to make our users’ browsing more efficient. Initially, AI is a retention and engagement tool, as we are already seeing significant interest by the early adopters who have begun to take advantage of these features and we find ourselves in an excellent position to build out new use cases across AI services as an independent and trusted player in the ecosystem

Opera

Impressive Earnings

Opera’s latest earnings were extremely impressive, as the company continues to see strong momentum across its products. It reported revenue of $87.1 million, up 21.6% YoY (year over year) compared to $71.6 million. The growth was led by advertising revenue, which grew 26% from $38.5 million to $48.5 million, accounting for 56% of revenue. Search revenue was slightly softer, but still grew 18%. ARPU (average revenue per user) was particularly strong, which increased 30% to $1.08, as the company continues to target developed countries.

The bottom line saw substantial growth as the company is starting to benefit from improving scale and leverage. For instance, marketing expenses as a percentage of revenue declined significantly from 47.6% to 28%. This resulted in the adjusted EBITDA growing 195.8% YoY from $7.3 million to $21.7 million, while the adjusted EBITDA margin expanded from 10.3% to 25%. It also flipped from a net loss of $(9.4) million to a net income of $15.5 million, or 18% of revenue. The diluted EPS was $0.17 compared to $(0.08).

The company’s balance sheet remains extremely healthy, with $84.8 million in cash and only $7 million in debt. It also owns a 9.5% stake in African fintech company OPay, which is valued at $130 million. This alongside the improving profitability should provide ample financial flexibility moving forward.

Risks

Macro uncertainty is the major risk for Opera. Due to the company’s heavy reliance on advertising revenue, a slowdown in the economy will likely impact the segment meaningfully, as advertising spending is highly discretionary. Another potential risk may be competition. Due to Opera’s success in niche-specific browsers, other browser companies may also try to develop their own version to compete. This is unlikely as large companies rarely go after smaller niches, but I believe it is something investors should be aware of regardless.

Investors Takeaway

Opera is a really compelling small-cap company. Despite the share price more than tripling, the company’s fwd PE ratio of 23.7x is still very reasonable in my opinion. For instance, this is well below other browser owners such as Microsoft (MSFT), which has a fwd PE ratio of 34.7x. Opera is also growing revenue substantially quicker at 21.6% compared to Microsoft’s 7%.

I believe Opera is well-positioned to generate upbeat and durable growth in the long run. The company has a great set of assets in the gaming space and should continue to benefit from the rapid market expansion. The development of AI should also be a meaningful tailwind that drives the engagement and usage of its browsers. The strong momentum is reflected in its recent earnings and should continue to do so. With a market cap of $1.55 billion, Opera should have huge upside potential moving forward.

Read the full article here