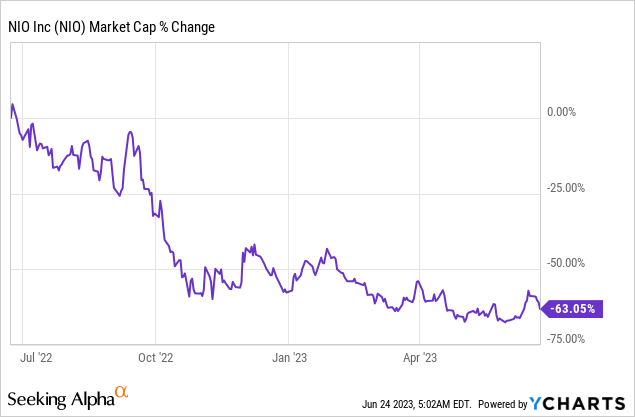

NIO (NYSE:NIO) found a new anchor investor last week when it secured a $738.5M investment from the Abu Dhabi government. The investment deal follows NIO’s first-quarter earnings release that showed declining vehicle margins and a weak delivery forecast for the second-quarter, and led to renewing pressure on NIO’s valuation. However, the investment of Abu Dhabi is a potential game-changer for NIO as it not only supplies additional resources at a time of spiraling losses, but also opens up a path, potentially, for an Abu Dhabi-based production hub for NIO’s electric vehicles down the road.

I believe Abu Dhabi is following into the footsteps of Saudi Arabia which is spending billions of dollars to create domestic EV manufacturing capacity and NIO could potentially use Abu Dhabi as a springboard into the Middle Eastern electric vehicle market!

Implications of the latest financing deal

A couple of days ago NIO informed the market that it received a strategic equity investment from CYVN Holdings, an investment firm majority-owned by the Abu Dhabi government, that will see the company invest $738.5M into newly issued Class A shares of NIO at a purchase price of $8.72 per share. NIO also stated that a CYVN Holdings entered into a share purchase agreement with an affiliate of Chinese mega-company Tencent (OTCPK:TCEHY) which will purchase 40,137,614 Class A shares of NIO from CYVN Holdings. After the transaction closes, Abi Dhabi’s investment fund is going to own approximately 7% of NIO’s outstanding shares.

Tencent is a large player in the autonomous driving market and both NIO and Tencent signed a strategic agreement in the fourth-quarter of last year that lays out cooperation terms in the fields of cloud-supported driving technology, intelligent driving maps and R&D efficiency.

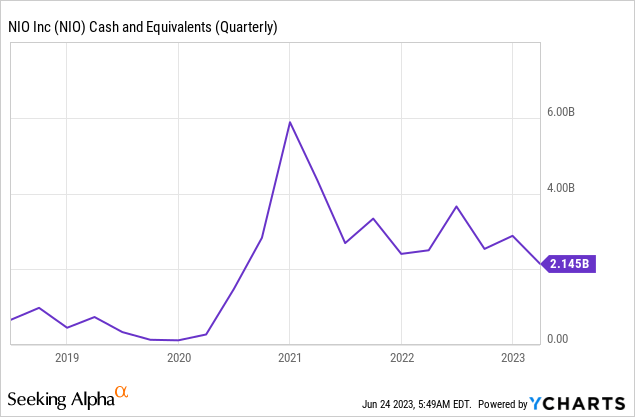

The $740M investment deal with Abu Dhabi comes at a time of expanding losses for the Chinese electrical vehicle manufacturer, which has seen a steep decline in its vehicle margins in the first-quarter. It also helps boost NIO’s cash reserves just as it keeps launching new models such as the ES6, which came to market on May 24, 2023. The ramp of NIO’s sedan models, especially, has weighed on NIO’s cash balances and Abu Dhabi’s investment will ensure that the company will be able to ramp its sedan line, including the ET5 and the new ET7.

My expectations regarding NIO’s investment agreement with Abu Dhabi

But besides making financial sense for NIO, the deal makes strategic sense for the electric vehicle manufacturer as well. This is because Abu Dhabi is starting to emerge as a local challenger of Saudi Arabia which, through one of its affiliates, Ayar Third Investment, has a 60% investment stake in electric vehicle manufacturer Lucid Group (LCID). Ayar Third Investment also participated in Lucid’s latest equity offering.

Lucid signed an agreement with Saudi Arabia’s government in 2022 that calls for the delivery of up to 100 thousand electric vehicles by 2030. Lucid is further solidifying its connection to Saudi Arabia by building its AMP-2 manufacturing plant in the country, with an expected annual capacity of 155,000 electric vehicles. The kingdom also signed another deal with Chinese EV start-up Enovate to build an EV manufacturing plant in Saudi Arabia as well.

NIO could now be set to strike a similar deal with Abu Dhabi. While there is no announcement (yet) that NIO will deliver electric vehicles to the Abu Dhabi government, competition between the United Arab Emirates and Saudi Arabia could very well result in a “Lucid-like” deal between NIO and the government of Abu Dhabi. NIO is facing stiff competition in its Chinese home market, but has entered other markets in Northern Europe in a bid to grow less dependent on China.

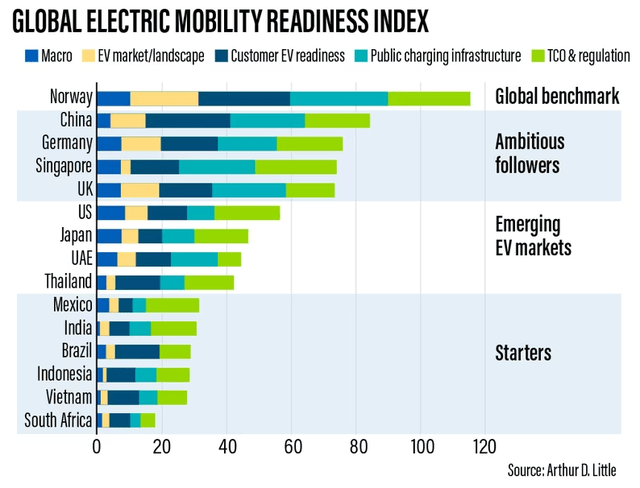

Abu Dhabi is an emerging player in the electric vehicle industry. Consulting company Arthur D. Little named the United Arab Emirates in its “Global Electric Mobility Readiness Index 2022” as the 8th most promising EV market in the world, and the company’s consultants estimate that the UAE electric vehicle market could grow 30% annually between FY 2022 and FY 2028. For NIO, a market entry into the United Arab Emirates, possibly through the establishment of a manufacturing plant, could be the next logical step. A strategic move into the UAE/Middle East, which is seeing accelerating EV adoption rates, could also eventually lead to a re-acceleration of NIO’s delivery growth.

Source: Arthur D. Little

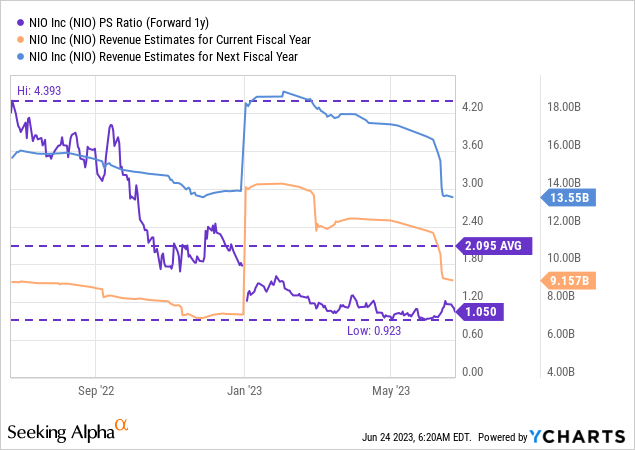

NIO’s valuation indicates that shares remain deeply undervalued

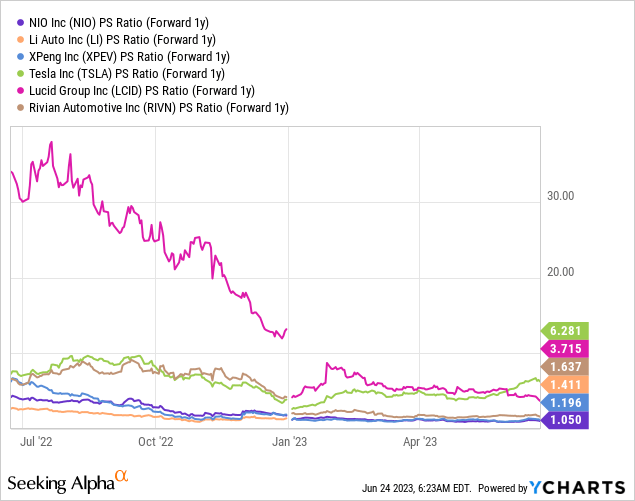

I consider NIO to be deeply undervalued, both in relation to its rivals as well as to its historical average. NIO is currently trading at a P/S ratio of 1.05X, which is about half of its 1-year average P/S ratio. Although revenue estimates have trended down lately, due to slowing consumer demand in China, NIO is still projected to achieve nearly 50% year-over-year top line growth next year. I have previously said that NIO’s valuation could double, and I continue to stand by this.

Compared against NIO’s EV rivals, both in the U.S. and abroad, NIO appears to be undervalued as well. NIO has the lowest price-to-revenue ratio in the industry group, with U.S.-based EV companies trading at the highest valuation multipliers.

Risks with NIO

NIO’s margins have come under pressure in the first-quarter which is the chiefly the result of pricing pressure, stronger competition in China’s domestic EV market that is seeing growing electric vehicle portfolios and waning consumer demand. As I said before, what would change my mind about NIO is if the company failed to ramp up its sedan portfolio rapidly and continued to see even weaker vehicle margins in the coming quarters.

Final thoughts

NIO’s investment partnership with Abu Dhabi could be a game-changer for both Abu Dhabi and NIO. The investment deal not only helps NIO financially and boosts its cash resources at a time it launches new models and ramps up its sedan deliveries, but it could also create a pathway for the Chinese company to enter a very attractive, emerging EV market in the Middle East. If I were to speculate, I would say that Abu Dhabi is not only seeking investment upside in the EV sector, but that it ultimately wants to encourage domestic EV production, in part because Saudi Arabia, a key rival to the UAE, is spending billions of dollars to create domestic EV manufacturing capacity. NIO is therefore not only gaining an anchor investor with Abu Dhabi’s $740M investment — which also boosts confidence in NIO’s long term growth prospects — but it also potentially creates a springboard into the growing Middle Eastern EV market.

Read the full article here