I. Introduction: Why I want more shares

I recently published an article going through my portfolio which consists of nine stocks and some cash, accompanied by an elevator pitch regarding the extent to which each company is ‘important’ and why (My $10,000 ‘Importance’ Portfolio: The Start Of A New Series). In the portfolio, I have a relatively small position (4.0% of the portfolio) in Sprouts Farmers Market (NASDAQ:SFM), but over time I would like to add more.

In the first place, Sprouts is important because it delivers healthy and quality foods. It is no secret that obesity in the United States is very high; specifically, 69% of U.S. adults are overweight or obese and 36% are obese (Harvard Obesity Prevention). Furthermore, the emergence of restrictive diets such as carnivore, keto, vegetarian, and vegan has become an increasingly popular health trend. I believe that Sprouts is in a position to phase out the old, unhealthy American with the new health-conscious, and eager-to-try American.

The company’s success in regard to this strategy can be reflected in its 80.1% revenue growth from 2016 to the last twelve trailing months, and around 200% growth in net income over the same time period. Furthermore, as a grocer, Sprouts is able to generate a lot of extra cash which is used to purchase around 4-6% of shares annually (Deutsche Bank Global Consumer Conference). In this article, I’m going to expand upon my valuation model for Sprouts and examine the underlying trends that lay the foundation for Sprout’s store growth.

When coupling nutritional trends with strong financial performance, I think Sprouts will continue being able to invest at high or even higher returns on capital (currently 12.7%) going forward which makes me want to buy more.

II. Valuation

- Sprouts Farmers Market: Strong Growth With A Margin Of Safety

In my previous article on Sprouts, I built a valuation model based on store count growth and profitability projections that management had presented. Currently, the company has around 390 stores in operation which I project can grow to 1012 total stores in 2032. The implication of this type of store growth is an incremental total revenue contribution over the next 9 years of ~$9 billion. To put that into perspective, Sprouts had a revenue generation of $6.4 billion in 2022 (Seeking Alpha Financials). While new revenue contribution will amount to around $9 billion, we can assume that Sprout’s old stores will grow comparable sales by around a 1-2% CAGR. Assuming a 1.5% CAGR same-store growth over the next 9 years, old revenue will become ~$7.3 billion (an increase of $0.9 billion). All in all, revenue is likely to amount to $16.3 billion in 2032 given that management executes the strategy that they have laid out. Furthermore, given that the company retains a 4% net margin (historical) then Sprouts will retain $652 million in net profit year 2032. This is slightly higher than my estimate of $623 million that I made in my article due to the assumption of continued same-store growth.

Since the company repurchases 4-6% of shares yearly, EPS growth will be even larger. I assumed in my article a share repurchase rate of 5% yearly which equated to 64.66 million shares outstanding in 2032 (compared to 108 million in 2022). With my updated net income projection, Sprouts will earn $10.08/share in 2032 (compared to my projected $9.64). There is further upside in this estimate, as in my model I did not assume any steady state same-store growth. So the upside is obvious for this company, but the big question is will they execute?

I recently listened to the Sprouts CEO & CFO speak at the Deutsche Bank Global Consumer Conference. Among other topics, such as pricing trends and competitive positioning, the moderator asked about Sprout’s store growth expansion plans. CEO Jack Sinclair mentioned that they have an internal projection with 1200 locations that have the right demographics to support a 23,000 sq./ft Sprouts store. About 800 of those ‘seed points’ are within 250 miles of a Sprout’s distribution center. Sprouts has a goal to keep stores within this radius in order to optimize costs. Jack also disclosed that the company has 30 stores signed off for 2023, and north of 40 stores signed off to open in 2024. He discloses that, in total, the company currently has about 90 new stores signed off. Working backward we can see that 70 of those pertain to 2023 & 2024, which means that 20 stores are already signed to open in 2025. In order to meet its growth projections, the company needs to open 47 new stores in 2025 so they are currently on the right track to deliver on this goal.

III. Macro Trends Supporting Growth

“The main shortcoming of the American diet is the surplus of energy (calories). Over one third of adult Americans are obese (and many more are overweight), and a growing number of children are overweight. The reason for this increasing trend is two-fold: energy consumption is up, and activity levels are down.”

Source: Encyclopedia.com

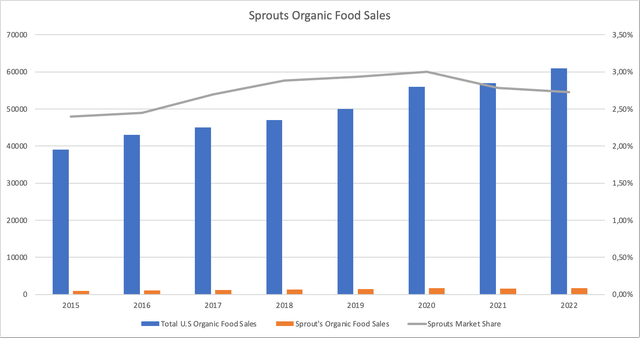

In 2021, organic food sales amounted to $51.7 billion; this surmounts to only 4% of total U.S. food sales (ProducePay). Given the development of the American diet, it is not surprising that organic foods make up such a small amount of total food sales. Sprouts stands well-positioned to capture a larger share in the growing organics market (14.2% YoY growth in 2020). The company disclosed that 26% of its sales are organic (Investor Deck, May). When applying this number to 2021 sales figures, we find that 2021 organic sales totaled $1.68 billion or 3.24% of all organic food sales in the U.S. For being a relatively small grocery store, Sprouts has quite a large market share in this area.

One pushback is that healthy eating, in general, is something that Americans find difficult to implement into their lifestyle. Although 80% of Americans “purchase low fat, sugar-free, and/or organic foods every year”, they on average only do so one to three times per month (sellwithsesame). One attributing factor to this trend is not a lack of intent, as 34% of Americans say they want to eat healthier within the next five years, but rather economic limitations. In 2019, Sprouts changed its strategy to purposefully get rid of the price-sensitive customer mix. Now, the average shopper at Sprouts earns $121 thousand/year. Furthermore, its customers are educated and economically resilient to a high degree; 49% of customers earn more than $100 thousand/year, 69% are college graduates, and 57% are married and typically have a dual income. Hence, the Sprouts customer group is not representative of the average American. While the company is currently exclusionary toward lower income groups, we could see a strategy shift again toward lower-priced healthy foods as Sprout’s scales and the health market matures. Based on a study by Colby College Students, organic foods are more expensive than non-organic foods for every item studied save oatmeal and brown rice. For example, organic dairy and produce products were between 44-117% more expensive than non-organic equivalents. For many Americans, these prices simply aren’t an option and will continue to stifle the average American to adopt a healthier diet.

If we assume that Sprouts has always had 26% of sales comprised of organic foods, then we can gauge the company’s relative market share over time. The blue bars depict the total U.S. organic food sales over time (Statista), the orange bars depict organic food sales at Sprouts, and the grey line depicts the company’s market share.

The Author

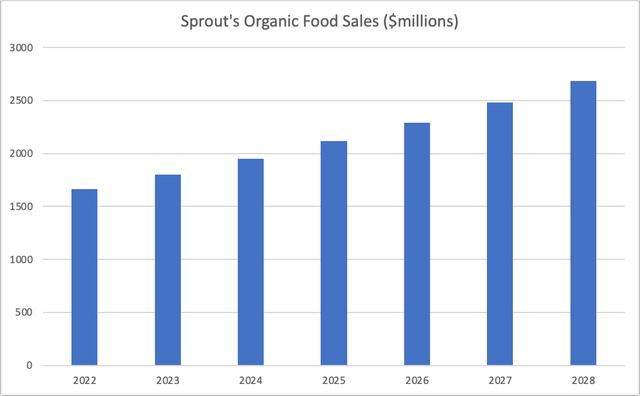

Based on this data, Sprouts is retaining a relatively stable market share that has slightly grown since 2015. The IMARC Group expects organic food sales in the U.S. to be worth around $123.3 billion (IMARC), which represents a CAGR of 8.3%. I mentioned in my $10,000 portfolio that investing in companies with natural headwinds is incredibly important for growth. Sprouts will especially benefit from this quickly growing segment because so many of its products are organic. Over the coming years, I expect Sprouts to continue targeting a high-income class and that organic sales will make up a larger part of total sales than it currently does. The market trends are an important part of my investment thesis in Sprouts, but with attractive markets come competitors. The market is still niched and small, but it is very likely that incumbents and new entrants alike will begin to sell a larger share of organic products as well. In a future article, I plan on covering the competitive landscape around organic food, but for the scope of this article, I would like to conclude with a graph projecting Sprout’s organic sales into 2028.

Given an 8.3% CAGR, organic food sales will amount to about $2.7 billion in 2028. In my valuation article, I forecast Sprouts to have sales of $10.7 billion which imply that organic foods will make up 25.2% of total sales. This is slightly lower than the current share of sales. So what should we conclude from this? There are two reasonable outcomes in my mind. One, Sprout’s organic food growth outpaces the rest of the market (12% CAGR would imply a 30.8% share of sales). Two, other categories than organic do indeed grow just as fast or even faster than organic foods. One of these large categories, for example, is vitamins and supplements, which Jack Sinclair claimed that Sprouts may consider taking control of its vitamin supply chain as it has done with fresh produce.

The Author

IV. Conclusion

In conclusion, Sprouts Farmers Market presents a compelling investment opportunity due to its focus on delivering healthy and quality foods, coupled with strong financial performance. Macro trends, such as the increasing prevalence of obesity and the growing interest in organic foods, provide a favorable backdrop for Sprouts’ growth strategy. With a significant market share in the organics market, the company is well-positioned to capitalize on the rising demand for healthier food options. Although affordability remains a challenge for some consumers, Sprouts’ target demographic of higher-income individuals suggests potential opportunities for future market expansion and strategic adjustments.

By expanding its store count and leveraging the trend of health-conscious eating, Sprouts is poised for continued success. The company’s projected revenue growth and same-store sales expansion support the notion that Sprouts can achieve its growth projections that I mentioned in my previous article. While competition in the organic food segment may intensify over time, Sprouts’ focus on quality, its established market position, and its proactive approach to capturing market share indicate resilience and adaptability in the face of evolving industry dynamics.

Read the full article here