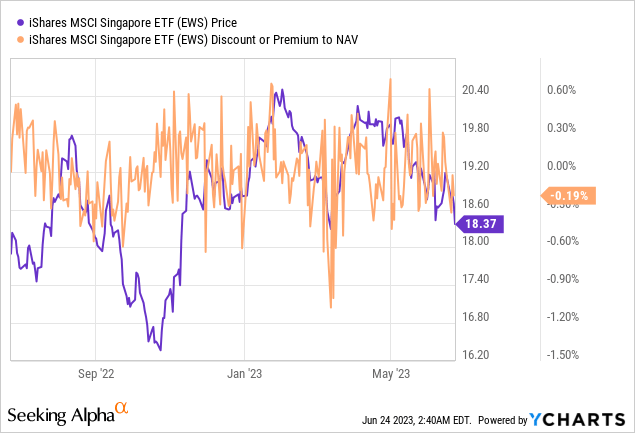

The relative outperformance of Singaporean equities relative to its ASEAN peers this year has been a surprise, given the lack of macro tailwinds. The MAS’ (the Singaporean central bank and financial regulator, i.e., the ‘Monetary Authority of Singapore’) April policy meeting indicates last year’s tailwinds could even reverse, with the rate hike cycle effectively ending amid concerns about growth and decelerating core inflation. Given the iShares MSCI Singapore ETF (NYSEARCA:EWS) portfolio skews heavily toward financials, the near-term setup isn’t compelling amid looming net interest margin pressure and asset quality headwinds. Plus, the Singaporean banking sector’s outsized exposure to further credit stresses from the US/EU system (relative to the rest of Southeast Asia) means there are tail risks to the EWS investment case as well. At ~12x trailing earnings, the fund screens cheaply relative to historical levels; with earnings revisions beginning to turn negative, though, the risk/reward doesn’t seem particularly positive here.

Fund Overview – Low-Cost Exposure to Southeast Asia’s Financial Hub

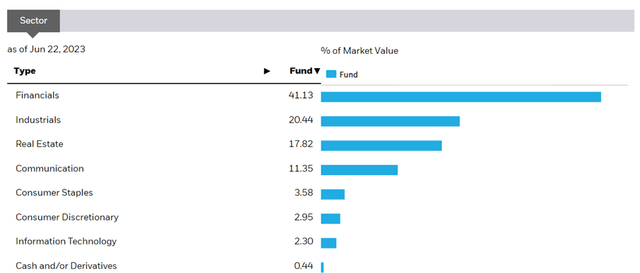

The ~$478m iShares MSCI Singapore ETF, which comes with a 0.5% expense ratio, is spread across 22 holdings. The largest sector allocation is Financials at 41.1%, followed by Industrials at 20.4% and Real Estate at 17.8%. Outside of Communication (11.4%), all of the fund’s other sector weightings are well below the 5% threshold, including Consumer Staples (3.6%) and Consumer Discretionary (3.0%). On a cumulative basis, the top five sectors accounted for ~94% of the total portfolio, making EWS the most concentrated Southeast Asian ETF from a sector perspective. That said, the financials concentration means the fund’s equity beta is relatively low at 0.71 to the S&P 500 (SPY), reflecting the portfolio’s relative defensiveness through the cycles.

iShares

In line with the sector breakdown, the single-stock allocation stands out for the size of the fund’s holdings in Singapore’s largest banks. DBS Group (OTCPK:DBSDF) is the largest holding at 16.6%, followed by banking peers Oversea-Chinese Banking Corporation (OTCPK:OVCHY) and United Overseas Bank (OTCPK:UOVEY) at 11.4% and 9.3%, respectively. Integrated e-commerce and digital entertainment platform Sea Ltd (SE) and flag carrier Singapore Airlines (OTCPK:SINGY) lead the non-banking names in the EWS portfolio at 7.0% and 4.8%, respectively. With the top five holdings accounting for ~49% of the overall portfolio, EWS is one of the more concentrated Asian funds from a single-stock standpoint as well.

iShares

Fund Performance – Lackluster Capital Appreciation but Still a Regional Outperformer

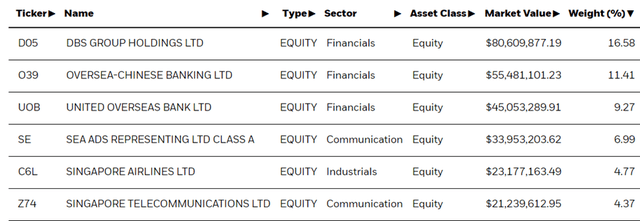

On a YTD basis, the ETF has declined by 2.4% but has compounded at a steady 2.4% rate in market price and NAV terms since its inception in 1996. Volatility has generally been low, however, with last year’s -9.2% decline (total return) outperforming its Southeast Asian peers. And while the five-and ten-year performances at -1.8% and +0.4% seem lackluster on an absolute basis, EWS has still outpaced comparable single-country ETFs such as the iShares MSCI Malaysia ETF (EWM) and iShares MSCI Indonesia ETF (EIDO).

iShares

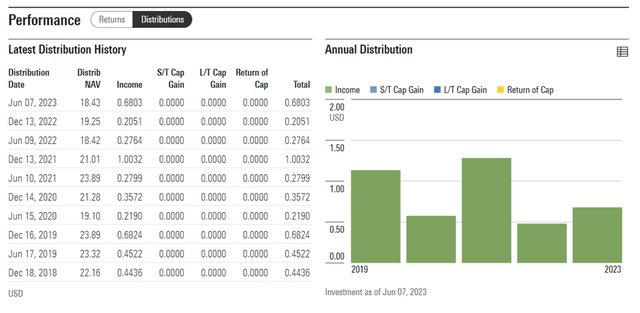

EWS also offers a semi-annual distribution, though income has generally been volatile through the cycles, with two notable dips in 2020 and 2022. Still, the yield stands at a solid 2.4% on a trailing twelve-month basis (3.2% thirty-day SEC yield), supported by the fund’s holdings in cash-generative stocks. And with this year already off to a good start, expect upside to the yield going forward. In addition to the distribution, the fund’s underlying ~12x P/E and ~1.3x P/B valuation multiples also screen cheaply relative to historical levels. But context is important – with the Singaporean cost of equity rising to new highs and banking earnings poised to come under pressure from MAS’ monetary policy pivot in April, the fund isn’t necessarily cheap here.

Morningstar

Mounting Headwinds as the Tightening Cycle Comes to an End

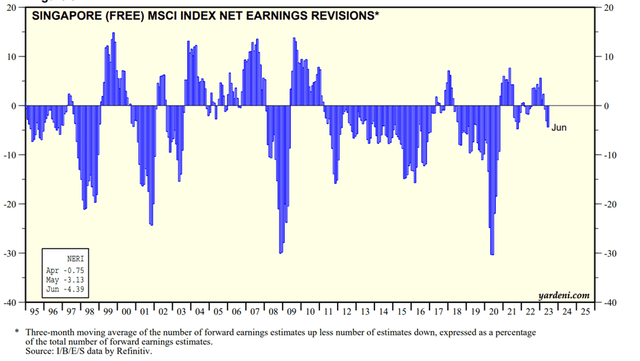

In a surprise policy decision, the MAS decided to pause tightening earlier than expected, leaving the slope of the S$NEER policy band unchanged at 1.5%/year (note Singapore monetary policy is exchange rate-targeted). The rationale was the central bank’s existing concerns over the domestic growth outlook following a disappointing Q1 GDP report. Also prompting the pause were downside inflation risks from slower economic growth overseas, particularly in the US and Europe. Recent data points indicate this was the right call – Singapore’s core inflation further declined to 4.7% YoY in May, while PMIs have turned contractionary in the West and, more surprisingly, in China as well. Assuming the downward energy and commodity price trend continues amid the global growth headwinds, expect further core inflation declines this year – even if core services inflation remains stickier than expected. While a neutral policy decision seems the most likely scenario at the next meeting in October, I wouldn’t rule out a surprise pivot toward monetary easing either, particularly with domestic earnings revisions already turning negative.

Yardeni

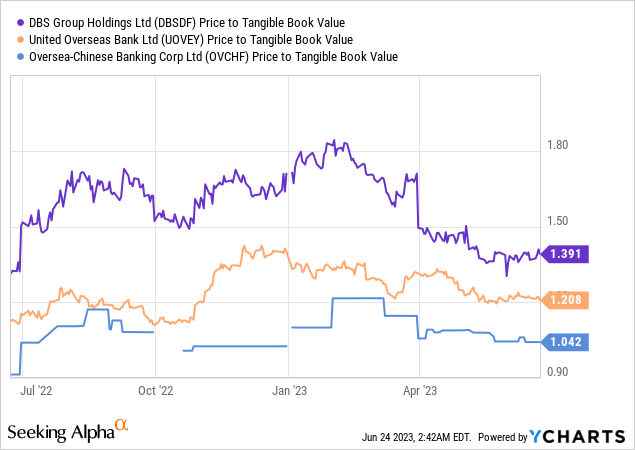

The one-two punch of slower growth and easier monetary policy doesn’t bode well for EWS, given its outsized banking exposure. Not only are credit and fee income likely to slow alongside the broader macro trends, but declining rates will also weigh on banks’ net interest margins, prompting further negative revisions. The prospect of a regional/developed market recession also adds to the asset quality risks. Having outperformed its Southeast Asian peers and with the country’s major banks still trading well above their underlying book values, I would be cautious about EWS here.

Singaporean Equities May be Poised for a Reversal

EWS may be slightly down YTD, but it has far outperformed its Southeast Asian peers despite emerging macro headwinds. Unlike last year, when the financials-heavy EWS portfolio benefitted from a stronger S$ and steep rate hikes, the MAS has turned surprisingly dovish on monetary policy this year. Chief among its concerns is slower growth (global and domestic), along with easing inflationary pressures; recent data points out of Singapore have validated the slower growth/inflation trend as well. Expect Singaporean bank earnings (recall, EWS’ top-three holdings are banks) to come under pressure in the coming quarters as a result, with worsening asset quality and lingering tail risks from US/EU banking stresses presenting additional headwinds as growth slows. Valuations screen cheaply at first glance (~12x P/E and ~1.3x P/Book); relative to the higher cost of equity and slower growth backdrop, however, EWS seems fairly priced.

Read the full article here