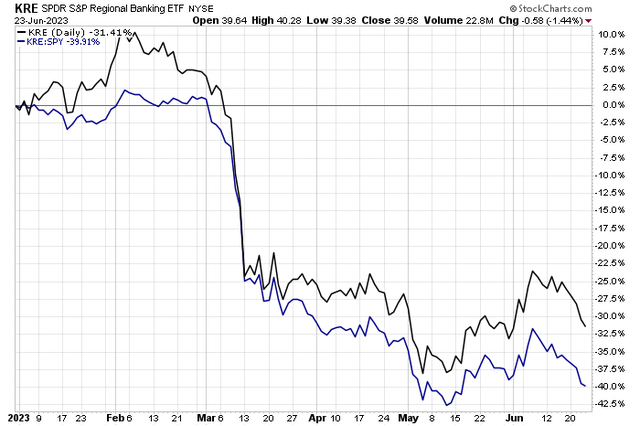

It has been a wild ride for regional banks in 2023. The year started off strong. While January and February did not feature as robust of gains as those seen last year, stable price action continued as the Fed lifted rates closer to 5%. Something finally broke in March, however. Silicon Valley Bank’s demise cascaded to other small banks, and weekends were fraught with anxiety as investors wondered what financial institution would be next to go into FDIC receivership. Fast forward to today, the dust has settled somewhat.

I have a buy rating on PacWest Bancorp (NASDAQ:PACW). I see a temporary Fed put, as Tom Lee calls it, in play for the space. Now that rate volatility is easing, regional banks should have a better gauge on how to position balance sheets and manage assets and liabilities in the coming quarters.

Regional Banks Giving Back May-June Gains

Stockcharts.com

ICE BofA MOVE Index (Treasury Rate Volatility) Near 52-Week Lows

TradingView

According to CFRA Research, PacWest Bancorp operates as the bank holding company for Pacific Western Bank that provides various banking products and services. The firm accepts demand, money market, and time deposits. The company offers its products and services to small, middle-market, and venture-backed businesses. It was formerly known as First Community Bancorp and changed its name to PacWest Bancorp in April 2008.

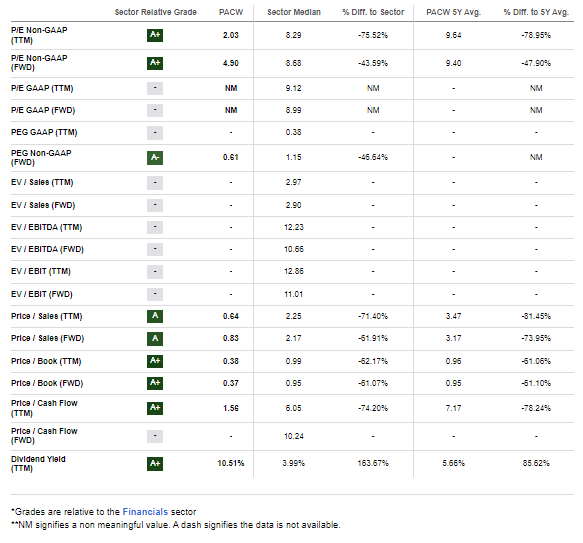

The California-based $853 million market cap Regional Banks industry company within the Financials sector trades at a low 4.9 forward operating price-to-earnings ratio and recently slashed its dividend rate by 96% to just $0.01 in order to shore up capital amid banking volatility and potential changes to regulatory capital rules.

Back in April, PACW topped earnings estimates and shares rose the following session. What was encouraging was a stabilization of deposit trends toward the end of the first quarter. Adjusted operating earnings verified at $0.66 which was a more than 20% beat compared to the $0.54 consensus figure. While net interest income fell from year-ago levels, total deposits actually increased a robust $1.1 billion by March 31, though that jump was given back in a later update.

Its immediately-available liquidity ratio of 153% should help ensure that capital is on hand should more turmoil ensue. I am encouraged by the general trends seen in the weeks after the worst of the regional banking crisis. The management team showed that it can navigate stressful times with prudent moves to shore up liquidity.

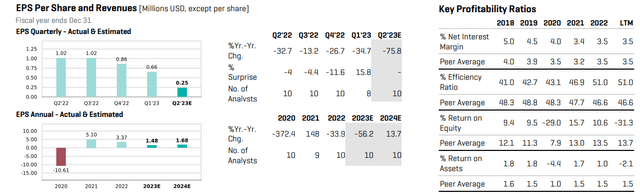

On valuation, Q2 earnings are expected to be just $0.25, down more than 75% from year-ago levels following turmoil earlier this year. The firm also marked substantial losses back in May, so the earnings picture looking ahead remains somewhat cloudy. The consensus 2023 EPS forecast is $1.48, a fraction of peak-per-share profits seen in 2021.

The good news is that Wall Street sees earnings bottoming this year – 2024 EPS is forecast to rise to $1.68. The bank hopes its profitability ratios and margin levels can revert to stable trends seen in the 2018 through 2022 stretch.

PacWest: Earnings Forecast & Key Profitability Ratios

CFRA Research

While still in a stressful situation, PacWest’s operating situation appears to have stabilized, according to Dick Bove at Odeon Capital. Roughly 20% of deposits flew away from the bank during the March crisis period, but the management team took quick action to raise rates for depositors. Of course, that leads to higher funding costs and stress on net interest margins. But PACW also sold off a portfolio of construction loans to boost capital.

So, if banking activities indeed stabilize, the stock is cheap right now since it sells for less than 5 times trough earnings. That is a nearly 50% discount compared to its 5-year average and quite inexpensive versus the sector median. What’s more, PacWest’s price-to-book ratio of 0.37 remains at panic levels. I assert that a fair value is somewhere between the current valuation and the 5-year average, so if we assume a 0.6 P/B multiple, then the stock should be near $11.50.

PacWest: Crisis-Level Valuation Ratios Remain

Seeking Alpha

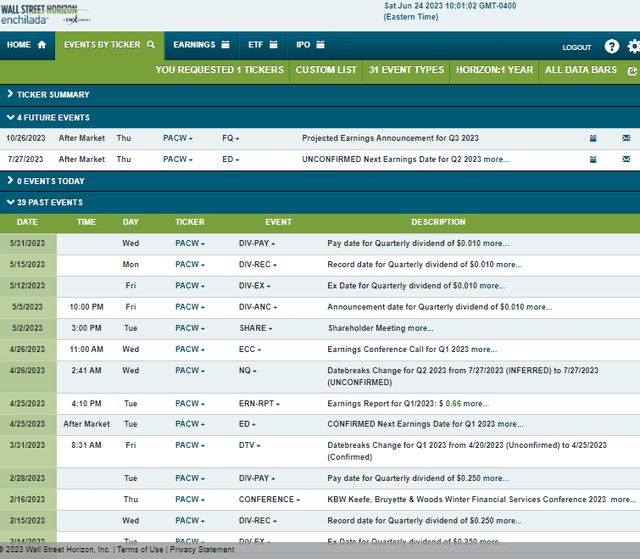

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2023 earnings date of Thursday, July 27 AMC. No other volatility catalysts are expected between now and then.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

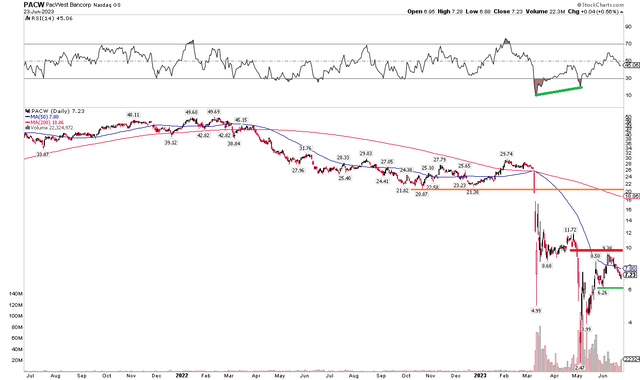

While PACW’s valuation is compelling, the technical situation leaves something to be desired. Notice in the chart below that the stock was recently rejected just shy of the $10 mark – that was the breakdown level in early May when the bank was relegated to slashing its dividend to nearly $0. We do have a reference price at $6.26, the early June low, around which to place a sell stop. In this case, a long position with a stop under $6 appears as a reasonable risk/reward in my view.

With massive capitulation-like volume taking place in early May when shares dipped under $2.50, bullish RSI divergence was seen. In my opinion, that’s a solid-looking low. Of course, there is no getting around that the long-term 200-day moving average is (and will be for a long time) downward-sloped, indicating that the bears are in control of the trend. Also, $11.70 to $12 is upside resistance, but there’s little volume between there up to $21 – thus if PACW ever breaks above $12, it could be a swift rally on this high short-interest stock.

PACW: Bearish Long-Term Trend, Capitulation Volume Selling In May

Stockcharts.com

The Bottom Line

I have a buy rating on PACW. Regional banking troubles appear to have ebbed though recent price action has not been all that constructive. With few bad headlines lately, and ahead of Q2 earnings in less than a month, I see a value case in PacWest despite the troubling chart.

Read the full article here