Microsoft (NASDAQ:MSFT) stock has led a dramatic recovery in the tech sector. The company reported resilient fundamentals in spite of the tough macro, but that alone does not explain the stock’s stunning strong recent performance given the premium valuation with which it trades at. Instead, it was the company’s focus on artificial intelligence including how it may benefit Azure growth that has propelled the stock. This remains a top tier business, appearing to still be doing everything right by shareholders, though I must acknowledge the rich valuation relative to other mega-cap tech titans. I downgrade the stock to “hold” due to my preference for cheaper peers.

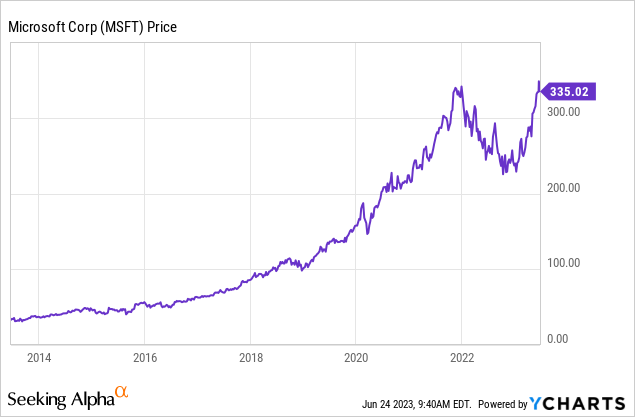

MSFT Stock Price

MSFT is one of the few tech stocks which trades close to all-time highs, seemingly oblivious to the brutal valuation reset that swept through the sector.

I last covered MSFT in April where I discussed what I was expecting heading into the earnings print. That report was quite solid and even came ahead of my expectations, though one can make an argument that the strong results are being efficiently priced into the stock.

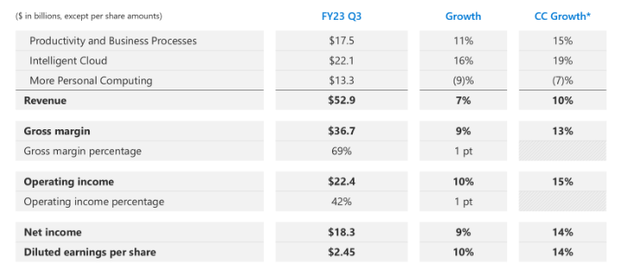

MSFT Stock Key Metrics

In the most recent quarter, MSFT delivered strong results when factoring in the tough macro environment. MSFT grew revenues by 7% (10% constant currency) and earnings per share by 10% (14% constant currency) – two achievements not necessarily typically seen under difficult economic circumstances.

FY23 Q3 Slides

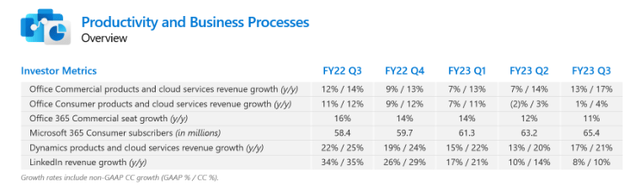

MSFT generated $8.64 billion of that operating income from its productivity and business processes segment, which houses its Office 365 product suite among others. As to be expected, LinkedIn revenue growth came in light at just 8%, a reflection of lower hiring demand.

FY23 Q3 Slides

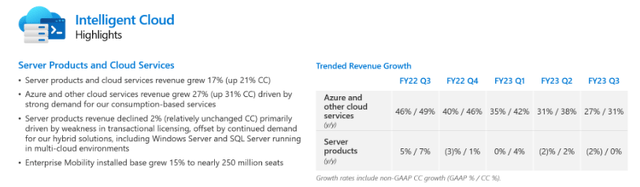

MSFT generated another $9.4 billion in operating income from its intelligent cloud segment. Azure grew at a 27% clip, far surpassing the 16% growth seen at competitor Amazon Web Services (AMZN).

FY23 Q3 Slides

Investors have been cautious on the ever-valuable cloud business ever since the cloud titans all revealed cloud optimization efforts undertaken by its customers. On the conference call, management implied that they may see easing headwinds as they pass the anniversary of those optimization efforts, stating that “at some point, workloads just can’t be optimized much further.” It is possible that MSFT’s partnership with ChatGPT’s creator OpenAI has something to do with that, as management noted that while they do not consolidate any operating losses due to them holding a minority equity interest, they do indeed recognize revenues generated from OpenAI using their cloud services. The other cloud titans did not offer the same bullish commentary surrounding the end of cloud optimization.

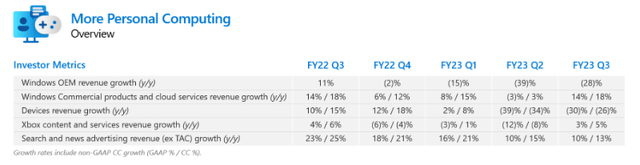

MSFT continued to see headwinds from its more personal computing segment, which saw revenues decline by 9% though still managed to generate $4.24 billion in operating income. At some point the comps should become easier here, but that may still be a couple of quarters away.

FY23 Q3 Slides

MSFT ended the quarter with $104.5 billion in cash versus $48.2 billion in debt. I note that the company also has another $9.4 billion in equity investments (the announced $10 billion investment in OpenAI is set to take place in parts throughout the year).

The company continues to pay a growing dividend and conducted $5.5 billion in share repurchases in the quarter. It is not too often that one can get long term innovation and have the majority of free cash flow returned to shareholders as well.

Looking ahead, management has noted that overall growth may struggle due to the prior year’s quarter being a tough comp, with that being their “largest commercial bookings quarter ever with a material volume of large multiyear commitments.” Management did, however, guide for up to 27% in Azure growth, which seems to imply that the bottom for that segment may be very near if not already passed. Investors may be worried about how ongoing tech layoffs may impact Office 365 growth, but management appeared unfazed by this risk, citing that they continue to see strong demand for their product suites.

Is MSFT Stock A Buy, Sell, or Hold?

MSFT continues to show why it is a favorite tech stock in growth allocations, as it has shown resilient growth in the face of tough macro. The strong fundamentals have helped the stock sustain a premium valuation multiple, as the stock recently traded hands at just under 35x earnings.

Seeking Alpha

That multiple is arguably stretched relative to peers considering consensus estimates for low double-digit top-line growth. MSFT trades as if the tech valuation reset has not occurred.

Seeking Alpha

In contrast, I consider the stocks of Alphabet (GOOGL) and AMZN to be offering some discount relative to MSFT. This premium relative to peers, however, does not change my view that MSFT stock may produce positive returns from here. Between the 3% earnings yield and double-digit growth, the stock may be able to beat the market assuming constant valuation multiples. But perhaps the optimism for artificial intelligence can increase further – I would not rule out the possibility that MSFT sustains its 35x earnings. While suggesting potential upside, I find it far more likely that mega-cap tech peers deliver even more stellar returns. The multiple expansion upside appears to have played out due to optimism for AI, and I typically do not invest without such upside as a margin of safety.

What are the key risks? Valuation remains the most obvious risk with that stock trading something between 50% and 100% higher than GOOGL depending on how many adjustments applied to the latter. With the stock trading so richly on present earnings, the stock could go nowhere for 7-10 years and still be trading at around 15x earnings at that time. Unless MSFT manages to sustain double-digit earnings longer than consensus, the stock will likely need to sustain a rich multiple in order to beat the market index. I note that this risk does not appear as large at the aforementioned mega-cap peers due to not just lower valuations but also due to MSFT appearing to already be operationally efficient with operating margins in excess of 40%. Another risk is that of potential disruption to its enterprise tech business. Wall Street appears to view the stock as being the strongest operator in any of its competing markets, but I do not share such views. In particular, I view competition from the likes of Zoom Video (ZM), CrowdStrike (CRWD), and GOOGL’s productivity suite as being underestimated risks. It is possible that MSFT is about to face long- term disruption just as its growth story is decelerating – which would have a catastrophic impact on multiples. Due to the near term upside from OpenAI, MSFT is a dangerous short and thus I downgrade the stock to “hold” as the stock is not compelling relative to alternatives.

Read the full article here