Introduction

So far this year, I have written a number of bullish articles on Union Pacific (NYSE:UNP), which is currently my second-largest dividend investment.

Being bullish on Union Pacific may not seem like a no-brainer, as I’ve also written multiple articles on economic weakness and the challenges facing the Federal Reserve.

While we’re not out of the woods, I’ve been buying cyclical stocks on every major correction since the economic peak of 2022. My rationale is simple: I want to buy the best cyclical dividend stocks at great prices. Even if I don’t always get the lowest price, I’m happy with this strategy.

In this article, I will explain why I’m looking to make UNP my largest investment, using Buffett’s investment principles as a basis.

While America’s largest independent public railroad is suffering from declining economic growth, it is well-positioned to benefit from long-term demand drivers like economic re-shoring, the benefits that come with rail transportation, and the fact that markets are slowly pricing in a rotation back to cyclical stocks.

Despite downside risks, I’m aggressively adding at prices below $200.

Now, let’s dive into the details!

UNP’s Moat

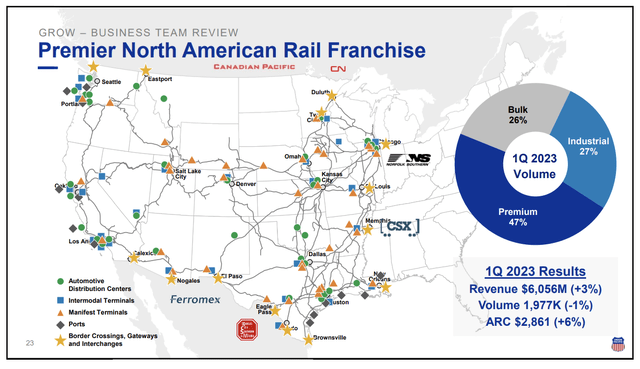

While UNP is a complex company, its operations are rather straightforward: using its massive rail network, the company connects major economic hubs in the Western two-thirds of the United States. This includes facilitating export to Canada and Mexico and connecting major ports to buyers and sellers of goods. The company is like the circulatory system of the human body. Without it, the economy doesn’t function.

Union Pacific

In 1Q23, roughly half of its shipments were premium shipments like intermodal and autos. The other half consisted of bulk and industrial, which means the company has exposure in every major transportation segment.

It also has pricing power, which includes fuel surcharges to offset the impact of higher fuel costs – albeit with a lagging effect.

This also means that the company has a huge moat. While it is consistently competing with on-road transportation, it only has one major Class I competitor, which is Buffett-owned BNSF.

It also helps that trucks aren’t nearly as efficient as railroads – especially when it comes to bulk. The major benefits of trucks are flexibility. They are not tied to rails.

UNP And Buffett

I didn’t incorporate Buffett in the title for clickbait.

The reason why I brought it up is because the content of this article goes well with an article I wrote earlier this month. In that article, I highlighted two investments that I was buying based on Buffett’s investment principles.

Here’s a list of the investment principles that I used back then and promised to bring up in future articles as well:

- Economic Moat: Buffett looks for companies with a durable competitive advantage or an economic moat. This could be in the form of strong brand recognition, high barriers to entry, superior distribution networks, or patents and copyrights. Such advantages provide protection against competition and help sustain profitability over the long term.

- Stable and Predictable Earnings: Buffett prefers companies with consistent and predictable earnings growth. He looks for businesses that have demonstrated stability and resilience rather than those with volatile or unpredictable earnings streams. I agree with that, as I have a hard time dealing with volatile tech or consumer companies that thrive on trends.

- Strong Management: Buffett believes that competent and trustworthy management is essential for long-term success. He looks for management teams with integrity, a proven track record, and a clear strategy for creating shareholder value. I have to admit that this is pretty tough to figure out. Unless you are in direct contact with management, you’ll have to rely on the company’s track record.

- Free Cash Flow: Buffett emphasizes the importance of analyzing a company’s free cash flow, which is the cash generated by the business after accounting for capital expenditures. Positive and growing free cash flow allows a company to invest in growth opportunities, pay dividends, and repurchase shares. As readers may have noticed, I discuss this in almost all of my articles.

- Reasonable Valuation: Buffett seeks stocks that are trading at attractive prices relative to their intrinsic value. He emphasizes the importance of estimating the intrinsic value of a business before considering an investment. Like Buffett, I try to buy companies below what I consider to be their fair value. That may sound obvious, but I’m not chasing charts anymore, betting on companies that may be profitable at some point in the future.

- Long-Term Perspective: Buffett takes a long-term view when investing and focuses on the fundamental value of a business rather than short-term market fluctuations. He prefers to buy and hold investments for extended periods.

Additionally, BNSF may be one of Buffett’s best investments. He bought UNP’s largest competitor in 2009 for roughly $44 billion. Not only does he own a major part of the North American economy, but he has also made a smart financial decision, as his dividends proceeds have already exceeded his initial investment.

While I own a minuscule part of UNP’s outstanding shares (I’m not comprising myself to Buffett), I believe that UNP is one of the best Buffett-like plays on the market.

As we already briefly discussed its moat, let’s now focus on the other principles, incorporating new developments.

Stable & Predictable Earnings: The Cycle

Stable and predictable earnings are always relative.

Because UNP connects sellers to buyers in various supply chains, it is highly cyclical. Hence, its earnings are predictable as long as investors are able to predict the business cycle. While this comes with economic uncertainties, the company has way more predictable earnings than companies depending on secular trends, like most technology companies or companies that have more competition.

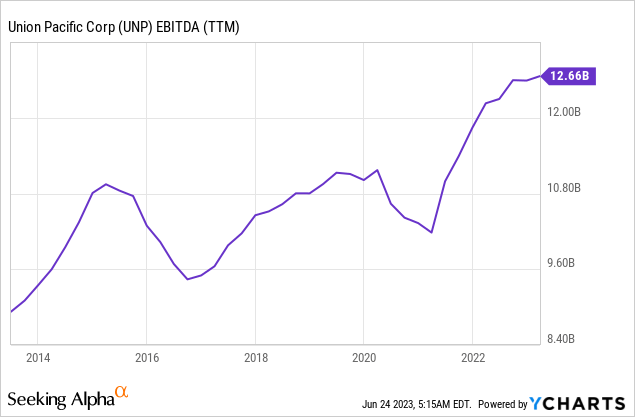

With that said, earnings are currently under pressure. While LTM EBITDA is essentially at an all-time high, the forward-looking trend is down.

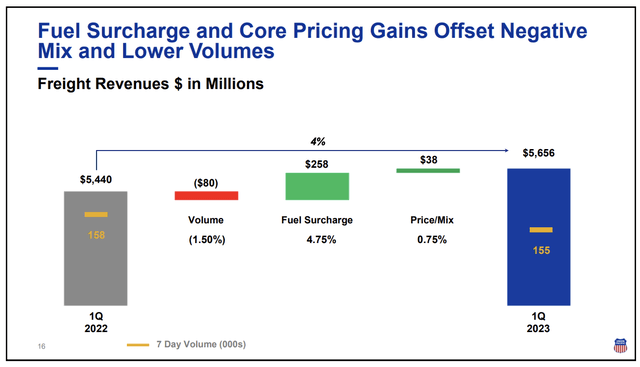

Slower economic growth is working its way through the economy. For example, in the first quarter, freight revenues were up 4%. However, this was mainly due to pricing and mix. Volumes were down 1.5%, as the graph below displays so well.

Union Pacific

On June 13, during the Wells Fargo Industrial Conference, the company elaborated on ongoing trends.

Bulk volumes remained flat quarter-to-date, with growth in grain and grain products and coal. This was offset by lower demand for fertilizer, food, and beverage.

The industrial segment saw a 1% increase in volumes, driven by growth in energy, specialized products, and metals and minerals.

However, there was a decline in premium volumes, primarily in intermodal, which resulted in an overall 4% decrease in premium volume. This has led to a 2% decrease in total volumes quarter-to-date.

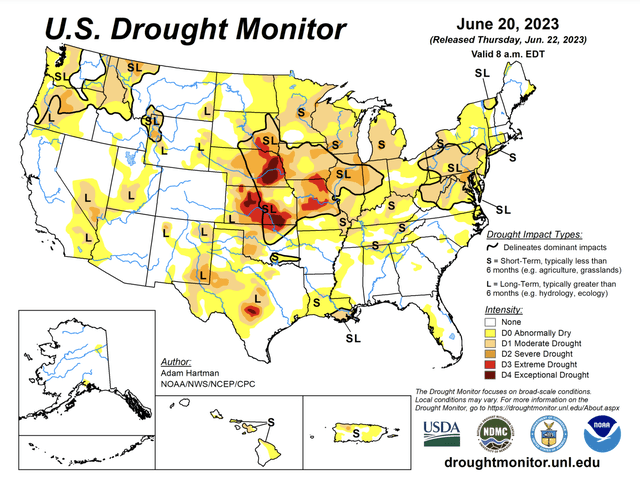

For the remainder of 2023, UNP anticipates the impact of weather conditions on grain and coal demand. Improved moisture and a better harvest are expected to drive stronger grain volumes in the fall of 2023.

In this case, I have to say that I’m not sure the company will be spared from adjusting these comments. Intermodal could weaken further as consumer sentiment remains weak and inventory de-stocking continues, while agriculture is now suffering from severe drought.

For example, 64% of corn production is located in drought. The same goes for 57% of soybean production. The drought trend will likely have a major impact on total volumes.

USDA

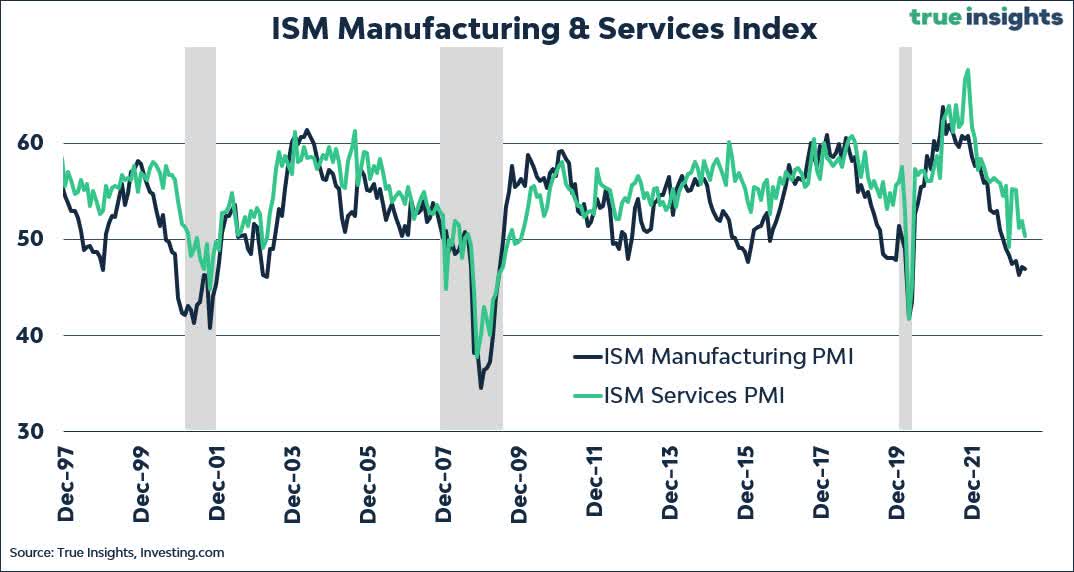

Additionally, leading economic indicators like the ISM Manufacturing Index point to lower growth in the months ahead, which could cause the company to witness more weakness in industrial and bulk segments, which tend to react with a 1-2 quarter lag to leading indicators.

Additionally, manufacturing weakness is accompanied by a steep decline in service sentiment.

True Insights

It also doesn’t help that trucking is in a recession.

During the aforementioned conference, Union Pacific acknowledged that the looser truck market presents some challenges in capturing pricing opportunities.

However, UNP has improved its service product and cost structure to adjust prices accordingly and maintain volume on its network, thus enhancing efficiency and competitiveness.

The company also emphasized building stronger relationships with customers through technology to help them manage their supply chains effectively.

While these developments are certainly offsetting some headwinds, the broader trend is down and hard to stop.

Strong Management: Making The Right Decisions

Assessing the strength of management is tough. Essentially, if a company has done well in the past, it has good management. That’s how people who do not have direct access to a company’s management (like you and me) access this situation.

With that said, UNP is currently looking for a new CEO as Soroban Capital Partners forced outgoing CEO Lance Fritz to resign earlier this year. I discussed that in a very bullish in-depth article.

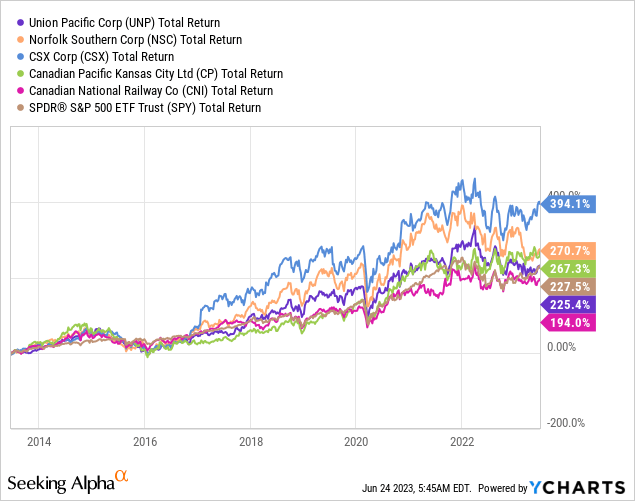

One issue that Soroban brought up is the poor performance of UNP. While UNP generated 225% in total returns over the past ten years, it has underperformed all of its peers except for NY-listed shares of Canadian National Railway (CNI).

Despite these issues, management is stepping up.

For example, using the latest Wells Fargo conference again, UNP highlighted its plans to grow volumes at a faster rate than industrial production by leveraging its network and business development efforts.

The company has been successful in winning new business across various sectors, including grain, biodiesel, renewable diesel, metals, and construction products. This includes major deals with Schneider National (SNDR) and Knight-Swift (KNX).

The company has contracts with new plants and expects the renewable diesel market to grow by almost 200% in the next few years. UNP is involved in both the supply chain and consumption of renewable diesel. The growth of EVs also presents opportunities, as heavier vehicles require transportation in bulk, generating more carloads.

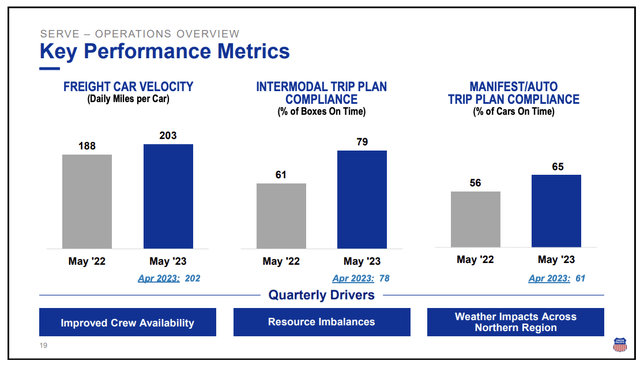

Furthermore, operating efficiencies are improving. For example, the reported car velocity exceeded 200 miles per day for the ninth consecutive week. The company also saw a 14% increase in car velocity since mid-April 2022.

Union Pacific

Trip plan compliance metrics, including intermodal and manifest auto trip plan compliance, have also been improved.

Related to this, the company has been actively managing its workforce, graduating 760 employees, and having a pipeline of nearly 1,200 employees in training.

The company also reached paid sick leave days for employees with major unions, causing more certainty in work schedules and lower risks of strikes. In general, these developments are important, as retaining good employees is what drives performance.

Furthermore, the company commented on near-shoring, re-shoring, or whatever we want to call it. Essentially, we’re witnessing the return of supply chains from Asia and Europe to the United States. This has been going on since the pandemic, as Europe is battling an energy crisis and an unfavorable shift in business conditions that triggered massive de-industrialization. Meanwhile, companies want to leave China because of pandemic-related risks and risks tied to the government.

However, as bullish as I am on re-shoring, it’s a slow process, and a complete decoupling from China won’t happen.

While Union Pacific has seen early indications of behavior and investment changes in Mexico and the United States, full-scale onshoring has not yet occurred. Customers are following through on strategic planning, but the extent of near-shoring remains limited.

In other words, it’s a favorable trend but not a trend that has a sudden and significant impact on its revenues.

With that said, the company is now working with an external consultant to find a suitable CEO whose top priorities include maintaining and improving service quality, enhancing employee engagement and culture, driving growth, and harnessing technology throughout the business.

Even if the search were to take much longer, I’m very confident that the current management team will get UNP back on track.

Free Cash Flow (Dividends!)

Free cash flow is important to Buffett – as a dividend (growth) investor, I agree with him.

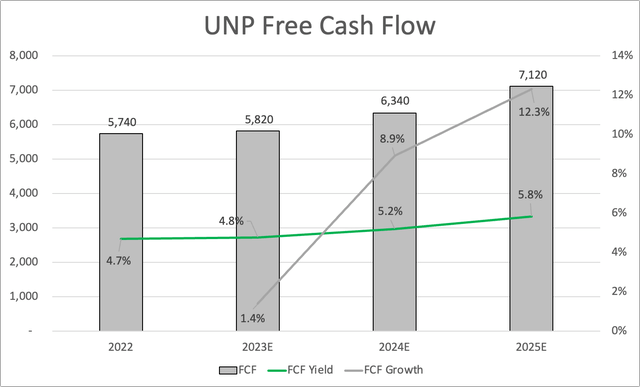

UNP is a cash cow. This year, the company is expected to generate $5.8 billion in free cash flow, which would be a small increase compared to 2022. It would also imply a 4.8% free cash flow yield, which protects the company’s current dividend yield of 2.6%. After 2023, analysts expect UNP to step up free cash flow growth, leading to a surge to $7.1 billion in 2025, which implies an FCF yield of almost 6%.

Leo Nelissen

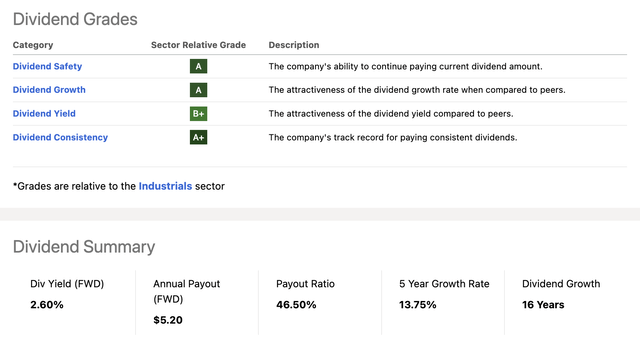

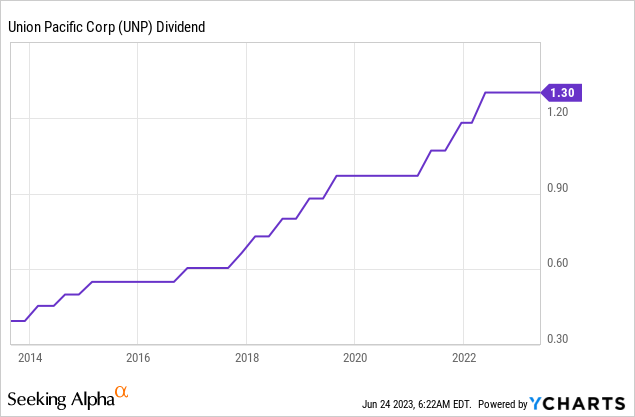

With that said, the company has a fantastic dividend scorecard. Not only does it come with a 2.6% yield, but it also had a 13.8% average annual dividend growth rate over the past five years.

Seeking Alpha

While the company tends to refrain from hiking its dividend during major recessions, it is unlikely to be forced to cut its dividend, as even a steep recession would not result in a less-than-100% coverage of its dividend.

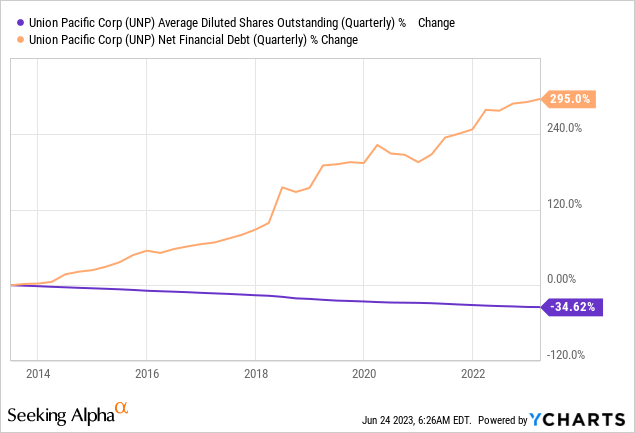

UNP uses excess free cash flow to buy back shares. However, in recent years, the company has used debt to buy back shares. While the company has lowered its share count by 35% over the past ten years, net financial debt has quadrupled.

However, most people fail to understand why net debt is up. The company has always made the case that it will use a healthy balance sheet to benefit its investors. There’s no need to have extremely low debt. UNP won’t run into trouble, as its business model is too strong. Hence, a very healthy balance sheet can be used to buy back additional stock.

Using 2023 expectations, UNP has a net leverage ratio of 2.7x expected EBITDA. The company has an A- credit rating.

Also, note that buybacks are flexible. The company can halt buybacks at any given time.

I’m not saying this because I’m a biased UNP investor (I’m not), but investors shouldn’t worry so much about its balance sheet. Start worrying if management ever starts to accelerate buybacks in a situation of declining or even negative free cash flow. However, UNP is so large and important that this would immediately cause activist investors to react.

Reasonable Valuation

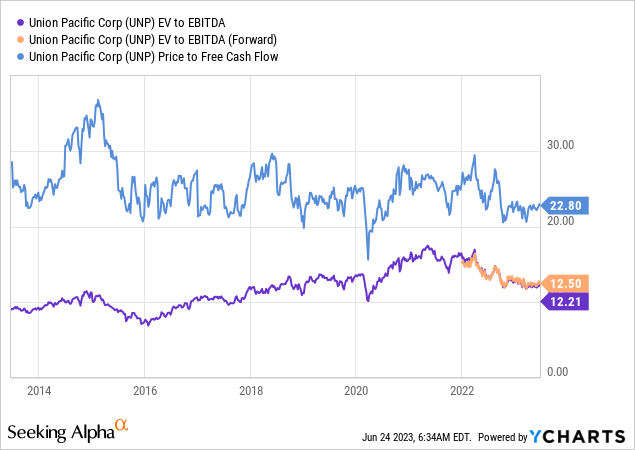

UNP stock is fairly valued. The company is trading at 12.5x forward EBITDA, which is at pre-pandemic levels. Using free cash flow estimates, UNP is trading at 19x 2024E free cash flow.

While these numbers can turn against us if estimates start to deteriorate, I believe we’re at attractive buying prices.

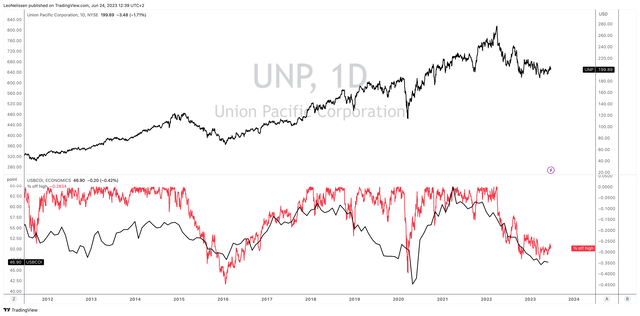

This is also supported by the fact that UNP shares are roughly 30% below their all-time high. Comparing this sell-off to the ISM Manufacturing Index (in the lower part of the chart below), we see that a lot of weakness has been priced in.

TradingView (UNP, ISM Index)

Historically speaking, UNP shares are a buy once the sell-off gets close to 30%.

While we could see 10-15% more downside if things get really ugly, I am starting to like the risk/reward – especially as I’m planning on holding these shares for many decades.

This also covers the last aspect, as I’m not looking to sell UNP anytime soon. The same goes for all other assets in my dividend portfolio.

Given its huge moat, fantastic business with growth opportunities, ability to boost shareholder returns, and favorable valuation (risk/reward), I’m going to boost my UNP position in the next few weeks and months, making it my largest investment.

Takeaway

Union Pacific presents an attractive investment opportunity despite ongoing economic challenges. As a dividend investor, I’ve been strategically buying cyclical stocks like UNP on major corrections.

The company’s moat as America’s largest independent public railroad, its exposure to diverse transportation segments, and its pricing power contribute to its competitive advantage.

Aligning with Buffett’s investment principles, UNP exhibits stable and predictable earnings, strong management, and healthy free cash flow.

While its earnings are currently under pressure due to slower economic growth, UNP’s plans to leverage its robust network, secure new business deals, and improve operating efficiencies indicate management’s commitment to driving growth.

With a solid dividend track record and a reasonable valuation, UNP remains an attractive long-term investment despite potential short-term downsides.

Read the full article here