Investment Thesis

Fastenal Company (NASDAQ:FAST) distributes fasteners along with construction and industrial-related supplies in the United States, Mexico, Canada, and worldwide under the Fastenal name. It serves the manufacturing market, truckers, mining companies, and farmers.

Its Onsite program, which offers strategic collaboration with its customers, and the digitization of its business by offering digital solutions and services through FMI technology and e-commerce are its catalysts for growth. Its share price increase of about 12.79% over the past year is a clear testimony to the impact of these performance drivers. The company has growing profits and steadily pays dividends, adding to its attractiveness.

Going by relative valuation metrics, FAST is trading at a premium, with nearly all its valuation metrics trading above industry medians. As a result, I don’t think now is the right time to buy into the company. I think the opportunity here is to cash out benefits and wait for a cheaper entry point.

Growth Catalysts:

Fastenal Onsite: A strategic partnership with its customers

FAST’s Onsite program involves collaboration with its customers by providing customized solutions to address their supply chain challenges. An onsite is the company’s business unit that is set up and located within a client’s facility.

The Onsite program includes staff from Fastenal operating full time and investment made by the company in terms of inventory, value-added services, technology, and subject-matter experts; all focused on aligning with the client’s business culture, needs, processes, and goals. The Onsite program aims to strengthen the customer’s supply chain by providing these on-site resources. This is achieved by analyzing the customer’s existing supply processes and thereafter presenting a range of solutions tailored to the client’s needs. Together, they then set goals, key performance indicators [KPIs], and milestones, setting a path for the future.

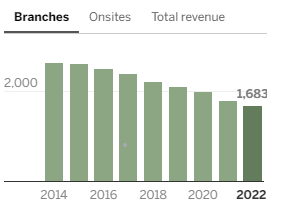

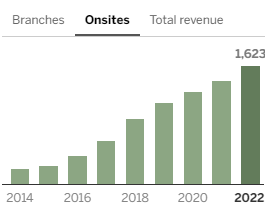

The company’s approach of reducing the number of its supply branches and opting to grow its onsite has yielded positive results so far. By the end of 2022, the number of branch stores had decreased from 2637 to 1683, while the number of in-factory sites or onsite stores had increased from 214 to 1623.

Star Tribune |

Star Tribune |

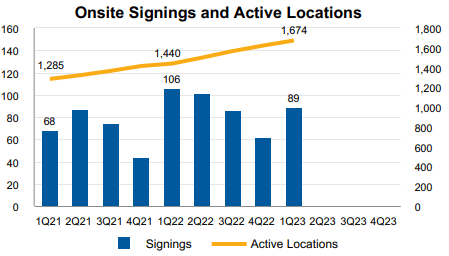

Since the change of approach, revenue has increased by 85% due to growth in its onsite locations. According to the first quarter of 2023, FAST had 89 onsite signings, resulting in a total of 1674 active sites, a 16.3% increase from Q1 of 2022. Daily sales through Onsite grew by about 20% in the quarter over last year’s same quarter.

FAST 1Q23 presentation

This growth was attributed to the activated and implemented Onsite during the past twelve months and the ongoing growth from older ones. This year, the company is targeting onsite signings in the range of 375–400.

A digital-driven distributor

As mentioned earlier, Fastenal has shifted its strategy by reducing its onsite growth and reducing its branch locations. Although growing Onsite may seem to be the primary reason, this is not the case. The company mainly focuses on its digital footprint, including its e-commerce operations and mainly focusing on its digital footprint, including its e-commerce operations and its Fastenal Managed Inventory [FMI] technology.

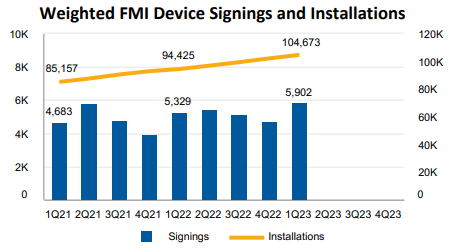

The FMI technology has streamlined inventory restocking, monitoring, controlling, and tracking products needed through three digital solutions. First is FASTStock, which simplifies the restocking process and shows details pertaining to a product as well as its location. Second is FASTBin, an infrared, RFID, and scale solution that allows inventory monitoring by providing real-time visibility of the exact amount of inventory. Lastly, there is the FASTVend solution that facilitates controlling and tracking inventory, thus reducing loss or consumption, and enabling access 24/7. Through this technology, FAST offers digital solutions to its clients by reducing the risk of too much or too little inventory, reducing restocking and ordering stocks, and minimizing waste. In the MRQ, the company signed weighted FMI technology devices amounting to 5902, an increase from 5329 in Q1, 2022.

FAST 1Q23 presentation

This increase resulted in a total of 104,673 FMI devices, up 10.9% from the year-ago period. The company’s FMI devices account for approximately 37% of its quarterly sales.

Its e-commerce site facilitates researching, sourcing, procuring, and managing a range of construction, Original Equipment manufacturers [OEM], and Maintenance, Repair, and Operations [MRO] products. The site provides fast solutions for its multiple products.

Now let’s look at the results of using technology to drive sales in the first quarter of 2023. Sales from the FMI technology platform accounted for 39.4% of revenue in the quarter, an increase from 35.4% in last year’s quarter. Daily sales from the e-commerce business in the quarter were up 48.7%, contributing 21.9% to total sales. Overall, Fastenal’s digital footprint accounted for 54.1% of sales, up from 47% in the past year’s quarter. Looking forward, FAST is targeting a revenue contribution of 65% from its digital footprint in 2023, and as for its long-term outlook, it is aiming for 85%.

The company has taken a broader and longer-term view in its approach to business. FAST is putting the interests of its customers first by focusing on understanding and delivering their needs, such as by offering customized solutions and going further to bring these solutions to their facilities through the onsite program. Through digitization, the company has streamlined inventory management as well as procurement. I think its approach to business is what gives it a competitive advantage and should sustain its business performance even in the long run.

Green Flags:

Growing profits

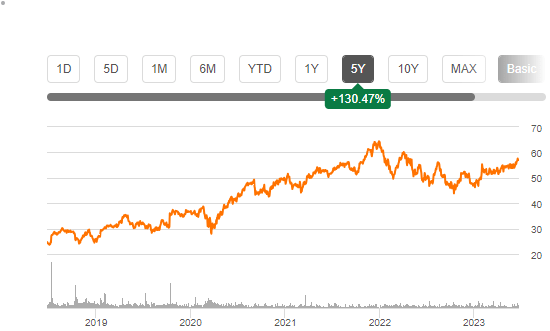

Over the last three quarters, the company has reported positive EPS surprises, beating the Seeking Alpha estimate. In the MRQ, it beat the estimate by $0.02. Naturally, EPS outcomes eventually reflect in a company’s share price in the long run, making growth in EPS a desirable trait for companies. This is the case for FAST. Over the past five years, it has increased its EPS from $1.31 to $1.94, and sure enough, its share price has appreciated approximately 130.4%.

Seeking Alpha

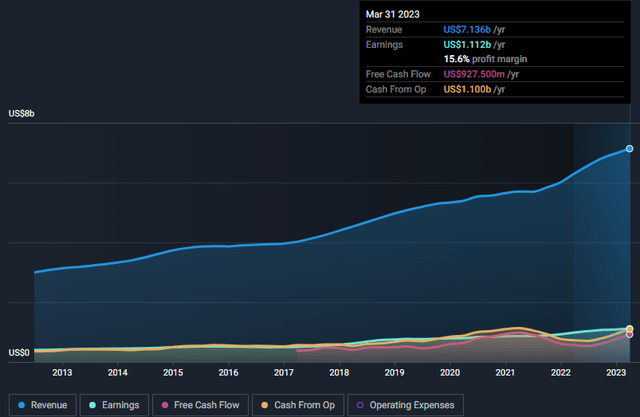

Double-checking the company’s growth, we can consider its revenue and EBIT growth. Fastenal saw an EBIT growth of 14.96%, although it underperformed the industry’s average of 16.20% and a 13.3% y-o-y revenue growth to $7.13 billion, outperforming the industry’s median of 12.34%.

Simply Wallstreet

As seen above, the company has increased its revenues and earnings over the years. With the company’s growth drivers, I have confidence in its ability to continue this growing trend of profits.

Stable Dividend Payer

Fastenal has a long history of making dividend payments (30 years), compared to the industry’s median of 9 years. Its latest announced dividend is $0.35. It had sufficient earnings to finance the dividend payments before the announcement, plus positive free cash flows ($927.5 million), a good sign of its ability to return capital to its shareholders.

The company’s current payout ratio is 65.9%, which I think is reasonable, leaving the rest for reinvestments. Ten years ago, the annual dividend was $0.40, while the current yearly premium was $1.24, resulting in a CAGR of 13.4%. This positive growth in dividends is encouraging. I think the company is an outstanding dividend stock with sufficient earnings to cover dividends and positive cash flows.

Valuation

FAST has a P/E GAAP [TTM] ratio of 29.36, which is higher than the industry’s median of 19.02. The valuation metric indicates that the company is overvalued. Its lower EBIT growth y-o-y of 14.96% compared to the industry median of 16.2% does not justify the current pricing.

The forward P/E ratio is lower than the current ratios, suggesting that the market anticipates growth in its earnings. However, the EPS diluted growth and EBIT growth of 10.32% and 10.2% are lower than the industry’s growth average of 10.48% and 11.35%, respectively. Moreover, the FinBox DCF model backs this valuation, with the estimated fair value at $52.89 and a potential downside of approximately 7%. Given that the company is trading at a premium with a potential downside, I believe potential investors should wait for a cheaper entry point, but current investors should cash out profits before the stock assumes a downward trajectory to its estimated fair value or beyond.

I think at the current price (56.89), cashing out would be a 7% premium according to the estimated fair price. Why I see a likely strong downside than an upside is because the current inflationary environment and the looming recession will affect the stock markets significantly. Further, should further interest rate hikes follow, this company could face higher operating expenses as well as decreasing demand due to hiked prices. All this could affect the company’s future returns, fueling a downward trend in share prices.

Conclusion

FAST has an Onsite program and its digital footprint as its growth drivers and has been progressing on these fronts. They have positively contributed to revenues in the first quarter of 2023 and should continue driving growth. It has been witnessing growing profits and is a stable dividend payer. Considering its current valuation, value-oriented investors should cash out profits now and wait for a cheaper entry point. For dividend-oriented investors, I think they can maintain their current position and wait for a cheaper entry point to improve their positions.

Read the full article here