If there ever was a competition for a company that most reflected the state of the economy, FedEx

FDX

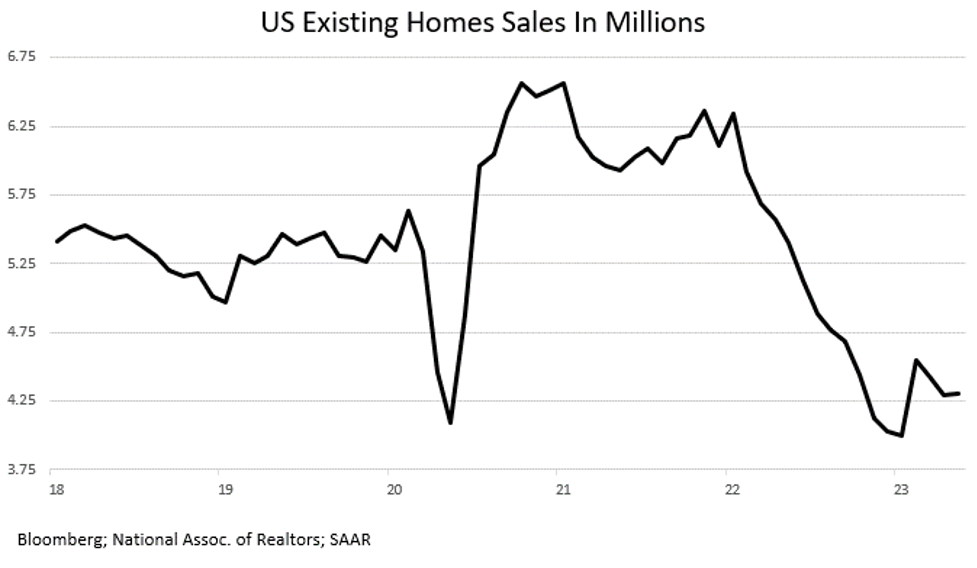

Nevertheless, the media and Wall Street continue to push the “soft landing” or even “no landing” scenario based on the “resilient” labor market and a few positive blips, like the +22% rise in housing starts or a +0.2% rise in May’s existing home sales. Regarding the latter, those sales are still down -20% from year-earlier levels (see chart). So, no, that’s not a positive for the economy.

Regarding the +22% jump in housing starts, they are rising because there is no inventory in the existing home market. About 85% of homeowners have a mortgage rate below 3% which they obtained prior to the Fed’s rate hiking campaign. Consequently, they can’t afford to move because they can’t afford a new mortgage rate at 7% and their payments would skyrocket even if they traded sideways. They’ve become prisoners in their own homes! Thus, the level of existing “for sale” inventory is at a record low level, so those looking to purchase have had to turn to the “new” home market. (This phenomenon has also ignited the prices of the homebuilder stocks.)

Cracks Appearing in the Employment Story

In past blogs, we’ve discussed the hesitancy of employers to layoff workers after two plus years of scratching and clawing to find employees. We have noted that they have chosen to reduce hours worked instead (see chart). May’s unemployment rate (U3) did tick up 0.3 percentage points, and in June we’ve seen three consecutive weeks of significantly higher Initial Unemployment Claims (>+260K, up from +220K in May and +216K in the same week in 2022). For Q2, Manpower’s

MAN

The State of Credit in the U.S.

We noted in our last blog that credit card, auto loan and mortgage delinquencies have been on the rise. The following chart shows Capital One’s

COF

Also relevant in this credit discussion is the state of the U.S. commercial banking system.

The left side of the chart shows the continued fall in bank deposits. Remember, besides raising interest rates, since March ’22, the Fed has been shrinking the money supply by $95 billion per month. With fewer deposits, and spurred by March’s bank runs, lending has all but dried up. The right-hand side of the chart shows that the year over year percentage change in lending is about to turn negative! Economic growth and credit growth go hand-in-hand in the U.S.

Other Indicators

Here are additional indicators showing that a pronounced economic slowdown is inevitable:

- The Conference Board’s Leading Economic Indicators (LEI) have fallen for 14 months in a row. This is a very reliable Recession predictor, even at 10 negative months. The only other time LEI has fallen 14 months in a row was April ’07 through May ’08. We all know what happened to the economy in the ensuing months.

- All the Regional Fed Surveys have indicated that manufacturing is already in Recession. The latest is Kansas City where the overall gauge is -5 (negative three months in a row). New Orders, Shipments, Production, Inventories, Employment, The Workweek, Backlogs, and Delivery Times all fell in May. The chart shows the Prices Received Index from the Philly Fed Survey. Note the near vertical line on the right-hand side of the chart.

- Bank balance sheets are loaded with Commercial Real Estate (CRE) loans. We’ve already seen office building owners in NYC and LA, and hotel moguls in SF give the keys to their properties to the lenders in lieu of payments. The chart above shows what has happened to CRE prices.

- Like FedEx, the movement of freight is a solid indicator of the country’s underlying economic health.

- And note what is happening to sales. Same store sales are barely above zero in nominal terms. Given inflation, physical volumes are clearly negative. No Recession, eh!

The Inflation Problem

When looked at holistically, there is a problem with the Fed’s plan to reduce inflation to 2%. In January 2021, pre-Covid, CPI’s annualized growth rate was +1.4%. The index level was 263.6. In May ’23, two and a half years later, the index sits 15% above that January 2021 level. Wages and incomes have simply not kept up.

Let’s do a thought experiment. If the 1.4% pre-Covid rate had continued, today’s index level would be 271.3. The May CPI Index was 303.3. It is 11.8% higher than it would have been without Covid’s supply chain disruptions, the governments free money giveaway, and the Fed’s rapid money creation in 2021. Even if we use the Fed’s 2% inflation target, May’s CPI would only be 275.2, i.e., 9.3% lower than today. This is an issue for the economy’s health, i.e., incomes haven’t kept up. Economic growth is going to suffer.

Deflation is Coming

As a result, in the future, to get to the same place that the CPI would have been with 2% inflation, we are going to need a significant period of deflation. Our crystal ball tells us that this lies ahead.

Interest rates are high, and, according to Fed Chair Powell and other FOMC members, they will be even higher by year’s end. It is well recognized that monetary policy acts with long and variable lags. Here’s why: each day many adjustable-rate mortgages reset higher, commercial real estate loans come due and, if a new loan can even be found, the interest rate is significantly higher than the rate that just dropped off. Each day, capital projects that were on the drawing board are mothballed because they no longer pencil. When rates for small businesses were 3%, the private economy grew. Not true when rates are 8%-10%!

Final Thoughts

Despite all the noise and protestations, the overwhelming evidence points to a Recession. It is our opinion that, when the National Bureau of Economic Research (NBER) gets around to dating it, we will find that the Recession began in Q2 ’23. The Fed appears on a path to raise rates, not for economic reasons, but for its own credibility. That will only serve to deepen the Recession because, as we illustrated above, monetary policy works with lags and the Fed’s past actions are still working their way through.

We also have the U.S. Treasury coming to the market for a record amount of borrowing. That impacts liquidity for the financial markets and is going to crowd-out the private sector. Did we mention that student loan repayments will restart this fall?

(Joshua Barone and Eugene Hoover contributed to this blog)

Read the full article here