Amazon is throwing good money after bad

Amazon.com, Inc. (NASDAQ:AMZN) is known for its wide range of products and services: From running the largest e-commerce store in the world to services within delivery, cloud, music, payments, and a host of other areas.

It’s like the mantra of being the “everything store” is becoming a costly and self-fulfilling prophecy: Amazon is trying to diversify into just about every imaginable field and while some of the ideas are exciting from at least a technological viewpoint, the financials often kind of suck.

There are multiple examples of this, but let me focus on satellites (yes, Amazon does this too) and health here.

Amazon’s moon shot

In 2019, Amazon revealed “Project Kuiper”. This is Amazon’s project to build 3,000+ satellites in low Earth orbit to provide high-speed internet. The project entails building a 172,000 square-foot factory in Seattle, Washington. Construction is underway, and Amazon already has a 219,000 square-foot R&D facility in Redmond, Washington, which has developed a prototype satellite for the project. The total cost of Project Kuiper is estimated at $10 billion.

Amazon has received regulatory approval for the project (FCC approval), but is yet to launch the first satellites under the program.

What does this mean to shareholders? Well, for one thing, it means Amazon is going to start competing with other internet providers. From a business perspective, it provides steady business with customers paying for their connections in cash up front. Customers don’t tend to “shop around” very often. A lot of customers will simply stick around with their provider for many years. I assume these are some of the attributes that Amazon likes about the internet service business. You see some of the same effects with AT&T (NYSE:ATT). This is a highly cash intensive business that generates enormous amounts of free cash flow. But at the same time, it’s very leveraged, and any expansion is capital intensive. Profit margins are slim.

The same can be said for Project Kuiper and the business that Amazon will enter after completion. The internet provider business is a low-margin and capital intensive one. It’s an exciting project, but from a business perspective, it really doesn’t seem like the kind of thing you’d want to bet this much money on, in my opinion.

Amazon’s health business is unhealthy

Amazon has tried to break into the health area for years. Amazon’s ambitions within pharmacy products have seen general stock price pressure on Walgreens (NASDAQ:WBA) and CVS (NYSE:CVS), in what appears to be the widespread retail fear that “Amazon is taking over everything”. But Amazon has had numerous disappointments in health, one of the areas they are intent on breaking into: From abandoning the “Care” telehealth service, to abandoning “Halo” health and to abandoning a joint venture within healthcare called Haven. Amazon Care was launched in 2019 and shut down by year-end 2022. The service provided virtual urgent care visits by doctors and nurses. It’s unclear at this point how much money the initiative and its cancelling has cost investors. When it was shut down, however, one anonymous employee told The Washington Post that:

This is a huge shock to a lot of us – Anonymous Amazon employee

So it appears that certainly some Amazon employees had anticipated Amazon to continue dedicating resources to the project. Amazon themselves have said that one reason for Amazon Care shutting down was that it was not a complete enough offering for large enterprise customers targeted.

Amazon “Halo” was Amazon’s foray into wearables. Among other things it consisted of a bracelet that tracked users’ fitness, including activity, body fat, and mental state. Launched in 2020 and shut down just three years later, it is also unclear at this point how much money the initiative has cost Amazon investors. According to Amazon, Halo was shut down in a cost-cutting move.

“Haven” was a joint venture between Amazon, Berkshire Hathaway (BRK.A) (BRK.B) and JPMorgan (JPM) aimed at disrupting US healthcare. The ideas was to provide US employees with lower cost high-quality healthcare. The service was launched in 2018 but shut down just three years later in 2021. A Harvard Business Review study found that one reason for this was that while the three founding constituents had a combined 1.2 million employees at the time, this wasn’t enough market power to push prices down from providers of healthcare. As with the other expansions into health described here, it is unclear what the initiative cost shareholders in total.

The numbers are good, anyway

My skepticism towards Amazon’s tendency to expand into just about every imaginable area – sometimes with little regard to the cost to shareholders – could be interpreted as general skepticism towards the business. This is not the intention.

On the contrary, I regard Amazon a highly successful business but one that has matured greatly over the past few years. It is starting to become apparent – in my opinion – that there is a core business of Amazon, and this seems to center around e-commerce, AWS and a few other services. These are the areas where Amazon has succeeded, and they are the drivers of revenue and income.

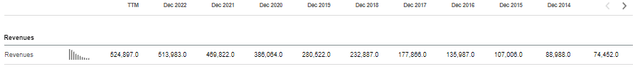

Amazon’s growth in terms of revenue has been impressive over the span of the most recent decade:

Seeking Alpha

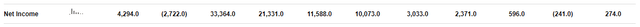

The same can be said of Amazon’s net income, although the company still struggles to maintain consistent profitability:

Seeking Alpha

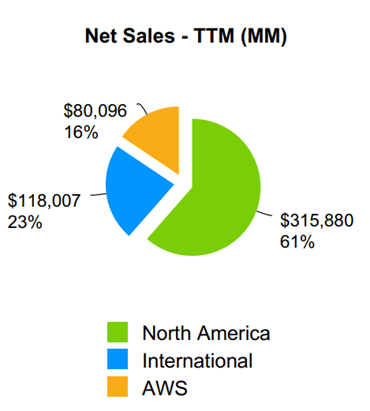

The point to be made here is that while Amazon is an innovative company with lots of projects that are considered mainstream “cool” (without the financials necessarily following suit), Amazon has a very strong core business. Among other things, this would include AWS, its cloud business. This segment alone made up 16 % of Amazon’s total sales (Q4 2022, TTM):

Amazon investor presentation, Q4 2022

The question then becomes: What do you pay for a business that has it in its DNA to attempt to expand in many directions – with some of that failing – but at the same time delivering strong growth consistently, particularly within its core business units? Amazon currently trades at a P/E (FWD) of ~83. With companies growing as much as Amazon, the P/E multiple is sometimes less informative, but if we assume here that Amazon in 10 years has grown to about three times its current net income – something I believe the growth trajectory points to – and will still trade at a fairly high multiple (justified perhaps at that time by the company’s maturity and ability to return cash to shareholders) – I regard the current valuation as a somewhat fair point to enter.

Key takeaways & conclusion

I’m rating Amazon a Buy because while I’m concerned with their tendency to “overreach” into too many areas, I am impressed with their numbers anyhow.

My thesis here is that there is a prevailing notion within retail in particular that “It’s Amazon, they can do anything in any field!”, and this notion is proving to be not quite true. Well, it’s mostly true, actually. Amazon has and will continue to expand into new areas. But there are limits to what areas Amazon can diversify into. Some areas are better left to their specialty operators. The costs of entry are too high, the margins too slim. Amazon’s stalling efforts to grow into healthcare speaks volumes to this point. Perhaps that’s not all bad. Leaving some areas alone will allow Amazon to concentrate cash on what they’re really good at. This includes Amazon AWS and e-commerce. With the company still growing impressively, I find the valuation to be at least decently attractive at current levels.

Do you agree or disagree with this analysis? Let me know in the comments below.

Read the full article here