Investment Thesis

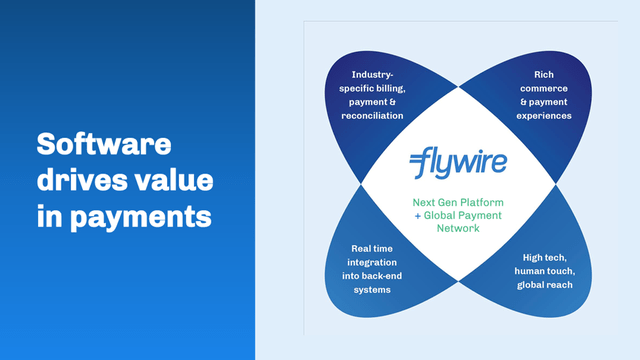

Flywire Corporation (NASDAQ:FLYW) possesses several key elements necessary for sustainable high growth in the payments industry. The company operates on a modern platform specifically designed to address the complexities of both cross-border and local payments. Its proprietary network further enhances its capabilities in this regard. Flywire offers vertical-specific software solutions, focusing on large niche markets that are ready for digital disruption. Moreover, the company benefits from favorable trends in the education and travel sectors. I view the stock as a buy and have an end-of-year price target of $39, based on a 10x forward EV/Sales multiple applied to 2024 revenue estimate of $471 million.

Robust Demand for FLYW’s Payment Solutions

Flywire entered the U.S. education market and successfully addressed the challenges faced by incumbent players who primarily focused on domestic payments, leaving cross-border payments as a major pain point. By offering innovative cross-border solutions, Flywire gained traction in the market and expanded its operations to the U.K., Canada, and other international markets, now serving around 30 countries. The company’s commitment to digitization and automation in higher education extended to underserved areas like K-12 schools and 529 plans.

Flywire’s strategy involved broadening its platform capabilities and delivering additional value-added services. Clients initially opted for Flywire’s cross-border solution and then expanded their partnership to include additional payment flows through products such as the Comprehensive Receivables Solution. This paved the way for the adoption of Flywire’s domestic payment solutions, including payment plans, billings, refunds, and e-store capabilities for campuses. Some clients even signed up for both domestic and cross-border solutions. Flywire’s excellence in integration led to Ellucian, a leading technology solutions provider for higher education, designating Flywire as its 2022 ‘Partner of the Year’.

The COVID-19 pandemic accelerated the demand for digitization and efficient unified solutions in education payments, pushing institutions away from legacy processes worldwide. Flywire responded by investing in its go-to-market teams and expanding its presence in existing and new international markets, such as Latin America. By combining domestic and cross-border capabilities on a single integrated platform and incorporating incremental software features, Flywire is emerging as a top choice for education institutions globally. The company’s success in acquiring new clients drives volume expansion, and its ‘land and expand’ strategy enables per-client share gains. Even though the adoption of Flywire’s domestic solutions is still in the early stages, they play a significant role in expanding the company’s client base.

Colleges and universities worldwide face slow payment processes due to manual methods like paper checks and a lack of real-time data, particularly when it comes to receiving cross-border tuition payments. However, Flywire goes beyond the basic transfer of payments. For instance, its software-based collections solution for overdue tuition payments helps universities achieve significant cost savings by replacing inefficient legacy processes. It also reduces the number of delinquent accounts that would otherwise require collections by up to 20%.

In the agent market, there is a significant opportunity for Flywire’s Agent Platform to penetrate further. According to ICEF, 40% of agents in 2022 did not utilize a customer relationship management system for managing student information, while 68% lacked the software to support commission payments. Flywire’s Agent Platform addresses these gaps by offering a digitized solution for agents, enabling them to manage student information effectively and streamline commission payments.

Flywire also digitizes the payment processing for 529 plans, facilitating the connection between educational institutions and 529 plan providers. Through automation, processing, and reconciliation, Flywire enables faster delivery times and simplifies cash management in this context. Similarly, the company’s solution for 1098-T forms eliminates the complexity and saves time and money by dynamically generating all relevant forms electronically in one centralized location. This ensures accurate and real-time information is delivered directly to students’ accounts.

Overall, Flywire’s solutions tackle the challenges of slow payments, manual processes, and data inefficiencies in the education sector. By streamlining collections, empowering agents, digitizing 529 payment processing, and simplifying form generation, Flywire drives efficiency, cost savings, and improved experiences for educational institutions, students, and other stakeholders.

Company Presentation

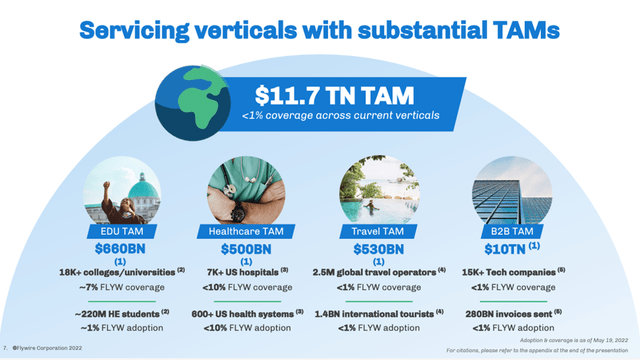

Large TAM in Target Markets

Flywire captures less than 1% of the spend in core markets of education ($660 billion TAM), healthcare ($600 billion), travel ($530 billion) and B2B ($10 trillion) served primarily by legacy providers. However, the company is well-positioned to capitalize on the ongoing digital transformation in these industries. To leverage this opportunity, Flywire is increasing its sales and client services, recognizing the potential for significant returns given its high customer lifetime value (LTV) to customer acquisition cost (CAC) ratio of approximately 7:1. The company’s “land and expand” strategy is particularly attractive, as the expansion of its product and service offerings has the potential to generate an eightfold increase in revenue from new clients within the first year. Flywire is poised to benefit from the increasing globalization trend, including the rise in international student enrollment in universities across OECD countries, as well as growth in international travel and trade.

Company Presentation

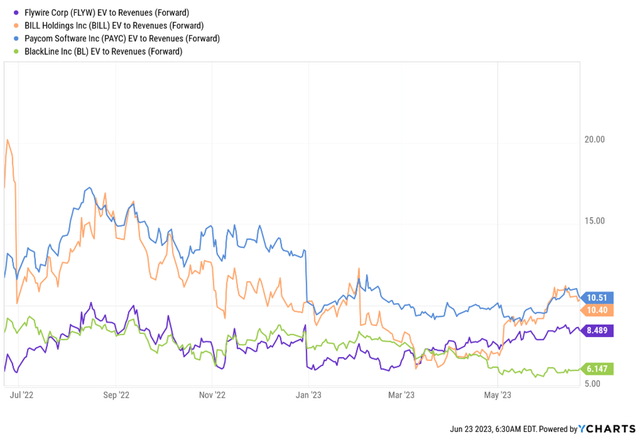

Valuation

My principal valuation metric for FLYW is forward EV/Sales. EV/Sales is the most commonly used metric across high-growth companies that are not yet profitable (or are operating below-normalized levels of profitability). My end-of-year price target of $39 is based on a 10x forward EV/Sales multiple applied to 2024 revenue estimate of $471 million. My target multiple is above FLYW’s current multiple (8.5x). I see upside potential if FLYW establishes a track record of 30%+ growth, given the scarcity of names that grow at such lofty levels.

Ycharts

Risks to Target

Flywire has yet to demonstrate consistent positive free cash flow and operating margins. As the company emerges from the pandemic, it is making substantial investments, doubling its operating expenses, in order to capture a larger market share. The long-term success and profitability of these investments are uncertain, and there may be a need for further investments if Flywire decides to enter new markets. This could potentially delay achieving profitability and raise concerns about the company’s earnings potential. Moreover, approximately half of Flywire’s revenue growth has come from new sales. Therefore, it is crucial for the company to replenish its backlog and ensure timely implementations to return to and sustain growth levels seen before the pandemic. Allocating the right resources to new sales and integrations will be important to monitor alongside other strategic initiatives.

Conclusion

I expect Flywire to sustain strong expansion in volumes by leveraging its unique software and payments platform to support its customers. The company’s focus on international expansion and its successful ‘land and expand’ strategy domestically are particularly noteworthy, as they are likely to drive further gains in market share. Flywire benefits from positive trends in the education and travel sectors, both in the long-term and short-term, which are expected to drive revenue growth exceeding 30%. I view the stock as a buy and have an end-of-year price target of $39, based on a 10x forward EV/Sales multiple applied to 2024 revenue estimate of $471 million.

Read the full article here