Thesis

The market has been on a tear, with the S&P 500 up over 14% this year. With many investors expecting stocks to tank in Q1 and set-up short, we have seen a wave of short covering. The move has impacted even bespoke names such as the Noble Absolute Return ETF (NOPE), an actively managed fund, which was significantly short in the beginning of the year, yet is now long via leveraged Nasdaq names! Let us just quote Goldman Sachs in order to put things in perspective:

Hedge funds betting against stocks in the technology sector rushed to unwind those trades in the first half of February as markets rallied. “The short covering in U.S. tech stocks from Jan 31st to Feb 15th is the second largest in magnitude over any 12-day period in the past decade,” Goldman Sachs wrote in a note reviewed by Reuters.

With the VIX fear gauge now firmly stuck below 15 and the CNN Fear & Greed Index at ‘Extreme Greed’ levels, it is fairly sensible to assume we will have some sort of market risk-off event in the second half of the year. The question a retail investor should ask themselves is around hedging, and what instrument to use.

One tool that has a catchy name and falls in the hedging instruments category is the AdvisorShares Ranger Equity Bear ETF (NYSEARCA:HDGE). As per its literature:

The investment objective of the AdvisorShares Ranger Equity Bear ETF (NYSE Arca: HDGE) is capital appreciation through short sales of domestically traded equity securities. HDGE is sub-advised by Ranger Alternative Management, L.P. (“Portfolio Manager”). The Portfolio Manager implements a bottom-up, fundamental, research driven security selection process. In selecting short positions, the Fund seeks to identify securities with low earnings quality or aggressive accounting which may be intended on the part of company management to mask operational deterioration and bolster the reported earnings per share over a short time period. In addition, the Portfolio Manager seeks to identify earnings driven events that may act as a catalyst to the price decline of a security, such as downwards earnings revisions or reduced forward guidance.

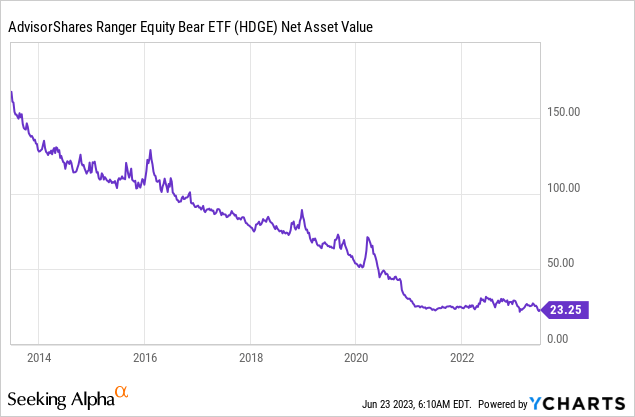

This is one of those rare ETFs that actually short-sells individual equities based on a proprietary strategy. Short selling is a very difficult endeavor to undertake due to the unlimited loss profile (technically stocks can go up without a hard ceiling), and the fact that stock markets usually go up over long periods of time. We can see this feature in the ever decreasing AUM for this fund:

HDGE is therefore to be used only as a hedging instrument on a short time frame, not a portfolio building block.

Collateral composition

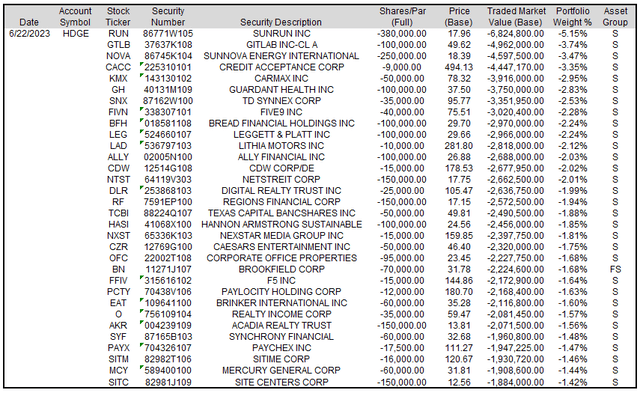

The fund is currently short 60 equity names:

Holdings (Fund Website)

We can notice the fund has a maximum 5.15% position weighting, meaning it does not take overly concentrated risk in shorting any individual name. Most short positions are in the 1% to 2% of the portfolio range. The granularity is encouraging, because when putting on short positions any one name that rallies significantly can really blow up a short portfolio (think Nvidia this year).

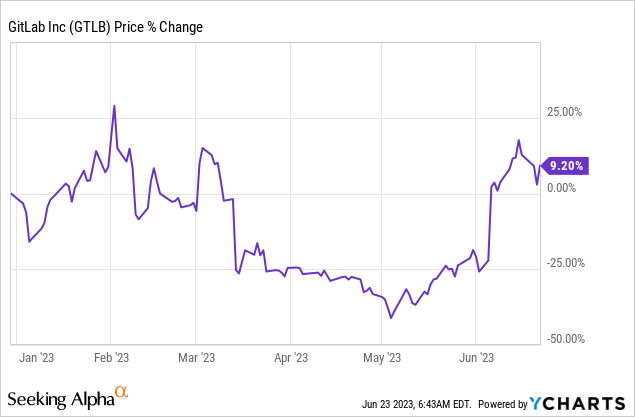

We can see why the manager is shorting some names like GitLab (GTLB), a DevOps software package company. The name has never had positive earnings, and its main competitor GitHub is owned by Microsoft. So from a fundamental perspective shorting GTLB makes sense, however the stock price action is nowhere close to a linear performance:

As we have seen with the ARKK components, the market does not always follow a rational approach when it comes to equity prices. Investors love the idea of growth and the ability to generate wealth quickly. Therefore, the manager’s acumen can only be gauged via performance.

How does HDGE stack up against its competition?

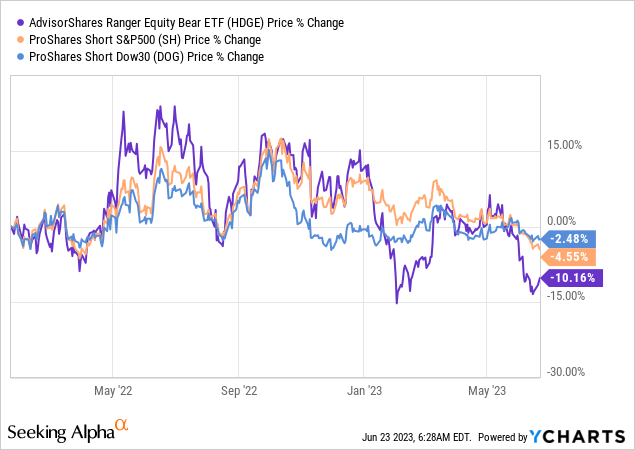

HDGE is only set-up to make money in down markets or market sell-offs. Therefore we are going to look at this name for the past year, when we have had major drawdowns across the equity spectrum, and also compare it to simple inverse ETFs:

We are comparing HDGE here with the ProShares Short S&P 500 (SH) ETF, which gives us the -1x return of the S&P 500, and the ProShares Short Dow 30 (DOG) fund, which gives us the -1x return of the Dow index.

We can see from the above graph that HDGE is much more volatile than the simple inverse funds, and exposes a much higher beta to sell-offs. In the June 2022 sell-off HDGE outperformed the simple inverse funds, and conversely HDGE got killed in January/February 2023 when short technology positions were being unwound.

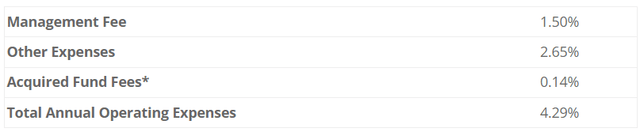

An investor also needs to be aware of the high fees charged by HDGE, which add up over long periods of time. Outside the standard management fee, the fund needs to fund its short positions, as opposed to simple inverse ETFs which operate via swaps (much cheaper to short via swaps):

Fees (Fund Website)

So do expect a drag of -4% from fees (annually) here when compared to other solutions in the market.

Conclusion

HDGE is a rare ETF that takes outright short positions on individual stocks. The fund is an actively managed one, and has a bottom-up, fundamental, research driven security selection process. However, equity prices do not always follow rational fundamental corporate metrics, and HDGE’s performance can attest to that. As a short vehicle, HDGE’s AUM has decreased significantly through time. Stocks generally go up over long periods of time, and the fund also has very high overall fees of 4.29%. We think we are experiencing a period of irrational exuberance and greed in the markets, and the second half of the year will see a risk-off event. However, HDGE is a very high beta instrument, so while we do see the price higher for this name six months down the road, a retail investor should not exclusively use this tool on a standalone basis, but use it in conjunction with simple inverse ETFs. As a reminder, HDGE is NOT a buy-and-hold name, but a short term high beta trading tool to hedge an equity portfolio.

Read the full article here