Investment Thesis

I wanted to take a look at Electronic Arts (NASDAQ:EA) after it just reported its FY23 earnings and see where the company is heading in the future. The current PE ratio seemed to be quite high, however, seeing that margins are quite decent, coupled with successful live service games that can be released until the end of time, the company seems to be a good buy in my opinion at these levels even with conservative revenue assumptions over the next decade.

Briefly on FY23 Results

Total revenue grew around 6%, operating income grew around 28% while net income was only around 1.5%. Gross margins expanded by around 300bps from the previous year, as did operating margins, while net margin contracted slightly by around 50bps.

Overall, the numbers seem to be alright in my opinion. I was a little surprised that Dead Space Remake did not contribute very much to the company’s results as there was not much mentioned in the 10-K report. I would expect Jedi Survivor to have done better and we will hear about it in the company’s next quarterly report, I’m sure.

Outlook

Sports Segment

EA is one of the companies that has almost completely converted to a live service games company by now, with around 74% coming from in-game purchases of content already developed, like the FIFA, NFL, and Apex Legends franchises.

With the new release of another football game just around the corner, which will be called EA Sports FC because the company couldn’t renew the licensing of the FIFA name any longer, FIFA 23 was the last one under the long-standing franchise. I doubt that this will cause much confusion for the fans of the previous franchise because EA as a publisher has many resources to market the change effectively. I’m a critic of annual sports games that EA releases, just like yearly releases of Call of Duty (ATVI) and other franchises, however, football fans are loyal enough to buy the new release every September, so I do not see that this will change with EA FC. FIFA Ultimate Team is the most popular game mode of the franchise, and we can see that EA knows how to make money on as much of the content on a premium title as possible with in-game purchases. EA FC will no doubt have something similar if not the same feature as FUT. The company has found a formula that works in sports franchises games with very little uproar from those communities, but when the company tried to over-monetize an FPS like Battlefront, the company saw a huge uproar which led to investigations. I don’t think the gambling aspect of these sports games is going to go away and yearly releases of these games will continue, because it works.

I think that game graphics are good enough to just have one game for each sport that they release and update it with seasons, and battle passes, and just make it free-to-play going forward and monetize everything in-game like Apex Legends. I do see why the company isn’t going to do that. That would mean it would lose out on $70 a pop of extra money, which is basically free money because the games are hardly updated enough to make it very different from one year to another.

Yes, I’m not a fan of EA sports games, but I have to give it to them, they know how to make money off them, and I won’t let my biases cloud my judgment if the company is making good money.

Respawn Entertainment

What I am a fan of is Respawn Entertainment. When EA announced that they are acquiring Respawn Entertainment, I was worried that Respawn is going to end up like many other high-profile acquisitions of the past, like PopCap games of Plants vs Zombies or the many struggles of Maxis studios, the creator of the very popular Sims franchise to name a couple. Probably the biggest one from memory would be Visceral Games, the brains behind the Dead Space franchise and how it went in the wrong direction because EA butted in, which eventually led to the company’s shutdown.

And at that point, I was already a fan of Respawn. Titanfall games did not get enough love. I believe it’s because of EA’s Battlefield and Activision’s Call of Duty series releasing at the same time as Titanfall. It is hard to compete with those.

After the acquisition, and after the successes of Player Unknown’s Battlegrounds and Fortnite’s Battle Royale mode, Respawn Entertainment took a shot at the genre and I was very surprised to hear that all creative control will stay within Respawn and that EA will stay out of it. Now fast forward a couple of years later, Apex Legends is still played by millions of users, including me from time to time, although not as much as when it came out first, EA has been praising the game ever since its release as it was a huge surprise for everyone. This led to the company becoming a premier developer for EA, up there with DICE, which has been slacking a little bit in my opinion. Respawn is taking control of EA’s Star Wars licenses with Jedi Fallen Order doing well in the past and Jedi Survivor topping charts and receiving acclaim all around.

There are at least 3 more games in the works for Respawn, including 2 Star Wars games, so the company is going to keep busy and hopefully release some solid games that will please the EA overlords.

Apex Legends is still going strong, however, if we look at player count statistics on Steam, we can see that the peak was reached in January of ’23 and ever since then it’s been going down. People are losing interest. I haven’t logged into the game in months. I think the BR genre is getting a little stale right now and I would like to see something new available soon. Every new season or a collection event brings back players, but the company cannot keep these players entertained for long and the numbers come back down.

Apex Legends Steam Player Count (Steam Charts)

Briefly on Financials

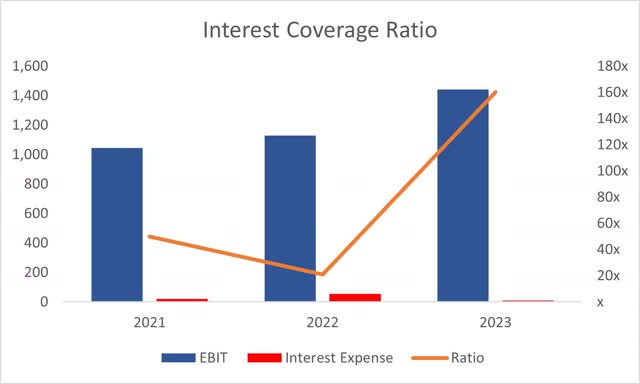

Cash on hand stood at around $2.4B and $340m in short-term investments, against $1.8B long-term debt. The interest expense on this debt is very low seeing that EBIT can cover this 160 times over, so leverage is definitely not an issue for EA.

Interest Coverage Ratio (Own Calculations)

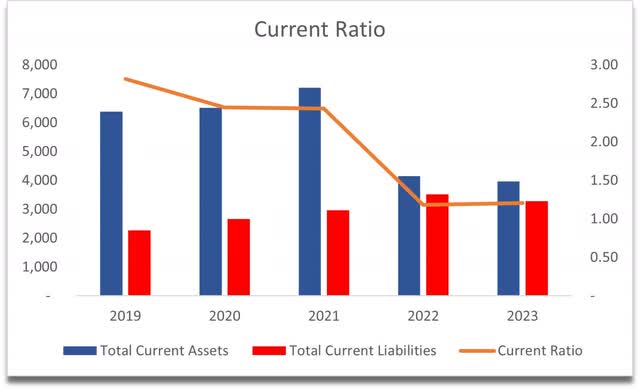

The company’s current ratio is decent as of FY23. In the past years, it has been higher, however, the ratio of 1.21 still indicates that the company does not have any liquidity issues and is capable of paying off its short-term obligations with ease.

Current Ratio (Own Calculations)

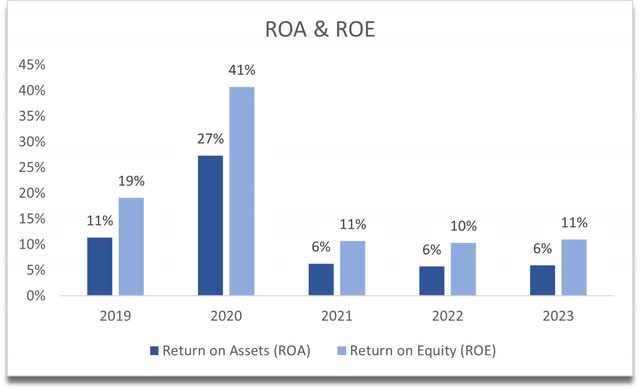

Looking at the company’s efficiency and profitability, we can see that ROA and ROE have dropped quite considerably in the last 3 years and are hovering at around my minimum requirements, which is still decent, but if you have the historical numbers, one might want to get back to such efficiency again. ‘20 numbers are not very realistic because it was the COVID effect when everyone was spending money online, and video game companies did very well.

ROA and ROE (Own Calculations)

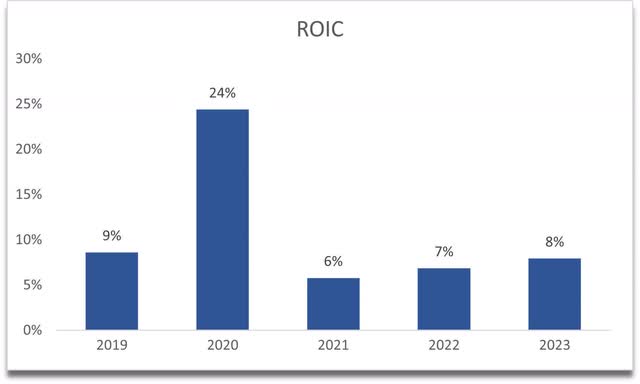

In terms of return on invested capital, we can see a similar situation, however, the last 3 years of returns are still acceptable in my opinion. This shows me that the company has some competitive advantage and a strong moat.

ROIC (Own Calculations)

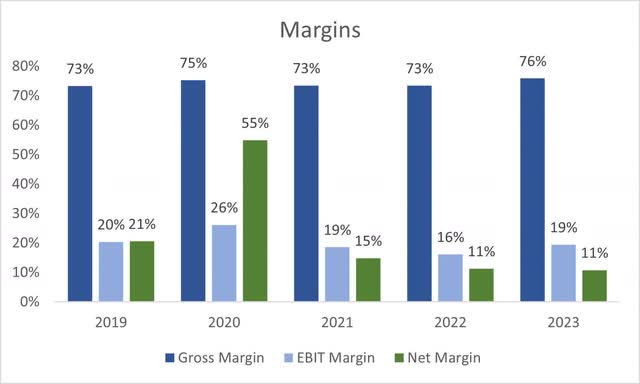

I like the company’s margins for the last 5 years. I could see slight improvements going forward as the company finds more ways to cut costs, maybe with future implementations of AI.

Margins (Own Calculations)

Overall, I can see the company is being managed quite nicely. I haven’t seen any red flags in the last 5 years of financials. The management knows how to run a business in the gaming industry.

Valuation

I decided to approach the company’s valuation linearly, just because the spikes in growth will be followed by stable growth or even troughs, which over the long run average out.

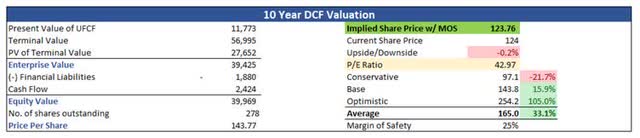

For the base case, I went with around 8% CAGR revenue growth over the next decade. For the optimistic case, I went with around 12% CAGR, while for the conservative case, I went with 6% CAGR. I feel like these might still be on the conservative side of estimates, but it’s better to be safe than sorry.

In terms of margins, I went with around 200bps or a 2% improvement on gross and operating margins over the next decade, which will bring net margins from around 11% in FY23 to around 18% by ’33. I think this is reasonable because just in FY19, the company’s net margins stood at around 21%.

On top of these estimates, I will add a 25% margin of safety which is the minimum I add to any intrinsic value calculation. This only increases if I don’t like something about the company’s financials. With that said, EA’s intrinsic value is $123.76, implying that the company is priced fairly.

Intrinsic Value (Own Calculations)

Closing Comments

It seems that with the assumed growth and margin improvements, the company is priced fairly and will reward investors in the long run even at a PE ratio of 43. To be honest, I was surprised that the company is not overvalued when I saw that PE ratio. The company’s profitability is what makes it a good investment in my opinion and with even slight improvements in the future, the company seems to be a buy right now. Of course, you have to take into account the macroeconomic headwinds that we will see, coupled with high inflation and interest rates, there may be a better entry point soon.

If EA will let their developers take control of their creations, we will hopefully avoid seeing shutdowns in the future. Let the developers focus on creative games and experiments while EA rakes in the dough from its sports and mobile franchises.

I will keep a watchful eye on the company to see how the development of new games continues and if there will be any other announcements of games in the near future. We can see that the company can make money hand over fist and I don’t see this cash machine stopping any time soon.

Read the full article here