Warren Buffett states, “Uncertainty is the friend of the buyer of long-term values,” and Washington represents a big question mark these days for the pharmaceutical sector.

After all, news broke a week ago that Bristol Myers Squibb

BMY

MRK

Bristol Myers and Merck b0th contend that the law violates the Constitution, with the former stating:

Since the IRA’s inception, we have expressed serious concerns about the impact this program will have on research and development and future innovation that can help patients prevail over serious disease. It has already changed the way we look at our development programs in oncology and beyond, whether it’s a decision to advance a new medicine or pursue additional indications for an existing one. This program is bad for innovation—and, in turn, the millions of patients who are counting on the pharmaceutical industry to develop new treatments and cures that save lives and improve health and wellbeing. It also violates the United States Constitution, in at least two ways.

First, the IRA violates the Fifth Amendment, which requires the government to pay a reasonable amount if it takes property for public use. The IRA does this by requiring BMS and other pharmaceutical companies to provide innovative medicines to third parties at prices set by the government, without any requirement that those prices reflect fair market value.

Second, the IRA violates the rights of free speech that are guaranteed by the First Amendment. The IRA makes manufacturers of innovative medicines state publicly that the government’s price setting is a true negotiation that resulted in a fair price, even if it was not. The First Amendment protects citizens from just this sort of forced speech.

Just days after the Bristol filing, the Pharmaceutical Research and Manufacturers of America, or PhRMA, filed a complaint in U.S. District Court for the Western District of Texas. PhRMA asserted that the drug price negotiation program is “unconstitutional,” and “a government mandate disguised as negotiation.”

POLITICAL INTRIGUE

I acknowledge that drug prices in the U.S. are high and a large third-party buyer should be able to use its purchasing power to negotiate discounts for customers’ best interests. At the same time, I think there are legitimate concerns that such efforts to control prices could adversely impact the level of research and development of lifesaving and life-improving medications.

Far too many compounds don’t pan out, while patent cliffs and the threat of biosimilars often awaits blockbusters. I might also wonder if we would still be in the middle of the pandemic without Merck, Pfizer

PFE

JNJ

GILD

Obviously, drug pricing is a political hot potato and the interplay between the companies in which I invest and Washington is not without consequence, but I always endeavor to make logical and unemotional investment decisions.

I can’t ignore that the new law extends beyond Merck and Bristol Myers to many other major pharmaceutical companies, with the initial drug price reduction process set to begin in September when Uncle Sam identifies the 10 most costly drugs. Following “negotiations,” the new pricing would go into effect in 2026.

However, as the Oracle of Omaha also points out, “You pay a very high price in the stock market for a cheery consensus,” while I am old enough to remember the fantastic returns afforded stocks like BMY following the collapse of the Clinton Administration’s Health Security Act of 1993 and its attempt to control drug pricing.

BRISTOL MYERS SHARES ARE UNDERVALUED

Blood clot drug Eliquis, sold by both Bristol Myers and Pfizer, is likely to face price controls under the IRA. The drug brought BMY nearly a quarter of its revenue in 2022 and is expected to peak at $13 billion by 2026, when the legislation is targeted to come into effect. Eliquis cost the U.S. government more than $12 billion in 2021 according to the Centers for Medicare & Medicaid Services.

Then-BMY-CEO Giovanni Caforio told the Financial Times last November that the legislation had initiated a portfolio review within the company to determine whether to halt development of new therapeutics or new indications of existing drugs. He cited Oncology as an area that would be most affected. Bristol’s cancer drug Opdivo is not far behind Eliquis in terms of revenue and has a similar growth trajectory.

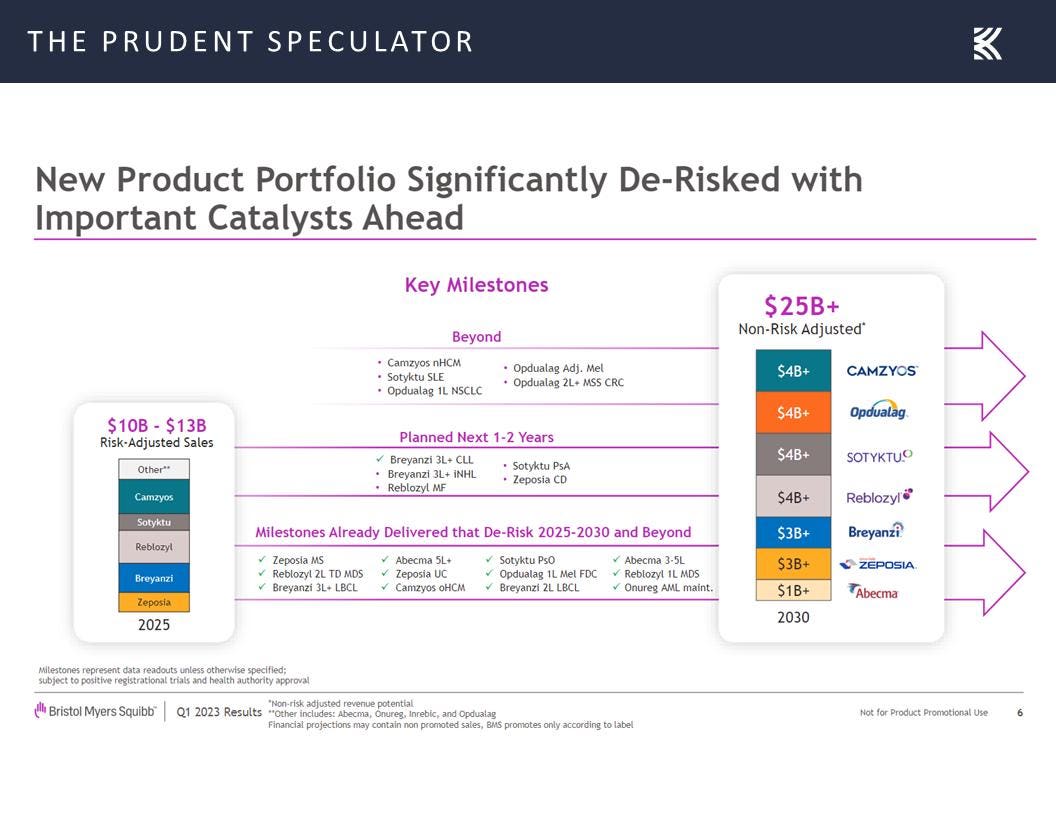

Nonetheless, as of late-April, the company said it had over 50 compounds in development. Bristol also has launched nine new medicines in the past two years across areas of significant unmet need, including Camzyos (cardiomyopathy), Opdualag (melanoma), Zeposia (MS and UC) and Sotyktu.

When asked at a recent industry conference last week about whether IRA might affect future research efforts, a BMY representative said, “I would say, no. I think we will continue to push innovation and push cell therapies, where we think we can have curative intent, and IRA is not changing kind of our pursuit of that aspiration.”

Shares are down nearly 10% year-to-date, putting the forward P/E multiple at 8 and the dividend yield at 3.5%. My long-term Target Price for BMY is currently $100.

Read the full article here