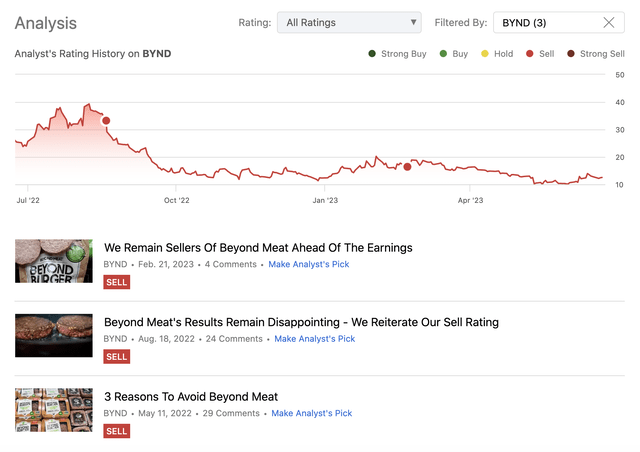

Beyond Meat, Inc. (NASDAQ:BYND) manufactures, markets, and sells plant-based meat products in the United States and internationally. Up till now, we have published three articles on Seeking Alpha about the firm, rating its stock as “sell” each time.

Rating history (Author)

Our main arguments for the bearish thesis have been:

- Lapping partnerships and frequent management changes

- Poor financial performance

- Challenging macroeconomic environment and increasing competition

Today, we will be revisiting Beyond Meat and we will take a look at the recent developments around the firm, while also discussing its profitability and efficiency.

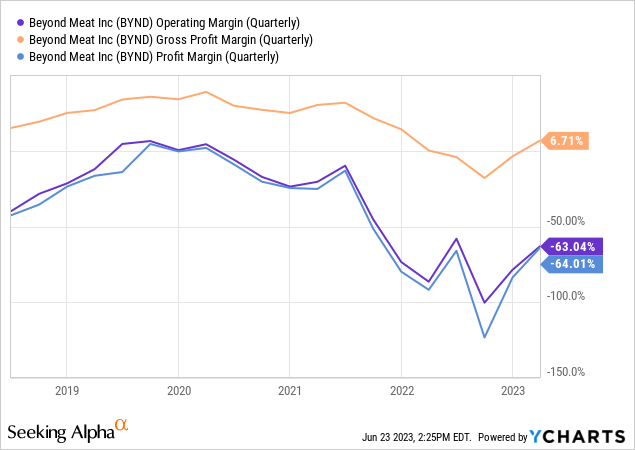

Profit margin

Normally, we do our profitability evaluation based on the net profit margin. But BYND does not have earnings, therefore using net profit margin may not be the most appropriate metric for our evaluation and for comparison.

The following chart shows the gross-, operating- and net profit margins for reference. Important to recognize that over the past five years BYND’s profitability has not improved.

While there has been an upward trend developing in the recent quarters, the readings are still below the firm’s 5Y averages. In general, we would like to see improving profit margins, especially if the firm is unprofitable. To see the path to profitability is always a good sign, however for BYND we do not currently see it yet.

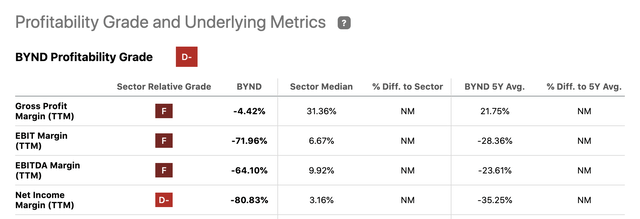

Profitability (Seeking Alpha)

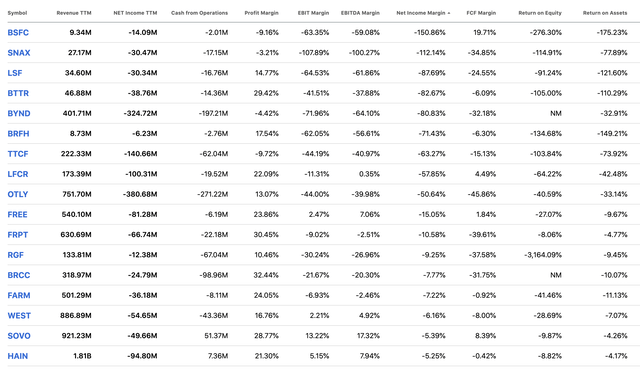

When we compare BYND’s figures with the respective sector medians, instead of its own 5Y history, the picture looks even worse. Now one may argue that in the consumer staples sector there are many companies, which are not comparable to BYND in terms of business profile, so we have decided to choose a narrower peer group for a fairer comparison.

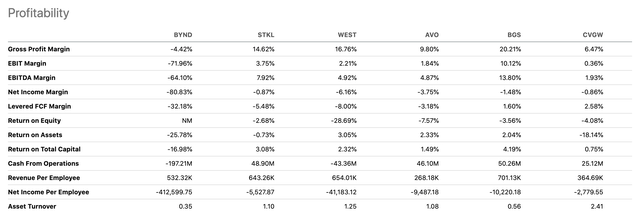

Comparison (Seeking Alpha)

Even when we compare BYND’s profitability to a narrower peer group, BYND’s figures look unfavourable. According to all profitability metrics, BYND appears to be the worst performer in this group.

To eliminate the appearance of biased peer group selection, we have looked at all the unprofitable companies from the packaged foods and meats industry. The comparison can be seen in the table below. Even among the unprofitable companies BYND’s metrics look unattractive.

Comparison (Seeking Alpha)

Although we have seen profitability slightly improving in the recent quarters, we would like to see the firm generating positive earnings before we could have a more bullish view. For these reasons, from a profitability point of view, we cannot justify upgrading the stock from “sell”.

We have to mention here that BYND’s stock has seen a sharp increase in June, which has been partially driven by the announcement of a new sausage product. While this may indeed boost sales in the summer grilling season, we believe its impact on the overall financial performance and profitability is highly uncertain.

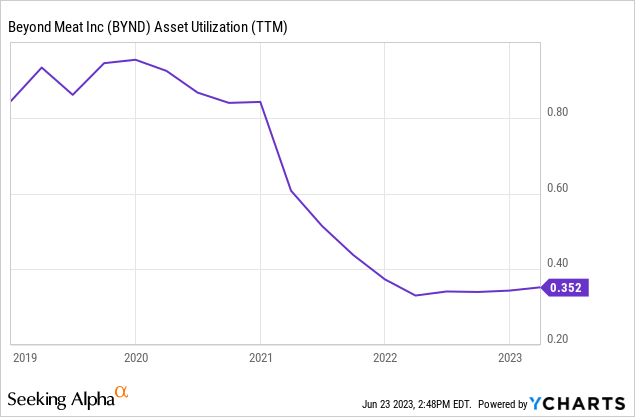

Asset turnover

Asset turnover, or asset utilization, is a measure of efficiency. This metrics is the ratio between revenue and total assets, and essentially shows how effective the firm is in using its assets to generate sales. Just like with profitability, we like to see this metric improving or staying stable.

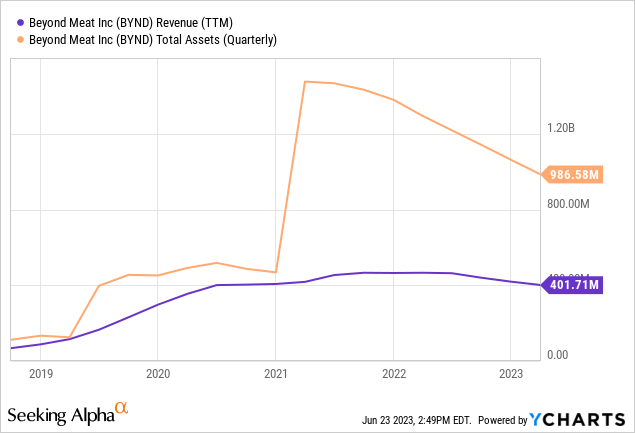

The chart above shows that asset utilization has significantly deteriorated over the past five years. While sales have declined slightly in the previous quarters, the primary reason for the decline has been the sharp jump in total assets.

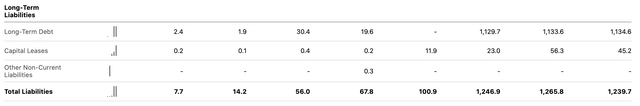

This jump can be associated with the significant increase of the long term debt in 2021. While the total assets have been declining since the peak in 2021, it has not resulted in a positive change in terms of the efficiency.

Long-term liabilities (Seeking Alpha)

Now, this change in total debt takes us our last point.

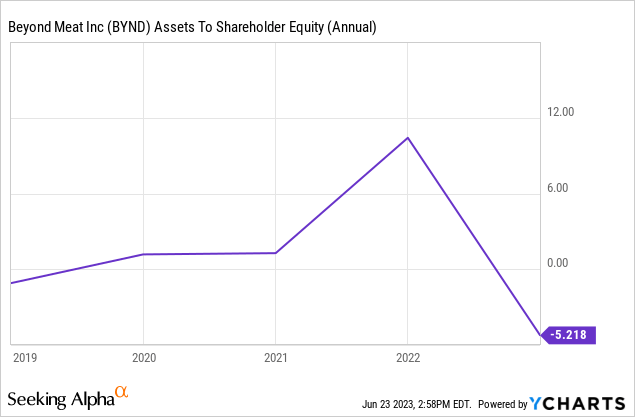

Equity multiplier

The equity multiplier shows, how much of the total assets are supported by equity. It is an indication of the firm’s capital structure and shows how the firm finances its operations – by debt or by equity.

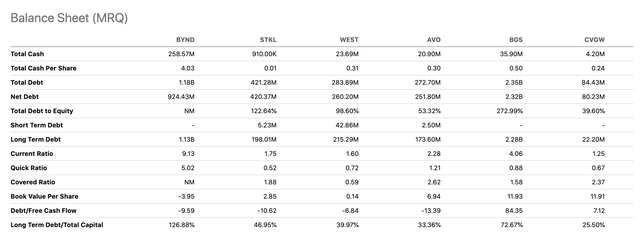

Just as mentioned above, the amount of debt has significantly jumped in BYND’s capital structure in 2021. Comparing BYND to its peers from a capital structure perspective also does not make the firm an appealing investment candidate. The company has substantial amount of debt in the capital structure, which in the current high interest rate environment may turn out to be critical, especially if it needs to be refinanced in the near future.

Balance sheet comparison (Seeking Alpha)

On the other hand, from a liquidity perspective the company appears to be well-positioned as its current- and quick ratios are well above one, 9.1 and 5.0 respectively.

Our takeaways

Beyond Meat does not appear to be an attractive investment opportunity from a profitability and efficiency perspective. Over the past half decade neither of these measures has shown meaningful improvement. Further, the amount of debt in the capital structure may also turn out to be an additional source of risk in the current market environment.

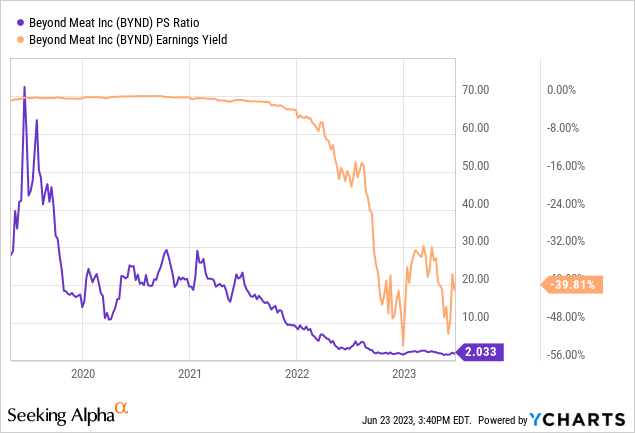

Over the past years, however, BYND’s stock price has fallen significantly. As a result, the stock’s valuation also became more reasonable, with the P/S ratio falling as low as 2. Note, that this value is still about double of the respective sector median value.

For these reasons, we still cannot justify buying BYND stock, even at this lower valuation.

We maintain our “sell” rating.

Read the full article here