Microsoft Corporation (NASDAQ:MSFT) is one of the largest technological companies in the world with a market capitalization of more than $2.5 trillion. However, that massive size isn’t supported by cash flow, even with the company’s growth. Going forward, we expect the company will struggle to continue growing its shareholder returns.

Microsoft FY23 Q2 Financial Results

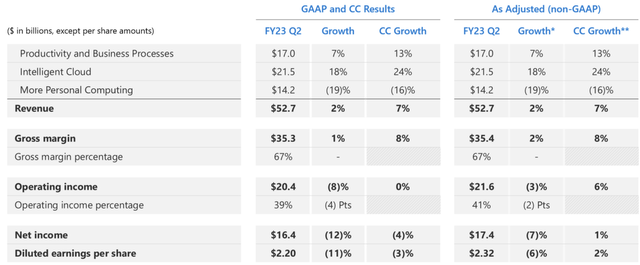

Microsoft generated reasonable financial results for the quarter, but was impacted by the personal computing slowdown.

Microsoft Investor Presentation

The company earned $52.7 billion in revenue for the quarter with 2% growth. That’s because the company’s business was supported by its cloud results despite substantial weakness in personal computing. The company’s net income of $17.4 billion was down 7% YoY and the company’s annualized EPS is almost $10 / share.

That gives the company a P/E of just under 35, or a yield of less than 3%. That’s a tough yield for the company to be able to continue its growth with.

Microsoft FY23 Business Performance

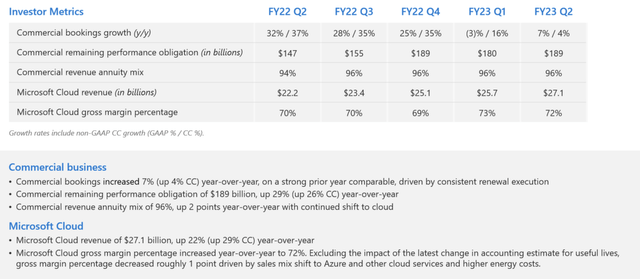

The company’s business shows substantial weakness in multiple segments.

Microsoft Investor Presentation

The company’s bookings growth rate has declined substantially. The company’s FY22 growth was more than 30% YoY but in 2023 that growth has dropped to the single-digits. The company’s remaining performance obligations of $189 billion are the same as they were in FY22 and they show minimal sign of continuing their growth.

The company’s cloud business remains strong. That’s what carrying its business at this time. Revenue of $27.1 billion was up 22% YoY while margins have remained strong. QoQ margins have declined slightly. If anything happens to the company’s cloud business, which has massive competition from Amazon (AMZN) and Alphabet/Google (GOOG), it could suffer substantially.

Microsoft Shareholder Returns

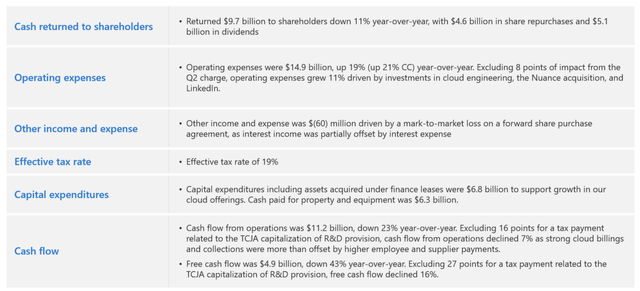

The company’s strong financial position means it can generate substantial shareholder returns, but not enough to justify its valuation.

Microsoft Investor Presentation

The company returned $9.7 billion to shareholders in the quarter, down YoY. Annualized that’s a yield of <2%. The company’s dividend yield is 0.78% and its share repurchases are below that. The company has steadily reduced outstanding shares over time, however, that rate has dropped to 1% or less annualized.

Part of that is the company’s almost $8 billion in annualized stock-based compensation, that it needs to solve first with repurchases. Only once that $8 billion is spent do the actual shareholder rewards begin, the rest is an expensive. The company’s free cash flow (“FCF”) declined 16% YoY, excluding unexpected tax payments, but that still puts post-RSU FCF at <$30 billion / year.

That’s simply not enough for a $2.6 trillion corporation.

Microsoft Cloud Growth

It’s worth noting that despite Microsoft’s lofty valuation, the company’s growth won’t make it up.

Microsoft Investor Presentation

The company’s cloud revenue remains the majority of its growth. Here the company has almost $9 billion in operating income, while revenue has grown at double-digits. The company’s QoQ decline in operating income and 6 month stagnation while revenue has grown shows that margins are being threatened for the company.

Google has recently sued Microsoft arguing that Microsoft’s other business lines have enabled it to unfairly grow its cloud unit. We expect the growth rate of the company’s Azure unit to continue declining hurting its ability to carry the rest of the portfolio.

Thesis Risk

The largest risk to our thesis is actually trust related. Microsoft is the only one of the large tech companies to have won its lawsuit in the late-90s against the U.S. government for anti-trust issues.

That means versus other tech companies that are at risk of being broken up, or have numerous lawsuits against them, the company’s position is much stronger. That could enable it to undergo acquisitions, etc., that other large tech companies are not able to, improving its returns, and enabling it to grow faster than competitors.

Conclusion

Microsoft Corporation is an enormous company that’s been on a run with big-tech share prices. YTD, the company’s share price is up roughly 40%. That’s pushed the company’s market capitalization from $1.8 trillion to $2.6 trillion, with no substantial earnings growth as a result. The company’s FCF, especially counting in share dilution remains low.

The company’s enormous scale means it’s a slow moving giant. With a recent Google lawsuit and increased competition, we don’t see Azure growth continuing. The scale needed to increase FCF to justify Microsoft’s valuation is unreasonable in our view, and as a result, despite the company’s strong nature, it’s a poor investment at its current valuation.

Let us know your thoughts in the comments below.

Read the full article here