I have been following the order and news flow of the Paris Airshow for subscribers of The Aerospace Forum, and, without doubt, the second day of the airshow was the “big day” for original equipment manufacturers. However, one of the things I have been looking forward to was not a particular order, but the Investor Day for Raytheon Technologies Corporation (NYSE:RTX), where they provided more details on their restructuring and medium-term targets which I will look at in this report.

The Raytheon Investor Day: A Convincing and Realistic Path

I have followed Investor Day conferences for various companies, and if there is one thing I have learned from them, it is that the management projections should not be taken at face value. They should be scrutinized heavily to assess whether the projections in fact are realistic. Years ago, I saw how Bombardier (OTCQX:BDRAF) put up rosy expectations that left no margin for error, and as things progressed slower than expected the company had to sell off some of its business segments. So, that is not a great way to project.

In November last year, I analyzed the Investor Day of The Boeing Company (BA) and while there are challenges ahead on the mid-term, the projections were solid. The market also perceived it as such, putting the stock price significantly higher and almost doubling the positive market performance. Having viewed the 3+ hrs webcast for the Raytheon Investor Day, I have to say things look well and the story to expand margins and free cash flow is even stronger than what we saw with Boeing.

Raytheon Technologies, which has rebranded itself as RTX, also needs it. I have had a buy rating on Raytheon Technologies for over two years, and the stock price has performed favorably compared to the broader market. However, more recently that performance has been a whole lot less favorable, and that demanded some action from management – and they did exactly that.

A Strong Path Ahead For Raytheon

Raytheon Technologies

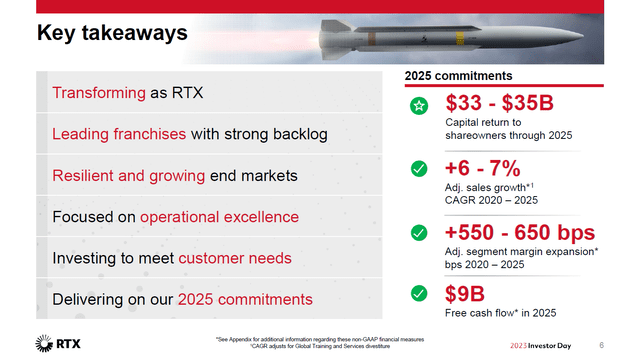

The slide above shows the key takeaways from Raytheon Technologies obviously what stands out is the 6 to 7 percent growth, which combined with a 550 to 650 basis margin expansion should drive free cash flow to $9 billion by 2025, which will fuel the company’s capital return to shareholders. That is the easy way to look at the investor day, but we also have to look at what drives the growth.

One item that should significantly drive the results is improved efficiency. That is achieved by realigning the business. Starting from the second half of the year, Raytheon Technologies will report in three reporting segments namely Collins, Pratt & Whitney and Raytheon. Raytheon Intelligence & Space segment will transfer several units to Collins Aerospace while Collins will transfer its Intelligence, Surveillance and Reconnaissance business to Raytheon Intelligence & Space. Subsequently, the Intelligence & Space and Missile & Defense will be merged into Raytheon. This combination of several segments should provide a simplified company structure where businesses within the segment are placed where they make most sense from efficiency perspective as well as for customers.

Secondly, the company is going big on digitization. That holds for digital services to provide more predictable and cost efficient solutions, while within its production capacity more machines will be connected and automated enabling higher productivity. In other words, the company will be able to increase production without making significant investments for that. Instead of investing in new machines, investments will be made in the existing machines to increase production capacity. Furthermore, the company aims for reducing the design cycle time through digitization.

This gives us three of four key drivers to Raytheon’s growth plan, which will add another $500 million in cost savings:

- Digital transformation on product and design level.

- Productivity increases through digitization and automated processes.

- Business combination.

The Strongest Driver: Leveraging the Product Portfolio

The third driver really is about the core of the business, which is the product portfolio. To make a strong business with growth you need to have a strong product portfolio, efficient value extraction, and growth in the end-markets either by growing demand or market share capture.

Raytheon Technologies

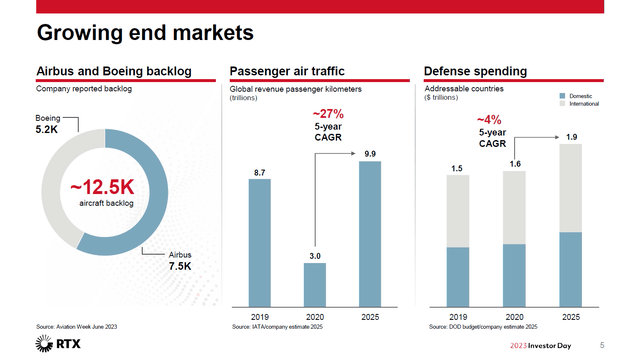

Looking at the end markets, we see that those end markets are growing nicely in the coming years with a 27% CAGR for passenger air traffic. Impacted by the pandemic, this CAGR is impressive. Rebasing to 2019, the total growth will be 13.7% for passenger traffic. In Defense, the spending will have a 4% CAGR and a 27% total growth from 2019 levels which is obviously driven by the war in Ukraine and the situation with China. Either way, we see strong growth in both end markets.

In the commercial aerospace sphere, higher production rates will be driving the OEM sales while the global recovery of flight activity will drive services and parts revenues. For Collins, the installed base and push for digital solutions will drive 10% of sales growth per annum for fleet upgrades while 10% annual growth comes from higher production at OEMs and 8% annual growth in sales due to out of warranty hours. Furthermore, continued investment in the Geared Turbofan to bring customers the Block D upgrade and two additional packages in the coming years will improve durability and positively enhance margins on service contracts for the GTF.

The Geared Turbofan, which powers the Embraer E2 (ERJ) and Airbus A220 and Airbus A320neo (OTCPK:EADSF), has been in the news quite a lot lately as many airlines have been forced to ground airplanes. Raytheon did point out that this is an industry issue and not a technological one. To some extent I agree, as long turnarounds at MRO facilities are causing the grounding of some GTF powered jets and Raytheon is increasing the number of MRO facilities to 19 to handle this. However, the block upgrades while fitting in the normal course of improving the engine are also showing that there are some technological issues, especially in hot environments. Those are the most challenging environments for air breathing engines.

So, I would say there are some technological issues that need to be addressed and did cause groundings of some airplanes next to the groundings driven by part shortages. Either way, with upgrades to the engine, Pratt & Whitney is able to optimize contract margins and likely also control pricing over the longer term, and this is a significant long-term program that could have 40 years in after-market sales.

In Defense, the company is developing advanced capabilities that do not only focus on supporting evolving demand for digital battlefield solutions, but also on advanced capabilities such as hypersonics providing Raytheon with strong long-term oriented platforms while it is moving away from lower margin development programs as those programs are shifting into higher margin production phase and the company is also able to better price their contracts in the defense as well as the commercial aerospace sphere with defense contracts being less fixed-price focused.

Overall, the company did disclose two pressures. One is for the GTF where wrong material use by a supplier will result in lower than anticipated deliveries during Q2 and the other one is the option exercise of a defense contract that could be a net unfavorable exercise for the business.

So putting it all together, we have a strong demand environment for the mid to longer term, significant expansion in digital solutions to drive sales and efficiency, improved business productivity, a huge installed base of commercial airplanes that require servicing, and higher production rates at the OEMs that drive higher OEM sales and future aftermarket sales and better contract mix – all of which is supported by an attractive product portfolio.

What Does This Mean For Raytheon Stock Price?

Quite often, I see analysts analyzing the business solely looking at numbers and not what drives the numbers and provides support to projections, which is what I did in this report. The big question, of course, is what all of that means for Raytheon’s stock price. At $9 billion projected free cash flow and 1.46 billion shares, it would bring the free cash flow per share to little over $6 and with an industry multiple of around 21.5x. This is lower than the current price-to-free cash flow, which is almost 50x the 2025 price target and would be $132.50. If we were to time weight this target, it would indicate a target of $114, providing 18% upside along with continued returns to shareholders in the form of share repurchases and dividends which is not baked into the target. This makes Raytheon extremely attractive in my view.

Conclusion: Right Product, Right Path Creates Upside

Raytheon Technologies Corporation’s recent stock performance has been underwhelming, but the company has recognized this and put together a plausible plan that better leverages the company’s product portfolio for value extraction in a high demand environment. It has a big installed base that drives aftermarket sales, while we see better pricing in end-markets and contract expansion driven by continued development of products.

All of that also seems to be positively impacting the upside to Raytheon Technologies Corporation stock, which is 18% when corrected and 37% by 2025, not including the added value of share repurchases or appeal from dividend growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here