Despite initially plunging after reporting earnings, Twilio (NYSE:TWLO) has somehow caught fire. Revenue growth has come to a near stand-still, with a tough macro environment being the source of blame. Yet the stock has been trading at undemanding valuations for quite some time, which together with management’s commitment to boosting profitability appears to have generated speculation for a potential takeover. An activist investor is involved and while there is no guarantee of any such result, the stock valuation remains undemanding even after the recent rally. I reiterate my buy rating for the stock though caution that unless takeover hopes come to fruition, there is not much to hope for in terms of near-term catalysts.

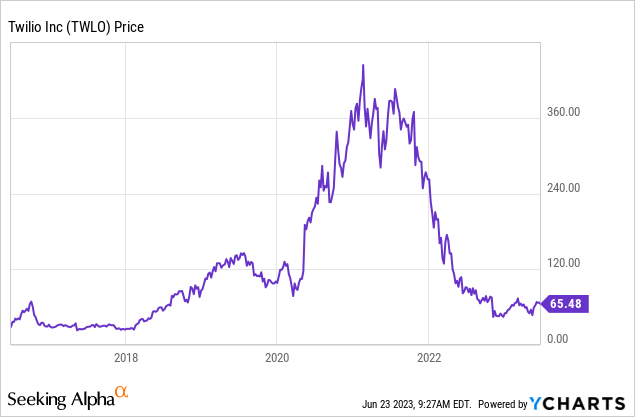

TWLO Stock Price

TWLO remains far below all-time highs, but at this point, it is clear that the stock never should have traded that high in the first place. At this point, investors should not be wondering about when TWLO stock might return to all-time highs, but “if,” as the growth story appears on pause amidst a tough macro environment.

I last covered TWLO in April, where I rated it a buy due to the low valuation and focus on profitability. The stock is up double-digits since then, and I continue to see upside though the path is anything but clear.

TWLO Stock Key Metrics

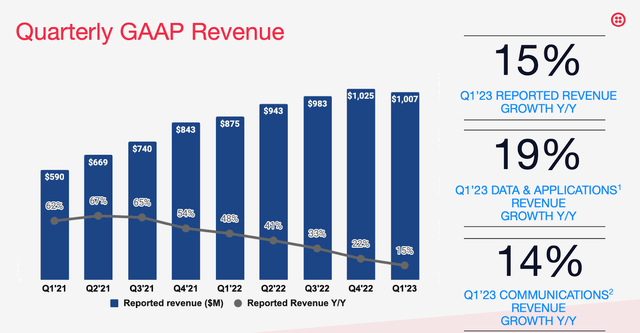

In its most recent quarter, TWLO delivered 15% YOY revenue growth to $1.007 billion, slightly ahead of guidance for $1.005 billion.

2023 Q1 Presentation

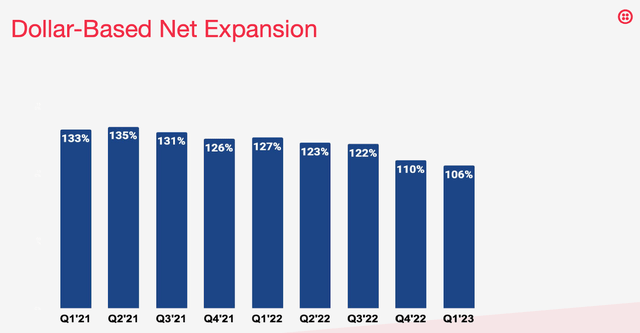

This was once a company projected to sustain at least 30% growth for many years. Amidst a tough macro environment, its dollar-based net expansion rate declined to 106% – illustrating the double-edged sword of the consumption based pricing model.

2023 Q1 Presentation

The lone bright spot was that the company continued to deliver improvements in profitability, with non-GAAP operating income jumping to $103.8 million, up from $5 million in the prior year’s quarter. TWLO ended the quarter with $4 billion of cash versus $1 billion of debt, representing a net cash position still making up over 20% of the market cap.

TWLO had previously announced a $1 billion share repurchase program, of which it has repurchased around $250 million as of the end of the quarter. Management stated intentions to complete about $500 million in total by the end of this quarter.

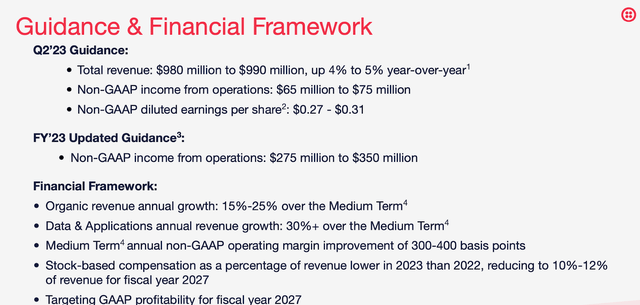

Looking ahead, management continues to guide for minimal top-line growth, with revenue expected to grow by only 5% YOY. Management did increase its guidance for profitability, with non-GAAP net income now expected to total between $275 million to $350 million for the full year, the low end of that guidance is up marginally from the prior guidance of $250 million.

2023 Q1 Presentation

On the conference call, management blamed the slowing growth on the tough macro environment, including the fact that the company is lapping peak crypto usage. Besides headwinds from crypto, management also cited headwinds from e-commerce as consumer-facing use cases are seeing decreased usage in the current environment. Management stated that they aren’t seeing elevated churn or market share losses, but I suspect such commentary offered little comfort to investors.

Management stated that artificial intelligence should be an accelerant to their business but judging by how the stock performed immediately following the report, it is clear that Wall Street isn’t so easily convinced. While it may seem like a reiteration of broken promises, management exuded confidence that their ongoing organizational changes should enable them to “re-accelerate bookings later this year and achieve our medium-term targets.” Recall that their medium-term target called for 15-25% revenue growth.

Is TWLO Stock A Buy, Sell, or Hold?

TWLO stock has since apparently recovered from the post-earnings collapse, bolstered by not only a broader tech rally but also by speculation regarding potential takeovers. That speculation has undoubtedly been boosted by reports that activist investor Legion Partners has been communicating with the board. Such a development shouldn’t be too surprising given that TWLO stock trades at a sizable discount to tech peers, with its stock trading at around 3x sales and 6x gross profits.

Seeking Alpha

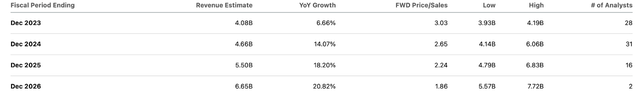

This isn’t a name which has traditionally generated profits but management has shown a strong commitment to margin expansion and consensus estimates reflecting that, with the stock trading at around 17x 2026e earnings.

Seeking Alpha

If TWLO can re-accelerate growth even to the 15% medium term target, then assuming 20% long term net margins and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see the stock trading at 4.5x sales, implying around 50% potential upside. If the company can re-accelerate growth to 25%, then the stock can trade as high as 7.5x sales, implying triple digit potential upside.

What are the key risks? The problem is that it is anyone’s guess when the tough macro environment improves, and it also is not immediately clear that macro is the only problem at play here. At this point, it is not unreasonable to wonder if management has issues coming up with growth forecasts given the dramatic fall from grace. I also wonder if artificial intelligence might not prove to be the positive force that management is expecting but instead proves to be a tail-end risk – would generative AI make creating a competitive offering easy for customers? If growth does not return, then I could see the valuation coming under pressure as a price to sales multiple or under 2x would not be out of the question. Moreover, due to profitability having great reliance on operating leverage over the long term, the stock may sell off violently, though the large net cash position may help buy some time. An investment in TWLO hinges on a return to double-digit growth, anything short of that will likely prove insufficient for satisfactory returns. The counterargument to that is the possibility that the company can cut enough costs to boost profits that way, but there are only so much costs that can be removed without impairing the growth outlook. While it is admittedly difficult to state with any sort of certainty that a return to growth is around the corner, the valuation is modest enough to keep me along for the ride – I reiterate my buy rating but note the lack of near term catalysts.

Read the full article here