Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 8th, 2023.

The Blackstone Strategic Credit 2027 Term Fund (NYSE:BGB) has benefited from higher interest rates through distribution increases. This is because the fund is mostly comprised of senior secured loans, also called floating rate loans. As the Fed has been increasing interest rates, the yields on these loans have been floating higher as they are mostly based on a benchmark rate plus a spread.

Therefore, as rates have been increasing, the income generation of the underlying portfolio has also been increasing. That has been passed onto shareholders through higher monthly distributions. BGB evaluates the distribution amount each quarter and sets the rate consistent for those three months.

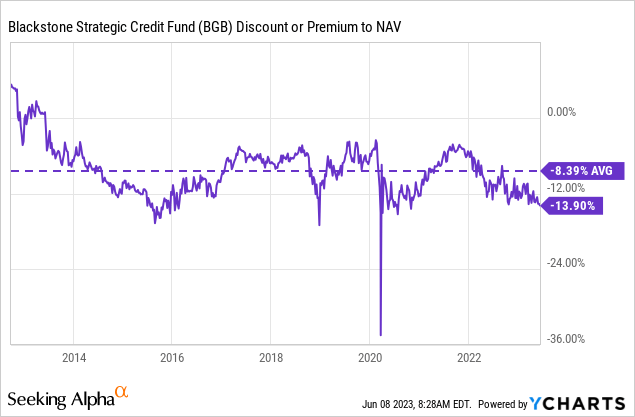

While senior loans have been benefiting this fund, the fund has also begun to trade at a deep discount. As a term fund, that offers another potential catalyst for alpha relative to other senior loan funds that aren’t term structured.

The Basics

- 1-Year Z-score: -1.59

- Discount: 13.90%

- Distribution Yield: 10.02%

- Expense Ratio: 2.29%

- Leverage: 36.49%

- Managed Assets: $860.1 million

- Structure: Term (anticipated liquidation date September 15th, 2027)

BGB has an investment objective to “seek high current income, with a secondary objective to seek preservation of capital, consistent with its primary goal of high current income.”

To achieve this, the fund will; “invest primarily in a diversified portfolio of loans and other fixed-income instruments predominantly US Corporate issuers, including first- and second-lien loans and high yield corporate bonds of varying maturities.”

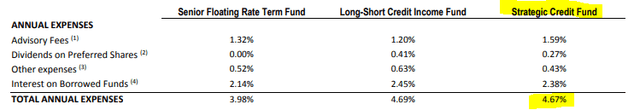

The fund’s expense ratio, when including leverage, goes to 4.67%. The fund’s expenses are on the high end, even compared to most senior loan peers.

BGB Expense Ratio (Blackstone)

While they benefit from rising rates in their underlying portfolio, it is partially offset by having their own floating rate borrowings. BGB, unlike most other CEFs, has a bit of an unusual leverage facility as it gets charged at different rates. Here’s how its described in their last annual report:

Interest on BGB’s Leverage Facility is charged at a rate of 1.00% above adjusted term SOFR with respect to BGB Tranche A Loans, 1.30% above adjusted term SOFR for one (1) month interest period BGB Tranche B Loans and 1.20% above adjusted term SOFR for three (3) month interest period BGB Tranche B Loans, with adjusted term SOFR measured for the period commencing on the date of the making of such Loan at adjusted term SOFR (or the last date upon which any other Loan was converted to, or continued as, such Loan at adjusted term SOFR) and ending on the numerically corresponding day in the calendar month that is one (1) or three (3) months thereafter, as the Fund may elect, or such other periods as the lender may agree in its sole and absolute discretion.

However, not all of their leverage is subject to increased borrowing costs under normal conditions. They also have mandatory redeemable preferred shares issued. Those currently pay at a fixed rate of 3.61%. That accounted for around $45.28 million of their leverage at the end of 2022. They had another $268.9 million from their leverage facility.

As of the last quarter, they had around $304 million in leverage, which would suggest they deleveraged a bit in the first quarter – as they had done throughout last year. At the end of 2021, they had total leverage of $369.087 million.

Attractive Discount For A Term Fund

The fund has tended to regularly trade at a deep discount, and the banking crisis around March saw the discount widen even further. This likely reflects credit risks going forward if/when we enter a recession. However, the widening discount reflects some of this being priced in now as it’s trading at a discount wider than its historical average. This fund heavily invests in below-investment-grade bonds and loans, so there are credit risks here to consider.

Ycharts

Additionally, this is a term fund that is anticipated to liquidate near the end of 2027, which means that the discount should be realized as the fund is liquidated.

The prospectus, in this case, lays out that it would require both the Board and shareholder approval to extend the term of the fund. That’s a bit unusual as, generally, the wording allows for an extension for a year or two from the Board only. In this case, it allows shareholders to have a say if the fund sees an extended life of up to two years or shorter. However, they also include that the fund’s term can be extended an unlimited number of times for a two-year period or shorter.

Pursuant to the Agreement and Declaration of Trust, prior to the date of dissolution a majority of the Board of Trustees, with the approval of a majority of the outstanding voting securities entitled to vote (as defined in the Investment Company Act), may extend the life of the Fund. If approved the dissolution date of the Fund may be extended by a period of two years or such shorter time as may be determined. However, the dissolution date of the Fund may be extended an unlimited number of times with the approval of a majority of the Board of Trustees and a majority of the outstanding voting securities of the Fund. In determining whether to extend the dissolution date of the Fund, the Board of Trustees may consider the inability to sell the Fund’s assets in a time frame consistent with dissolution due to lack of market liquidity or other extenuating circumstances. Additionally, the Board of Trustees may determine that market conditions are such that it is reasonable to believe that, with an extension, the Fund’s remaining assets will appreciate by an amount that is meaningful relative to the cost and expense of continuing the operation of the Fund.

If extended, then the discount would likely linger for longer, and investors wouldn’t be receiving NAV per share. That leaves it a bit open-ended, but as we get closer to the termination date, the discount should naturally narrow the closer we get.

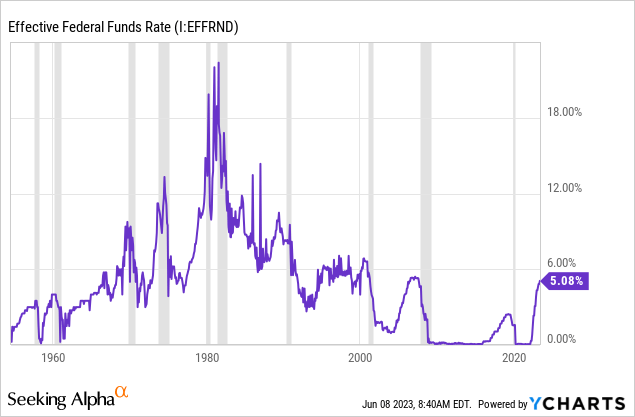

In my previous article on the BlackRock Floating Rate Income Strategies Fund (FRA), I discussed how we are kind of at an important point in the overall interest rate environment that should be considered before investing in floating rate funds. That discussion remains relevant here, too.

The outlook for interest rates is higher for longer, and that should mean that floating rate funds should continue to be fairly strong considerations. However, if rates are cut next year, we would anticipate the gains in terms of the distribution increases to reverse. Additionally, if the Fed keeps hiking, it isn’t necessarily an automatic positive. In the short term, it would likely be a positive as yields would then continue to rise, as we’ve seen over the last year.

However, it would also start to push the yields potentially too far for the underlying companies to be able to handle. Thus, we get the desired impact of a slowdown that the Fed wants. The unfortunate side effect of that is it will be from company’s starting to fail and result in a recession.

Going back in history, the Fed has never really been able to get the soft landing they are looking for. Each rate hiking cycle ends with a recession and the eventual decrease in interest rates. Therefore, higher interest rates can be a benefit in the short term, but too high, and that would ultimately have a negative impact on floating rate funds over the medium term.

Ycharts

All this being said, BGB is potentially in a better relative position compared to other perpetual senior loan funds. As the idea of being able to cash out at NAV would produce alpha, while comparable senior loan funds would probably continue to trade at deep discounts in any scenario. On top of this, the fund also has the flexibility to be “strategic,” as its name would suggest. That could mean swapping some of their floating rate exposure for fixed-rate high-yield bonds to lock in higher yields if rates are going lower.

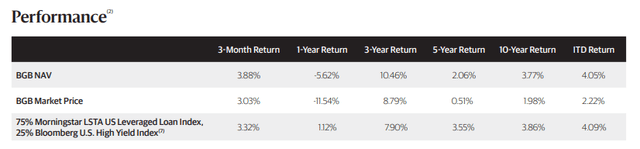

The longer-term results of BGB might seem rather lackluster, but they are consistent with the fund’s benchmark. That means even including the higher-than-usual expenses of the fund. In the more recent history, particularly focusing on the last year, the fund detracted quite materially from this benchmark. Even as their benchmark had slightly positive results, BGB’s NAV produced a negative return.

More recently, in the last three-month performance, it appears that BGB is back on track. However, note that this is from their fact sheet that was posted as of March 31st, 2023.

BGB Annualized Performance (Blackstone)

Distribution – Benefitting From Rising Rates

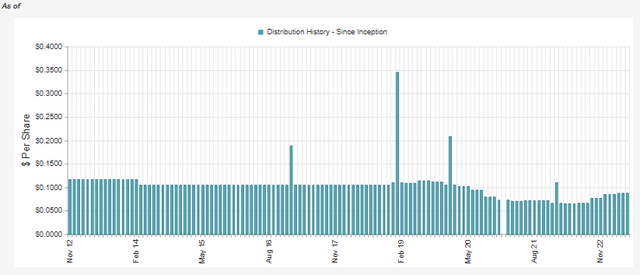

They have raised their distribution in the last four quarters thanks to the rising interest rates. Of course, while they benefit from rising rates, they also took a hit in 2020 when rates were cut to 0%. Most senior loan funds have a history of adjusting based on rising and decreasing interest rates, so the many adjustments we’ve seen in the last several years are fairly normal. It was the period prior to around 2019 that was more unusual as they held a mostly flat distribution.

BGB Distribution History (CEFConnect)

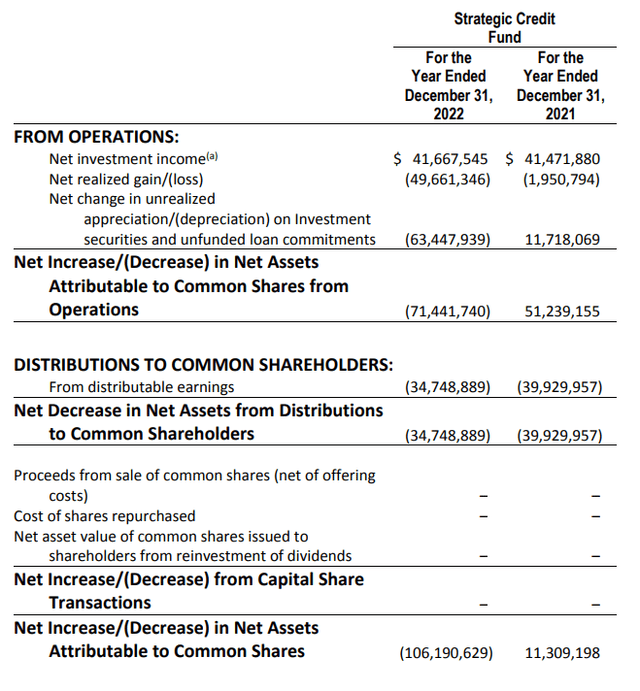

It seems that BGB was a bit slower in increasing its payout to investors. When looking at the last annual report, it seems to suggest that they weren’t benefiting from the rising rates, and that’s why they were a bit slower. On a per-share basis, they reported net investment income of $0.93 and $0.93 in both 2021 and 2022. This could have been impacted by a reduction in the fund’s leverage throughout the year, resulting in lower income generation. Additionally, the costs for the leverage facility went from around $3.8 million to around $8.134 million from 2021 to 2022.

BGB Annual Report (Blackstone)

However, that also means that the underlying portfolio was able to generate a higher income to offset that large jump in borrowing costs. Once again, reflecting the floating rate nature of the majority of the underlying portfolio. With the distribution now being increased, it would suggest the benefits are starting to kick in more for the fund.

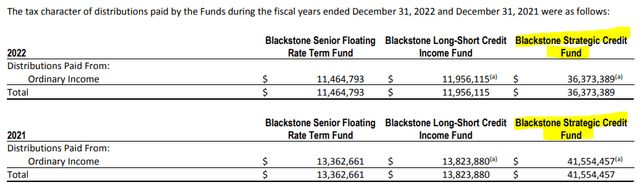

As is usually the case with a fixed-income fund, the distribution is classified as ordinary income due to the interest received from the underlying loans and bonds. That would make it more appropriate for a tax-sheltered account.

BGB Distribution Tax Classification (Blackstone)

BGB’s Portfolio

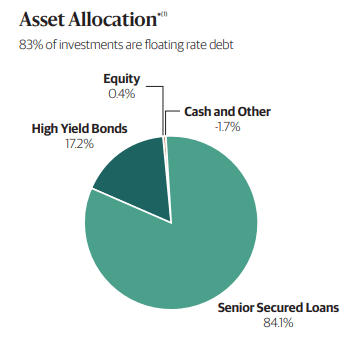

Overall, BGB’s portfolio is listed as having 83% of investments in floating-rate debt. This is largely thanks to the senior secured loan allocations that command a majority of the fund. Due to the floating rate exposure, the fund’s duration comes to a rather low of 0.77 years. For every 1% increase (or decrease) in interest rates, the fund’s underlying portfolio should move 0.77% higher or lower.

BGB Asset Weightings (Blackstone)

Besides the fund’s discount, the portfolio also comes with its discount. At the end of the last quarter, they noted in their fact sheet that the average asset price came to $93.86. Besides interest rate changes, this is also where credit risks are being priced in. As mentioned, the majority of BGB’s portfolio is listed as below investment grade. Blackstone is a leader in the alternative asset management space, and it’s certainly not something that is new to them. Being able to navigate in this space is something that they should be familiar with.

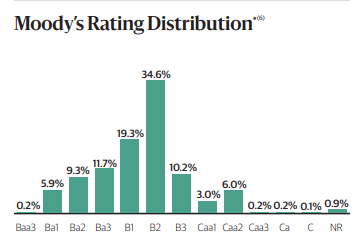

BGB Portfolio Credit Quality (Blackstone)

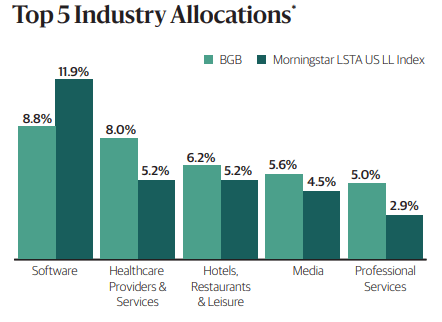

The fund is fairly diverse in terms of its allocations to various industries; providing diversification to the fund can be important when investing in junk-rated debt. It does tend to vary from the blended benchmark it seeks to track, which can result in divergences in performance that we’ve seen above in the annualized results.

BGB Top 5 Industry Weights (Blackstone)

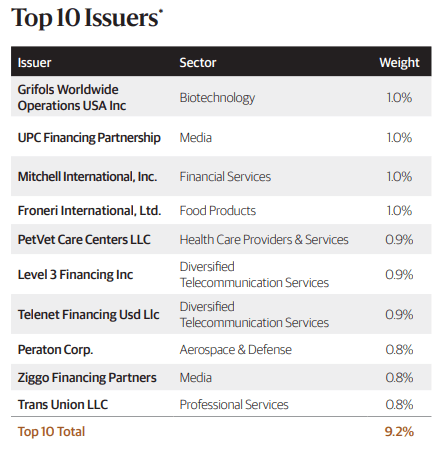

The top portfolio positions in the fund are also reflecting a low emphasis on any particular issuer. The top ten holdings come to only around a 9.2% allocation.

BGB Top Ten Holdings (Blackstone)

They list that the average position size is 0.24% overall. CEFConnect puts the number of holdings at a sizeable 453 total positions. This is also another fairly standard characteristic of funds that put a focus on junk-rated debt. By spreading assets among hundreds of holdings, it means that not only just one or two companies specifically going down could have an outsized impact on the fund.

Conclusion

BGB is offering potential investors a deep discount, as it is a term fund; that discount should be realized in the future. While we still have several years before that becomes a larger factor to consider, it can start to impact the fund the closer we get. It can produce alpha relative to other perpetually structured senior loan funds. Higher interest rates are starting to kick in for this fund as we’ve seen the distributions start to increase; this would be thanks to the fund’s heavy focus on holding senior loan funds.

Read the full article here