Triumph Financial (NASDAQ:TFIN) is a regional bank that sold off during the regional banking crisis triggered by the failures of three large regional banks. While Triumph’s common shares have recovered to their pre-crisis levels (off 3% for the year), the company’s preferred shares (NASDAQ:TFINP) are still down 20% compared to the beginning of the year. The decline in preferred shares has led to a dividend yield of 8.75%. After reviewing the bank’s financials, I opted not to purchase their preferred shares.

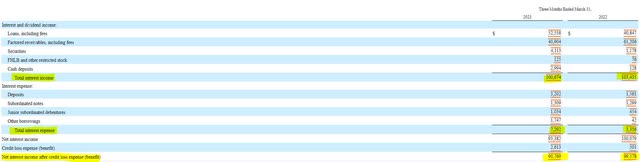

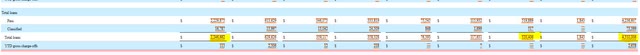

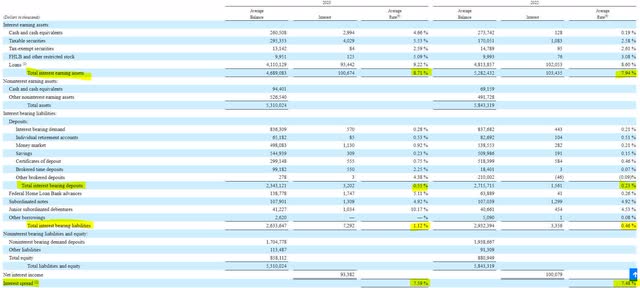

Triumph’s net interest income seemed to buck the industry trend. While several banks I’ve examined (and written about) have seen year over year increases in interest income, Triumph has seen a decline of $3 million. Interest expenses are up modestly to over $7 million, compared to $3 million from the same quarter a year ago. Put together, net interest income is down $9 million, or 10% from last year to $90 million.

SEC 10-Q

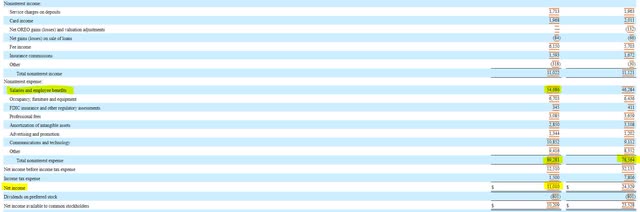

Further down the income statement, the bank saw its fixed costs rise year over year. Led by an $8 million increase in salaries and benefits, the bank’s operating expenses grew by $11 million to $89 million. Once all the income components are added in, net income for Triumph finished the quarter at just $11 million, less than half of what it was in the first quarter a year ago.

SEC 10-Q

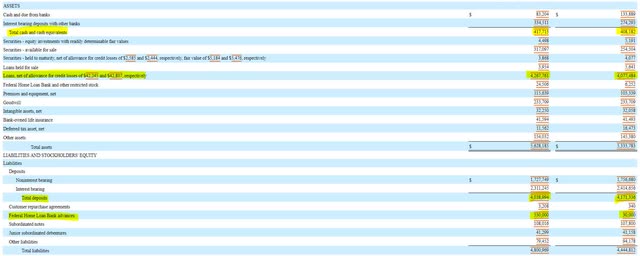

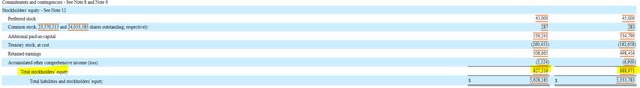

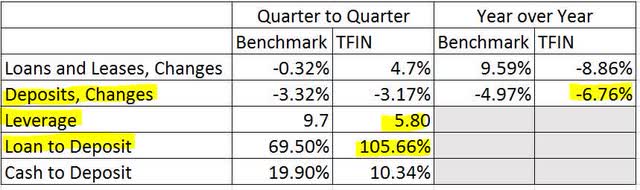

The bank’s balance sheet shows another concerning trend. During the first quarter, the bank saw its deposits decline by more than $130 million. Meanwhile, the bank’s loans grew by nearly $200 million. Where did they find the capital to originate those loans? The bank raised capital by borrowing $500 million from the Federal Home Loan Bank. The drain in deposits and the need to borrow has increased the bank’s borrowing costs and eroded its shareholder equity by $60 million to $827 million.

SEC 10-Q SEC 10-Q

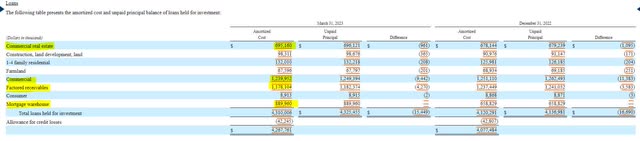

Fortunately, Triumph does not have significant exposure to commercial real estate, with approximately 15% of its loans tied up in the category. The bank does have large amounts of its loan portfolio dedicated to commercial loans, factored receivables, and mortgage warehousing. While the bank’s loan portfolio is rather diversified, it creates an additional concern.

SEC 10-Q

The mortgage warehouse and factored receivables are all short-term loans and account for more than 50% of the portfolio being originated in 2023. Yet, the bank’s interest income and net income are down, which should not be the case for all of these new loans in a higher rate environment. Furthermore, the bank’s interest-bearing assets saw their average interest rate rise more than 75 basis points to 8.71%, and the bank’s interest spread rose 11 basis points to a healthy 7.59%.

SEC 10-Q SEC 10-Q

The bottom line is that Triumph Financial is overburdened by its overhead expenses. The bank needs to reduce its operating costs (like salary and benefits expenses) to improve its net income. Additionally, the average interest rate on deposits is 0.55%, allowing the bank’s depositors to easily flee for significantly higher US Treasury rates. While the bank has disclosed approximately $1 billion in liquidity, it has not disclosed its uninsured deposit exposure, leaving a question mark as to whether they can cover withdraws by uninsured depositors.

SEC 10-Q

One thing going in Triumph’s favor is its outstanding leverage. At just 5.8 to 1, it is one of the lowest levered banks in the regional banking sector. This will likely change given the circumstances highlighted as the bank will need to borrow more to meet the loan demands of its existing customers. With a very high loan to deposit ratio already, the bank must find ways to shift away from outside borrowing and attract depositors.

TFIN Financials vs Federal Reserve Bank Data

While Triumph’s 8.75% yielding preferred share is one of the last high yielding preferred shares left in the sector, I am avoiding taking a position. The bank’s net income is in a precarious state, along with its reliance on outside borrowing. I do not believe the preferred dividend is safe relative to the other options available in the industry.

Read the full article here