Passive income through investing in dividend growth stocks is arguably the best way to approach retirement financial planning. This is because:

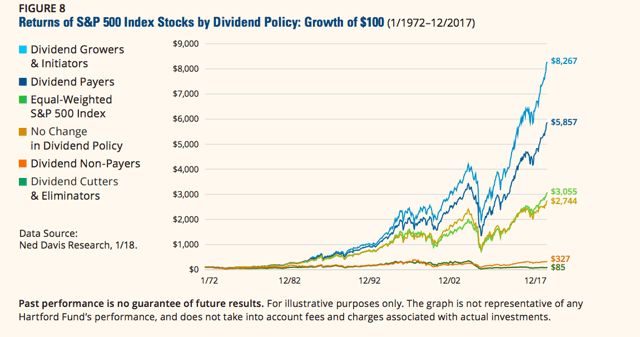

- Dividend growth stocks have a long and storied track record of generating significant long-term outperformance.

Dividend Stocks Outperform (Ned Davis Research)

- Investors can live off of the dividend yields, providing a stable stream of income to support expenses through good times and bad. In contrast, investors who live off of their portfolio principal are at risk of having to sell a substantial percentage of their portfolio during market crashes and prolonged bear markets.

- Dividend growth stocks often sustain the purchasing power of the passive income stream by growing their dividends at or above the long-term rate of inflation.

In this article we will look at and compare two popular funds for generating passive income for retirement: Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD) and SPDR Portfolio S&P 500 High Dividend ETF (NYSEARCA:SPYD).

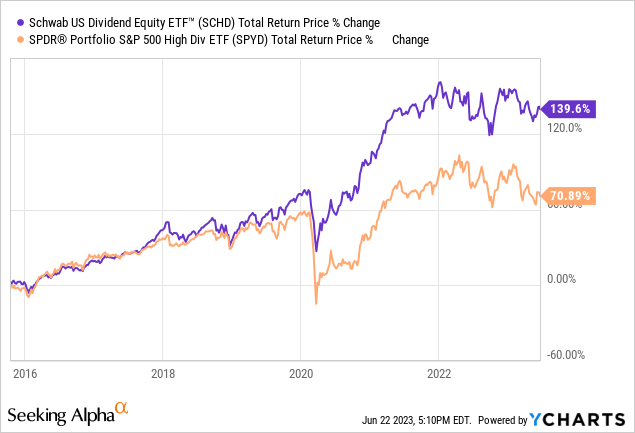

SCHD Vs. SPYD: Track Record

As the chart below makes clear, SCHD has a vastly superior track record to SPYD, generating nearly two times the total returns over the long term:

Moreover, it has also proven to be a more successful dividend growth stock. Since 2016, SPYD has grown its dividend per share at a 4.60% CAGR, whereas SCHD has grown its dividend per share at a 12.58% CAGR over the same time span. In fact, dating back to 2012, SCHD has grown its dividend at a 12.2% CAGR, making it a remarkably consistently rapid dividend growth machine.

SCHD Vs. SPYD: Current Yield & Expense Ratio

That said, one thing that SPYD has going for it is the fact that its current trailing twelve month dividend yield is 4.86%, which is meaningfully higher than SCHD’s trailing twelve month dividend yield of 3.63%. This makes it a better choice for investors looking to maximize current yield to pay living expenses in retirement even if it is not as good at growing its dividend over the long-term.

When it comes to expense ratios, both funds have very low fees, with SCHD narrowly edging out SPYD in this area at 0.06% vs. 0.07%.

SCHD Vs. SPYD: Portfolio Construction

Portfolio construction is another area where there is a clear difference between these two funds:

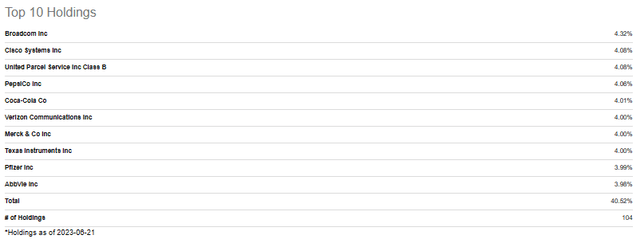

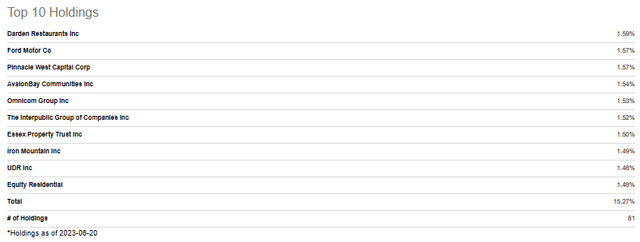

- SCHD has better diversification with 104 total holdings compared to 81 for SPYD. That said, both have plenty of diversification to make this a relatively moot point.

- In fact, one can argue that SPYD is actually better diversified than SCHD is given that its top 10 holdings only constitute 15.27% of its total portfolio, whereas SCHD’s top 10 holdings constitute a whopping 40.52% of its total portfolio.

SCHD Holdings (Seeking Alpha)

SPYD Holdings (Seeking Alpha)

- SPYD and SCHD also significantly overweight different sectors. While SPYD’s largest sector is Real Estate (VNQ) and its third largest sector is Utilities (XLU), SCHD has zero exposure to Real Estate and a meager 0.28% exposure to Utilities. Meanwhile, SCHD has much greater exposure to Industrials (IYJ) (18.15% vs. 2.78%), Health Care (RYH) (16.03% vs. 4.91%), and Technology (QQQ) (12.46% vs. 2.99%). What this means is that SCHD is likely more aggressively positioned than SPYD, which explains its outperformance during a period of general economic growth and upward movement for the stock market. In contrast, SPYD is likely better positioned for a slow growth environment, with its higher yielding, more defensively focused emphasis likely to outperform during periods of economic weakness.

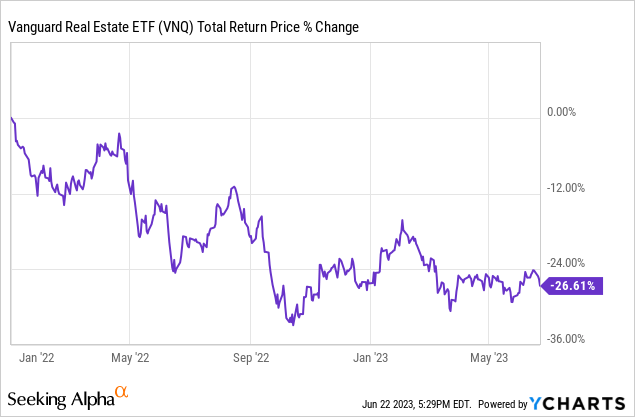

- That said, SPYD’s large concentration in Real Estate and Utilities does make it sensitive to rising interest rates, which has likely hurt its performance considerably recent given the rapid rise in interest rates since early 2022, which has decimated REITs in particular:

SCHD Vs. SPYD: Investor Takeaway

When it comes to retiring on dividends, investors need the following traits in their portfolio:

- A sufficient current income stream to comfortably meet – and ideally exceed – their living expenses alongside a substantial emergency fund to handle any unforeseen emergencies that come along. These qualities are important because the number one rule of living off of passive income in retirement is to never have to use the principal which would mean cannibalizing your income stream (i.e., killing the goose that lays the golden eggs).

- That income stream needs to be reliable through good times and bad. If that income stream suddenly dries up during tough economic times, it is effectively useless.

- That income stream needs to consistently sustain its purchasing power in the face of inflation. As a result, a dividend portfolio that consistently churns out higher dividends at a pace that comfortably exceeds the long-term inflation rate is needed.

SCHD meets requirements two and three with flying colors. It has not only consistently paid out its dividends year after year through good times and bad, but it has also consistently grown its dividend payout at a double-digit CAGR, making it an income machine that can easily handle inflationary pressures on purchasing power. However, where it struggles a bit is with point number one. Given that its yield is under the 4% level that is typically given Retirees as a target number for retirement savings, it may force retirees to save a bit more for retirement before being able to live solely off of the cash flow that it can throw off.

That said, this problem can be fairly easily remedied by buying some higher yielding ETFs or even blue chip stocks in sectors where SCHD lacks meaningful exposure such as Real Estate (i.e., W. P. Carey (WPC)), MLPs (i.e., Enterprise Products Partners (EPD)), BDCs (i.e., Ares Capital Corp (ARCC)), and Utilities and Infrastructure (i.e., Brookfield Infrastructure Partners (BIP)(BIPC)). When adding these securities to the mix, SCHD’s yield gets boosted closer to or even in excess of the 4% level and the overall dividend growth rate remains quite strong while the portfolio’s diversification gets even better.

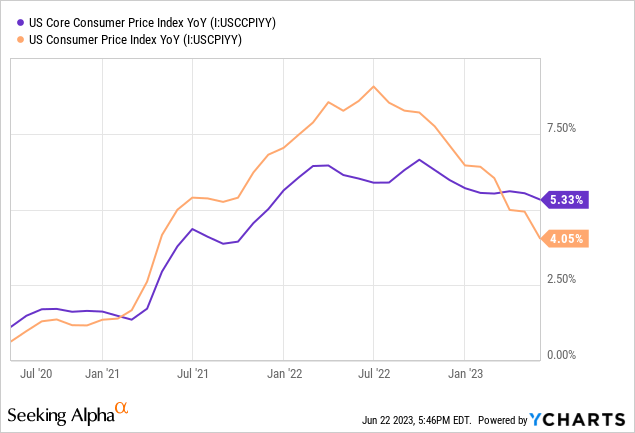

SPYD better meets requirement number one given that its current yield is close to 5%. Moreover, its income stream has proven to hold up pretty well through good times and bad thanks to its strong diversification with no more than 1.59% tied up in any single security. However, its ability to grow its dividend at a pace that exceeds inflation is a bit less certain. Its 4.6% dividend per share CAGR since 2016 exceeds the historical average ~3% inflation rate and easily beats the Fed’s stated long-term target ~2% inflation rate. However, the current core inflation rate is a bit higher than this level and the headline inflation level is not much below it:

As a result, investors are taking a greater chance with the long-term sustainability of their purchasing power with SPYD.

Overall, we think that SCHD is the superior fund to invest in for passive income in retirement. However, for investors who plan to follow the 4% Rule strictly in retirement, they may want to supplement their core SCHD holding with some higher yielding ETFs and/or individual securities, among whom one could even buy SPYD.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here