Investment thesis

Alight (NYSE:ALIT) is a company that offers human capital solutions and offers a cloud-based solution that is more efficient and effective than traditional approaches. I believe ALIT is well-positioned to capture the change in the HR industry, where there is an increasing focus on temporary workers and employee wellbeing, as well as the need to navigate complex regulatory landscapes. As I have become optimistic about the company’s mid-term growth guidance, which is being driven by the possibility of 15% annual growth in BPaaS revenue, I am changing my recommendation from hold to buy. In particular, the 60% incremental margin on BPaaS revenue should help ALIT get closer to its EBITDA margin goal of 25 to 26%. Importantly, I anticipate that the market will begin to value the company in light of FY25 figures as we progress through FY24.

Strategy to gain share

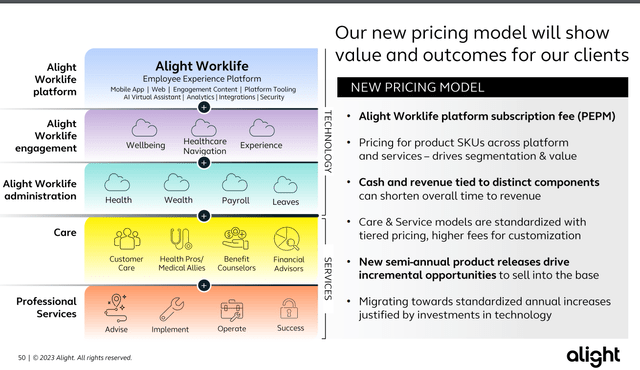

I have confidence in management’s abilities to achieve its mid-term targets given its strategy to capture share. I think ALIT product, at its core, addresses a significant issue that exists in many businesses today. Typically, businesses use a lot of many distinct point solutions to create their “ideal” HCM system, which comes with a lot of problem due to lack of full integration. Because of the complexity of these solutions and the difficulty in quickly locating the one an employee needs, their adoption rates tend to be low. Therefore, ALIT BPaaS offering stands out from these individual products because it combines the three essential elements of effective HCM—software, data, and delivery capabilities. The goal is to make the ALIT WorkLife platform the entry point for all of an employee’s benefits by integrating these three aspects throughout the entire employee life cycle, from hiring to retirement. I think this integration approach will bring more attention from both employers and workers to ALIT’s growing suite of services geared toward workers, which helps businesses reduce turnover, boost loyalty, and cut expenses. This in turn should drive new logos acquisition and improve customer retention rates. The new method, which includes a more transparent pricing strategy (an annual price increase), also gives the ALIT better insight into its growth and cash flow. Last but not least, I think it’s significant that a major incumbent (Workday (WDAY)) has chosen to increase its partnership with ALIT in Europe. I anticipate this collaboration will generate a multi-year tailwind for the expansion of international revenue.

ALIT

Guidance

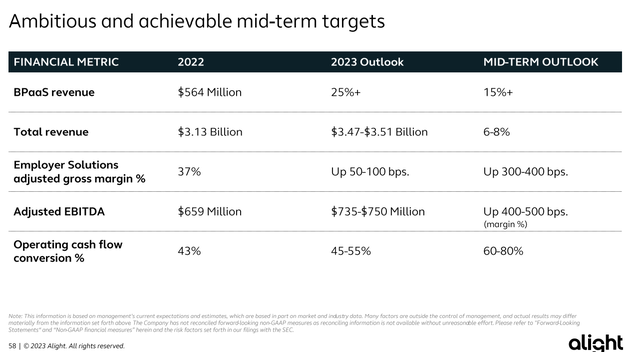

Attention should be paid to the mid-term guidance as it is what consensus estimates are anchoring on. In my opinion, the guidance for the next few years is great, and I have full faith in management’s ability to meet all of the goals that have been set. The anticipated annual rate of growth in total revenue is 6-8% (below FY23 guided growth), which I think is too conservative as it includes the Reed Group acquisition. I expect the growth to be primarily driven by the higher- growth BPaaS business, which is only 18% of revenue today, as such, there is still a lot of room to grow by growing at an expected 15%+ clip annually based on management’s mid-term targets.

Analyzing the components of this growth algorithm, I anticipate that several factors, such as new logos capture from rollout of WorkLife platform, new pricing strategy, and expansion of the product suite, partnership with Workday, will drive revenue growth. Importantly, I see no issues with margin expansion in the coming years as the core growth driver – BPaaS – has 60% incremental gross margins (overall GM is only 32% today). In addition to a higher organic margin, the scalability of the WorkLife platform should speed up payments, and the enhancements to working capital should increase the FCF margin.

Valuation

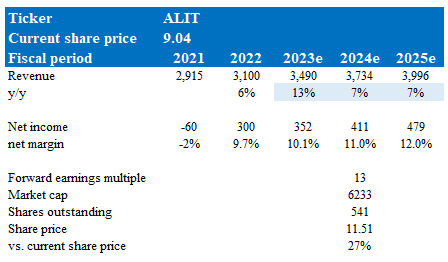

With a revised outlook for revenue growth and margin expansion, as well as expectations for how the market will value ALIT stock based on FY25 figures, I believe the upside is now appealing. My updated model reflects the guided mid-term growth and my expectation of margin expansion as the BPaaS revenue mix shifts. Because BPaaS is expected to grow at twice the rate, margin expansion should be common in the near term. I would also expect multiples to rise above current levels, but to be conservative, I will remain at 13x and treat any potential for re-rating as a call option.

Valuation ALIT

Risks

I still see the main risks with ALIT being a steep recession and change in regulations (which ALIT is particularly exposed to given it operates in the HR industry). Readers may refer to my previous post for more details on this.

Conclusion

I am upgrading my recommendation on ALIT from hold to buy based on my optimism regarding the company’s mid-term growth prospects. ALIT’s cloud-based human capital solutions are well-suited to capture the evolving HR industry, with its focus on temporary workers, employee well-being, and regulatory compliance. The potential for 15% annual growth in BPaaS revenue and a 60% incremental margin contribute to my positive outlook. As we progress through FY24, I anticipate the market will start valuing ALIT based on FY25 figures.

Read the full article here