Investment Summary

Following my December publication on AxoGen, Inc. (NASDAQ:AXGN), the investment case is turning more constructive. The firm continues adding sales at its long-term rates of growth whilst management expects $160mm in the top line this year, a company record.

There are many positives for AXGN that will be discussed here today. However, there are also uncertainties, that are therefore challenges when bringing up the question of opportunity cost. This report will cover all of the moving parts in the AXGN investment debate, with extra detail on the corporation’s use of capital and productivity.

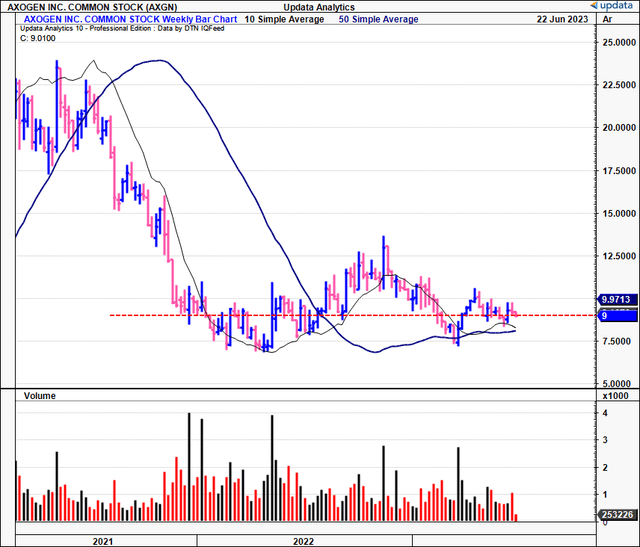

Findings corroborate a hold rating for now, but there is reason to stay constructive on the firm and watch its numbers as we walk through FY’23. Interestingly, I have technical targets to ~$12, but I’m not inspired by these without the fundamental backing. Food for thought though. Rate hold.

Figure 1.

Data: Updata

Critical facts forming AXGN investment debate

There are several important points to consider when debating the investment potential of AXGN. Chiefly, these revolve around the company’s recent fundamental momentum, and how this impacts the market’s expectations. In my view, the company is displaying a recent run of fundamental gains, but there is more to it than just the top-line and asset growth.

Breaking down AXGN’s latest numbers, presented early last month, is telling. Much is gleaned from a thoughtful analysis of the firm’s economic factors and what this means going forward.

Revenue growth and account penetration

AXGN clipped Q1 revenue of $36.7mm, an 18% YoY increase. Key point to note here – this is the 3rd sequential quarter of growth. Much of this has been helped by a more favourable hospital staffing environment and surgical capacity. In addition to this:

- I’d point out that the company’s focus on pushing uptake in core and active accounts looks to have yielded positive results. Core accounts were up 23% YoY to 350 in total. Additionally, active accounts saw a YoY growth of 9%, reaching a total of 994. These accounts – which generated over $100,000/account in revenue over the last 12 months – contributed to ~60% of the company’s Q1 revenues. All this through surgeon engagement and early adopters of its nerve repair algorithm.

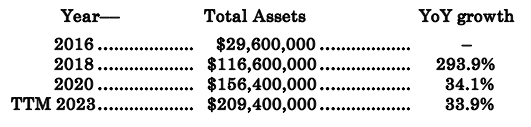

- The strong start to FY’23 is good news in my view. It maintains a reasonable pace of growth that aligns with the longer-term range. You can see below the average 2-year revenue growth rate is ~33-34% since 2018 (or, roughly double the 18% AXGN saw in Q1). Hence, it remains on track to deliver these kinds of upsides moving forward in my opinion.

Table 1. AXGN growth record (2-year sequential)

Data: Author, AXGN SEC Filings

Marginal analysis and capital productivity

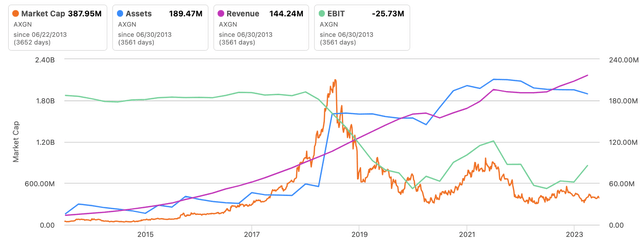

It pulled the sales growth to 81.7% which is high and attractive. In terms of its ability to make money, I’d be looking to the gross margin as one telling factor. Further, the market looks to be valuing the company on factors of earnings rather than sales or asset growth. As seen below, the correlation is strikingly similar, with pre-tax earnings leading to changes in market value since 2018.

Figure 2. Investors look to be pricing AXGN on earnings vs. asset factors

Data: Seeking Alpha

This makes sense, given sales generated on the firm’s products, that are deemed as the “capital” (in terms of inventory, receivables, etc.) in this situation. There are no real asset factors other than the NWC required to produce and sell the company’s portfolio.

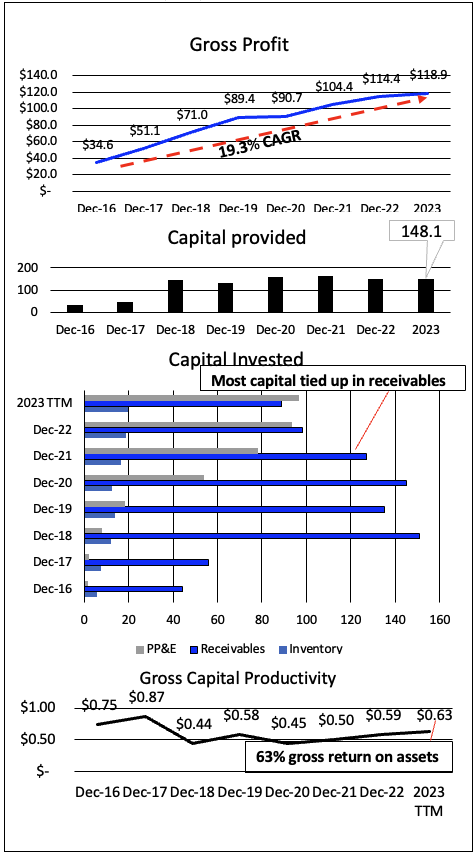

Hence, profitability is key, yet AXGN does not eclipse the profitability barrier, even when adjusting for various investments that are expensed on the income statement under GAAP accounting (things like R&D). Gross capital productivity is, therefore, critical to know. Figure 3 breaks down the entire spectrum of capital provided and put to work for the company dating back to 2016. You can see the gross capital productivity (labelled as gross profit) at the top, showing the amount of gross return its assets are producing.

You can see that:

- It recognized $119mm in gross (TTM figures) in Q1, equating to a 19.3% annual compounding rate since 2016.

- Of the capital provided to date, $148mm or so, the bolus of this has been tied up in receivables (on product sales) and inventory (to sell). Again, this makes perfect sense given the firm’s economics.

- When scaling the gross profit by total assets, AXGN typically circles ~$0.50-$0.60 for every $1 in assets, down from times gone by. Still, the c.63% gross return on capital is something to note. Yet, at an ~82% gross margin, there is a divergence on the productivity side that needs improving.

Figure 3. AXGN capital return analysis 2016-date

Data: Author, AXGN SEC Filings

Further analysis plus guidance

Moving down the P&L, quarterly OpEx was up 1% YoY to reach $37.3mm This was primarily driven by higher compensation costs. Sales and marketing expenses also rose by 300bps for similar reasons. Critically, its R&D investment was up by 6% YoY. It pulled this down to a net loss of $7.1mm. Looking forward, AXGN intends to maintain FY’23 revenue guidance within the range of $154mm-$159mm. The transition to its new processing facility is expected to compress gross margins, but the company anticipates a return to ~80% by Q4 this year.

Market generated data

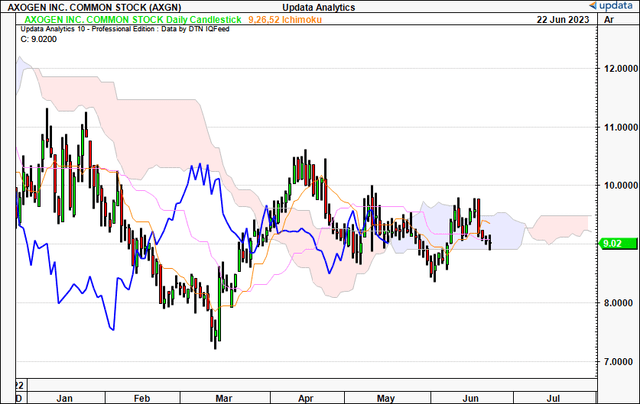

The data presented in Figures 4 and 5 provide a clear indication of the current state of affairs. The stock is testing the cloud base. Notably, it has bounced from this level previously, and the lagging line positioned in the cloud also supports this observation. A change in perspective would require a break to $9.50 in my view. Overall, the chart appears to be neutral, and no unexpected fluctuations in the price have been detected, aligning with the findings thus far.

Figure 4.

Data: Updata

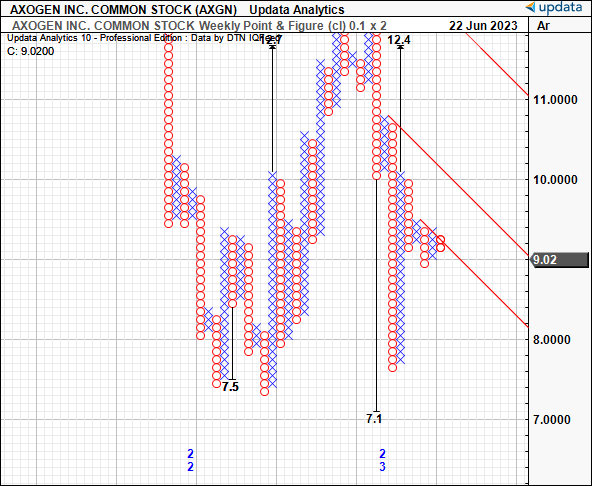

The point and figure studies conducted have yielded objective findings that support a neutral view. These findings indicate a downside target of $7.10 and an upside target of $12.40. The breadth of the studies is noteworthy but does not inspire confidence in an agreed value on the stock. A shift towards the higher end of the spectrum could activate the $12.40 target, which would be quite interesting, in my opinion. Conversely, a break lower could see us looking at the $7.10 target. In either scenario, there is no major confidence around the price objective. Both technical studies align with a neutral view.

Figure 5. Breadth in technical price targets

Data: Updata

Valuation

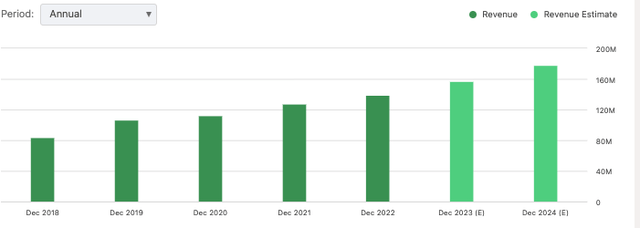

Shares are priced at 2.5x forward sales, which may be deemed attractive. They are also trading at a 42% discount to the sector and at approximately 4x book value, indicating the value created from its capital investments thus far. The consensus is also bullish on its revenue growth prospects, as evidenced below. This would be less meaningful given I believe the market is valuing it on operating earnings.

Figure 6.

Data: Seeking Alpha

However, given the lack of earnings and catalysts, it is challenging to estimate an accurate valuation. Nonetheless, the breadth in targets listed above is intriguing, and a $12.40 target is inclined, which would add another 36% upside potential to the investment debate. Nevertheless, the absence of fundamental evidence supporting this figure leads to a hold rating.

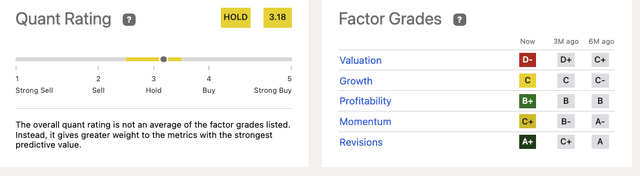

Objective data is valuable in this regard. The quant system also supports this view and suggests AXGN as a hold. The composite identifies and weighs several factors that drive returns. If the system indicates a hold, it implies a lack of chance to pull or dart either way. Therefore, the neutral view has the most support in the evidence, adding a layer of confidence to the overall analysis.

Figure 7.

Data: Seeking Alpha

Discussion

There are building crosscurrents for AXGN as it continues to advance its core accounts and obtain new ones. I want to stress that I believe AXGN is a fantastic company that is performing some of the most groundbreaking work we could hope to see succeed, in neural/neurological repair. There is no question of this.

The questions pertain to whether or not the company is investment grade at this point in time. Based on findings discussed in this report, the answer I’ve arrived at is “not yet”. I am watching very closely on the sidelines to see the company’s next moves, looking for a jump in operating profit, as it appears the market is looking to this in the company’s valuation. Management looks to ~$160mm in turnover this year and I believe it can get there given the 18% growth in Q1. Hence, I am turning more constructive on the company, but require additional data to push over the line. Rate hold.

Read the full article here