Meet Copper, the Wiring That Connects the Present to the Future

Just as copper tools helped ancient civilizations emerge from the Stone Age, copper wiring plays a critical role in the world’s transition to a low-carbon economy. Copper is used in electric vehicles (EVs) and power grids, as well as in traditional infrastructure such as telecom wiring, plumbing and HVAC.

Consequently, there is a secular demand surge for copper — driven not just by a low-carbon transition, but also the megatrends of rapid urbanization and emerging global wealth. As the “metal of electrification,” copper connects the past and future — generating exciting potential opportunities for investors.

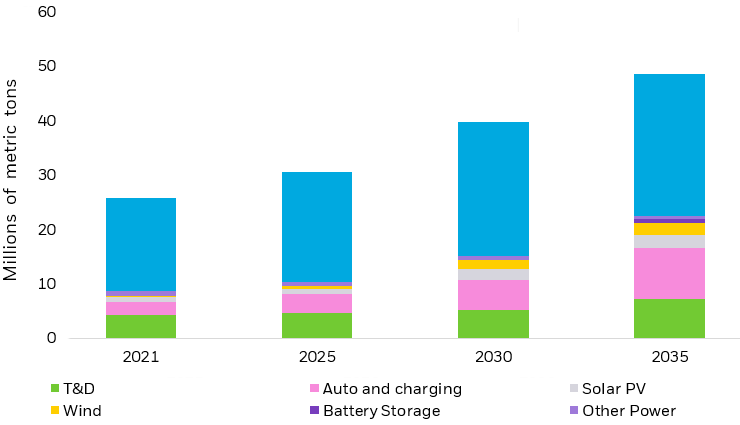

Copper Demand is Rapidly Growing

Global refined copper demand

Source: S&P Global. “The Future of Copper – Will the looming supply gap short-circuit the energy transition?”, 7/14/2022. Future years are estimates.

Chart description: Bar chart showing the category breakdown of the global refined copper demand from 2021 to 2035 based on S&P Global’s “multitech mitigation scenario”, aligning with Biden administration’s net-zero ambitions. The T&D category refers to transmission and distribution. The PV category represents photovoltaics. The “Other Power” category includes conventional generation (coal, gas, oil, and nuclear), geothermal, biomass, waste, concentrated solar power, and tidal.

Copper is durable, malleable and an excellent conductor of heat and electricity. Demand for copper is forecast to grow from 25 million tons today to 53 million by 2050, driven by three key factors:1

First, the electrification of transport, is projected to have the largest impact on copper demand. EVs require nearly 2.5x the amount of copper used in internal combustion engine (ICE) vehicles across electric motors, batteries, and charging infrastructure, and EV sales are projected to grow 35% in 2023.1,2

Second, copper demand from power grids is projected to grow nearly 5x by 2050.3 Thanks to its unmatched conductivity and corrosion resistance, copper is used extensively in power distribution and transformers, particularly underground and subsea lines, and is needed to upgrade aging transmission infrastructure.

Third, the shift toward renewable power generation technologies such as solar and offshore wind — which require 2x and 5x more copper, respectively, per megawatt of capacity vs. gas and coal — should further increase demand.1

In addition, the growing demand from building construction, appliances, electrical equipment, and cell phones, is still projected to account for 58% of copper usage by 2035.1 As emerging markets continue to grow wealthier, and urban populations expand, copper is crucial to meet the demands of a growing middle class for electronics as well as the building needs of a rapidly urbanizing world. (Read more about the structural growth opportunities in infrastructure.)

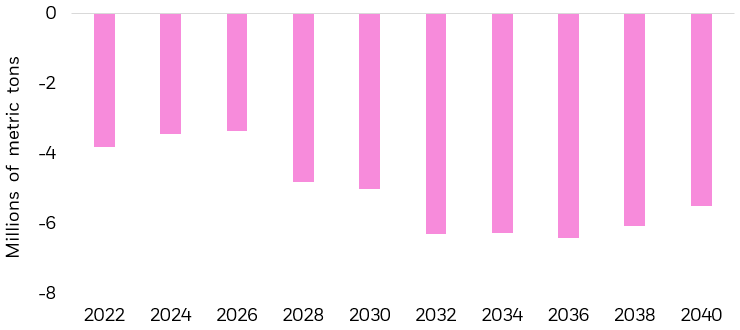

Copper Supply is Restrained

Forecast supply deficit, refined copper

Source: BloombergNEF. “Surging copper demand will complicate the clean energy boom”, 9/1/2022.

Chart description: Bar chart showing the forecasted supply deficit for refined copper under BloombergNEF’s “best-case supply growth scenario”, excluding recycling supply.

Copper — a soft, red-colored metal — is extracted alongside rock from copper-rich ore deposits in underground or open-pit mines. The world has approximately 870 million tons of untapped copper deposits.4 By the early 2030s, demand could outstrip the current supply by more than 6 million tons per year for two key reasons:

First, geographic concentration risk for copper production is high. Chile and Peru alone account for 40% of output.5 These countries possess some of the world’s richest copper reserves and best-established mining operations. However, political instability, labor disputes and economic challenges in the region periodically disrupt supply and lead to shortages and price fluctuations.

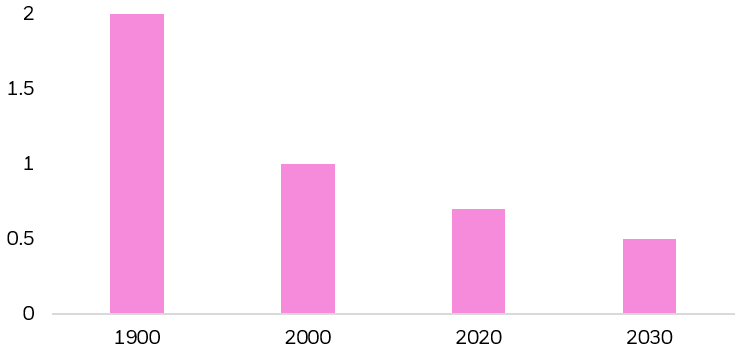

Second, existing copper mines are approaching production peaks. As high-grade ores become depleted, mining operations extract lower grades. Miners must now use grades of 0.5% copper (a measure of how much copper is present in rock) — a quarter the concentration of a century ago.6 As a result, more rock needs to be processed to extract the same amount of copper, raising extraction costs.

Falling copper ore grades, % copper

BloombergNEF. “Surging copper demand will complicate the clean energy boom”, 9/1/2022.

Chart description: Bar chart illustrating the declining level of copper ore grades from a century ago to today. The 2030 number is projected by BloombergNEF research.

As a result of these constraints, global copper output in 2022 was 21.8 million tons, rising only 1 million tons over the previous three years and is expected to peak by the mid-2020s.7

While there is no quick fix on copper supply, technological innovations are coming. For example, sulfide-leaching technology leverages special chemical solutions to extract copper from rocks. This approach enables efficient extraction by dissolving copper and separating it from rocks, increasing yield. Leaching technologies offer a pathway to recover primary copper from ores with grades of less than 0.25% — grades that are currently considered waste.8

In addition to technological advancements, government policies will play a role. In the U.S., the Biden administration announced $39 million to fund projects that support domestic supplies of critical minerals required for the transition to a low-carbon economy including copper, lithium, and nickel.9 The European Union tagged copper as a strategic material as part of the Critical Raw Materials Act, with an aim to ensure speedier permits and easier access to capital.10 These are steps that could increase copper supply in the future.

Finally, recycled copper will likely become a more important source of supply as primary copper output growth stalls. More than 30% of global copper demand was met with recycled copper during the last decade, and we expect this to grow as innovations in sorting, separation and refining technologies enable higher recovery rates.11 This circular economy approach also reduces energy consumption and environmental impacts associated with primary copper production.

How to Invest in Copper

Investors seeking to capture the copper theme may want to consider ETFs that offer pure-play exposure to copper miners, as well as the firms developing next-gen technologies to support supply such as copper-leaching chemicals and recycling.

Conclusion

As the world electrifies, urbanizes, and grows wealthier, demand for copper will be challenging to meet, potentially bolstering the price of the metal. At the same time, the implementation of innovative mining and processing technologies, policy support, and investments in recycling, may help drive innovation. As the “metal of electrification,” copper connects the past and future. Likewise, ETFs that offer exposure to copper mining can be quite electrifying for portfolios, helping investors access the potential opportunities of tomorrow.

Disclosure:

© 2023 BlackRock, Inc. All rights reserved.

1 S&P Global. “The Future of Copper – Will the looming supply gap short-circuit the energy transition?”, 7/14/2022.

2 IEA, “Demand for electric cars is booming, with sales expected to leap 35% this year after a record-breaking 2022”.

3 BloombergNEF. “Global Net Zero Will Require $21 Trillion Investment In Power Grids”, 3/1/2023.

4 International Copper Association. “Copper meets our future needs”, June 2021.

5 International Energy Agency. “The role of critical minerals in clean energy transitions”, May 2021.

6 BloombergNEF. “Surging copper demand will complicate the clean energy boom”, 9/1/2022.

7 WSJ. “Copper shortage threatens green transition”, 4/18/2023.

8 McKinsey. “Bridging the copper supply gap”, 2/17/2023.

9 Department of Energy. “DOE Announces $39 Million for Technology to Grow the Domestic Critical Minerals Supply Chain and Strengthen National Security”, 10/27/2022.

10 Reuters. “EU tags copper and nickel as strategic, but industry wants more”, 3/16/2023.

11 International Copper Association. “Copper meets our future needs”, June 2021.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Technology companies may be subject to severe competition and product obsolescence.

Negative changes in commodity markets could have an adverse impact on companies the Fund invests in. The price of the equity securities of companies engaged in mining and the price of the mined metals may not always be closely linked. Worldwide metal prices may fluctuate substantially over short periods of time, so the Fund’s share price may be more volatile than other types of investments.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0623U/S-2952185

This post originally appeared on the iShares Market Insights.

Read the full article here