The Bank of England, on Thursday, raised its policy rate of interest by 50 basis points.

This follows recent moves by the European Central Bank, the Bank of Canada, and the Reserve Bank of Australia.

Although the Federal Reserve did not raise its policy rate of interest last week at its latest meeting of the Federal Open Market Committee, yesterday Fed Chairman Jerome Powell testified in front of the U.S. Congress that the Fed may have to raise its policy rate of interest one-, maybe two-more, times this year, beginning at the meeting taking place on July 25 and 26.

Inflation in the world seems to be maintaining its strength, and so the central banks of the world need to keep on in their struggle to master the pressures that exist on prices in the world.

The Bank of England raised its rate to 5.00 percent, the highest level since April 2008.

The inflation rate in the U.K. came in at 8.7 percent for May, year-over-year, the same rate that held for April. The core rate of inflation, however, rose to its highest level in more than three decades.

“The U.K.’s central bank has been raising its key interest rate for longer than either the Fed or the ECB. The cumulative rise in its key rate since December 2021 is slightly more than the Fed’s and a percentage point more than the ECB’s ” writes Paul Hannon in the Financial Times.

All of this just points to more problems for the Federal Reserve.

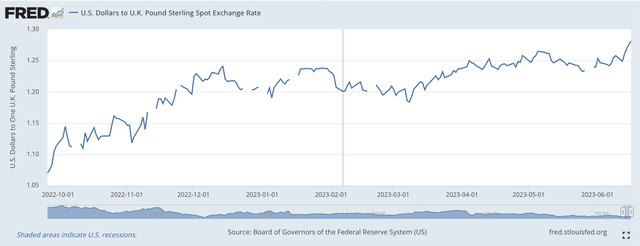

Note how the value of the British Pound has risen relative to the U.S. Dollar.

U.S. Dollars to U.K. Pound (Federal Reserve)

This chart moves from late September 2022 to June 21, 2023.

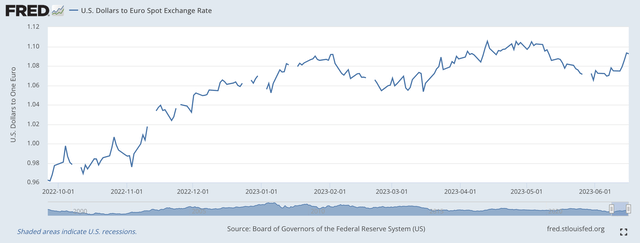

Note, further, how the value of the Euro has risen relative to the U.S. Dollar.

U.S. Dollars to Eurodollar (Federal Reserve)

The value of the Euro has risen relative to the U.S. Dollar from late September 2022 to June 21, 2023.

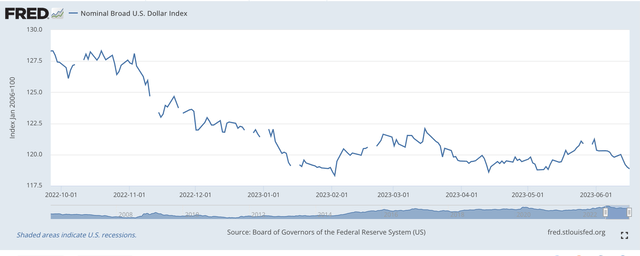

And, against a larger number of currencies, the value of the U.S. Dollar has fallen in value over the same time period.

Nominal Broad U.S. Dollar Index (Federal Reserve)

Again we get the same general movement point to the fact that during this period, even though the Federal Reserve was raising its policy rate of interest, investors throughout the world believed that the Federal Reserve was falling behind other central banks in terms of the strength of its fight against inflation.

In other words, other nations were putting up a stronger fight against inflation than was the United States.

The question is…can the United States continue to lag behind these other major central banks in terms of raising its policy rate of interest?

In terms of the relative movements in currency values, the United States is not taking a leadership position in the fight against inflation.

This may be one of the major reasons why investors are reluctant to support what the Federal Reserve is doing or what it says that it is doing.

This may be one of the major reasons why investors continue to believe that, sooner or later, Mr. Powell and the Federal Reserve are going to “pivot” their monetary policy stance and ease up on the monetary brakes.

In almost everything that the Federal Reserve has done since Mr. Powell took over the reins of the U.S. central bank, Mr. Powell has sought to always err on the side of monetary ease.

Over the past several years, this has been the main concern against what Mr. Powell has done.

Yes, he managed the Fed through the spread of the Covid-19 pandemic and the recession that followed along with the financial distress of that period.

But, during that time, the Federal Reserve also seemed to create an asset bubble that we are still having to deal with at this time.

When the current inflation showed that it was the “real” thing and was not just transitory, Mr. Powell and the Fed began to raise the Fed’s policy rate of interest and also created a program to reduce the size of the Fed’s securities portfolio.

Yes, the Federal Reserve has raised its policy rate of interest and, yes, the Federal Reserve has reduced the size of its securities portfolio, yet, the Fed has always moved to allow bank excess reserves to remain well above $3.0 trillion.

In my column “Federal Reserve Watch,” which I produce every Friday, I have tried to document what the Federal Reserve was doing in terms of managing its balance sheet, and I think that I have shown that Mr. Powell’s efforts to constantly err on the side of monetary ease, remain in place.

It is my proposal here that the actual behavior of the value of the U.S. Dollar in world markets confirms the fact that Mr. Powell and the Fed continue to err on the side of monetary ease relative to other countries and central banks in the world.

Otherwise, why would the value of the U.S. Dollar decline in international currency markets over the last nine months?

The United States is not maintaining global leadership in addressing the problems and difficulties that exist in the world today.

No wonder that investors continue to believe that Mr. Powell and the Federal Reserve will, sooner or later, pivot from its fight against inflation.

This would not be a good thing for the Federal Reserve to do.

Inflation needs to be brought under control. The Fed needs to continue the fight.

Investors need the Fed to “stay the course” so that the business and investment community return to some kind of stability.

Investors also need the Fed to “stay the course” so that they can return their focus to the economy and to what their investment prospects are doing. They need to be able to take their eyes off of “what is the Fed going to do?”

As long as the economy and financial markets remain in turmoil, investors are going to give lots and lots of attention to the Federal Reserve.

We have to get past this stage so that investors can, once again, focus on what the business community is doing.

Over the past decade, too much attention has had to be given to the Federal Reserve and other policymakers.

Read the full article here