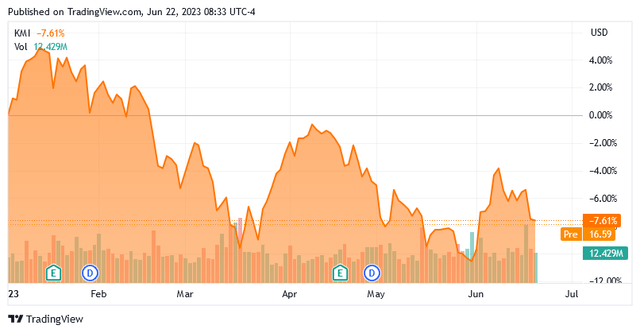

Kinder Morgan, Inc. (NYSE:KMI) is one of the largest and most well-known midstream companies in the United States. It has also long been a favorite of investors that are seeking to earn a high level of income from their portfolios. This is hardly surprising, considering that the company has been one of the highest-yielding companies in the market for many years now. As of the time of writing, it yields an impressive 6.79% so this is a reputation that it still holds. Unfortunately, the KMI stock performance recently is not likely to impress anyone, as it is down a whopping 7.61% year-to-date:

Seeking Alpha

This is probably due to the weakness in crude oil prices that has dominated the market so far this year. However, Kinder Morgan’s cash flows are not significantly affected by changes in energy prices. Thus, the recent price weakness could be providing investors with an attractive opportunity to buy in and get a higher yield than could have been obtained earlier this year. As income investors, we tend to like high yields so this is something that is always very nice to see.

About Kinder Morgan

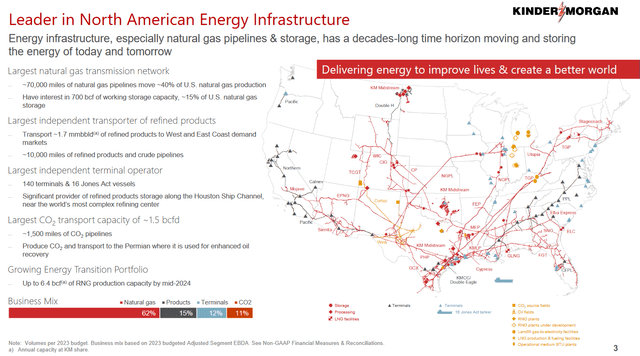

As stated in the introduction, Kinder Morgan is one of the largest midstream corporations in the United States, boasting a network of pipelines, resource storage, and infrastructure that stretches across the continent:

Kinder Morgan

As we can see above, the company has the largest natural gas pipeline network in the United States and transports more liquid resources than any other country in the nation. The natural gas business is the company’s key focus, however, as it accounts for approximately 62% of Kinder Morgan’s gross margin. That is a pretty good place to be since the fundamentals of natural gas are better than those of crude oil or refined products. This is due to the fact that natural gas demand globally is likely to grow over the coming years as it is a complement to renewable power generation.

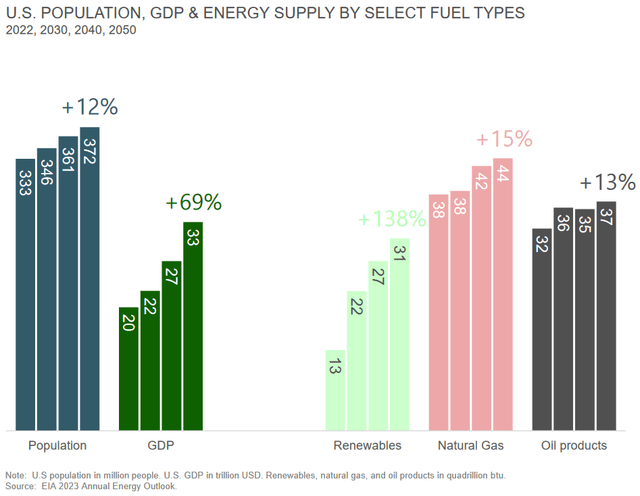

In short, renewables such as wind and solar are not reliable enough to provide the “always available” capability that people expect from a modern electric grid. The usual solution for this problem is to have natural gas turbines available as a backup since natural gas burns cleaner than other fossil fuels and is reliable enough to ensure that the power grid remains stable and active. According to the Energy Information Administration (“EIA”), the demand for natural gas in the United States will grow by 15% between now and 2050:

Kinder Morgan/Data from U.S. EIA

As we can see, the demand for natural gas is expected to grow more than the demand for crude oil over the period. In addition, nearly all of the crude oil demand growth comes by the end of the decade while natural gas demand continues growing over the thirty-year period. We see the same trends in Western Europe, particularly if that continent is going to continue trying to wean itself off Russian-supplied natural gas. The fact that Kinder Morgan is more heavily weighted towards natural gas than crude oil thus provides an advantage to the company.

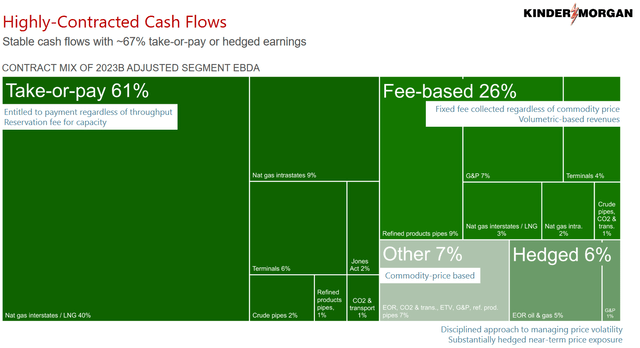

The demand for both crude oil products and natural gas is expected to grow going forward. That scenario will naturally require someone to transport the hydrocarbon products to the end-users. This is where Kinder Morgan comes in as its entire business is built around transporting natural gas and refined products. In short, the company enters into long-term (usually five to ten years in length) under which customers transport their products through the company’s transportation and storage infrastructure. In exchange, Kinder Morgan bills the customers based on the volume of resources that it handles, not their value. This provides a great deal of protection against the adverse impacts that might accompany resource price fluctuations and it is why I pointed out in the introduction that Kinder Morgan is not really affected by changes in energy prices. Approximately 93% of the company’s adjusted segment EBDA is insulated from changes in energy prices:

Kinder Morgan

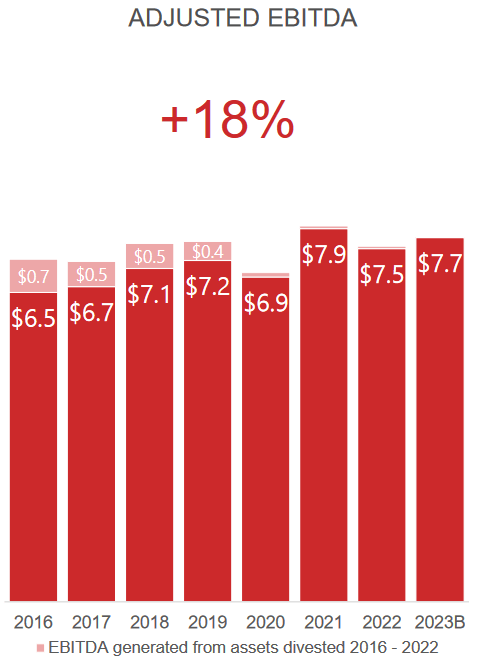

As we can see, only 7% of the company’s adjusted segment EBDA is exposed to commodity prices. This provides the company with a great deal of cash flow stability regardless of the broader economic climate. We can see this quite clearly by looking at the company’s adjusted EBITDA (a proxy for pre-tax cash flow) over the past seven years:

Kinder Morgan

As everyone reading this is probably well aware, crude oil prices plunged to multi-generational lows during 2020. In fact, the price of West Texas Intermediate crude oil briefly went negative in April 2020. This was due to the COVID-19 pandemic and the economic lockdowns that caused many people to stay at home and forgo all travel. We can see that this had almost no impact on Kinder Morgan’s adjusted EBITDA. We can also see that the company’s adjusted EBITDA saw no real benefit from the very high energy price environment of 2022. This is the downside to that business model. In short, the company is not really affected by either good or bad market environments. This is very nice for income investors though since the general stability of the company’s cash flows provides a great deal of support for the dividend. After all, it is easier for the company to pay out a substantial percentage of its cash flow to the shareholders if management can be certain that it will earn a similar amount during the following period.

Growth Prospects

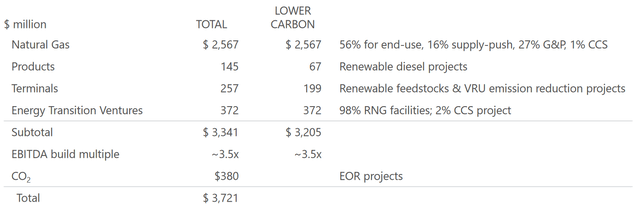

Naturally, as investors, we are unlikely to be satisfied with mere cash flow stability. After all, we like to see a company that we are invested in grow and prosper with the passage of time. Kinder Morgan is well-positioned to deliver on this goal. As already mentioned, the company’s cash flow directly correlates to the volume of resources that it transports and handles. Thus, in order to grow its cash flow, the company must increase the volume of resources that it transports. As pipelines, storage facilities, and similar infrastructure have a limited capacity of resources that they can handle, this process requires constructing new infrastructure. Kinder Morgan is doing exactly this as the company currently has $3.721 billion worth of projects under development at various stages of completion.

Here are the projects that Kinder Morgan currently has under construction:

Kinder Morgan

One of the best things about these new projects is that Kinder Morgan has already secured contracts from its customers for their use. This serves two purposes, both of which benefit the shareholders. The first benefit is obviously that we can be certain that Kinder Morgan is not spending a great deal of money to construct infrastructure that nobody wants to use. The second benefit is that Kinder Morgan knows in advance how much it will earn from each of these projects, so it can be certain that it will earn an acceptable rate of return on its investment. In this case, each project will pay for itself after about 3.5 years of operation. That is, to put it mildly, a very impressive return for a midstream project.

The Williams Companies, Inc. (WMB), another major natural gas pipeline operator, typically achieves about a six-year payback period when it constructs a new project. Other midstream companies are normally in the six- to eight-year range. Thus, Kinder Morgan appears to be earning higher returns on its growth projects than most of its peers. This is something that any investor should appreciate.

The fact that the company’s growth projects already have contracts provides another benefit that we should not ignore. Basically, the projects should begin generating positive cash flow as soon as they come online and start operating. As the company’s current growth projects are scheduled to begin operations between now and the end of 2025, this gives the company a nice growth pipeline over the next two years. Kinder Morgan usually tries to increase its dividend annually, so this will probably result in two more years of dividend growth. This is obviously something that anyone should appreciate.

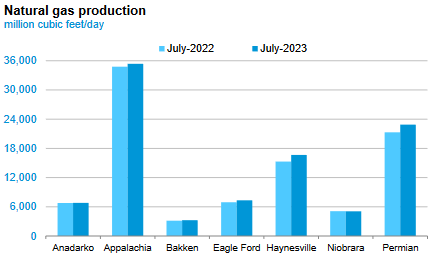

As we can see, the overwhelming majority of the company’s growth spending is dedicated to natural gas projects. This is hardly surprising considering that the majority of the company’s cash flow comes from its natural gas infrastructure. A sizable proportion of this money will be devoted to increasing the company’s takeaway capacity from the Permian Basin. This probably is not surprising to anyone that follows the energy industry, as the production of natural gas in the Permian Basin has been growing over the past year. We can see this quite clearly here:

U.S. Energy Information Administration

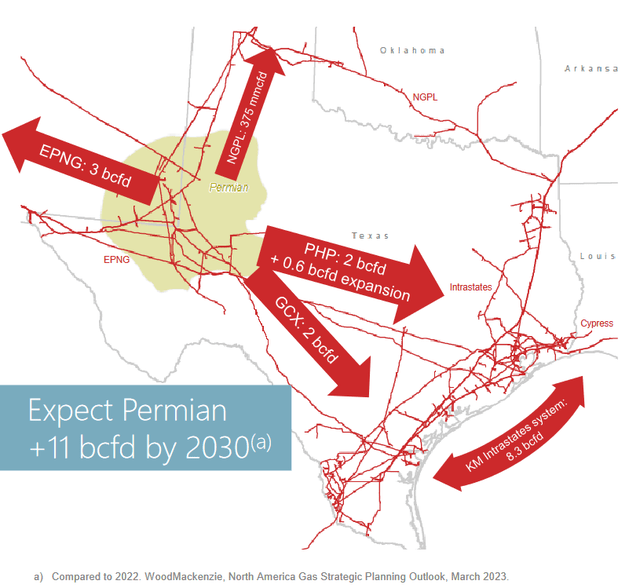

In a recent blog post, I discussed how upstream natural gas producers have been trying to reduce their production in response to the current supply glut. However, this is expected to be a temporary condition as the long-term still points to the growing production of natural gas. The Permian Basin is the third-richest natural gas deposit in the nation and the second-largest producing natural gas basin so it seems likely that the basin will benefit as U.S. natural gas production grows in the coming years to meet demand. Kinder Morgan is moving to take advantage of this by constructing approximately eleven billion cubic feet per day of new natural gas capacity by 2030:

Kinder Morgan

This will provide a potential growth engine that contributes to the company’s growth during the second half of this decade, well after the current projects have started operation. That is attractive for anyone that is planning to hold the stock for an extended period.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is typically accomplished by issuing new debt and using the proceeds to repay the existing debt since very few companies can afford to completely repay their debt with cash as it matures. New debt is issued with an interest rate that corresponds to the market interest rate at the time that it is issued, so this process can cause a company’s debt to increase following the rollover in certain market conditions. As of the time of writing, interest rates are at the highest levels that we have seen since 2007 so this is a very real possibility right now. In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flows to decline could push it into financial distress if it has too much debt. While Kinder Morgan has remarkably stable cash flow over time, we should still not get complacent and ignore this risk.

The usual metric that we use to analyze a midstream company’s debt is the leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio basically tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax free cash flow to that task. As of March 31, 2023, Kinder Morgan had a leverage ratio of 4.1x based on its trailing twelve-month adjusted EBITDA.

Wall Street analysts usually consider anything less than 5.0x to be acceptable so Kinder Morgan easily meets this requirement. However, I am somewhat more conservative and like to see this ratio under 4.0x in order to add a margin of safety to the investment. This is the level that some of the most attractively-financed midstream companies like Enterprise Products Partners (EPD), Energy Transfer (ET), and MPLX (MPLX) currently possess. Unfortunately, Kinder Morgan has not managed to achieve this yet but the company’s management is stating that it will be under 4.0x by the end of the year. That is a marked improvement over the 4.5x that the company was maintaining not too long ago and it is very nice to see given today’s interest rate environment.

Investors should probably not have to worry too much about the company’s debt, especially if it manages to get its leverage under 4.0x by year-end. The company’s strong cash flow and near-term growth prospects make this a very real possibility so I am optimistic here.

Dividend Analysis

As stated in the introduction, Kinder Morgan has been a favorite of dividend investors for a very long time. The company has a history of possessing one of the largest and most reliable payments available in the market. Admittedly, Kinder Morgan did mar its reputation in 2014 when it merged the various Kinder Morgan companies into the corporation but it has managed to reacquire its reputation since then.

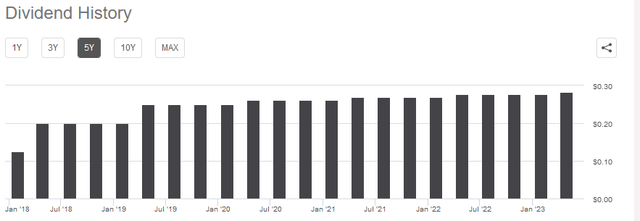

As of the time of writing, the company’s stock yields an impressive 6.79%, which is obviously far higher than the 1.66% yield of the S&P 500 Index (SP500). Kinder Morgan is also one of the few companies that has a dividend yield above the current inflation rate. The company has raised its dividend consistently for the past five years, but its track record prior to that is somewhat spotty:

Seeking Alpha

The fact that the company increases its dividend on a regular basis is something that is very nice to see during inflationary periods, such as the one that we are experiencing today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. This can make it seem as though we are getting poorer and poorer with the passage of time, particularly for those investors that are dependent on their portfolios for the income that they need to sustain themselves. The fact that Kinder Morgan increases its dividend annually helps to offset this effect and maintains the purchasing power of the dividend over time.

As is always the case, it is critical that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be the victims of a dividend cut since that would reduce our incomes and most likely cause the company’s stock price to decline.

The usual method that we use to judge a midstream company’s ability to pay its dividend is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of money that was generated by a company’s ordinary operations that is available to be paid out to the common stockholders. In the first quarter of 2023, Kinder Morgan reported a distributable cash flow of $1.374 billion. The company paid a dividend of $0.2825 per share to each of 2.260 billion shares. That works out to a total of $638.45 million paid out, giving Kinder Morgan a dividend coverage ratio of 2.15x. Wall Street analysts generally consider anything above 1.20x to be reasonable and sustainable, but I am more conservative and like to see this ratio above 1.30x in order to add a margin of safety to the position.

As we can clearly see, Kinder Morgan easily meets even this stricter requirement. The company should have no trouble maintaining its dividend at the current level.

Conclusion

In conclusion, the year-to-date decline in Kinder Morgan’s stock price appears to be providing investors with a very attractive entry price. The company boasts a 6.79% yield, which is better than we have seen in a while. It should also prove to be very resistant to any economic problems that might occur in the near-term while still delivering growth. This growth will probably translate into dividend growth, so someone buying today will likely have an attractive yield on cost in a few years. Overall, Kinder Morgan, Inc. stock might be worth purchasing today.

Read the full article here