Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 7th, 2023.

The John Hancock Hedged Equity & Income Fund (NYSE:HEQ) is designed, as its name implies, as a way to hedge one’s portfolio. The fund invests in a diversified portfolio, favoring more of the value-oriented sectors such as financials and healthcare. In addition to a broad mixture of investments, the fund will employ an options writing strategy and utilize futures contracts to hedge. Additionally, the fund also hedges with forward foreign currency contracts.

This strategy worked out well in 2022 when most of the equity and fixed-income market was down; this fund was flat. However, hedging always comes with a cost, which usually restricts upside potential in bull markets. Throughout most of the last decade, when equities were enjoying strong returns, this fund didn’t really do much, as expected.

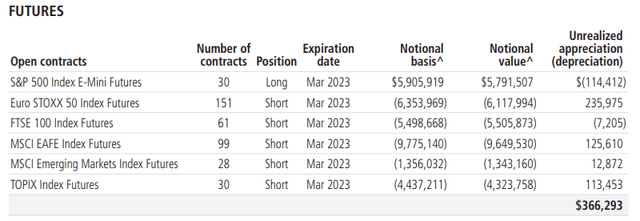

The fund employing the options strategy is fairly standard, as other closed-end funds do the same. The futures contracts are where they seem to get a bit more aggressive.

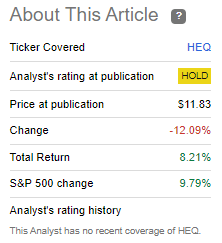

The fund’s deep discount provides a potential entry point for one looking to diversify and hedge their portfolio if their outlook is for a potential big drop in the market. Since our prior update, the fund did provide some positive total returns, but it has been quite some time since that update. The last time I looked at HEQ CEF was in March of 2021.

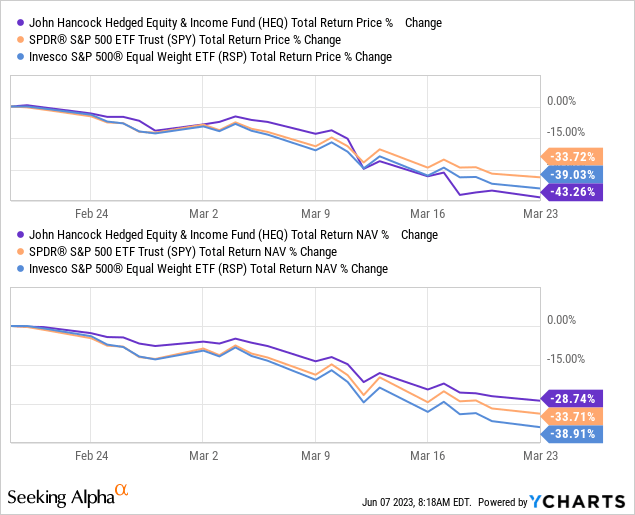

HEQ Performance Since Prior Update (Seeking Alpha)

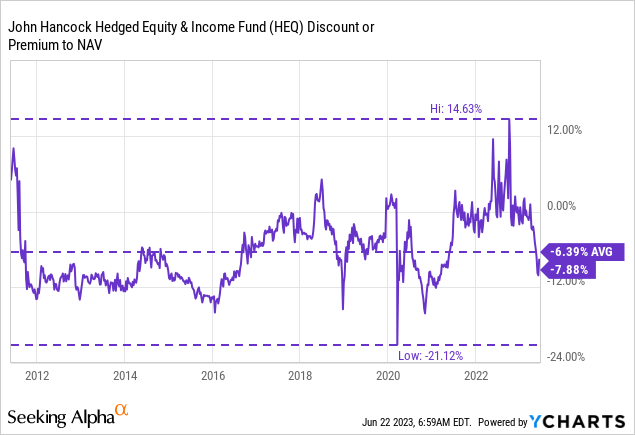

During this time, the fund also spiked to a large premium. That was fairly short-lived as the fund came crashing back down to a sharp discount. However, the fund has fairly consistently been flirting with a premium for most of the last two years. Going back further, the fund has had several periods of where it has touched premium levels.

The Basics

- 1-Year Z-score: -1.79

- Discount: -7.88%

- Distribution Yield: 11.03%

- Expense Ratio: 1.16%

- Leverage: N/A

- Managed Assets: $143.59 million

- Structure: Perpetual

HEQ’s investment objective is to “seek total return consisting of both income and capital gains.” To achieve this, the fund will invest “at least 80% of the portfolio in a diverse selection of equities across market capitalization.” TO manage the downside risks, the fund employs “options strategies to mitigate capital losses in periods when equity markets decline.”

Interestingly enough, the fund actually didn’t list any options gains/losses or even outstanding options positions in the last annual report. Instead, it was only futures contracts and currency contracts.

HEQ Futures Contracts (John Hancock)

As you might expect, a fund focusing on hedging isn’t utilizing leverage. However, with futures contracts, you can get outsized gains or losses. Additionally, with writing options against indexes, there is theoretically no limit to those losses either. So while the fund doesn’t employ borrowings, it can still experience outsized gains or losses based on how good they are at employing these derivative “hedging” tools.

The fund is also quite small, which can lead to limited trading volume. That creates a risk of having a large spread between the bid/ask prices. While that can be resolved with limit orders, the limited volume also means investors will have a difficult time trying to take larger positions or exit those larger positions if they are built up over time.

Performance – Discount Opening Up

This fund has a history of touching premium levels, so the latest discount could be a potentially strong argument for starting a position. This discount has come rapidly too. The drop can seem even steeper due to coming off of the fund’s all-time high premium that it was selling for last year.

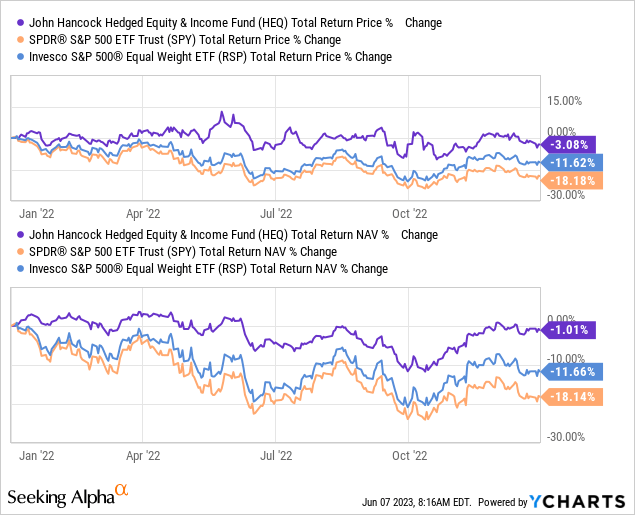

As a hedge, 2022 would seem like it accomplished its goal. The total NAV return for the year was essentially flat when the equity market was down, as reflected by the S&P 500 ETF (SPY) and its counterpart, the Invesco S&P 500 Equal Weight ETF (RSP).

YCharts

To reflect on another period, we can go back to the pandemic crash. This is measuring the total return results from February 19th, 2020, to March 23rd, 2020. As was the case with most funds that would normally be defensive, the drop came so swiftly that the downside protection wasn’t able to function, perhaps as most would expect. That, and basically everything, sold off hard – which is natural for black swan events.

Still, HEQ mostly accomplished its goal of being a hedge in terms of its total NAV results seeing a meaningfully lower drop. It was the total share price results with the CEF’s discount dropping substantially to all-time wide discounts that saw investors not participate in the downside protection. This actually highlights the risk of trying to use a CEF as a hedge during market panics; they can often be poor hedging tools since their discounts expand so sharply during these black swans.

YCharts

Over the longer term, the results are fairly poor if you were holding this fund over the years instead of tactically. At least if your goal was to expect competitive results relative to equity-based peers such as the S&P 500.

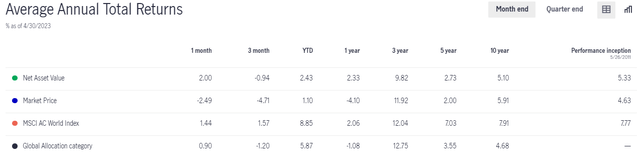

However, against one of their benchmarks, the Global Allocation category, it’s done relatively well. Against the MSCI AC World Index is where it really looks like they’ve provided lackluster results. Again, this isn’t unexpected, as hedging comes with the risk of minimal results during strong periods for the market. If one has a more dour outlook going forward, the results of this fund could be seen as more attractive.

HEQ Annualized Performance (John Hancock)

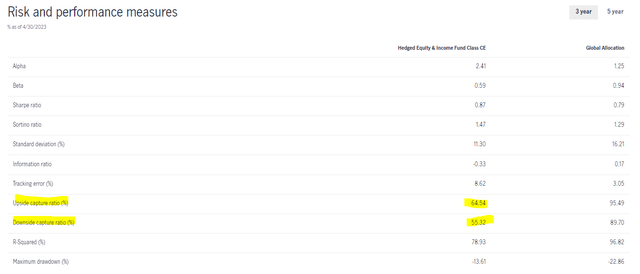

To look at this another way, the fund provides the upside capture ratio and the downside capture ratio. Note that this is against the global allocation benchmark, not their first listed benchmark, which they assign to MSCI AC World Index. What this tells us is that the fund in the last three years captured around 65% of the upside of its benchmark – clearly why it would have lagged in performance in the last three years. However, the hedging also meant the downside was more limited too, at around 55%. The fund’s beta is also lower at 0.59.

HEQ Risk/Performance Measures (John Hancock)

HEQ’s Double-Digit Distribution

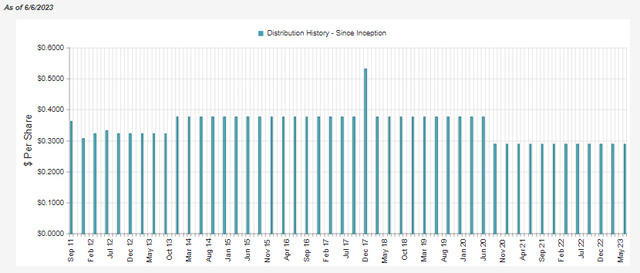

The fund currently sports a distribution yield of 11.03%. That’s quite tempting, and thanks to the fund’s significant discount, this is higher than the 10.03% the fund has to earn to cover it. Of course, history shows us that since the fund’s launch, it hasn’t been able to earn this distribution. The fund also cut its payout in 2020.

HEQ Distribution History (CEFConnect)

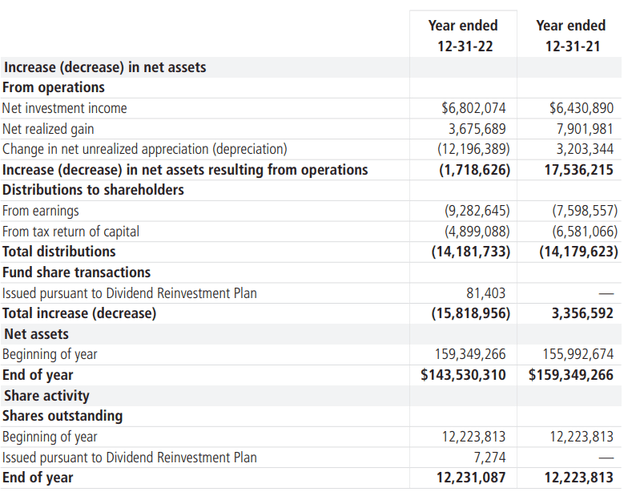

The fund’s net investment income isn’t enough to cover the distribution. As usual, with a fund that invests heavily in equities, this isn’t unusual. Most equity-heavy funds will require capital gains to fund their payouts to investors.

HEQ Annual Report (John Hancock)

The NII coverage in the prior year came to nearly 48%. That’s fairly strong compared to what we see out of some other equity funds. The fund was also able to realize some capital gains last year to help fund the payout too. However, we also see a substantial amount of unrealized appreciation on the underlying portfolio too.

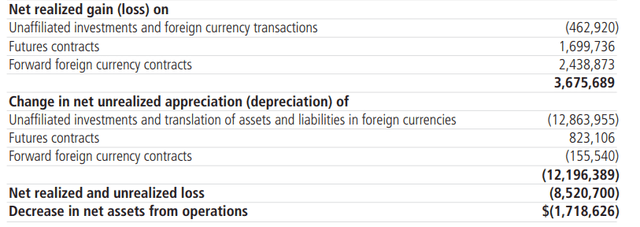

Some of the gains they were able to realize came from their derivative strategies. In fact, it was all of their realized gains as they realized losses instead of their underlying portfolio. The largest of these gains came from the currency contracts.

HEQ Unrealized/Realized Gains/Losses (John Hancock)

Again, I’d point out that they didn’t list any option positions in the last annual report, and the report doesn’t show any gains or losses from written options. This is unusual, as it had appeared in previous years. I tried to find out if they removed the options strategy, but it’s still posted on their website of their options writing strategy and within their annual report, they listed the options strategy too.

It would appear they just simply didn’t utilize options in the entirety of 2022. As an actively managed fund, they have the flexibility to pick and choose when a strategy is employed or not, so they must have determined it was best not to write any options last year.

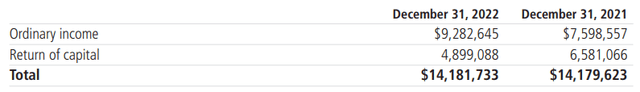

For tax purposes, the fund lists a fairly substantial portion of the distribution being classified as ordinary income. Although they also list a sizeable allocation to return of capital. These two classifications make it less clear what type of account may be the most appropriate. Ordinary income is going to be taxed heavily, while ROC distributions defer tax obligations until a position is sold, as it reduces an investor’s cost basis. At that time, it gets taxed at a more favorable capital gains rate.

HEQ Distribution Tax Classification (John Hancock)

HEQ’s Portfolio

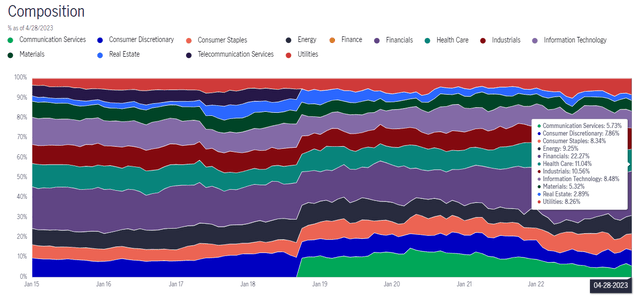

The fund lists 479 total holdings, which provides plenty of diversification. The fund is also quite active, as the portfolio turnover in the prior year came to 163%. The fund has favored weightings to financials, healthcare and industrial, all considered value-oriented sectors. The financial allocation this year was caught up in the banking crisis volatility. That being said, most of their larger banking positions are to the large-cap names that experienced more limited pressure, such as JPMorgan (JPM) and Bank of America (BAC).

HEQ Sector Allocation (John Hancock)

They’ve limited their exposure to tech, but it still represents a fairly meaningful weighting because most of the fund is fairly diversified. Mostly, the financials get the outsized weighting relative to the other allocations.

The portfolio can change a bit, but even going back to our 2021 article where we looked at the weightings as of January 29th, 2021, the highest weighting was to the financial sector.

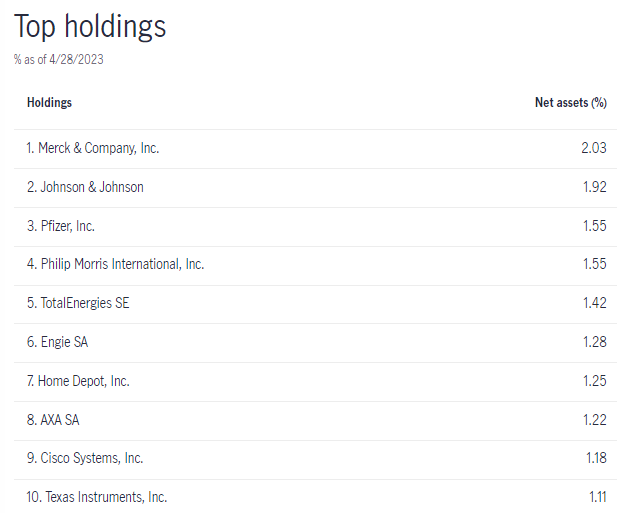

The top holdings contain plenty of familiar large-cap names that investors and consumers will recognize.

HEQ Top Ten Holdings (John Hancock)

That being said, there is a lack of financial names for having financials as the largest weighting in the fund. AXA SA (OTCQX:AXAHY) is an exception, an insurance company based in France. Instead, we are met with three healthcare names that represent the top three positions. Those include Merck (MRK), Johnson & Johnson (JNJ) and Pfizer (PFE). Those are the top three weightings, but they don’t represent a significant overweight or anything. Instead, similar to the fund’s allocation of being fairly diverse in sectors, the weighting of each individual position is also fairly even.

Conclusion

HEQ has mostly accomplished what it was designed to do, hedge the downside moves. Hedging comes with a cost, and that cost is more muted returns when times are good. Given the uncertain outlook currently and the fund’s attractive discount, it is likely to have some appeal to investors at this time. That would be whether to play it as a hedge should they expect the market to remain pressured or as a way to play the mean reversion back to its more historical ~6% discount level. Even more optimistically, investors could potentially see HEQ return back to a premium. That said, I don’t view HEQ as a long-term buy-and-hold position but one that should be traded tactically.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here