Almost every major streaming platform appears to be benefitting from HBO content, except for Warner Bros. Discovery (NASDAQ:WBD). In the latest development, reports have surfaced that WBD is currently in talks to license some of its HBO content to its top D2C rival and streaming market leader Netflix (NFLX). Materialization of such an arrangement would add to the ongoing divergence in WBD’s direct-to-consumer strategy from those implemented by its streaming peers – such as backtracking to a windowing strategy and rejecting the idea of direct-to-streaming for films, leveraging distribution partners such as Amazon (AMZN) at a time when rivals are looking to have greater “control over user interface and billing”, and licensing content to competitors when others like Disney (DIS) are looking to buy back rights on its original titles.

While a confirmed licensing deal to Netflix could bolster returns on WBD’s content investments, the undertaking would mark only a temporary patch to the company’s existing financial woes, while also symbolizing a strategic shift in its D2C business model. Although the arrangement remains in speculation, with little detail to provide visibility on its potential impact over WBD’s fundamental prospects, an extended licensing strategy to rival streaming platforms risks dimming the company’s share of longer-term growth opportunities in the digital shift of D2C media and entertainment. As the stock’s recent performance reverts towards our base case PT of $12, we remain hold-rated given the underlying business’ potential adoption of a heavier licensing mix in its D2C strategy could risk bringing more harm to current investors’ sentiment than good by muddling the durability of its longer-term growth prospects.

WBD-Netflix Licensing Deal Could be a “Streaming Shocker”

U.S. media and entertainment news outlet, Deadline, had exclusively reported earlier this week that WBD is in the process of licensing some of its original HBO titles to Netflix. While some of HBO’s most popular original titles – such as the “Suicide Squad” spin-off “Peacemaker” – can already be found on competing streaming platforms such as Prime Video, WBD’s potential licensing deal with Netflix would mark a major shift in its D2C strategy and risk ceding share to its largest rival within the increasingly heated content arms race.

While discussions on the arrangement between the two parties remain under wraps, the potential realization of the content licensing deal would first result in the non-exclusive distribution of HBO original “Insecure” concurrently on Netflix and WBD’s Max. Although the potential decision differs from core growth strategies implemented by WBD’s rival streaming platforms, it does not come as an entire surprise, given CEO David Zaslav’s hard-fixed focus on realizing the annualized cost synergies from Discovery’s blockbuster-turned-bust merger with WarnerMedia last year, alongside ongoing efforts in deleveraging the company’s balance sheet.

Zaslav has made some questionable calls over the past 12 months over the direction in which WBD’s D2C strategy is headed – including the abrupt closure of CNN+, revert to its traditional content windowing strategy, and more recently, the rebrand of HBO Max to Max which is unlikely to yield material incremental growth tailwinds within the foreseeable future. With Zaslav at the helm, WBD has also dug up some of its ancient content to facilitate a run on free ad-supported TV (“FAST”) in hopes of squeezing any last ounce of return on its content investments, including the recent decision to “distribute 2,000 hours of content…to Roku (ROKU) [ROKU] and Tubi, [and] reaching an agreement with Amazon Freevee to launch 11 FAST channels featuring WBD-owned IP”.

So, look, on FAST, we always believe in a – what we call, a hybrid strategy, which is ultimately, first and foremost, kind of what we call channel syndication, which is ultimately, we realize that the platforms and the distributors out there, there are many who have the scale and the size, and we want to get our channel portfolio out there and viewed. And since it’s an audience aggregation and advertising business, we have already gotten out with Roku and Tubi. And we have been very pleased with the initial success with a very small, but a handful of channels that were out there already. We will continue to look to see if we can increase that volume, to your point, for a second, third, fourth monetization windows for certain content.

Source: WBD 1Q23 Earnings Call Transcript

However, even in an era where profitability comes before growth, WBD’s cost-savings efforts are looking more like an off-balanced endeavour that is bound to compromise the durability of its growth prospects, differing from our previous optimism over potentially short-term pains for longer-term gains.

Licensing to Netflix Would Only be a Short-Term Fix to Deeper Financial Woes

According to Deadline’s report, WBD’s potential licensing deal with Netflix stems from financial considerations:

According to sources, this is a financial move. We hear HBO veterans pushed back against the plan but corporate financial consideration won out.

Source: deadline.com

As mentioned in the earlier section, such an arrangement would complement existing efforts implemented to optimize WBD’s cost structure, especially amid secular declines in its core linear TV business which management seeks to overcome by bolstering the company’s D2C exposure. Recall that management remains hard-fixed on achieving annualized cost-savings of $3 billion by the end of the year, and at least $4 billion to $5 billion through 2024. And achieving these financial targets would be critical for offsetting the impact of its unwinding linear TV business, and supporting the company’s ongoing deleveraging goals.

By licensing its content to Netflix, WBD effectively creates a new revenue stream to absorb some of its operational fixed costs, enabling opportunities for further margin expansion. It would also be analogous to WBD’s content licensing revenues stemming from its studios and networks segments, and potentially offset those declines amid the secular shift away from linear TV.

Yet, the difference lies in the muted subscription growth at Max relative to Netflix. Historically, WBD’s HBO has been a juggernaut in linear TV content production, licensing and distribution, boasting the upper hand as partnering networks rely on its content to lure TV screentime. But now, with on-demand streaming subscriptions anchored primarily by exclusive original titles – a strategy that industry leader Netflix has successfully built and profited from – WBD’s potential adoption of greater content licensing arrangements in its D2C strategy might even weaken its market share gain prospects in the secular shift in consumer TV viewership preferences.

Even as the advent of internet connectivity and on-demand streaming availability continues to disrupt linear TV, the form of media and entertainment content distribution and consumption remains a sub-priority at WBD. Despite the company’s industry-leading content library created from the amalgamation of popular unscripted IPs via Discovery and iconic scripted franchises via WarnerMedia, which would supposedly give it an upper hand in the transition to streaming versus its peers in legacy media and entertainment, WBD continues to focus on maximizing its content’s facetime across as many distribution channels as possible as its core strategy in optimizing investment returns – hence its return to the windowing strategy that has traditionally driven robust growth for the legacy media and entertainment industry.

We don’t want our entire [content] slate on the streaming service, $1 billion, $2 billion worth of content. Put it in the theatre, have that great shared experience. Put it in PVOD, have people buy it. And then when we put it on the streaming service, it’s much more powerful.

Source: WBD SVB MoffettNathanson’s Inaugural TMT Conference, May 2023

However, we remain skeptical on the extent to which management’s decision to apply a traditional monetization strategy on a disruptive form of media distribution and consumption will bear fruit. Specifically, consumers pay for streaming subscriptions on the grounds that it can access a myriad of content across different types (e.g. film, drama series, etc.), genres and languages on demand. And subscribers typically hold on to platforms that offer a differentiated slate of content.

Recall that WBD faces an increasingly challenging growth environment given the secular decline in linear TV. If WBD remains fixed on a windowing strategy that prioritizes in-theatre and pay-per-view over streaming for its original titles – whether that is film or TV series – it risks dampening Max’s appeal for the broader consumer end-market. And any potential non-exclusive content licensing arrangement with Netflix or other rival streaming platforms would likely give prospective and existing subscribers another reason to deviate from Max. In an environment where the streaming arms race is becoming increasingly competitive, any incremental reason for consumers to drop a subscription is one too many – let alone the potential for WBD’s recent consideration of D2C content licensing to further dull Max’s differentiation.

WBD Risks Distancing Its Reach In the Secular Shift to AVOD Advertising

Recall that growth in D2C streaming primarily stems from two sources: 1) subscriptions, and 2) advertising. While the bread and butter comes primarily from higher-margin ad sales (except in Netflix’s case given its successful first-mover advantage in on-demand video streaming subscription sales), they come hand-in-hand with subscription growth.

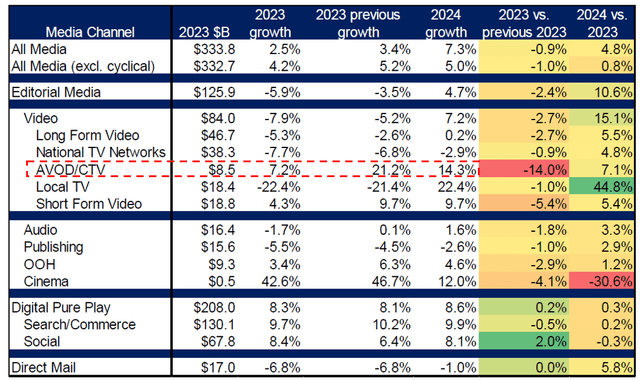

But signs of deteriorating focus at WBD on streaming in its D2C strategy risks distancing its reach in the burgeoning AVOD business – a key channel for digital ad sales growth in the coming years. Specifically, AVOD is expected to be a “secular winner” in digital advertising, second to retail media, over the coming years, despite near-term cyclical headwinds as advertisers tighten budgets amid looming market uncertainties. Specifically, U.S. AVOD ad sales growth are expected to exceed 7% y/y in 2023, and accelerate to the mid-teens next year, leading total digital advertising sales growth estimates of about 3% to 4% in the current year and 7% in the next.

RBC Capital Markets, with data from MAGNA

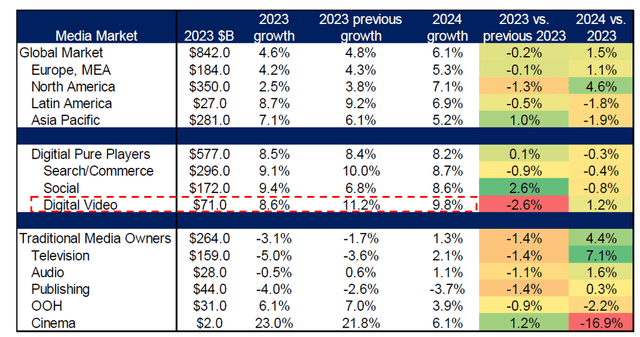

A similar lead in AVOD ad sales growth is expected from a global standpoint:

RBC Capital Markets, with data from MAGNA

With both incumbents in linear TV like WBD and streaming pureplays like Netflix rolling out their respective takes on AVOD subscription and ad sales, the company’s lack of focus on bolstering Max’s appeal to both consumers and advertisers cannot come at a worse time. Specifically, it is becoming an increasingly evident risk that the durability to WBD’s longer-term trajectory of sustainable and profitable growth is challenged, as it continues to lag peers in the shift to D2C streaming. And the muted growth prospects would only dim WBD management’s hellbent efforts in realizing those billions of dollars of annualized cost savings over the longer-term – what is $4 billion in annualized cost savings over the longer-term when the company might be losing out on secular growth opportunities in the billions, alongside irreversible declines in linear TV that continues to bleed its sales dry.

Licensing content to rival streaming platforms would only bolster its competitors’ success, while dulling WBD’s own access to growth opportunities in the secular shift. For instance, Amazon only pays a fraction of WBD’s production costs to feature blockbuster HBO original titles on Prime Video across its core operating regions – including Peacemaker in North America, and another 20+ HBO original films and series in India. In return, the e-commerce giant has further reinforced its grip on both the global online retail and burgeoning digital advertising markets (namely, retail media and AVOD ads) – in North America, where an annual Prime membership now costs C$99 or $139 but provides a full year of “privileges like speedy free delivery, video streaming and access to 100 million songs” to members, the program effectively safeguards double the volume of sales for Amazon relative to non-members, with a trial-to-paid conversion rate as high as 90%. And WBD’s streaming rivals are likely to experience similar benefits as the company becomes increasingly open to the idea of D2C content licensing.

While the undertaking would potentially entail a near-term boost to WBD’s D2C revenues, licensing its content and IPs to rival platforms that boast a greater market share lead would likely dull Max’s longer-term appeal to subscribers and, inadvertently, advertisers, hampering its newly combined service’s adoption rate. And the ripple effect would be equally detrimental in the worst-case scenario, where its D2C strategy – core to replacing declines from linear TV – faces a challenged long-term growth outlook despite secular industry tailwinds.

The Bottom Line

Admittedly, the foregoing analysis on the prospective impacts of WBD engaging in content licensing to rival streaming platforms depicts some worst-case scenario considerations for its D2C strategy. However, the latest development does increase our wariness over possibilities that WBD may be tipping the balance over to the downside in its efforts to achieve both sustained profitability and growth amid looming recessionary pressures and an irreversible secular decline in its legacy linear TV business.

With little detail from management and visibility into what the potential D2C content licensing arrangement and strategy might entail, we remain hold-rated at our base case PT of $12 for the stock. This is in line with considerations that the D2C content licensing strategy may introduce further downside execution risks and further complicate WBD’s longer-term fundamental prospects, while also indicating some growing financial woes in the immediate term amid a deteriorating macroeconomic environment blighted by spiralling inflation, surging borrowing costs, and a looming recession.

More importantly, the latest development potentially strips the differentiation that investors were previously optimistic about given WBD’s industry-leading content slate and ensuing competitive advantage. With limited catalysts within sight to spur sustained upside prospects, and deteriorating confidence in the company’s ability to reaccelerate growth by capturing opportunities arising from longer-term secular tailwinds, the WBD stock continues to lack appeal to investors, whether they are focused on income, value and/or growth. And considering persistent uncertainties in the market climate that continues to weigh on the performance of low-growth and unprofitable businesses, we expect further exposure to volatility in the WBD stock despite its relative discount to peers on a multiple-based consideration.

Read the full article here